fintech

banking & insurance

According to multiple data available, banks that consistently improve the customer experience grow 3.2x faster than competitors that don’t. In today’s fierce market, where over 50% of consumers switch to a different service after a single unsatisfactory interaction, providing an exceptional UX has become more important than ever before.

One of the largest banks in Poland, a subsidiary of the international corporation BNP Paribas, recognised the importance of meeting the surging user demand for intuitive experiences and decided to revamp its mobile channels completely. In collaboration with Miquido, the bank wanted to create the new GOmobile application, which empowers BNP clients to have financial control at their fingertips.

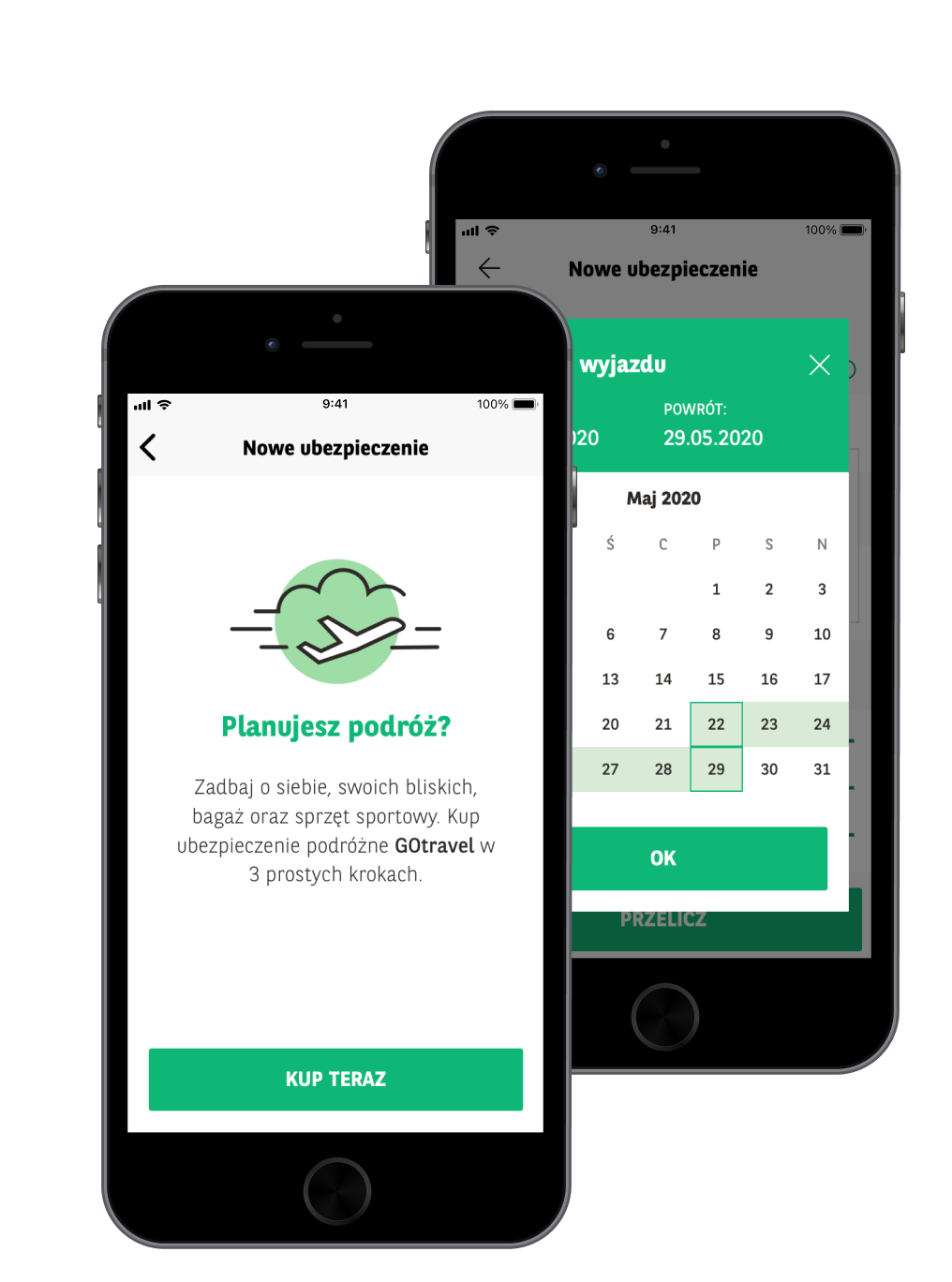

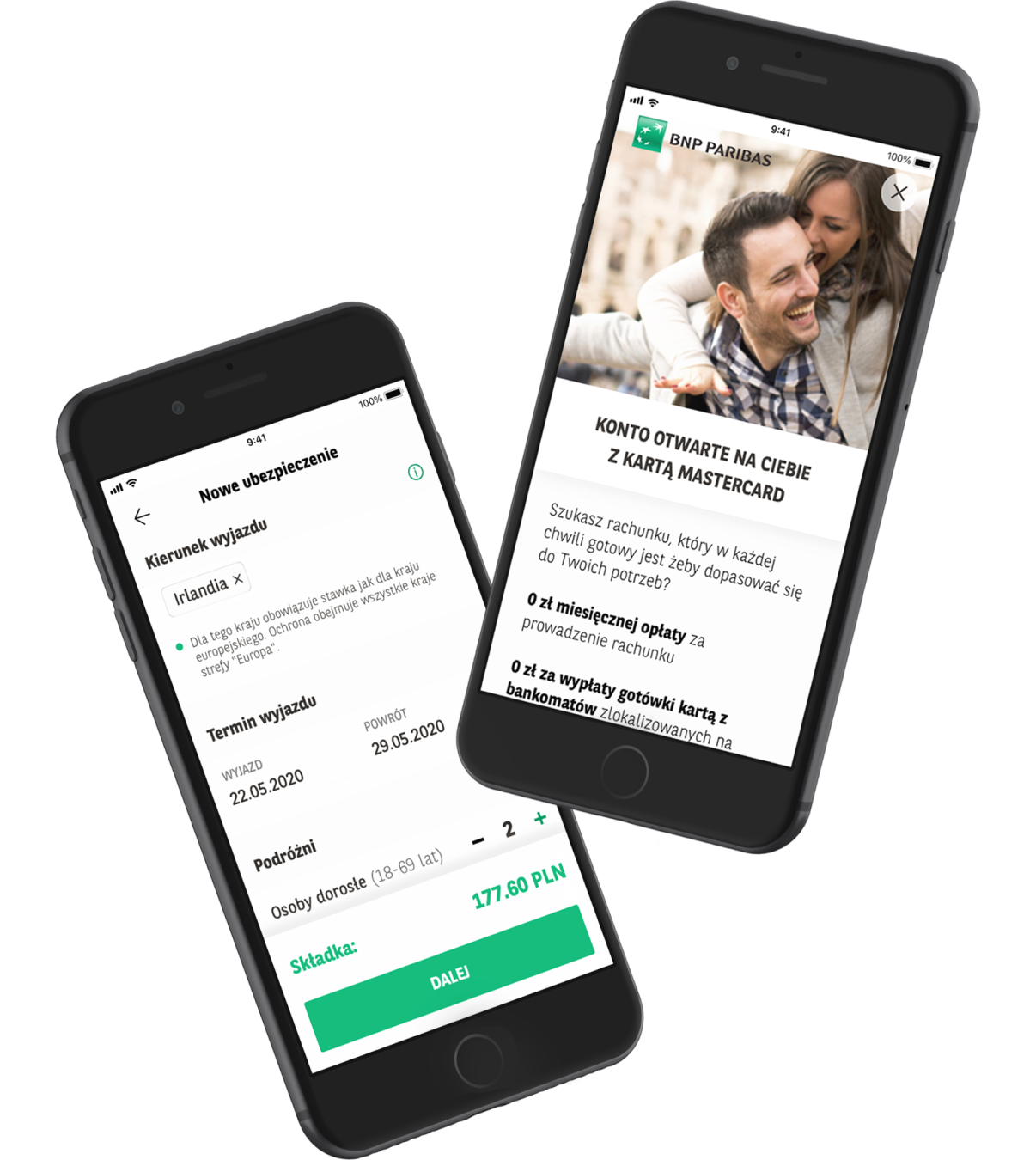

Miquido worked closely with the internal bank’s team to develop essential personal finance modules, such as account access, transaction history, spending and revenue charts and integrated Apple Pay and BLIK mobile payment systems. Our team also helped BNP introduce various innovative features, including the GOtravel insurance module and Account Opener with face recognition service. The GOmobile app has been downloaded more than 1 million times and maintains an average rating of 4.8, accompanied by almost 150,000 reviews from satisfied customers.

