Embedded Finance Services

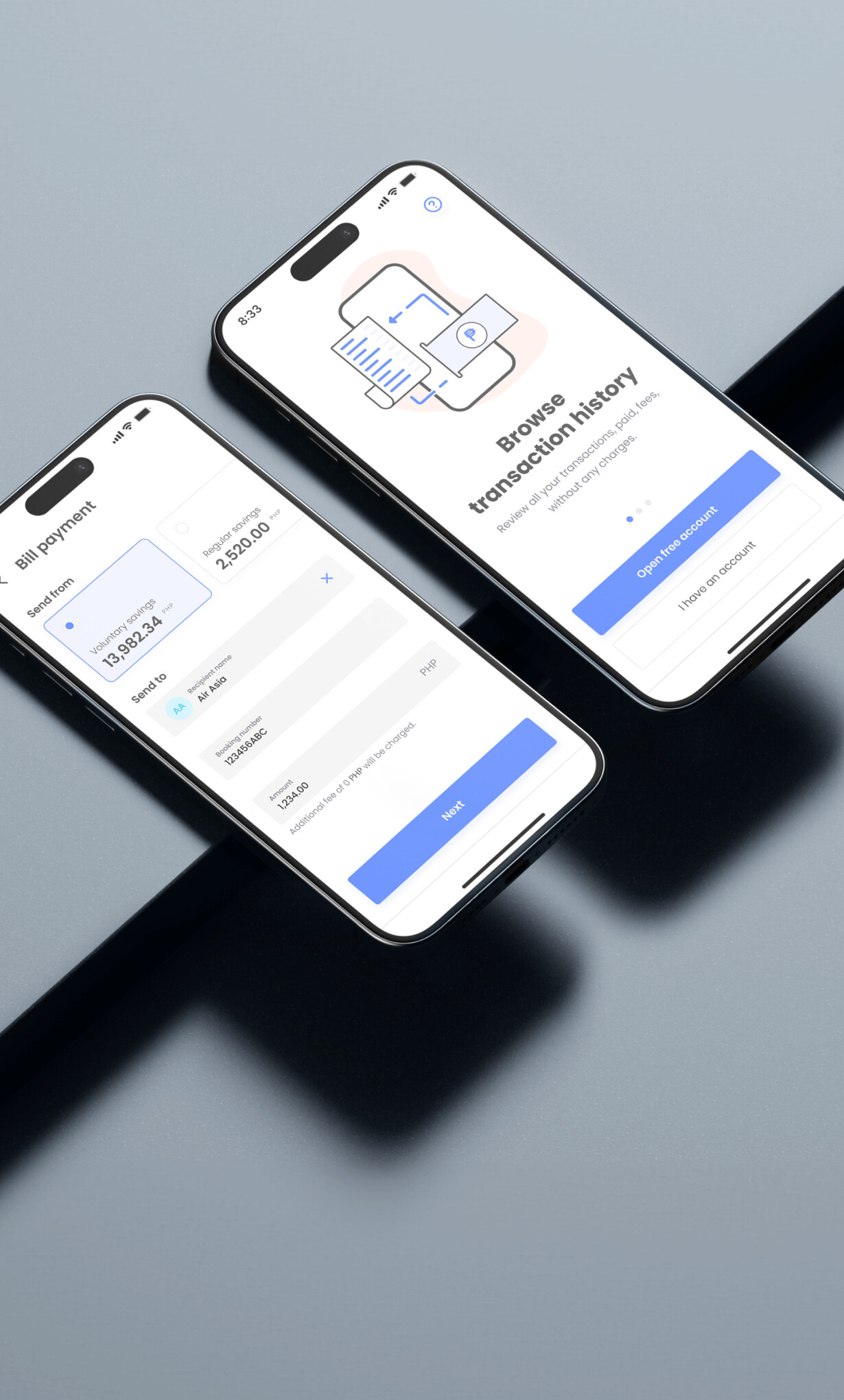

FinTech solutions that go beyond banking

Bring payments, lending, and financial tools right into your product. Create new value for users, open up revenue streams, and lead the way in digital finance.

