Can you offer banking services such as loans or funding in case you are not a bank? With the evolving open banking technology, it is now easier than ever! Banking-as-a-service is gaining increasing popularity across companies as a way to increase customer engagement and retention.

At the heart of the BaaS revolution lies the concept of open banking, an approach that advocates for the secure sharing of financial data between banks and authorized third-party providers.

By leveraging BaaS principles, FinTech and software platforms can offer customers personalized, data-driven financial solutions that were previously inaccessible within the confines of traditional banking systems. Miquido has been at the forefront of empowering businesses to embrace BaaS and open banking. Through strategic partnerships with financial institutions and forward-thinking technology providers, we played a pivotal role in revolutionizing how banking services are delivered and consumed through banking solutions. In this article, we take a closer look at BaaS and its potential for FinTech or software platforms.

What is Banking-as-a-Service?

Even if you don’t know the BaaS term yet, you have probably heard of SaaS. In all the “as a service” domains, the principles remain the same. The service provider offers you its existing solution, usually in the form of a subscription, enabling you to enjoy all its benefits without investing in your own resources and infrastructure.

While in the case of SaaS, companies pick this model to spare themselves the custom software development, BaaS allows them to avoid all the formalities tied to providing banking services. Otherwise, in order to be capable of delivering them, they would need a licence, which is not that easy to get. Granted by the national supervisory authority, it obliges you to meet a bunch of strict requirements.

Whether it is a licence for traditional or digital services, your company needs to prove that it’s financially sufficient (meaning it has available reserves) and capable of effectively protecting customer data. With a BaaS FinTech or software platform, you can cut corners, implementing the services of the banks on your platform without fulfilling these requirements. The banks provide you with their products, technology, and operations.

What can you use BaaS for as a FinTech or software platform?

Banking services is a broad umbrella term, but how can you actually improve your platform using BaaS? There are various banking services to adopt, but we will bring up a few here just to illustrate what you can do with it.

Let’s imagine you run a FinTech platform that aims at facilitating online purchasing. You can use the services of the bank to, for example, provide the users with easy access to a loan directly on your customer’s website or within their app. That increases the purchase probability, granting an alternative funding option without interrupting the customer journey.

Another example: you run a crypto platform that provides mobile crypto wallets, and you want to enable your users to easily exchange crypto to fiat in the browser. Using BaaS, you can achieve that, taking advantage of a bank’s licence and providing your customers with fiat coverage.

As for software platforms, you likely want to provide your users with maximum flexibility to shape their solutions according to their needs. Banking-as-a-service through an API will grant you the ability to include different features in your suite, from loans, through non-traditional credit scoring, to loyalty points. Your e-commerce clients could, for instance, enable the “Buy Now, Pay Later” option with BaaS or unlock the possibility of obtaining credit for in-store purchases for their customers.

Embedded finance may cover such services as:

- payments

- lending

- financial accounts

- business cards

- digital wallets

And that’s just the beginning of a long, long list!

Embedded finance, encompassing a wide array of services from payments and lending to digital wallets, represents the future frontier of digital banks. As BaaS platform providers forge strategic collaborations with diverse industries, the integration of financial services into non-financial platforms can change the way consumers interact with money, creating convenience and driving further innovation in the financial technology space.

Why is it worth turning into banking as a service in FinTech or software platform?

Even though banking as a service is relatively new, it’s steadily gaining popularity among FinTech and software platforms, since it opens new opportunities in front of them without needing to meet all the strict initial requirements of the licence providers. Such a model enables all the parties involved to create unique, seamless financial experiences, strengthening the bonds of the financial sector with various others and facilitating the data flow.

As a platform owner, you can significantly cut your time to market with BaaS, avoiding the timely feature development and still providing your customers with the highest value. At the same time, you don’t need to maintain all the software and infrastructure responsible for facilitating banking services – all that is on the provider’s side. The same for security – it is the licensed party who is responsible for the safety measures regarding user data. All that means you’ll likely lower your operational costs while getting rid of responsibilities that often require additional investments.