1M+

4.8

150K+

The fintech industry has presented a new growth paradigm for banks – now even more determined to win the race for customer loyalty. BNP Paribas faced the challenge of accelerating its time-to-market of new mobile app features. The bank acknowledged the need for external expertise to complement its current development team and started looking for a reliable mobile software development partner. The ideal collaborator needed to have substantial experience in native development for both Android and iOS platforms, ensuring seamless integration with the bank’s existing infrastructure.

In the digital age, it is crucial for companies, especially in the banking sector, to meet user needs and adapt to evolving trends. However, to get ahead of retail banking, anticipating customer expectations and setting new security and customer experience standards is essential. BNP Paribas sought support in introducing innovative technologies such as biometric authentication and real-time spending insights. The bank aimed to release several new functionalities in a short period of time while also expanding internal software development competencies and dynamically responding to changing market trends.

Developing secure and reliable banking apps is a crucial task that requires strict adherence to rigorous standards, including GDPR, AML, and KYC regulations. Developing GOmobile was a challenging process that involved not only typical mobile development issues but also those related to security measures and compliance with legal standards. BNP Paribas had to ensure smooth cross-team collaboration with microservices providers and build a flexible team ready to work on the application while considering security measures.

Miquido collaborated with BNP Paribas to provide support for native Android and iOS mobile development. The bank needed assistance in delivering new functions that could be used in both the current version of the application and GOmobile 2.0 – a new banking platform.

To deliver the required features, we developed libraries for iOS and Android supplemented with diagrams of the sequence of calls between the libraries, the main application and the backend. This approach enabled us to maintain a high-security level and facilitate cooperation with the existing development team. Yet, most importantly, it allowed our team to work on an existing application while building a new digital product full of innovative, customer-friendly features.

To address security measures and ensure a robust development process, Miquido adopted a strategy that involved delivering app functions in native mobile libraries. This approach helped create modular components, facilitating testing and maintenance. By encapsulating the functions into libraries, the team could focus on securing and testing these smaller units independently, guaranteeing that each component met the required standards.

One significant challenge faced by the Miquido team was the lack of direct access to the main banking application. This constraint required a high level of adaptability in testing the solutions provided. The team implemented thorough unit, integration, and continuous testing practices to overcome this hurdle, ultimately streamlining the process.

During the development process, we gave great importance to communication and collaboration with other entities, such as Autenti, a fintech specialising in digital signature, and IDENTT, a company that provides AML compliance, age, and identity verification solutions. This proactive approach helped us to identify potential security vulnerabilities early in development and ensured that all stakeholders were aligned with the security objectives.

