In an era where digital transformation has become a strategic imperative rather than a technical upgrade, financial services companies are reimagining how they operate, serve, and compete. By integrating new technologies such as advanced technology, artificial intelligence, and intuitive digital tools, these organizations are moving beyond outdated systems toward streamlined, insight-driven delivery models.

A successful digital transformation is not measured by flashy apps or one-off automation—it’s defined by the ability to redeploy talent toward high-value activities, unlock deep data analysis, and install new systems that evolve with the business. Learning from digital transformation trends across other sectors, forward-thinking institutions focus on understanding customer behavior at a granular level, enabling more personalized, agile, and resilient operations.

Why digital transformation in finance has become imperative

Financial services must transform or fall behind. Outdated systems, rising competition, and changing customer expectations demand faster, smarter, and more flexible digital operations.

Rewriting the story of financial services

The financial services industry is undergoing one of its most profound shifts ever. At the center of the change is digital transformation in finance—a shift from incremental upgrades to wholesale reinvention.

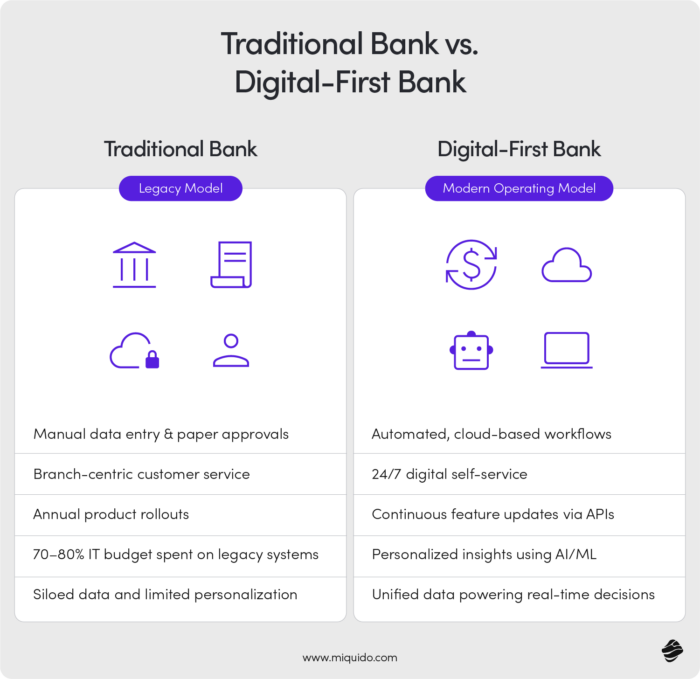

Traditional banks and legacy systems built decades ago for stability now find themselves ill‑prepared for a world that values flexibility, speed, and personalized experiences. Key drivers drive the pace of disruption:

- Customer expectations shaped outside finance—In an era of seamless e-commerce and streaming, consumers expect the same convenience from financial institutions: unified views of customer data, friction-free financial transactions, and real-time access to their finances on mobile devices. The result: anything less feels outdated. In fact, 76% of consumers are willing to switch banks for better digital services, and 91% list digital banking capabilities as critical factors in choosing a bank

- FinTech and non-finance players encroaching – Technology majors and nimble financial services companies are weaving money management into everyday apps. A new default emerges: financial services embedded in life, not siloed in an app.

- The financial services sector is more competitive than ever. Incumbent banks compete not just with each other but also with startups and global platforms. Staying relevant means evolving your operating models and business processes through the integration of digital technologies like AI, cloud, and automation.

In short, the future belongs to organizations that embrace new technologies, build digital platforms, and invest in cloud solutions—because survival demands it.

The cost of ignoring digital

Meanwhile, failure to evolve isn’t merely a missed opportunity—it creates a cascade of problems:

- Legacy systems hamper transformation. Venerable financial systems built on outdated architectures obstruct integration, slow innovation, and rack up high maintenance costs. They also reduce agility and constrain responsiveness. Banks allocate 70% of their IT budgets to maintaining legacy systems, significantly limiting innovation and digital transformation efforts.

- Manual data entry slows operations. Excessive human dependency on manual data entry, spreadsheets, and paper-based approvals introduces error, friction, and cost, burying efficiency under process overhead.

