In today’s banking sector, digital transformation and evolving customer expectations have made value added services in banking far more than optional extras—they’re becoming essential. Customers no longer settle for just a basic bank account or savings account; they demand meaningful experiences beyond transaction processing. Modern financial institutions are now differentiating themselves by offering value added services—smart, results-driven enhancements that boost customer loyalty, improve customer satisfaction, and open new revenue streams.

Let’s explore why value added services (VAS) are transformative, then dive into 10 services in banking examples grouped into key pillars—Sustainability, Social Equity, Education & Empowerment, and Health & Well‑being. Along the way, we’ll highlight future trends in banking, including AI-driven personalization, cryptocurrency and stock trading, mobile banking apps simplify investing, and specialized tools catering to evolving demands.

Why added services in banking matter?

Understanding the rationale behind VAS is crucial for designing services that resonate. This section examines the business case and strategic benefits of integrating added services in banking, especially in a market where differentiation is increasingly challenging.

Stand out in a crowded market

Traditional banking services—basic checking, debit cards, interest-bearing accounts—are commoditized. Offering value added services creates a unique value proposition, helping banks stand out from competitors and meet the premium market’s evolving demands.

Boost engagement and cross‑selling

Value added tools like payment requests currency exchange, AI-driven budgeting, or tax advisory personalized investment strategies encourage customers to use their banking app actively. More app engagement means richer behavioral data and higher revenue growth from VAS.

Build loyalty and enhance experience

When services align with users’ values—environmental awareness, financial education, or cryptocurrency and stock trading—banks move from transactional to relational partnerships. That promotes deeper customer loyalty and long-term retention.

Tap new revenue streams

Many VAS can be monetized: premium subscription tiers (for example, advanced trading tools), partner commissions (e.g. discounts on wellness), or direct fees for specialist services (like tax advisory personalized or specialized SME support services).

Serve underserved audiences

Tailored added services in banking can target niches—students, SMEs, rural communities, gig economy workers—helping banks expand their user base without substantial additional costs.

These crucial factors in VAS, from driving loyalty to generating profit, make banking value added services essential for future‑focused financial services industry players.

10 impactful VAS in banking examples

When looking at the FinTech landscape, it’s crucial to notice not only products and services that generate money, but also those creating real value for our world and the communities they serve. These institutions can actually engage their clients and prove they’re impactful in more than just business areas. Let’s dive into 10 examples of value added services that can inspire banks and customers.

Carbon footprint trackers in banking apps

Germany’s Tomorrow Bank empowers users with carbon footprint trackers that categorize every purchase. Transactions aren’t just debits—they become lessons in environmental impact. This elevates routine banking into a banking app experience that educates and engages users with their shared values. Tomorrow Bank attracts environmentally conscious users and sets a new standard for services (VAS) in banking.

