Custom FinTech Software Development Services

Build the Future of Financial Services

Leverage cutting-edge AI, proven software solutions, and frictionless implementation to stay ahead in the rapidly evolving financial landscape.

Consult your idea

Our expertise

Delivering innovative, scalable, and tailored technology solutions that empower the FinTech industry to thrive in a digital-first world.

AI-Powered Solutions for Finance

Transform financial operations with secure, scalable AI tools that reduce costs, enhance efficiency, and elevate customer experiences. From intelligent document verification to 24/7 conversational AI, our production-ready solutions deliver rapid implementation and seamless scalability.

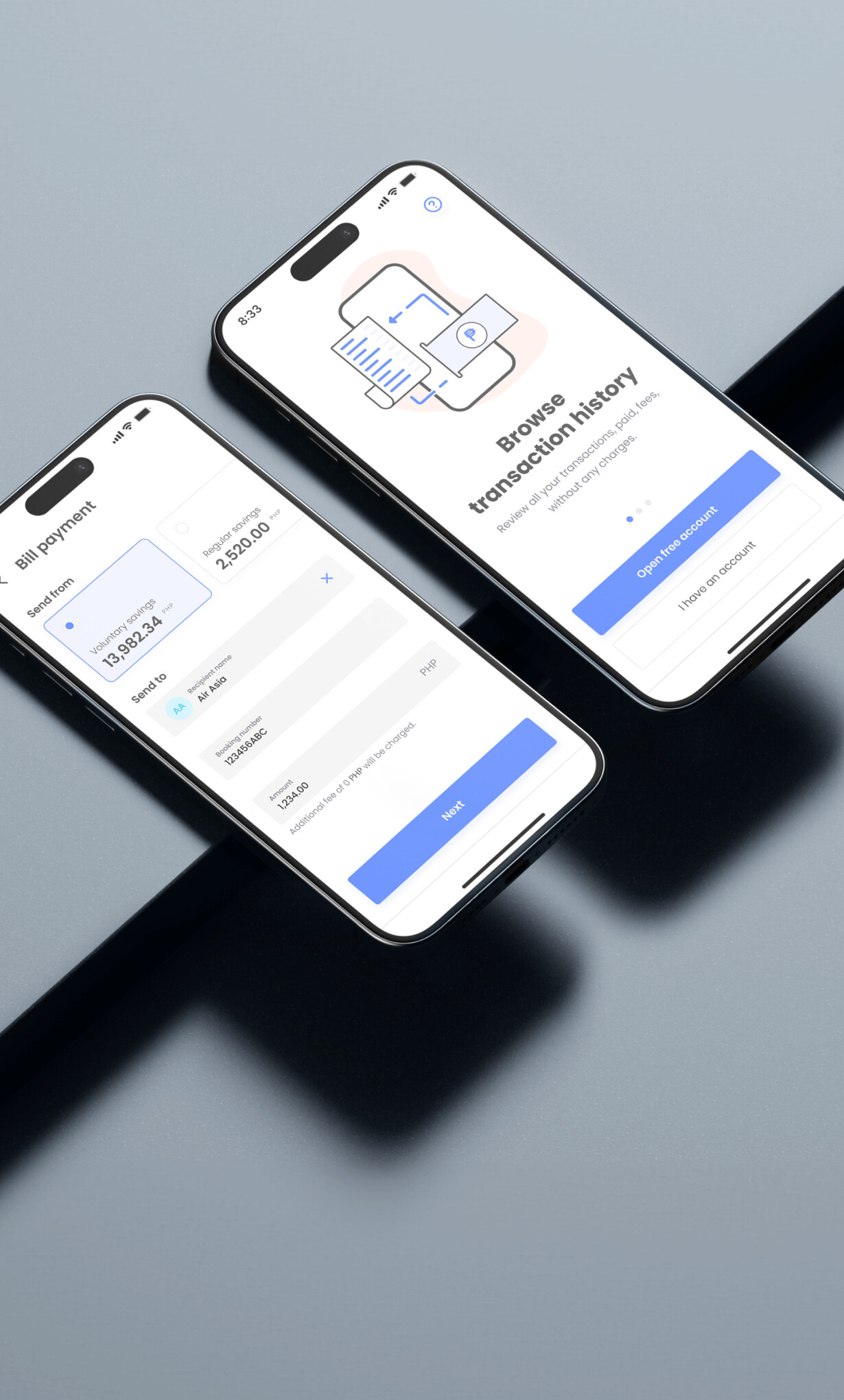

Software Solutions Packages

Enterprise-grade financial software built for modern institutions, combining rapid implementation, proven reliability, and robust security. From mobile banking to fraud management, our modular solutions scale effortlessly to meet your evolving needs.

