Across Asia's tech landscape, super apps have transformed digital life by encompassing social media, financial services, transportation, e-commerce, and government services into a single interface. The idea of a super app in Europe is gaining momentum, though its path is more complex due to regulatory, cultural, and technical differences.

Unlike many private apps that serve niche purposes, super apps offer all the usability benefits of a unified platform, integrating services and simplifying access to a wide range of daily needs. However, in the highly regulated environment of the European Union, bringing such a platform to life requires significant effort, particularly around managing consumer data, digital identity, and ensuring compliance with data protection rules.

This article offers leading industry insights into how Europe is adapting the super app model, the roadblocks ahead, and the strategic opportunities for more consumer-facing brands and digital transformation leaders.

What makes an app "super"?

A super app goes beyond a multifunctional application. It represents a platform-centric ecosystem where users can perform various activities, often across different industries, under a single digital roof. Key characteristics include:

- Service integration: Combines various core services like payments, messaging, e-commerce, mobility, and more.

- User identity management: A single login for multiple services, enabling seamless user experiences.

- AI-driven personalization: Utilizes artificial intelligence to personalize content, suggest actions, and optimize navigation.

- Mini-app ecosystem: Allows third-party developers to create and integrate microservices or mini-apps.

- Consistent UX/UI: Offers a unified design language and navigation system.

These capabilities have made super apps essential to day-to-day life in countries across Asia, but country-specific data laws in Europe mean the model must evolve. To better understand the trade-offs involved in developing and adopting super apps, it’s helpful to consider their key benefits and challenges.

| Benefits of super apps | Challenges of super apps |

|---|---|

| All-in-one user convenience | Data privacy and regulatory compliance (e.g., GDPR) |

| Cross-service personalization | High technical complexity and architecture demands |

| Higher customer retention and loyalty | Difficulties in unifying UX across services |

| Platform-based monetization (ads, fees, data) | Security risks from integrating multiple services |

| Improved data insights for service optimization | Dependency on reliable third-party partnerships |

| Increased user engagement and frequency | Market fragmentation across regions and languages |

| Easier scalability through third-party integrations | User skepticism over data sharing with private entities |

The WeChat effect: How Asian super apps revolutionized digital ecosystems

The super app model reached global prominence with the success of WeChat in China. Originally a messaging app, WeChat evolved into a central hub for communication, payments, e-commerce, health services, and even government transactions.

Other notable examples of super apps include Grab in Southeast Asia, which has grown far beyond its ride-hailing roots to offer services like food delivery, insurance, and digital payments. Similarly, Indonesia’s Gojek has evolved into a multi-service platform providing over 20 offerings, from transportation and logistics to digital wallets and microloans.

A great example of such an application can be the South Korean Gbank. Developed by Kakao, Gbank merges digital banking with social messaging and lifestyle services, exemplifying how financial and communication features can be unified. It leverages Korea's strong mobile infrastructure and national digital ID framework to deliver a frictionless user experience.

These platforms thrive due to centralized services, low app storage needs in emerging markets, and government collaboration. Their success proves that users value convenience, speed, and integrated ecosystems.

Why super apps haven’t dominated Europe (yet)

While digitally advanced, Europe presents a complex landscape that has delayed the widespread adoption of super apps. Strict data privacy regulations, particularly GDPR, place firm limits on how user data can be collected, shared, and used, posing significant constraints for platforms that rely on deep personalization.

Additionally, Europe's cultural and linguistic diversity creates a fragmented market where designing a one-size-fits-all experience is both technically and strategically challenging. Unlike markets where super apps have flourished, European users tend to favor best-in-class apps for specific tasks, leading to entrenched loyalty across categories. The high smartphone penetration and widespread availability of digital services also mean that many consumer needs are already being met, leaving less obvious space for disruption.

European consumer behavior and market readiness

A few reasons explain why European consumers haven't fully embraced super apps yet. Consumer behavior in Europe has long favored many private apps each serving a specialized function. Yet, as digital expectations rise, interest in consolidated, all-encompassing functionality is growing.

Surveys show increasing openness to managing financial services, food delivery, social networking, and even government services in one app, provided it offers value and respects user privacy. The increasing complexity of managing multiple logins, notifications, and service providers is nudging users toward platforms that integrate services more efficiently.

Regulatory complexity and identity-centric models

Europe's digital economy is shaped by some of the world’s strictest data protection rules, making it challenging to replicate models from Asia. Key differences include:

- Decentralised identity models that remove the need for a single private entity to store huge databases of sensitive information

- Legal requirements for genuine presence assurance, such as proving minimum legal age or national residence before gaining access to retailers selling alcohol or education institutions

- Tight restrictions on how private organisations can use consumer data for future marketing communications

In this context, digital identity becomes a critical enabler. Tools like the mobile driving licence and other forms of credentials securely stored on a mobile device are increasingly used to prove personal attributes such as age, residency, and citizenship. This identity-centric approach is especially relevant for services that span financial services, healthcare, and government services.

Technical and data architecture considerations

Building such platforms in the European context requires technical excellence and a deep understanding of evolving legal frameworks, user expectations around data sovereignty, and the need for seamless interoperability across diverse services.

