What do you think when you hear Dubai? More and more often, aside from being a synonym for luxury, the UAE’s capital is also associated with tech innovation. Thinking out of the box is at the core of Dubai’s business scene, and that shows in the projects born there, which gained global recognition.

You may have heard about the floating Vertical City or its emblematic human-made archipelagos, but Dubai’s drive for innovation goes beyond architecture. Aside from organizing renowned tech events, the city also became a home for various startups, introducing innovative products and services.

The Dubai startup scene may not be as visionary as its urban planning, but without a doubt, it contributes to the digital development of the Middle East region. We gathered the most inspiring examples of innovative on-driving companies to outline the current startup landscape for you. From fintech to healthcare professionals, here are some best startups in Dubai worth keeping an eye on.

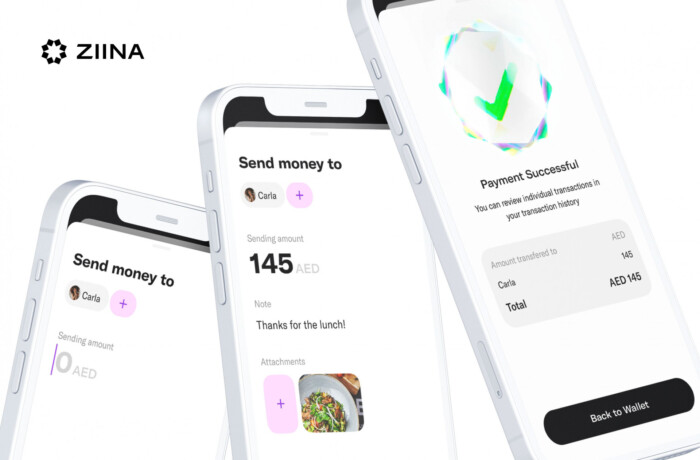

1. Ziina

Founded: 2020

Total funding amount: $8 M

Industry: Fintech

Applications: UX Design, No-Code Development

Mission: Bringing P2P payments to UEA

Peer-to-peer payments have been with us for decades, with PayPal being their precursor, but only entered the mainstream with the popularization of mobile-oriented payment apps such as Venmo or Zelle. According to the European Central Bank, while P2P payments in the EU are still predominantly cash, the share of mobile payments more than tripled in terms of number between 2019 and 2022.

Thanks to Ziina, that might soon be the case in the Middle East, too. The startup offers the first peer-to-peer payment software in the UAE, making money exchange easier and faster than ever. Its users can pay with debit, credit, Apple Pay, and Google Pay, accept payments with QR codes, and send payment requests. All come bundled with impeccable UI & UX.

2. Huspy

Founded: 2020

Total funding amount: $ 47M

Industry: Fintech

Applications: Mortgage

Mission: Bringing P2P payments to UEA

The mortgage struggle is real, whether you live in Poland, Spain, or the UEA. But according to Huspy’s creators, the latter is a particularly tough nut to crack in terms of acquiring loans. Over 85% of UAE’s population consists of expatriates, for whom it is even more challenging to get their way through the mortgage process. Huspy addresses their problems, enabling them to acquire home loans online – with no paperwork involved.

However, it is not only expat-oriented – any UAE resident can benefit from using Huspy. Having experienced the issues with the mortgage process firsthand, its creators decided to simplify it by providing customers access to all the major UAE banks and exclusive offers, within one app, without additional fees. It makes the loan acquisition process much more transparent, allowing the potential future homeowner to monitor the status of their application in real time.

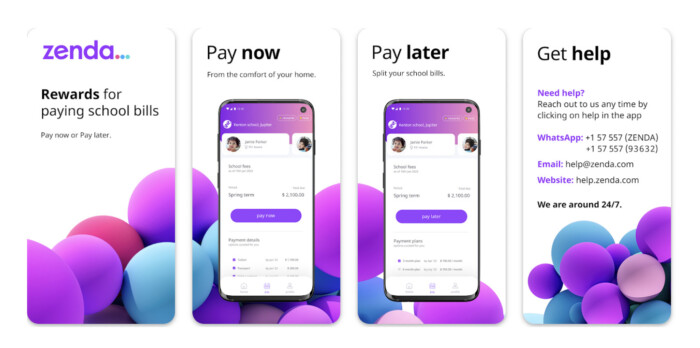

3. Zenda

Founded: 2021

Total funding amount: $9.6 M

Industry: Fintech

Applications: payments

Mission: Streamlining school payment process

We have already mentioned that the expat community makes up the majority of UAE’s and Dubai’s population. At the same time, free public education is only available to UAE citizens. And saying that acquiring citizenship is hard would be quite an understatement. Doing the maths, that means most parents in Dubai will pay for their children’s education.

