The global banking sector is undergoing a significant transformation driven by digital innovation and a growing recognition of its role in addressing climate change, supporting responsible banking, and creating long-term value.

Across the world, financial institutions are stepping beyond a business-as-usual approach. They are embedding sustainability into their business strategy, aligning with the Paris Climate Agreement, the Sustainable Development Goals (SDGs), and the growing demand for transparency, climate action, and accountability. Read on to understand how sustainability is transforming FinTech.

From philosophy to business strategy: Sustainable banking takes center stage

Sustainable banking is no longer just a philosophy—it’s a core element of how top banks operate, plan, and grow. In this model, financial institutions go beyond offering services—they become agents of positive global transition.

Rather than seeing sustainability as an add-on or a PR exercise, banks align their business activities with environmental, social, and governance (ESG) principles. This means actively reducing environmental impact, financing green projects, supporting renewable energy and energy efficiency, and building sustainable infrastructure while maintaining strong governance and delivering shareholder value.

The goal is to create a future-proof financial system that benefits customers, supports the environment, and supports future generations.

Why climate change is a financial risk, not just an environmental one

Climate change is no longer a distant threat—it’s here, and its financial consequences are growing. From the human cost of extreme weather to economic disruptions caused by fossil fuel volatility, climate chaos is now directly impacting the financial sector.

The Bank for International Settlements and central banks worldwide now recognize climate-related risks as material financial risks. In response, regulations are tightening. Governments are introducing climate change bills, and financial regulators are pushing for climate disclosures, climate stress testing, and ESG-aligned practices.

In such a world, ignoring climate-related risks means being blindly headed into instability. The only viable path is to embed climate into strategic planning, lending decisions, and risk management processes.

Regulation is reshaping the banking world

The European Union has taken the lead in developing a robust ESG framework. The EU Taxonomy, SFDR, and CSRD are pushing banks to redefine how they measure success, not just in profit but in positive impact.

These policies demand complete transparency around ESG risks, green finance activities, and sustainable practices. Banks must report their emissions and how their investments, lending, and internal operations align with the transition to net zero.

Meeting regulatory expectations now requires sophisticated systems capable of tracking environmental performance, managing ESG data, and integrating climate action into core banking operations. This shift opens up significant market opportunities for digital transformation and FinTech innovation.

Given the complexity of these regulations, banks must collaborate with trusted software development companies like Miquido, which are deeply familiar with EU-specific requirements. Miquido’s expertise in building tailored, scalable solutions can help financial institutions ensure compliance and integrate ESG principles into their core operations. By partnering with EU-based developers, banks benefit from local knowledge and a more seamless, agile approach to meeting evolving regulations.

The rise of green finance and sustainable investment

Green finance is gaining momentum fast. Green bonds, climate-aligned loans, and ESG funds are unlocking capital for green projects—from solar energy and reforestation to low-carbon housing and sustainable transport.

According to Bloomberg, global green bond issuance reached approximately $500 billion in 2024, marking a continued upward trend in environmentally-focused investments. The demand for green bonds remains strong as investors increasingly seek sustainable financial products that align with climate goals. Financial institutions, particularly in the banking sector, facilitate these investments and drive the transition toward a low-carbon economy.

This surge in sustainable finance is not just investor-driven. Customers, especially younger generations, are increasingly making decisions based on sustainability and conscious consumption. This trend reflects a shift toward responsibility for the environment in purchasing choices, with many individuals seeking products and services that align with their values.