To achieve super app status in Europe, developers must design platforms that are:

- Inherently highly secure, with encryption and role-based access to highly sensitive databases

- Built on modular, API-first architectures that support third-party organisations

- Aligned with decentralised identity models that enable third-party organisations to verify users without storing raw identity data

For example, a super app facilitating embedded finance and payments platforms must support country-specific compliance while offering seamless integration with identity documents, loyalty programs, and corporate email address verification.

The AI advantage in super app ecosystems

Artificial intelligence drives the adaptability and personalization that make super apps work. As these platforms expand, AI plays a crucial role in connecting services, customizing user experiences, and helping businesses make smarter decisions—all while keeping everything smooth and responsive across different features.

Personalization engines: Creating tailored User Experiences

AI enables real-time service personalization by analyzing user behavior, preferences, and intent, allowing businesses to tailor experiences across key touchpoints—from product and service recommendations to personalized financial planning tools and dynamic content feeds. At Miquido, we use collaborative filtering, natural language processing, and deep learning to build smart personalization engines that drive engagement, increase retention, and strengthen customer loyalty.

Conversational AI and virtual assistants as service hubs

Voice and chatbot interfaces act as seamless gateways into complex service ecosystems, enabling users to easily book rides or appointments, manage shopping lists through voice commands, or easily access AI-powered customer support. By improving accessibility and reducing cognitive load, these interfaces make digital interactions more intuitive and user-friendly.

Predictive analytics for cross-service optimization

Predictive models can anticipate user needs before they arise, enabling smarter features like inventory optimization, fraud detection, and personalized upselling. By analyzing patterns in user behavior and historical data, these models help businesses respond proactively rather than reactively. Super apps tap into these insights to deliver more innovative, efficient services while strengthening customer loyalty and minimizing churn.

Building a value-added service strategy

For super apps to succeed, it's not just about offering many features—they need to create a seamless, valuable experience that keeps users coming back. That means carefully choosing, building, and connecting services that meet real user needs and strengthen the app’s core purpose. VAS business model can be a step towards building a super app in Europe.

Identifying core vs. complementary services

Successful super apps are built around a compelling core use case, then expanded into logical adjacencies. For example, FinTech super apps might expand from payments to lending, insurance, and investments. Another use case is that mobility apps could integrate parking, tolls, and public transport schedules. The key is to prioritize high-frequency, high-utility services.

Build, buy, or partner? Strategic approaches to service expansion

Each approach offers trade-offs:

- Build: Greater control and integration, but slower time-to-market.

- Buy: Faster capability acquisition but requires cultural and technical alignment.

- Partner: Scalable and flexible, but dependent on third-party reliability.

Miquido supports clients across all three strategies, offering custom development, technical due diligence, and integration frameworks.

Creating seamless experiences across multiple services

Creating a consistent user experience across services is key to making a super app feel seamless and intuitive. This means using shared UI elements, global search, and familiar interaction patterns that help users feel at home, no matter which feature they use. Tools like design tokens, component libraries, and contextual shortcuts are vital in maintaining visual and functional harmony throughout the app.

Emerging use cases: Super apps for Europe

Rather than one dominant player, Europe is likely to see sector-specific or country-specific super apps. Promising categories include:

- FinTech: Financial platforms already adopt super app characteristics, combining financial services with shopping, budgeting, and travel.

- Government services: Apps that help users access national residence documents, exchange identity documents, or connect with public utilities will gain traction, especially if tied to official mobile driving license-based systems.

- Retail and lifestyle: Retailers offering alcohol or age-restricted products must verify users' minimum legal age, opening the door for apps that combine payment platforms with age verification and delivery tracking.

While no European company has reached the scale of WeChat, several are moving in that direction:

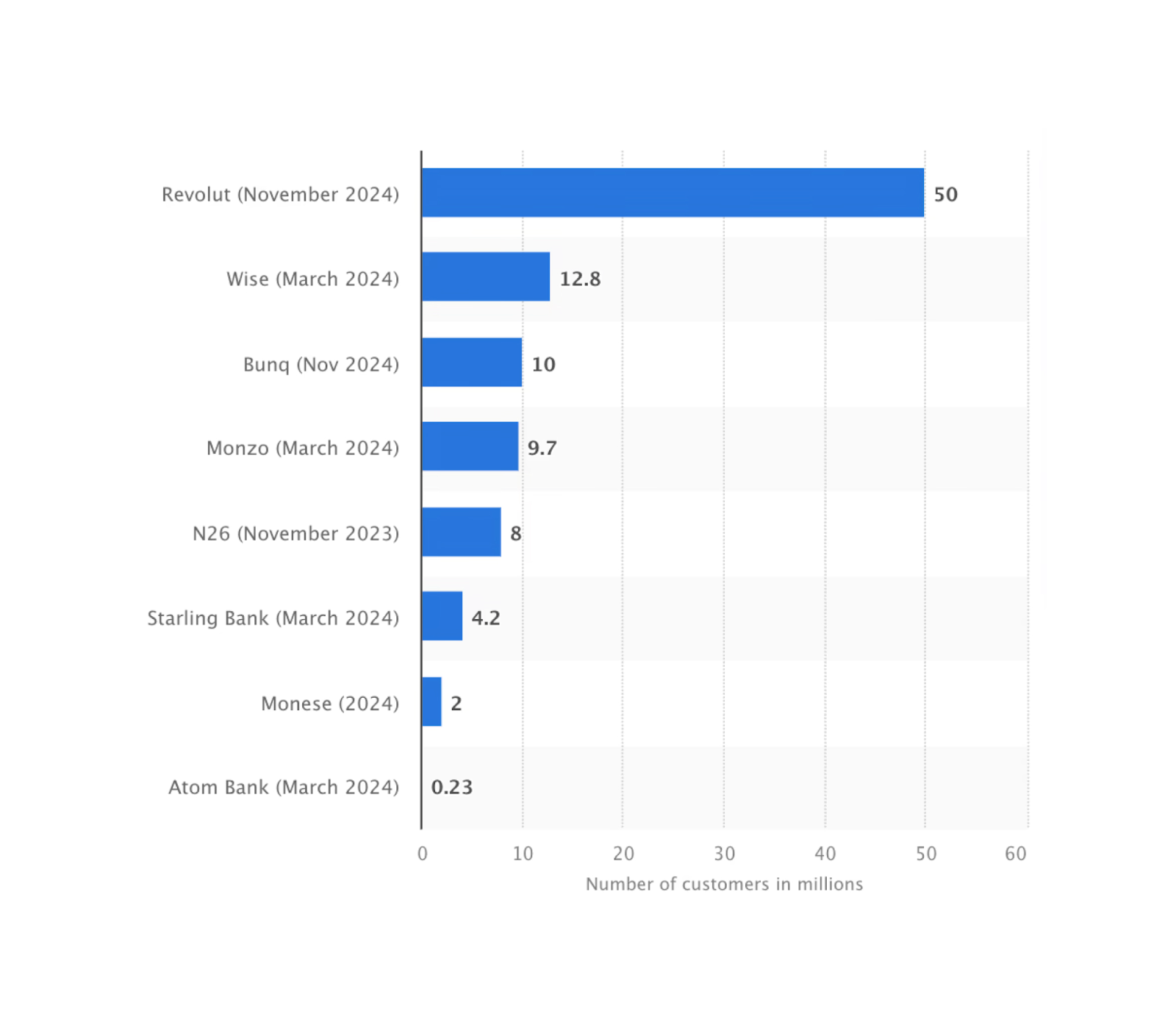

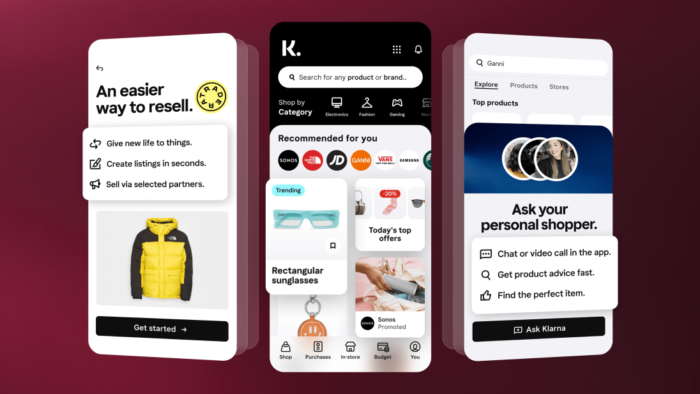

- Revolut (UK): Originally a fintech startup, Revolut has evolved into a multifunctional platform offering currency exchange, stock and crypto trading, travel insurance, and lifestyle integrations. Its vision is to become a financial super app tailored to modern consumers. According to Statista, Revolut is the market leader in the European neobank sector, with 50 million customers reported in November 2024.

- Satispay (Italy): A mobile payment app expanding into bill payments, charity donations, and small business transactions. It maintains strong regional adoption and hints at broader ambitions.

Data sovereignty and the path forward

In Europe, data sovereignty and identity control are essential, not optional. The super apps that will thrive are those that give users complete control over their own data, move away from centralized private ecosystems, and adopt decentralized identity models for authentication. This approach goes beyond meeting regulatory requirements—it builds lasting trust.

By enabling users to manage their identities, maintain control access to their credentials, and securely authenticate across services, these apps position themselves to earn both user loyalty and a more substantial presence in the market.

The rise of super apps in Europe is not about replicating Asia’s tech giants. It's about evolving the model to fit a highly regulated environment, empowering users through decentralised identity, and unlocking the value of such a variety of interconnected services.

For digital leaders, the opportunity is massive. But success requires a blend of technical expertise, regulatory compliance, and strategic insight into consumer day-to-day life.

![[header] the rise of super apps in europe – opportunities, challenges,and future directions](https://www.miquido.com/wp-content/uploads/2025/05/header-the-rise-of-super-apps-in-europe-–-opportunities-challengesand-future-directions.jpg)

![[header] 10 embedded finance examples](https://www.miquido.com/wp-content/uploads/2025/03/header-10-embedded-finance-examples-432x288.jpg)