Tree planting with transactions

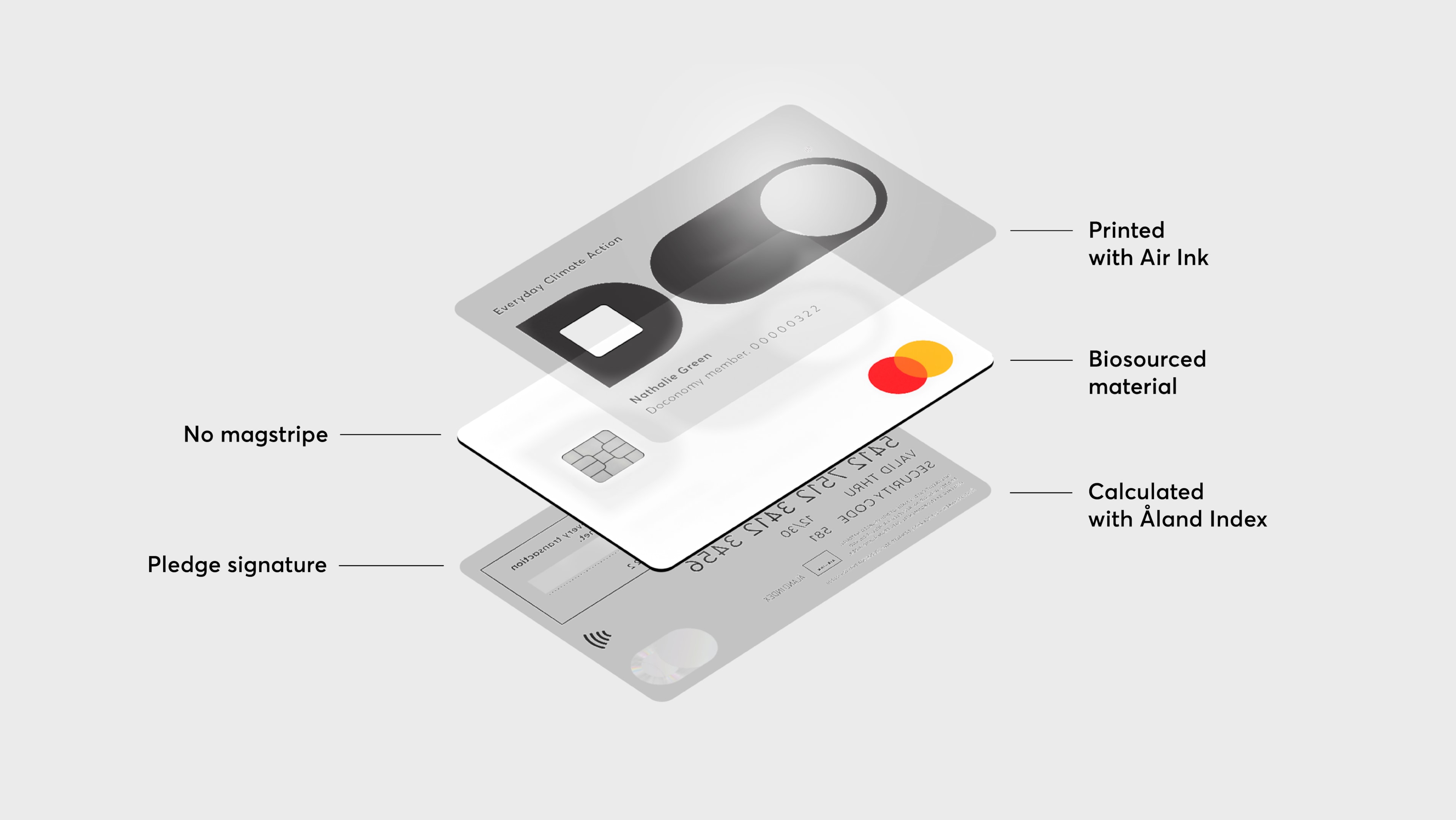

Doconomy (Sweden) and Mastercard’s DO Card automatically plant trees or offset CO₂ with each purchase. Such services make sustainable choices effortless for users and are embedded in everyday commerce. It offers a distinct added service for banks that resonates with eco-conscious audiences and attracts new customers.

Mobility and micromobility rewards

Monzo Bank in the UK rewards eco‑friendly commute actions—cycling, public transit, walking—with points or cash‑back. Such services in banking prize incentivize behavioral change and workflows aligned with sustainability. These are great banking example benefits: loyalty, engagement, and public goodwill.

Financial literacy for underserved communities

Cash App in the U.S. integrates gamified tutorials, teaching underbanked youth budgeting, saving, and investing basics. Banking apps simplify investing, helping users gain competence and confidence. This improves customer satisfaction and builds a base of loyal, lifelong clients.

Micro‑savings for education and emergencies

M‑Shwari, part of Kenya’s M‑PESA mobile banking ecosystem, empowers users to save and borrow in small increments. From saving for school fees to building emergency cushions, this micro‑finance model demonstrates how value added services in banking can drive meaningful impact—and resilience.

Job training and career platforms through banking

Banco Santander’s Universia platform is a powerful value-added service that connects education, career development, and finance into one cohesive experience. As a free digital network, Universia helps students and recent graduates across Spain, Portugal, and Latin America access job and internship opportunities, AI-powered résumé tools, virtual career fairs, and employer-led workshops. Though it operates separately from the main banking app, Universia is deeply aligned with Santander’s broader mission—supporting young people as they move from education into the workforce, while integrating career support into the bank’s broader service ecosystem.

Free online education platforms

India’s Paytm offers access to Khan Academy and similar content within its ecosystem. This is especially valuable in rural areas where resources are limited. By reimagining banking industry infrastructure as an education & empowerment channel, Paytm pushes boundaries: financial apps become platforms for lifelong learning.

Mental health support

CaixaBank’s Imagin platform offers a strong example of how wellness can be meaningfully integrated into digital banking. Through its “MyHealth” initiative, Imagin goes beyond traditional financial services to provide users with access to wellness-focused content, including tips on mental well-being, fitness, and healthy living. By embedding lifestyle and emotional health tools into its app experience, CaixaBank taps into the deep connection between financial stress and overall well-being. This value added approach enhances the customer experience and reflects a broader understanding of what today’s users need from their banks—support that extends beyond money management to life management.

Telemedicine as a financial add‑on

Bangladesh’s bKash offers integrated telehealth consultations and medicine delivery directly from its financial app. This blends finance and healthcare, becoming a daily-use app that simplifies life and deepens brand trust.