- Lack of data insights. Booming volumes of financial data and big data lie underutilized without strong data analytics and advanced analytics capabilities, leaving leaders flying blind.

- Security and compliance headaches. Outdated existing financial systems can’t meet modern regulatory compliance obligations, exposing institutions to risk and undermining trust.

For finance leaders, the message is clear: transforming operations using digital technology isn’t a bonus—it’s essential to staying competitive, defending margins, and serving evolving expectations.

Where digital transformation pays dividends

Nothing proves the value of digital transformation in finance like results. The payoff spans four interconnected domains: customers, operations, intelligence, and competitive positioning.

Elevating customer experiences with digital platforms

Attracting new clients and retaining valued ones depends on delivering more than classic service—it requires insight and empathy:

Personalized services at scale

Financial services organisations can use machine learning, AI-powered recommendation engines, and data analytics to track user behavior and customer data, from savings patterns to spending anomalies. That enables contextual guidance, tailored advice, custom product offers, and real-time access to insights like never before.

Empowering self-service through automation

Customers now expect to do complex tasks independently: open a mortgage, adjust investments, or transfer funds 24/7, without human assistance. Well‑designed digital services, cloud solutions, and automated workflows facilitate seamless self‑service, reduce friction, and protect against costly mistakes.

Safer, smarter interactions

Modern solutions use AI-powered fraud detection to flag suspicious behavior and block threats in real time, while biometric identity and strong data security make digital channels trustworthy.

Financial institutions redefine what banking should feel like by upgrading from reactive support to proactive friendship.

Amplifying efficiency through automation and the cloud

Here’s how automated workflows, robotic process automation RPA, and cloud reinvention reshape the core:

End-to-end processing automation

Robot process automation removes the chokehold of repetitive workflows—loan approvals, risk flagging, reconciliation, client onboarding—liberating staff to focus on more creative, judgment-driven tasks.

Scalable IT with cloud infrastructure

Cloud computing, virtual environments, and microservices infrastructures enable rapid system deployment, easy scaling during demand surges, and centralized management, without the cost or rigidity of on-prem servers.

Redeploying talent to high-value work

With a digital hammer sifting through the grunt work, human capital can shift toward advisory, partnership-building, or strategic decision-making, where empathy and insight count.

Improved cost structures

Combined, automation and cloud solutions reduce the cost per transaction, improve SLA adherence, and expand capacity without linear increases in headcount or overhead.

Unlocking insights from data

Big data and data management capabilities turn raw touchpoints into foresight engines:

Cohesive analytics ecosystems

Consolidated data from transactions, operations, and touchpoints feeds data analytics, advanced analytics, and machine learning tools that detect patterns, predict churn, and provide real-time performance indicators.

Proactive fraud, credit, and compliance controls

With AI-powered monitoring, financial services organizations can spot fraud automatically, assess creditworthiness dynamically, and ensure regulatory adherence without manual oversight.

Empowering finance leaders

Dashboards populated with live metrics—conversion rates, risk exposure, adoption—enable finance leaders to pivot swiftly, guided by fact, not guesswork.

Seizing competitive advantage and ecosystem influence

Digital financial companies don’t just compete—they architect new industry standards:

Continuous innovation at speed

Digital-first champions iterate features in weeks or months—not years—using cloud-native stacks and API-first development cycles. This speed keeps the business agile and responsive to feedback.

Platform thinking and partner networks

With application programming interfaces, banks can embed services inside nonbank apps—or invite fintechs into their ecosystem, delivering end-to-end solutions that drive stickiness and differentiation.

Recasting value propositions

By integrating advanced technology, automated workflows, and data analytics into everyday life, financial services companies offer reasons beyond price to stay loyal to them.

Bridging the gap: trends, pitfalls, and pathways forward

Digital transformation doesn’t happen overnight. It unfolds in waves, shaped by market realities and technology horizons. Let’s explore what’s next—and how organizations can navigate.

Emerging technologies that redefine boundaries

AI and machine learning (ML)

Evolving beyond rules engines and chatbots, artificial intelligence AI now underpins portfolio optimization, sentiment analysis, next-best-action prompts, and client behavior modeling. Governance frameworks must follow to interpret and trust ML-driven advice.