No wonder, an idea for an app like Zenda emerged. Based in Dubai, the startup has created an online platform that rewards users for paying school fees. With its help, schools can grant parents the flexibility to pay later and save time by removing manual reconciliation. On-time payments are rewarded, motivating parents to keep the deadlines but not punishing them for breaking them.

4. Tarabut Gateway

Founded: 2018

Total funding amount: $57 M

Industry: Fintech

Applications: open banking

Mission: Redefining financial management via open banking

When it comes to open banking, the EU and the United Kingdom are the unquestioned leaders. That’s because its economic growth and adoption are catalyzed by law regulations, which many other regions lack. MENA region is a good example, not having introduced so far a legal framework that would streamline open banking in the area. However, Dubai startups are noticing the potential of this concept, making it easier for the banks to connect and exchange customer data.

Tarabut Gateway is a great example, providing financial companies easy access to open banking APIs. Using its services, businesses can transform their transactional data into actionable customer insights and facilitate direct bank-to-bank payments. Their offer links fintech, banks, and merchants, allowing all parties to provide the maximum value to their customers.

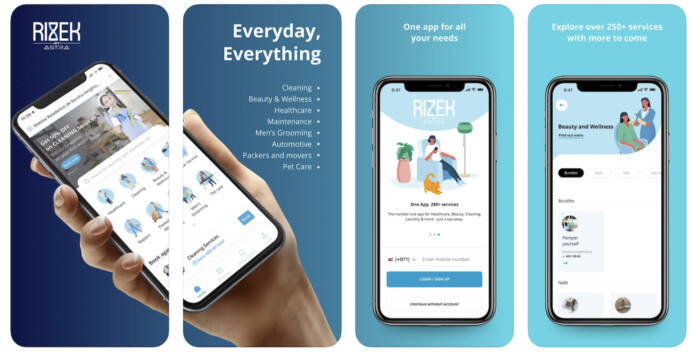

5. Rizek

Founded: 2018

Total funding amount: $15 M

Industry: Human Resources

Applications: employment platform

Mission: Facilitating access to on-demand workers and allowing them to find safe employment

The United Arab Emirates is a popular destination for migrants from around the globe – from the United States to the Far East. As it befits a dynamically developing city with many ambitious architectural projects and business opportunities, it attracts not only notable investors but also job seekers and workers looking for job opportunities in the services or construction sector. The country’s economy is heavily dependent on migrants’ work. However, even though it has undergone some law changes, its work system can still be considered flawed.

As a work platform, Rizek empowers the on-demand employees, among which many are migrants, helping them find contractors safely and directly without relying on the middlemen. The verification processes and transparency protect employees who can find work with Rizek quickly within various categories, from grooming to housekeeping or nursing.

6. Fenix Games

Founded: 2022

Total funding amount: $150 M

Industry: Gaming

Applications: games production

Mission: Expanding the diversity of Web 3.0 games scope

What will happen if the gaming and Wall Street veterans come together to do business? As Fenix Games proves, such a mix is doomed to success! The Dubai-based startup company entered the market in 2022 and has already raised over 150 million dollars in a funding round for further development. What makes it stand out is its focus on blockchain. Fenix Games is a Web 3.0 publisher, revolutionizing the players’ relationship with the games by inviting them in as stakeholders.

Its creators have noticed that regardless of the impact blockchain had on the industry, the scope of the games published on the blockchain platforms was still relatively limited. They aim to fill the apparent market gap, investing in the games that present a potential for the web 3.0- fuelled future. And they know what they’re doing, considering their extensive experience with such market leaders as Electronic Arts or Mythical games.

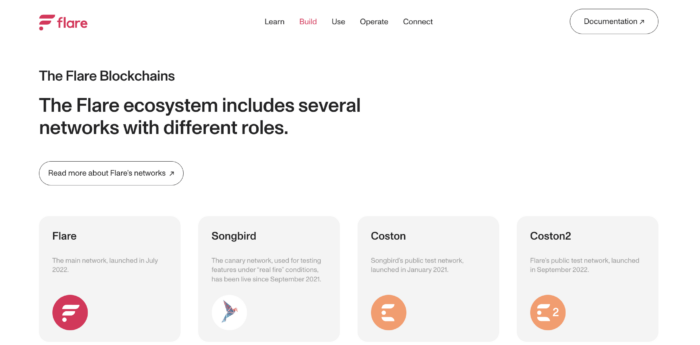

7. Flare Network

Founded: 2015

Total funding amount: $8 M

Industry: Blockchain

Applications: Interoperability protocol

Mission: Increasing connectivity between blockchains

As the world shifts towards the decentralized internet, blockchain tools could be a gateway for Dubai startups to worldwide recognition. Flare Network is one of these companies that have already grasped this opportunity. As a cutting-edge layer 1 blockchain, it offers robust decentralized connectivity with other chains and reliable real-world data sources.

