In a rapidly digitizing financial world, consumers expect convenience, speed, and personalization from their financial service providers. This evolution has led to the rise of FinTech super apps — comprehensive digital platforms that enable users to manage their entire financial life within a single app. From transferring money, peer-to-peer payments, and bill payments to tracking investment platforms and making online shopping decisions, these apps consolidate multiple services that once required multiple apps.

These super apps provide a seamless gateway to financial institutions looking to enhance customer loyalty, streamline services, and gain super app status. Offering mobile payments, personal finance management, and peer-to-peer transactions in a single place simplifies the user journey and enhances overall user convenience.

As a team of developers, designers, and product strategists at Miquido, we’ve had the opportunity to help build some of Europe’s most advanced financial technology solutions. Our hands-on experience, especially with leading institutions, has taught us invaluable lessons on creating financial super apps that go beyond functionality to deliver meaningful, secure, and engaging experiences.

In this post, we share our development playbook—a guide shaped by real-world implementations, collaborative innovation, and a clear focus on user needs. Whether you’re a bank, FinTech startup, or enterprise exploring the super app model, our insights aim to give you a practical foundation to move forward.

Miquido’s approach to building FinTech super apps

We’ve built super app modules for some of the biggest names in the financial sector, and each engagement has reinforced three principles: modularity, security, and personalization. Below is a breakdown of how we bring these principles to life.

Modular architecture: Scalable by design

Our development philosophy centers around modular architecture, where each feature is a self-contained unit that can be independently developed, tested, and deployed. This approach:

- Enhances maintainability and reduces technical debt

- Supports faster feature updates and iterations

- Enables secure financial transactions by isolating sensitive data flows

- Provides flexibility to introduce new financial solutions and other financial services without disrupting the system

For instance, in our collaboration with Santander, we developed an auto-savings module that allowed users to set financial goals and save through multiple strategies:

- One-time transfers

- Recurring monthly deposits

- Transaction round-ups

The module operated as a standalone feature while fully integrating with the broader app. The result? Increased daily app usage and long-term customer engagement.

Modular web features embedded in native apps: A scalable approach for FinTech super apps

One of the core strategies we followed in building features for one of the leading Polish banks’ mobile ecosystems was developing modular web applications seamlessly embedded within the native app. This hybrid approach allowed for rapid feature delivery, easy maintenance, and strong design consistency—key ingredients in the evolution of any FinTech super app.

Case study 1: Auto-savings module – personal finance, personalized

For the auto-savings module, Miquido was responsible for end-to-end delivery of a fully standalone feature that empowered users to define savings goals and automate their savings journey. The MVP included three smart savings strategies: one-time transfers, recurring monthly deposits, and transaction round-ups—each designed to make saving effortless and habitual.

Business outcome: By providing users with a diverse set of intuitive saving paths, Santander increased user engagement and fostered long-term retention through daily app utility.

Recommendation: When designing financial planning tools within a banking super app, aim for modularity and personalization. Each goal-based feature can function as a self-contained microservice, delivering value without increasing operational complexity.

Case study 2: Deposit opening flow – expanding access, streamlining UX

In another initiative, we collaborated directly with the bank’s internal teams to build a step-by-step flow for opening fixed-term deposits. Initially launched for individual users, the feature was expanded to support business clients, leveraging the same frontend with adaptable backend rules.

Business outcome: By enabling a fully digital onboarding process for individual and corporate customers, the bank streamlined a traditionally branch-based operation, reducing friction, increasing conversions, and accelerating time-to-deposit.

Recommendation: Use dynamic business logic behind a unified UI to efficiently serve multiple user groups. This reduces front-end overhead and accelerates time-to-market for future segments.

Unified UX & web-first agility

Every web module was designed to mirror the branding, behavior, and experience of the native application. Using Angular, we built custom UI components that matched the native environment, creating a seamless user experience for users while benefiting from the speed and flexibility of web-based delivery.

Business outcome: Users interacted with embedded modules as native features, while our teams benefited from a faster development cycle and easier updates across platforms.

Recommendation: For such apps, consider embedding web-based modules with consistent branding and UI logic. This provides the agility of web technologies without sacrificing a seamless user experience.

Embedded security: Proactive and continuous

With great functionality comes great responsibility. In financial technology, trust hinges on secure transactions, compliant data handling, and built-in protection against threats.