RPA plus orchestration

When robotic process automation RPA is teamed with orchestration engines, workflows can react to real‑world events—upsizing, blocking, routing decisions—in fully automated systems.

Blockchain and cloud solutions

Blockchain technology is being piloted for settlement, trade finance, and identity in tandem with cloud computing, though questions around scalability and regulation remain. Combined, they promise transparency and resiliency.

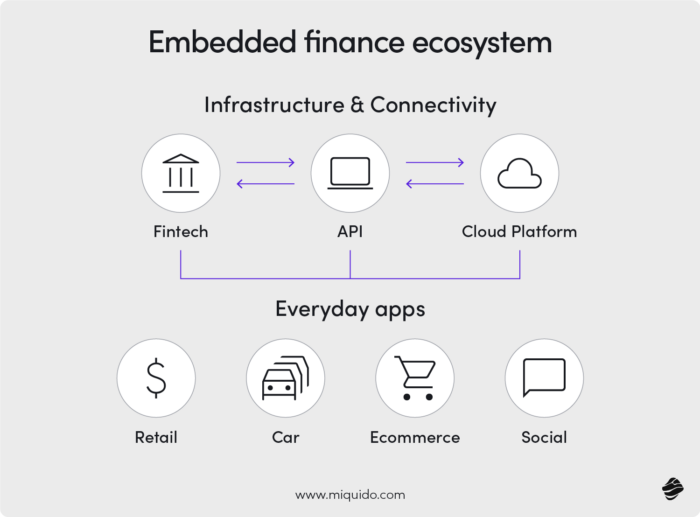

API-driven ecosystems

Open banking and embedded finance depend on robust, secure application programming interfaces—the plumbing that makes connecting new services and sharing data across boundaries easy.

FinTech platforms use APIs to connect with cloud infrastructure. Together, these systems embed financial services directly into consumer-facing apps across sectors like retail, mobility, e-commerce, and social platforms.

Next-frontier spheres

IoT-linked payments, biometric security, quantum-safe encryption, and immersive AR customer experiences signal where financial services organizations could evolve next.

Overcoming barriers to transformation

Even with strong intentions, organizations face real friction:

- Untangling legacy systems. Decades of systems, tapes, and tenure create technical knots. Wrapping them with APIs is often more feasible than wholesale replacement, enabling gradual integration of new technologies.

- Meeting regulatory compliance and security needs. All innovation must comply with privacy, audit, and capital adequacy rules. Cybersecurity, identity management, and transparent data handling are non-negotiables.

- People, culture, and change readiness. Cross-functional teams are critical, but so are investments in training and clear role transitions. Digital transformation requires culture change as much as code.

Foundational practices for sustainable transformation

- Start with strategy, end with impact. A digital transformation strategy begins with business goals, not tech specs. Define KPIs like reduced cost-to-serve, increased adoption, or higher NPS—then choose the right advanced tools to get there.

- Build incrementally and scale iteratively. Launch use cases with quick feedback loops: automated claims, dynamic offers, and AI assistants. Measure, learn, refine, and then expand.

- Govern and guide cross‑functionally. Create unified oversight with aligned finance, compliance, IT, UX, data science, and product managers, who are responsible not for tasks but for delivering outcomes.

- Ingest data and surface insights. Set up dashboards that surface real-time financial data, fraud indicators, adoption metrics, and economic trends, building visibility and enabling agile responses.

Regulatory guardrails in the age of digital finance

As digital transformation reshapes financial services, regulation is evolving parallel, balancing innovation with security, privacy, and systemic stability. FinTech organizations must navigate an increasingly complex global regulatory environment. Three of the most relevant frameworks shaping the landscape are:

- EU Digital Operational Resilience Act (DORA)

Effective January 2025, DORA establishes uniform standards across the EU to ensure financial entities can withstand, respond to, and recover from ICT-related disruptions. It mandates risk management protocols, third-party oversight, and incident reporting—critical for any digital-first financial firm. - General Data Protection Regulation (GDPR)

Still a cornerstone of data privacy globally, GDPR governs how financial institutions collect, store, and process customer data within the EU. Its principles—data minimization, consent, and transparency—are foundational for any digital transformation strategy involving AI or advanced analytics. - Financial Action Task Force (FATF) Guidelines

FATF sets global standards for anti-money laundering (AML) and combating the financing of terrorism (CFT). Its evolving recommendations now include virtual assets and service providers, emphasizing digital ID systems and transaction monitoring across borders, especially vital for fintech scaling globally.