Value Added Services (VAS)

Enhance your financial product with premium lifestyle features that boost customer engagement and unlock new revenue streams. From travel perks to educational tools, our tailored solutions integrate seamlessly to elevate your offering.

Secure success with strategic benefits

Cut operational costs from day one

Achieve a 20-30% reduction in KYC costs by automating document processing and enhancing employee efficiency, optimising your financial operations from the start.

Transform customer interactions

Leverage instant feedback, multi-language support, and 24/7 automated assistance to elevate your customer service and satisfaction levels.

Gain enterprise-grade reliability

Ensure your financial services are always available with our proven solutions, processing Millions of monthly transactions with 99.99% uptime.

Secure your financial platform

Protect your data with built-in security features and modern architecture, minimising risk and ensuring compliance with industry standards.

1 of 4

Our FinTech client success stories

SBAB

Mobile app for financial management

AI

Integration

Services

Mobile, Web, AI

Intuitive

Mortgage loan guide

Available for projects

Choose your next

FinTech application

development company

At Miquido, we’re familiar with the twists and turns of music application development. If you’re searching for fresh ideas based on years-long expertise and granted industry awards, reach out to us. Here’s why we can find common ground.

Book consultationComplete documentation

Time can be critical in a project, but we never let technical debt become a problem. We ensure the highest quality of the delivered code and technical documentation – and treat refactoring as a vital part of every app development lifecycle.

Proven track record

Over the past 12 years, our teams have contributed to the creation of over 250 innovative digital products for brands such as Warner, Dolby, Skyscanner and TUI.

Long-term partnerships

While we love MVPs, most of our client partnerships are long-term and last on average 5 years.

Transparent cooperation

Clear project scope and requirement definitions, effective communication channels, regular progress reports, risk and change management and open feedback are the pillars of the custom app development process at Miquido.

Holistic approach

Our software agency offers digital transformation consultancy services that cover a wide range of fields, from business strategy and product design to full-stack development.

Team seniority

With most of our team at senior or regular levels, you receive the right combination of experience and unconventional thinking.

Here’s what

our clients say

Top-notch software, award-winning design, revolutionary mobile apps. Listen to our clients and discover what’s possible for you.

See our portfolio

“They’re very goal-oriented, actively looking for solutions to every challenge. The team is collaborative but still low-maintenance.”

“Flexible with their approach. They are able to adapt to our preferences and work independently without having to involve us in all the details.”

1 of 2

How much does it cost to build a FinTech app?

How much does a FinTech app cost?

• How complex is the app idea?

• What features do you want the app to have?

• Which technology stack should be used to build your app?

To give you a little of an estimate, looking at average rates for leading software houses in Central Europe, one man-day (MD) costs around 530 USD. Considering that 1 month of developing the MVP project would cost a minimum of 53 000 USD for one platform (iOS or Android or just a web app, the cost does not include the UX/UI designs). The team consisted of iOS or Android Frontend, Backend developer, Project Manager, and QA would need around 3 months to deliver a fully functional MVP. However, please keep in mind that the final quote can vary depending on your specific needs and technology requirements.

Unsure of your financial app features requirements, technology stack and the final FinTech app development costs?

Consult our experts > We will advise you on what’s best for your unique financial product idea.

Which programming language is best for FinTech?

What are the applications of AI in FinTech?

Custom vs. pre-made FinTech app: which one is better?

Pre-made FinTech apps have one major asset on their side, which is a significantly lower cost. However, you have to consider that pre-made solutions have major drawbacks regarding scalability and customisation. And when it comes to additional costs along the way, a custom solution may actually prove to be the cheaper choice in the long run. Custom app development allows you to stay ahead of the competition as it offers the possibility of making various changes and adding multiple new features.

What are the benefits of outsourcing FinTech software development?

Haven’t you found the answers?

Talk to usAvailable for projects

Want to talk about your project?

Partner with us for a digital journey that transforms your business ideas into successful, cutting-edge solutions.