Contact us

Unlock growth with business benefits

New revenue streams

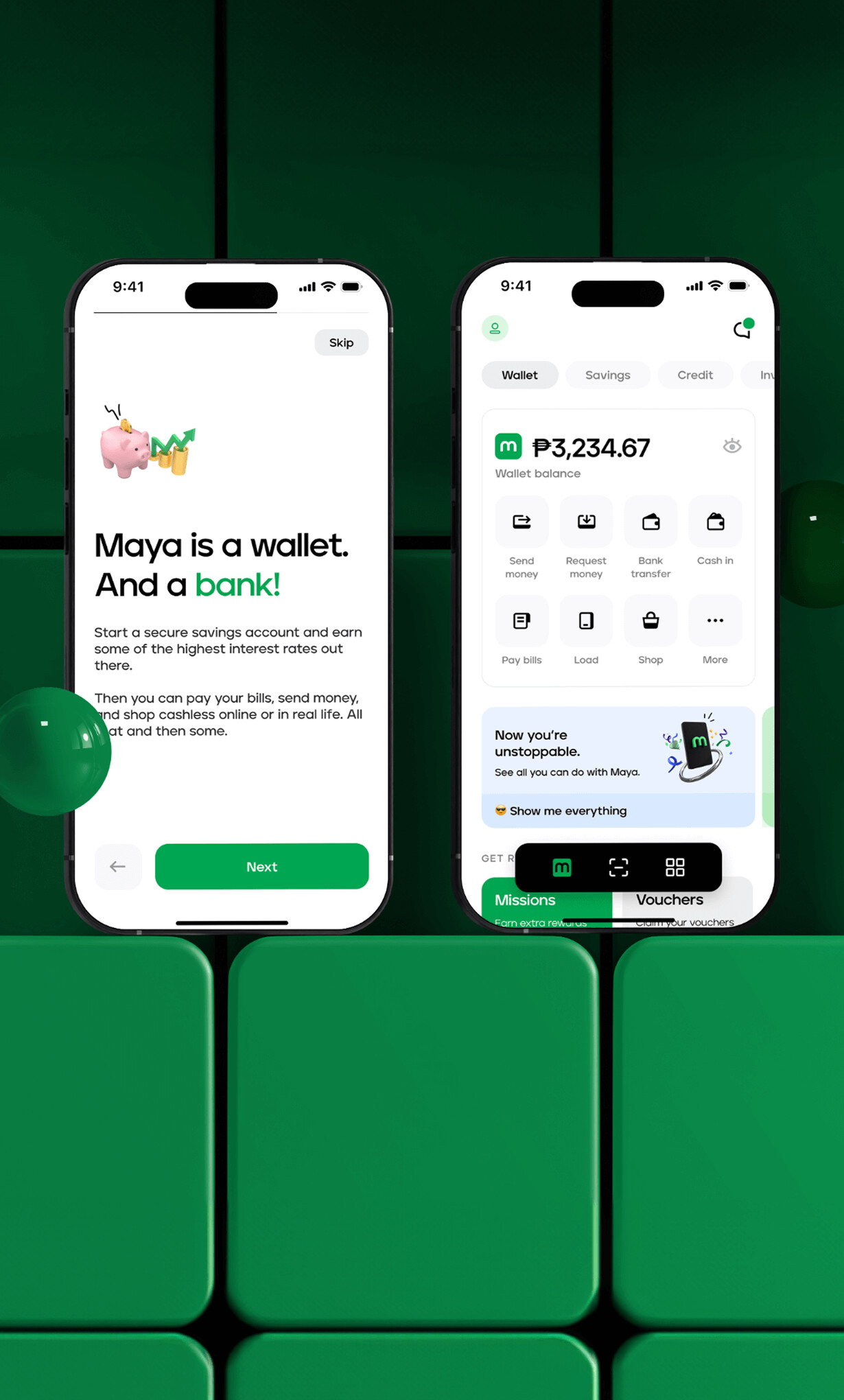

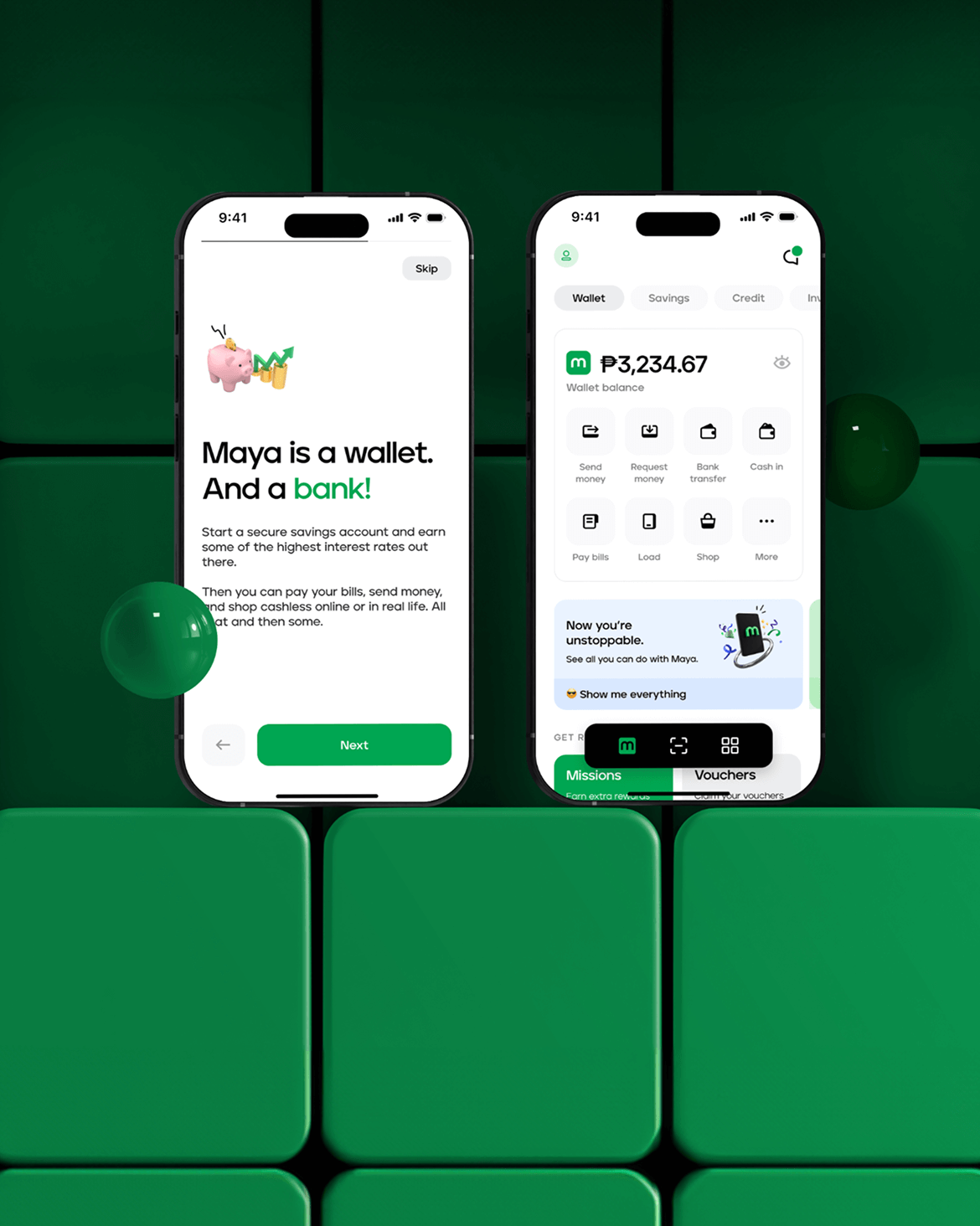

Offer wallets, loans, insurance, or other financial services directly in your app. More ways to serve users = more ways to earn.

Deepened customer engagement

Let users save, pay, or invest without switching apps. That ease keeps them returning and builds loyalty over time.

Strategic differentiation

Embedding finance transforms your app from a service into a platform. Stand out in a saturated market by delivering financial capabilities your competitors haven’t even considered.

Long-term adaptability

Embedded financial services keep your product future-ready, allowing you to adapt quickly and agilely to user needs and regulatory shifts.

1 of 4

Our FinTech client success stories

SBAB

Mobile app for financial management

AI

Integration

Services

Mobile, Web, AI

Intuitive

Mortgage loan guide

Available for projects

Want to talk about your project?

We help companies deliver finance that feels invisible, yet delivers impactful results.

If you're ready to innovate confidently and securely, we’re here to help.