Technology: The backbone of sustainable banking

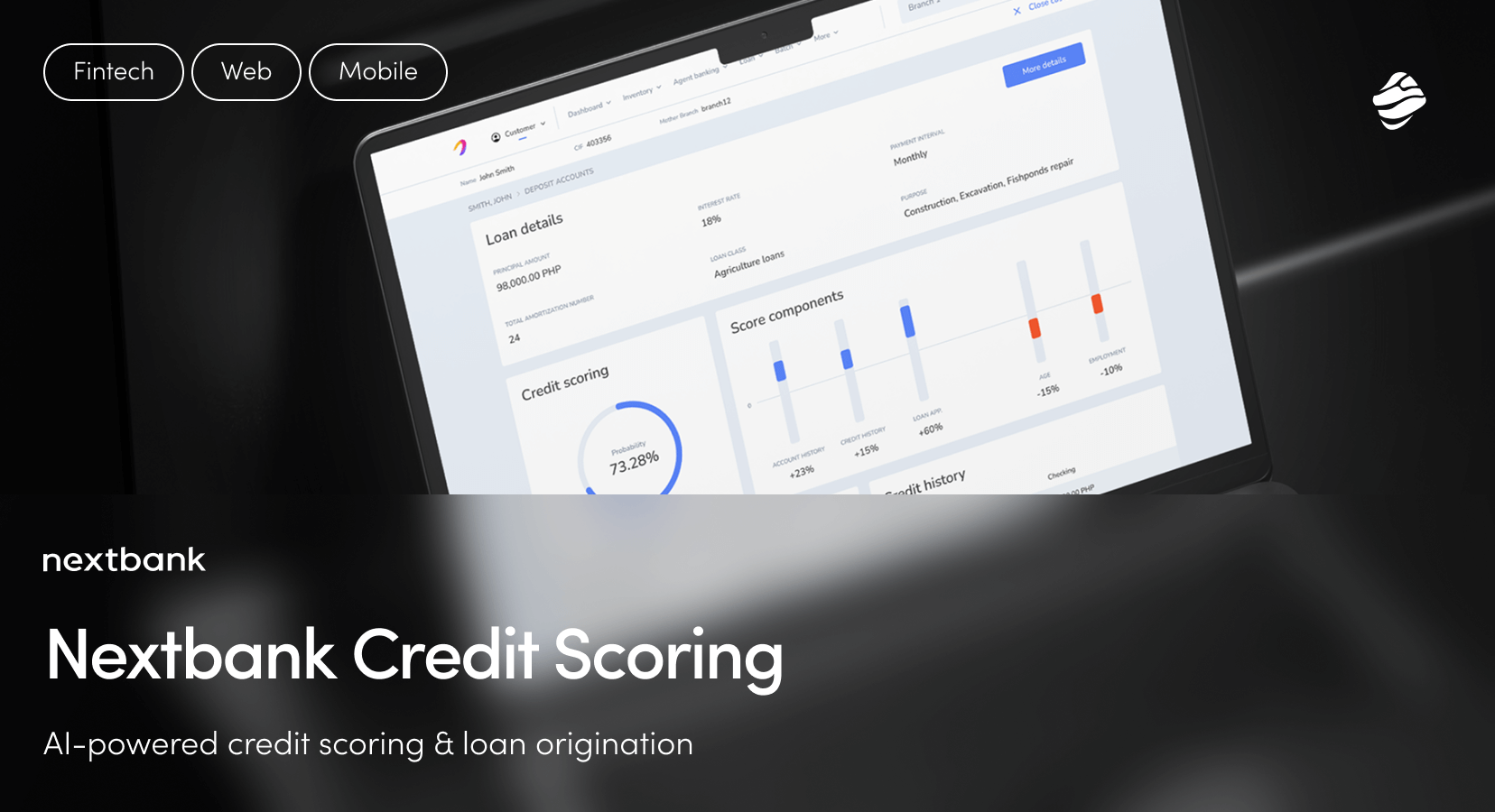

Digital innovation enables the financial sector to embed sustainability deeply into operations, product offerings, and reporting mechanisms. From AI and APIs to blockchain and big data, FinTech is the enabler of modern responsible banking.

AI for ESG and target-setting

Artificial intelligence is revolutionizing ESG analysis and target setting. Banks use machine learning to assess climate risk, model transition pathways, and monitor real-time ESG performance.

AI can flag reputational risk, detect greenwashing, and support strategic planning with predictive insights. It also helps streamline sustainability reporting, cutting costs while improving accuracy and governance.

Blockchain for transparent finance

Blockchain supports transparency, traceability, and accountability—especially in green finance. It’s being used to verify the use of green bond proceeds, monitor carbon credit transactions, and create immutable ESG records.