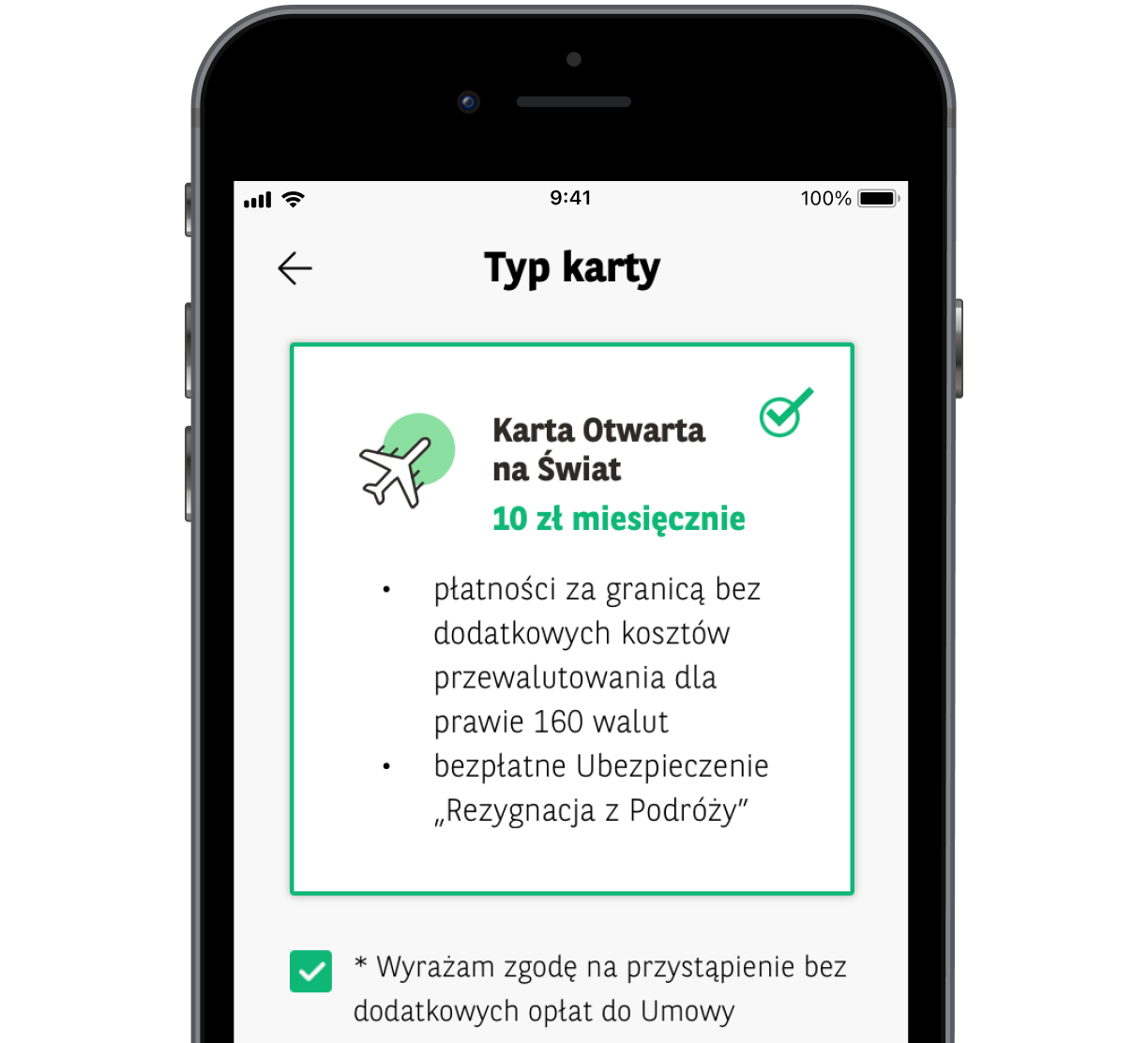

BNP Paribas has partnered with Miquido to improve the customer experience and security by introducing new features, such as the Starter Kit. This innovative service simplifies the account opening process for users. Once they choose to open an account with BNP, they receive a QR code that initiates the onboarding journey. This approach makes the process more efficient and fulfils the customers’ need for seamless digital experiences.