Green Loans & Sustainable Investment Guidance

Dutch neobank Bunq is reshaping everyday finance with sustainability in mind. Through its partnership with Birdee, it offers curated investment portfolios—including ESG-focused options—so users can invest in line with their values. While it doesn’t currently provide green loans for home upgrades, Bunq’s Easy Green plan rewards spending with tree planting, reinforcing its environmental mission. It’s a clear example of how banking apps are evolving to support both financial goals and climate-conscious living.

Advanced tools and future trends in banking

The future of VAS lies in personalization, automation, and real-time decision-making. In this section, we highlight cutting-edge features, AI applications, and strategic moves that signal where value added services in banking are headed.

AI‑powered personalization

AI plays a pivotal role in scaling value added services. Banks can identify stress patterns and nudge users toward wellness tools, recommend tailored financial planning tools, or suggest relevant budgeting and investment tools. AI helps segment users for offers like specialized SME support services or advisory personalized investment strategies and tailored financial recommendations.

Cryptocurrency, trading and disposable virtual cards

Tools for cryptocurrency and stock trading are becoming VAS staples in modern mobile banking platforms. Banks also offer disposable virtual cards for online purchases and security during e‑commerce, giving users peace of mind with fraud protection and currency exchange or bill-splitting tools.

Private banking and wealth management

Delivering true added services in banking, some institutions offer private banking and wealth management tiering: access to financial advisors, bespoke investment strategies, tax advice, and exclusive deals. This approach not only addresses this premium market’s evolving demands, but also helps banks monetize banking value added services through fee-based expertise, and deepen relationships with high-net-worth clients.

Multi‑account and multi‑currency support

Managing multiple users and accounts—whether family or SME—comes with complexity. Features like payment requests, currency exchange or bill splitting integrated directly into apps simplify operations. Add tools for global payments revenue globally, and you’re looking at a powerful VAS suite for the modern world.

Platforms for SMEs and gig workers

Banks are building ecosystems for small businesses and freelancers: specialized SME support services, invoicing tools, and financial planning tools to streamline operations are gaining traction. These additional services help banks gain market share in a growing freelance and small business segment.

Key factors in VAS implementation in banking

Implementation success requires more than great ideas. This section identifies the must-haves for rolling out VAS that deliver value to both the customer and the bank.

- Align your strategy with consumer preferences for VAS

Understand what your users truly value—digital convenience, sustainability, education, health—and tailor services accordingly. - Leverage existing infrastructure

Many VAS can be integrated into current mobile banking apps, leveraging technologies you already have (APIs, modular components, FinTech partnerships) without rebuilding from scratch. - Prioritize data privacy and compliance

Especially with payment requests, currency exchange, and investing tools, ensure robust security, encryption, and transparent data practices. - Build strategic partnerships

Collaboration with FinTech, healthcare, wellness, sustainability, or EdTech firms expands your service catalogue at lower cost and risk, while adding credibility and expertise. - Personalization is crucial

Generic services fall flat. Treat VAS delivery as a continuous, personalized journey—tailor investment strategies and financial advice to user behavior and profile. - Develop sustainable monetization and ROI plans

Whether it’s subscription tiers, partner referral commissions, or premium advisory offerings, define how each VAS contributes to revenue growth from VAS. - Measure impact thoroughly

To assess effectiveness of value added service and optimise, use KPIs like active monthly usage, feature engagement, cross‑sell conversions, NPS improvements, and churn reduction.

How financial institutions reap the benefits

Offering VAS is a strategic win across all fronts. This section explores how banks benefit from higher engagement, stronger relationships, diversified revenues, and a lasting competitive edge.

- Elevated customer loyalty and satisfaction:

When a bank becomes a lifestyle partner rather than just a payment processor, customers stay longer and spread the word. - Higher app engagement:

VAS converts dormant users into active participants, leading to richer data and better insights for marketing and product development. - Diversified earnings and new revenues:

Banks can generate profit with value—through premium offerings, partnerships, or advisor services—rather than relying solely on interest and fees. - Boosted brand differentiation:

In a crowded banking app landscape, VAS has become a signature offering that drives brand preference and loyalty.

Final thoughts: The future of banking lies beyond basic services

Banks must go beyond the basics to stay relevant—they must add real value to people’s lives. The examples in this article show a clear shift: leading banks are becoming trusted partners in everything from education and mental health to green finance and crypto. Value added services can respond to various customer expectations and elevate user experience.

As technologies like AI and personalization mature, they’re not just streamlining services but creating more profound human experiences. For anyone in product, tech, or strategy, the question is no longer if to offer value added services, but which ones will genuinely matter to your customers.

![[header] value added services in banking (1)](https://www.miquido.com/wp-content/uploads/2025/06/header-value-added-services-in-banking-1.jpg)

![[header] 10 embedded finance examples](https://www.miquido.com/wp-content/uploads/2025/03/header-10-embedded-finance-examples-432x288.jpg)