We follow industry-standard security practices such as:

- HTTPS-only communication

- SSL pinning

- Use of native secure storage (e.g., Keychain)

- Biometric authentication (e.g., Touch ID, Face ID)

- Code obfuscation and log sanitation

Case study 3: E-signature module – digital approvals, seamless flows

In several projects, including one for the leading Polish bank, we developed embedded e-signature modules that enabled users to securely approve and sign documents directly within the app interface. By integrating with the bank’s internal workflows and identity verification systems, we ensured compliance with legal standards while maintaining a smooth and intuitive user journey.

Business outcome: Customers could complete entire product applications—such as loans or agreements—without leaving the app, increasing conversion rates and reducing drop-offs caused by physical paperwork or external platforms.

Recommendation: For any huge financial super app dealing with regulated products, invest early in a frictionless yet compliant digital signature process. This enables complete in-app transactions and significantly boosts self-service capabilities.

Case study 4: Security monitoring automation – proactive by design

In SwiftPay, a next-gen payment system, we implemented automated monitoring for page headers and content integrity across key transactional views. The system runs verification scripts daily that check for unauthorized security header changes and track any frontend content modifications via hashing mechanisms.

Business outcome: The platform gains daily assurance that its financial services pages remain compliant and tamper-free. This satisfies auditor requirements and acts as a proactive layer of defense against subtle injection attacks or misconfigurations.

Recommendation: As your financial platform scales, automate routine security checks to detect vulnerabilities before they become incidents. Implementing continuous compliance validation—especially on user-facing flows—builds a trustworthy digital environment while easing regulatory reporting.

Personalization: Powering engagement and loyalty

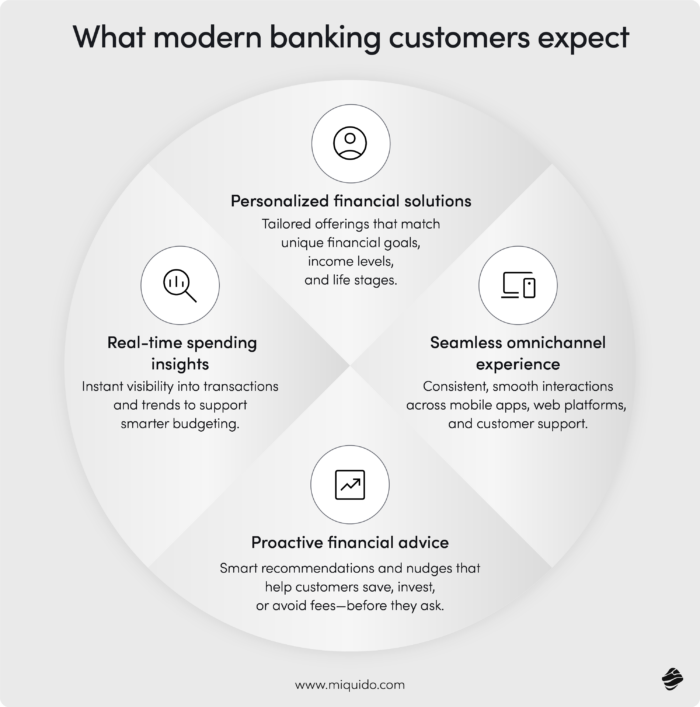

A financial app must deliver features and contextually relevant personalized insights to stand out. Miquido uses behavioral analytics and machine learning to create highly personalized banking ecosystems.

Personalization tactics we use:

- Dynamic dashboards and in-app suggestions based on customer behavior

- Contextual nudges for saving, investing, or budget control

- Tailored recommendations and offers linked to loyalty programs

Why it works:

When apps adapt to users’ personal financial management needs, they become indispensable. Personalization drives frequency, satisfaction, and improves customer engagement.

Miquido’s banking super app services

As a full-service software development partner, Miquido delivers tailored solutions across the entire super app development process. Our services cover:

1. Strategy & ideation

We start by aligning product vision with market opportunities. Our business analysts and product strategists help define key features, monetization models, and compliance needs for various services.

2. UX/UI design

Our design team focuses on creating consistent, accessible interfaces that encourage user adoption and minimize friction across financial transactions.

3. Development (mobile, web, backend)

Our developers specialize in:

- Native and cross-platform mobile app development

- Modular web apps embedded in native containers

- Scalable and secure backend infrastructure using advanced technological solutions

4. AI & data analytics

We integrate machine learning to enable smart categorization, investment analysis, spending insights, and generate valuable insights.

5. Security & compliance

From data encryption to GDPR-compliant architecture, we build platforms that protect user data and meet legal standards in the financial sector.

6. Ongoing support & maintenance

We ensure long-term success through post-launch monitoring, security updates, and performance optimizations.