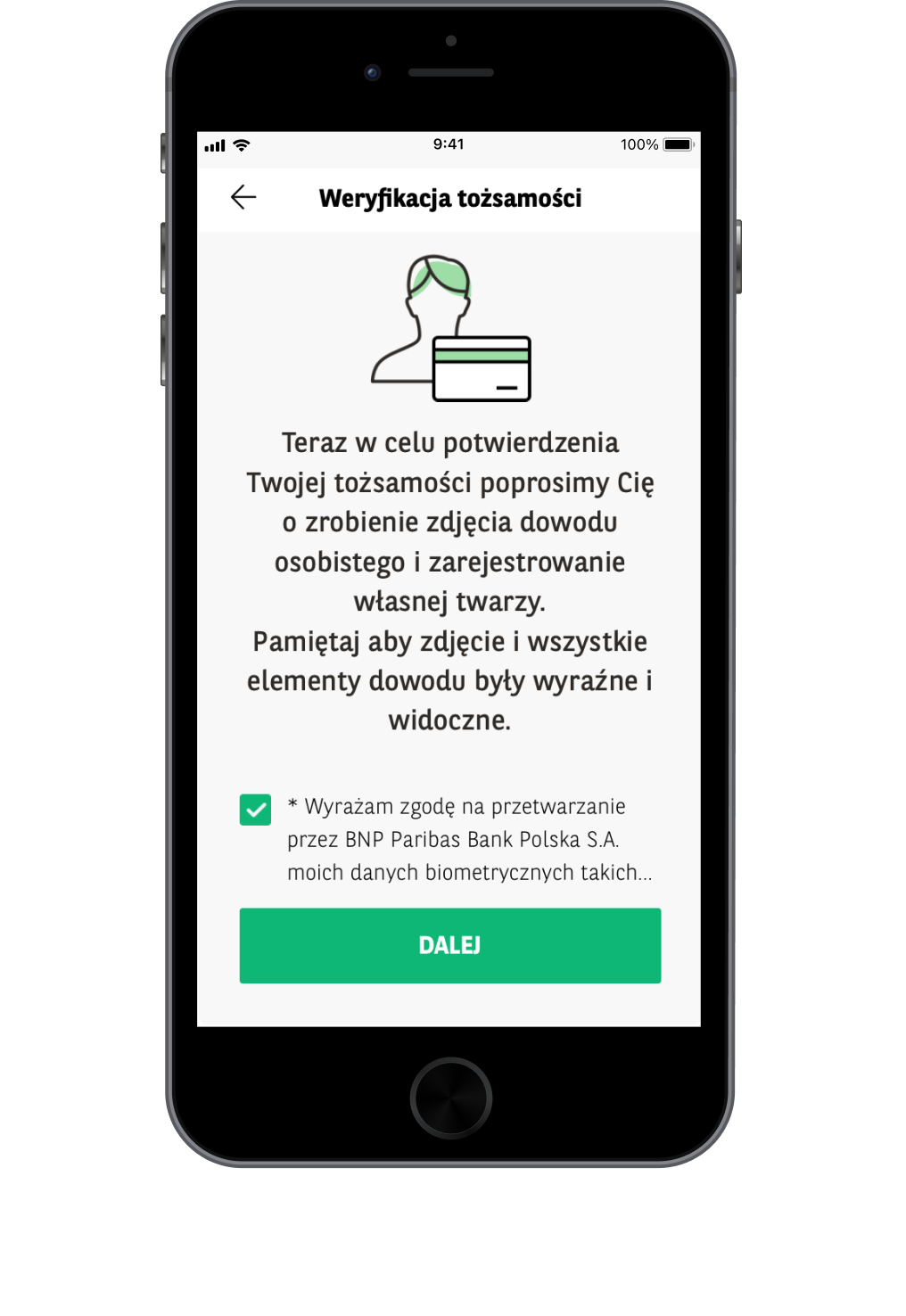

Another new feature called the Account Opener enhances the security of the account opening process. The Account Opener is integrated with IDENTT, a government-cooperating company specialising in identity verification through video recordings. By incorporating facial recognition technology and ID scanning, BNP Paribas has adopted a robust and multifaceted approach to identity verification. This new feature ensures strict validation standards that address fraud and unauthorised access concerns.

To keep up with customers’ changing needs, BNP Paribas has introduced Insights. The feature provides users with detailed information on their spending patterns, leveraging real-time spending insights and offering a personalised view of their financial activities. The collaboration with a transaction categorisation library enables the automatic classification of expenditures, enhancing the user interface by displaying categorised transactions and store logos.

Swift, RxSwift, UIKit, XCodeGen, Fastlane

SDKs (Pods libraries) – MVVM

Architecture, Unit Testing

GOmobile 2.0 – Clean Architecture,

Behavior-Driven Development Testing

Kotlin

Working closely with the BNP Paribas team, Miquido developed GOmobile 2.0 – a new user-friendly application with simple activation, personalised currency transfer, and easy marketing consent management. The revamped mobile app also offers extensive options for push notifications, allowing customers to access the appropriate application screens, such as the dashboard, product list, or news list, with a single swipe of a finger.

Throughout our collaboration with BNP Paribas, Miquido was responsible for implementing the banking application features such as:

The GOmobile app has garnered a lot of appreciation from its users, with an impressive rating of 4.8 based on nearly 150,000 reviews and over 1 million downloads. BNP Paribas has won the trust of its customers by simplifying the traditionally complicated processes, such as account opening. The app incorporates facial recognition and interactive gestures like blinking, enhancing security and accelerating account activation.

The app’s efficiency has been particularly beneficial during the COVID-19 pandemic, providing a secure solution for acquiring new customers at a time when physical interactions are restricted. With its user-friendly features and flexibility, the GOmobile app from BNP Paribas continues to set the benchmark for a seamless and secure experience in today’s mobile banking app market.