For your clients, software or FinTech banking as a service equals a seamless experience, as they can access various banking products, such as loans or funding, directly through your platform. Having access to these additional services directly through your solution, the customer is less likely to migrate to competition and more likely to expand the usage of your services, which boosts their lifetime value.

How can you use Banking as a service?

As a platform that relies on BaaS, you can either become a:

- distributor, offering unique financial service propositions with the help of banks (most common path for software platforms)

- distributor-aggregator, who enhances them by combining the offers of various providers and implementing new products (for instance, mobile wallets)

- provider-aggregator, expanding the similar banking services (most common path for fintechs)

As you can see, the potential of BaaS for software and FinTech companies is immense, but how can you really incorporate it into your platform? There are two scenarios, one direct and the other – involving a third party.

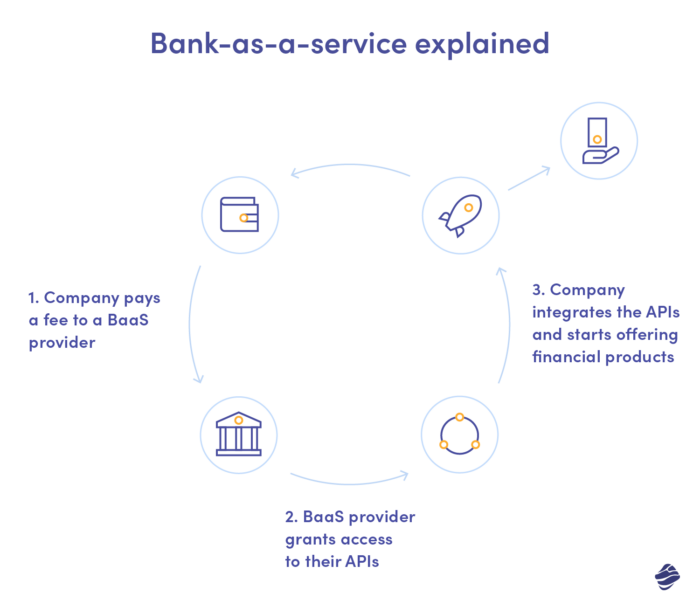

In the first scenario, you can become a BaaS FinTech or software platform yourself, cooperating directly with the banks that grant you access to their data and systems through the Application Programming Interface. In the second one, you join forces with a BaaS third-party provider who grants the underlying service, linking you with the financial products and services. You can either be charged in a subscription model or per service. What’s important, the cooperation can either be white-label or co-branded, adopting a form of a curated partnership.

The role of open APIs in enabling seamless integration in the banking industry

While the direct cooperation with the banks removes the third parties, which could cut your costs and provide you with more flexibility when scaling, requires you to invest more in API management and maintenance and often implement significant changes in your infrastructure. At the same time, you are bound to manage regulatory requirements, including GDPR and Payment Card Industry compliance.

Open Application Programming Interfaces (APIs) enable seamless integration of banking functionalities into FinTech and software platforms. By exposing well-defined APIs, banks and financial institutions empower third-party developers to access their core services, allowing for the secure exchange of data and transactions. These open APIs serve as the bridge that connects traditional banking infrastructure with the innovative solutions offered by agile technology providers.

The use of open APIs not only streamlines the process of accessing financial data but also fosters a collaborative environment, encouraging cross-industry partnerships that lead to inventive financial products and services. As a result, the adoption of open APIs has become a driving force in reshaping the financial landscape, revolutionizing how consumers and businesses interact with their finances while propelling the industry towards a more interconnected and user-centric future.

Therefore, with the third-party provider, you can easily embed financial products and services in your software. They handle compliance on your behalf while you can focus on your primary activity. Risk management, fraud protection, and underwriting also stay on their side. BaaS providers grant you direct or indirect access to payment networks and schemes.