In a sector where trust and traceability matter, blockchain is helping financial institutions prove their commitment to environmental integrity and sustainable development.

Carbon Tracking and Conscious Banking

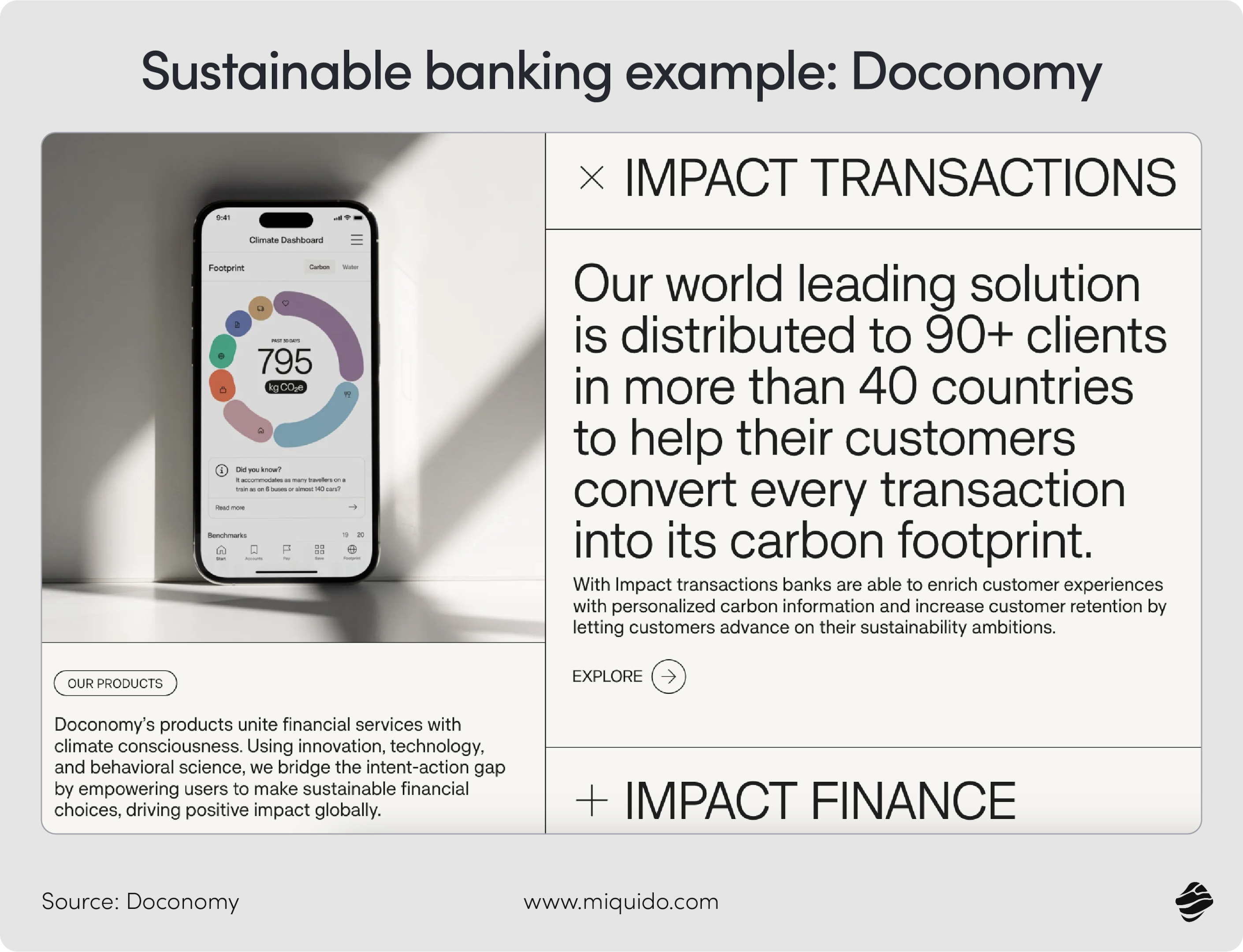

APIs are now allowing banks to integrate carbon tracking directly into customer apps. These tools let customers see the carbon impact of their spending and make choices that positively impact the environment.