Together, these regulations underscore that compliance is no longer a back-office task—it’s an essential enabler of trust, resilience, and scalable innovation in digital finance.

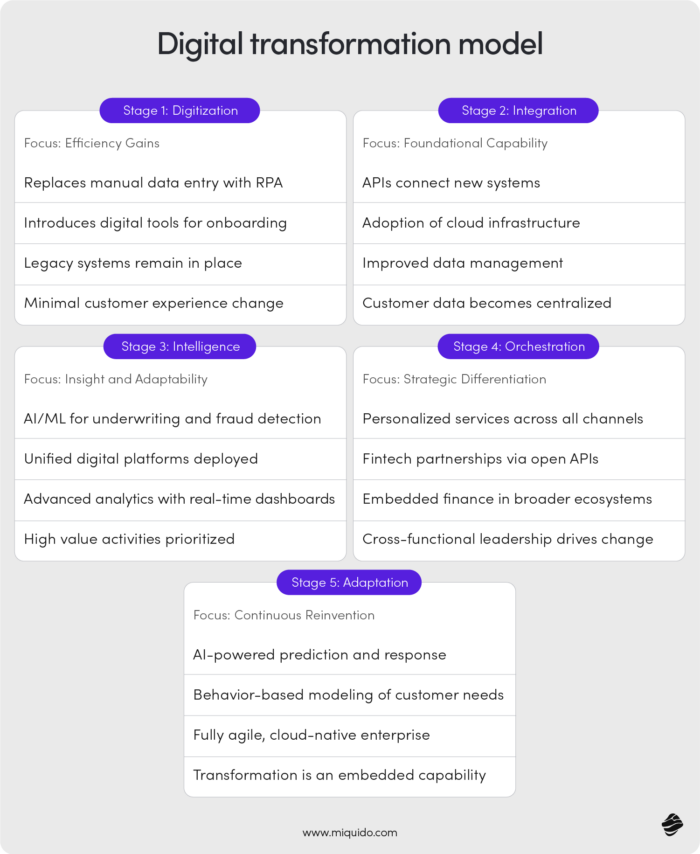

Digital transformation maturity model for financial services

Digital transformation isn’t a one-time upgrade—it’s a multi-stage evolution. This model outlines how financial services organizations progress from digitizing legacy processes to becoming fully adaptive, insight-driven enterprises. Each stage builds on the last, combining advanced technology, artificial intelligence, cloud infrastructure, and data analytics to deliver greater agility, customer relevance, and operational resilience. Use this framework to assess where your organization stands—and where it needs to go next.

Conclusion: delivering greater value in the financial sector

The successful integration of new technologies—from advanced analytics and cloud infrastructure to AI, RPA, and blockchain and cloud solutions—is changing the shape of modern banking. Financial services organizations that deploy digital platforms, protect data, and personalize experiences will not just win— they’ll redefine what finance is in everyday life.

Those who deliver better advice, seamless experience, and embedded value—not just balance sheets—will set tomorrow’s standards. In this new era, digital transformation in finance isn’t just about tech adoption—it’s about transforming trust, redefining relationships, and enabling real-time relevance in a world that increasingly expects it.

![[header] digital transformation in finance](https://www.miquido.com/wp-content/uploads/2025/06/header-digital-transformation-in-finance.jpg)

![[header] top ai fintech companies transforming finance in 2025](https://www.miquido.com/wp-content/uploads/2025/05/header-top-ai-fintech-companies-transforming-finance-in-2025-432x288.jpg)

![[header] how to reduce churn on a form validation stage (1)](https://www.miquido.com/wp-content/uploads/2025/12/header-how-to-reduce-churn-on-a-form-validation-stage_-1-432x288.jpg)