Implementing embedded finance into your platform – practical recommendations

As you can see, the BaaS provider takes care of the crucial aspects of the embedded finance, minimising the involvement and required resources on your side. But how to pick the right partner? We have put together some essential aspects to look into when choosing your provider.

Reputation

Banking-as-a-service is a relatively new niche, so you might struggle to recognize well-established providers right away. Check their references and case studies to understand whether they are a good pick. If you cooperate with a BaaS consulting company, you can ask for a list of BaaS providers, comparing various aspects of their service to get a bigger picture. Some banking as a service providers, like BBVA, have gone all the way from traditional banking to embedded finance offerings – in their case, the reputation is easy to keep track of.

Security Protocols

Even though, as a platform, you are not directly responsible for customer data protection within BaaS services; any privacy breach may affect your reputation and cost you, clients. Solid security coverage is thus a must. Search for BaaS providers that don’t limit themselves to basic protocols, using encryption technologies that add an additional layer of security, such as PGP keys and eIdAS.

The variety of banking services available

Various different services may be the most relevant for you as a platform owner, depending on the specifics of your platform. Maybe for now, you need only access to one particular service, but think about the future! As you scale, you could benefit from implementing other financial products for your customers. Pick a provider that covers their wide range to avoid dividing your embedded finance between various platforms in the future, which would generate additional costs and logistic issues.

Regulatory compliance

As we’ve mentioned, your BaaS provider should facilitate your regulatory compliance, helping you stay on top of the rules, which change incredibly fast in the banking sector. Even though, as a software or FinTech banking as a service company, you need to be aware of the evolving regulations, a reliable one will handle it for you. From KYC (know your customer) procedure which is a preventive measure against criminal activity, through PCI compliance and AML (anti-money laundering), to transaction monitoring – make sure that your provider covers these areas.

How to make the most of banking as a service?

The BaaS model allows you to boost customer engagement and margins by facilitating their access to financial products, but there’s more to it. Customer data that in the traditional model would be reserved only for banks, now become accessible for you, and you can use it to optimise your services.

Through the API, the BaaS providers grant you access to the collected information on clients using payment services, cards, loans, etc. You can use them to leverage your data analytics, identifying key customer needs and preferences. Based on the customer data captured via these channels, you can customise the user experience, increasing the overall retention rate. That, of course, means unlocking a higher margin.

Examples of companies successfully using banking as a service platforms

Many of today’s digital giants rely on BaaS providers to ensure embedded financial services within their software. Uber can be a good example, having partnered with Green Dot and Barclays to facilitate its drivers earning management and unlock their access to funds with a real-time earning function.

Another driver-oriented BaaS service within an Uber ecosystem is lending. It lowers the entry threshold for the drivers, helping them aggregate funds for the vehicle, whether it’s renting or buying. Considering the rising demand for Uber services, such BaaS features are a clever move from the company’s side, providing it with constant coverage.

FinTech companies often partner with BaaS providers but move on to become independent money institutions due to their growth and related constraints within BaaS partnerships. When it comes to startups, Swile comes across as a great example. The company provides an employee engagement app combined with a card that allows your staff to collect points and use the gift, meal, and culture vouchers. Swile is an indirect SEPA participant, meaning they have their own BIC and can issue their own IBANs.

The same goes for Varo, a FinTech-turned-neobank that incorporated banking as a service with a mission of democratising access to loans for “credit invisible” clients who never established a credit profile. Varo partners with a Bancorp Bank to provide financial services, but it became a financial institution itself back in 2020.

Baas services – what comes next?

Banking as a service is expanding and gaining significance across sectors, and with time, we’ll likely see it developing further, with new products and financial concepts coming ahead. It’s a great chance for small businesses and marginalised groups to get access to financial products and services that were out of their reach in a traditional banking model due to lack of data, bureaucracy, or strict scoring rules. Many companies that today rely on banking as a service will become financial institutions themselves at some point, having reached a level of operations that calls for independence due to costs and legal constraints.