We also offer cross-team collaboration, where our developers embed directly into client teams to accelerate delivery and knowledge transfer.

Future-proofing super apps: Key trends

As the demand for financial and lifestyle services grows, super apps must evolve to stay relevant. Here’s where we see the market heading:

1. AI-driven financial assistants

Future super apps will leverage AI to create smart assistants capable of real-time budget coaching, investment management, and risk analysis.

2. Interoperability with third-party platforms

To broaden their ecosystem, super apps will increasingly integrate with third-party services, including e-commerce, insurance, and health. Customers can benefit from accessing various services within the banking super app.

3. Expansion of digital assets

As digital currencies gain traction, super apps will offer more tools to manage digital assets like cryptocurrencies, NFTs, and tokenized securities.

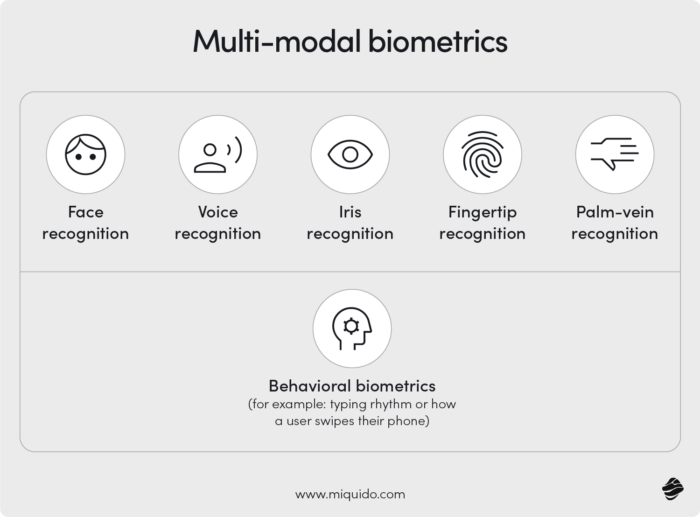

4. Biometric and context-aware authentication

Expect smarter authentication through a combination of biometrics, behavior analysis, and contextual factors.

5. Regulation-aware innovation

From PSD2 to AI regulations, the most successful apps will innovate within evolving regulatory landscapes.

Value-Added Services: The first step toward a FinTech super app

Before launching a full-fledged super app, many financial institutions introduced value-added services, which were modular and complementary features beyond traditional banking. These include tools like currency converters, subscription management, budgeting assistants, bill splitters, loyalty integrations, or even insurance calculators. Though simple, these microservices provide immediate user value and help extend daily app engagement.

By embedding these utilities into existing mobile banking ecosystems, institutions can test customer appetite for more advanced features while gradually building the infrastructure for a broader super app strategy.

Why start here?

- Low barrier to entry: Quick to develop, easy to integrate.

- Customer stickiness: Encourages users to return to the app for non-transactional purposes.

- Data foundation: Helps gather behavioral data for future personalization.

- Brand differentiation: Adds competitive edge without overhauling core banking systems.

At Miquido, we often advise clients to treat value-added services as stepping stones—small wins that validate user interest and support long-term product scalability. Whether it’s a travel insurance wizard or a smart budget alert system, each module nudges your app closer to super app status.

Conclusion: Building the super app of tomorrow, today

Creating a financial super app isn’t just about combining features—it’s about orchestrating them in a way that enhances the user’s financial health, builds trust, and offers day-to-day value.

At Miquido, we’ve helped global institutions build platforms that are:

- Modular and scalable

- Secure and compliant

- Personalized and engaging

- Built for both traditional banking functions and modern ecosystems

As the line between banking services, lifestyle services, and digital payments blurs, super apps will become the digital foundation of people’s lives. Integrating in-app messaging, peer-to-peer transactions, personalized services, and cloud computing, these platforms offer not only a new level of user convenience but also an opportunity to redefine how users interact with financial institutions.

If you’re looking to build a platform that does more than manage money—one that empowers, engages, and adapts—let’s talk.

We bring the development process, user insights, and technical expertise needed to bring your vision to life.

Want to be the next Cash App or become the Chinese internet giant Tencent of Europe? We’re ready when you are.

![[header] fintech super apps lessons from miquido’s development playbook](https://www.miquido.com/wp-content/uploads/2025/08/header-fintech-super-apps_-lessons-from-miquidos-development-playbook.jpg)

![[header] 10 embedded finance examples](https://www.miquido.com/wp-content/uploads/2025/03/header-10-embedded-finance-examples-432x288.jpg)