Teams can use Flare to connect the currently developed innovative solution with the data from other blockchains. This way, they expand the reach of their project, maximizing its potential profit. What’s more, as a part of its grant program, the Dubai startup offers developers an opportunity to access funds for building tools supporting the further growth of the ecosystem.

8. Verofax

Founded: 2018

Total funding amount: $ 3M

Industry: Tech consulting

Applications: Blockchain

Mission: Strengthen consumer-brand connections, turning shopping and products interactive

“Never trust, always verofax; as we look to the future, our resolve is only strengthened to bring forth innovations that redefine the consumer landscape,” said Wassim Merheby, CEO of Verofax, shortly after winning the GITEX Supernova Web3 & Blockchain Award 2023. Verofax, a UAE-based startup and service provider, pioneers a transformative approach to consumer-brand interactions by revolutionizing the shopping experience. Their platform creates a seamless and immersive shopping journey where consumers have the tools to validate product attributes.

Through their cutting-edge technology, Verofax facilitates a direct and transparent connection between consumers and brands at the crucial point of purchase. They leverage interactive Product IDs and state-of-the-art product recognition powered by advanced computer vision. Verofax’s platform introduces augmented reality interactions, offering consumers personalized experiences that redefine brand loyalty. By incorporating individual purchase history and preferences, they tailor exclusive discounts, amplifying the value for consumers while fostering an intimate engagement between customers and brands. At its core, Verofax’s mission is to reshape the consumer landscape by empowering individuals to make informed purchasing decisions.

9. Tabby

Founded: 2019

Total software funding amount: $ 1.7B

Industry: Fintech

Applications: Shopping assistant

Mission: Create financial freedom. Interest-free monthly payments online and in-store

Tabby, an innovative Buy Now Pay Later (BNPL) fintech startup, revolutionizes the shopping experience by offering consumers flexible payment options. With Tabby, users can make purchases instantly and split their payments into manageable installments, easing the financial burden and enhancing affordability. This empowers shoppers to buy the products they desire without immediate full payment. Tabby’s seamless integration at the checkout simplifies the process, allowing customers to select the BNPL option and enjoy their purchases immediately while paying in convenient, interest-free installments.

Beyond convenience, Tabby prioritizes user-centric experiences and financial technology. The platform promotes responsible spending while offering transparent terms and conditions by eliminating the need for traditional credit cards or complex loan applications. Tabby’s mission is to redefine both shopping and financial landscape, providing a frictionless and inclusive payment solution that enhances the purchasing power of consumers while supporting merchants in driving growth and customer loyalty.

Best startups in Dubai: the overview

It seems like the most innovative UAE startups have established themselves in the fintech market, which is quite understandable considering that some financial technology solutions are not yet present in the MENA area. At the same time, its different socio-economic reality calls for unique tools that will not necessarily achieve widespread adoption in other parts of the world.

But as you can see, Dubai is not only about finance – innovations are popping up in various areas, including SaaS and blockchain. Although we mainly associate UAE’s capital with visionary, often otherworldly projects incorporating AI into architecture and various other domains, it doesn’t lack down-to-earth initiatives and significant investment, with Global Founders Capital playing an active role in funding ventures that have the potential for international success.

What are the future perspectives for the startups in Dubai?

In the near future, Dubai will likely strengthen its strong position as a lead blockchain player. Already in 2016, IBM called it a future “blockchain capital of the world“, following the UAE’s announcement of the Dubai Blockchain Strategy, which, in a nutshell, aimed at full blockchain adoption of the governmental system. Seven years later, the city made significant progress in its journey toward paperless bureaucracy. At the same time, it is building its reputation as a blockchain adoption accelerator, organizing events that have already gained international recognition, such as Future Blockchain Summit or Blockchain Life.

The UAE has already proven its openness to crypto, and it may soon join the wave of countries establishing incentives for crypto companies as a response to the US’s SEC recent restrictions. At the same time, we will likely see Dubai’s enterprise software development sector, which already has a strong international presence, expand further and strengthen its position, both in the area of end-to-end development and IT team augmentation.

As a software development outsourcing services company with a portfolio of innovative projects, we closely follow the latest novelties across industries. If you want to keep up with them, too, subscribe to our newsletter! Today, we focused on the best startups in Dubai, but every once in a while, we cover a different region, so if you’re interested in the startup scene, don’t miss out on it. And now, you can dive into the innovative world of Scandinavian tech entrepreneurship with The Best GenAI Scandinavian Startups article or uncover the ingenious renewable energy startups driving us towards a greener tomorrow.

![[header] startup product strategy unlocking growth opportunities for series a startups](https://www.miquido.com/wp-content/uploads/2023/06/header-startup-product-strategy_-unlocking-growth-opportunities-for-series-a-startups-432x288.jpg)