Companies like Doconomy and Ecolytiq have pioneered this space. Now, customer-centric products are making climate action personal, turning conscious consumption into everyday banking.

Miquido: Supporting sustainable innovation in FinTech

Miquido, a custom software development partner, is key in helping banking institutions build future-ready digital products. With expertise in AI, cloud solutions, and user experience, Miquido enables banks to deliver sustainable, scalable, and customer-centric innovations aligned with their initiatives.

Whether building ESG analytics platforms, integrating carbon tracking features, or creating secure, compliant green finance apps, Miquido helps banks embed sustainability into their technology, workflows, business, and customer experiences.

Our approach supports banks in modernizing internal operations, meeting regulatory requirements, and creating a competitive edge in a crowded marketplace.

The business case for sustainable banking

Banks that prioritize sustainability are not just doing good—they’re doing well. Sustainable banking offers banking institutions real advantages:

- Competitive advantage: Customers will switch to banks that demonstrate a commitment to aligning with their values.

- Risk reduction: Better ESG integration leads to better risk management and resilience, which is key for business.

- Market access: Investors increasingly allocate capital to banks with strong ESG performance.

- Cost savings: Sustainable initiatives like paperless operations and energy efficiency reduce overhead.

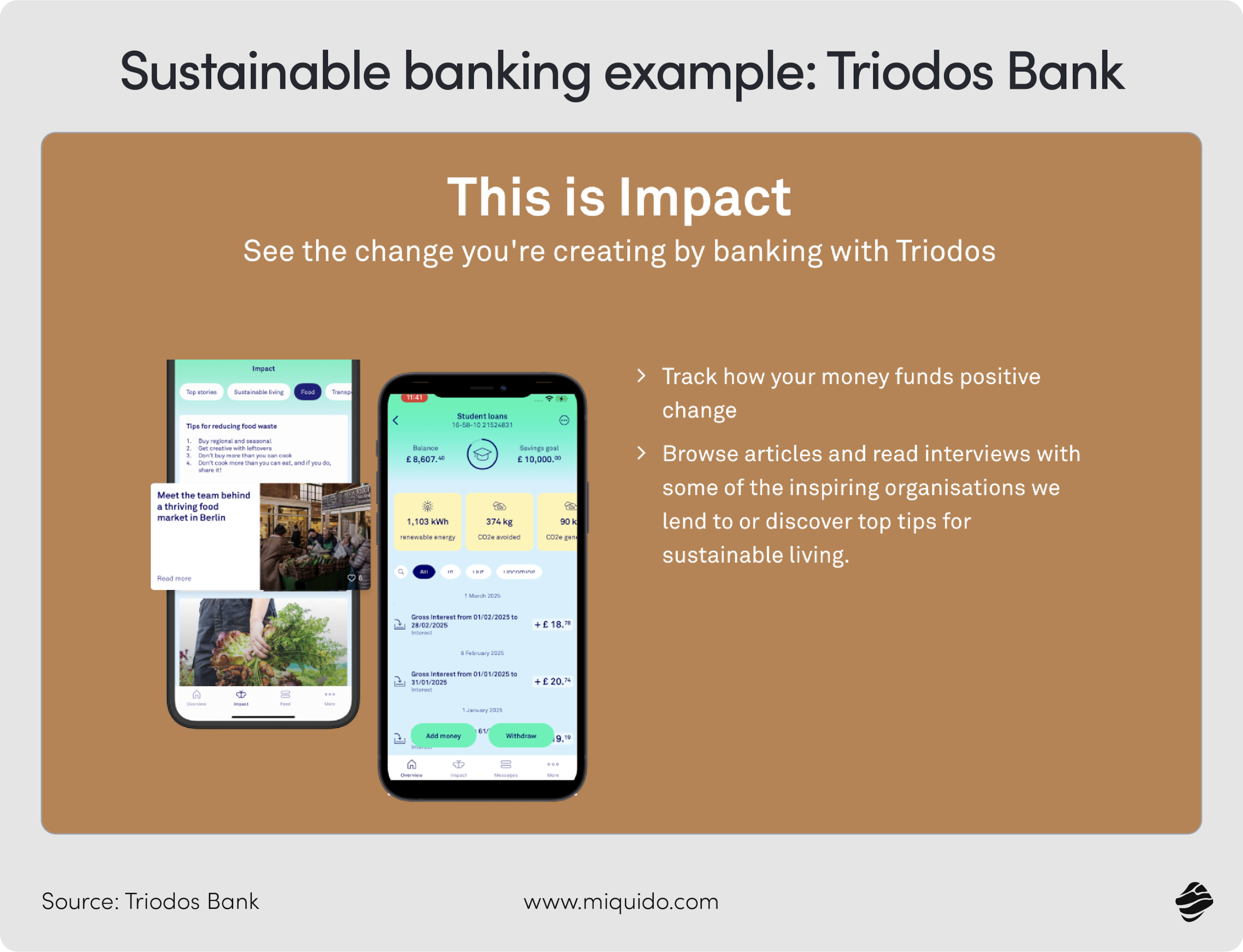

Triodos Bank and other pioneers have proven that responsible banking is profitable, scalable, and attractive to both consumers and capital providers.

Customer expectations are changing fast

A growing share of customers—especially Millennials and Gen Z—expect banks to contribute to a more sustainable world. They want to know how their money is used, what impact their investments have, and how their bank supports climate goals.

Customer expectations include:

- Clear ESG disclosures

- Sustainable investment options

- Carbon footprint insights

- Support for renewable energy and green projects

- Strong governance and ethical leadership

Transparency and credibility are now essential. Banks that fail to meet these expectations risk losing customer trust and future relevance.

Future-proofing the banking sector

To stay competitive, banks must modernize systems, upgrade infrastructure, and shift their cultures. This requires not only technology but also a rethinking of values, processes, and long-term goals.

Miquido’s legacy app modernization service helps businesses transform outdated systems into high-performance, scalable, and future-proof applications. By leveraging cutting-edge technologies and innovative approaches, Miquido revitalizes legacy software to align with today’s digital demands, enhancing efficiency and security while ensuring seamless integration with modern platforms. Our expert team supports businesses in reducing technical debt, improving user experiences, and optimizing operations, empowering organizations to stay competitive in an ever-evolving market.

Building sustainable infrastructure

Modern banking infrastructure must support capturing, analysing, and reporting ESG data. It must also enable the design of new, sustainable financial products. This includes cloud-native platforms, real-time analytics, and API-first architectures.

Integrating ESG into core systems

Sustainable banking must be baked into the core, not added on. That means ESG criteria must influence credit decisions, investment planning, and performance evaluation. Banks must ensure that their internal operations align with their external sustainability commitments.

Miquido supports this transformation through integrated, end-to-end development that connects ESG frameworks with real-world digital tools.

The road ahead: Toward a sustainable financial future

The path to net-zero emissions is complex, but the role of the financial sector is clear. Banks have the capital, influence, and infrastructure to lead a positive impact on the planet and society.

But the time for action is now. Delaying the adoption of sustainable banking models will mean missed opportunities, reputational risk, and regulatory penalties. Institutions that move decisively today will shape the financial world of tomorrow.

In the years ahead, success will not be measured by profit alone, but by the ability to:

- Drive climate action

- Meet regulatory standards

- Support sustainable development

- Align with ESG principles

- Earn trust from customers and investors alike

Final thought

Sustainable banking is redefining finance, not just as a sector but as a force for good. It challenges financial institutions to lead, not lag, in the global push for a sustainable, equitable future.

The tools are already in place, and partners like Miquido support digital transformation. It’s up to banks to act with purpose, precision, and commitment.

Because in the banking world of tomorrow, only those institutions that combine innovation with responsibility will thrive. Only those who lead on sustainability will earn the trust of future generations.

![[header] how sustainable banking is redefining the financial sector](https://www.miquido.com/wp-content/uploads/2025/07/header-how-sustainable-banking-is-redefining-the-financial-sector.jpg)

![[header] 10 embedded finance examples](https://www.miquido.com/wp-content/uploads/2025/03/header-10-embedded-finance-examples-432x288.jpg)