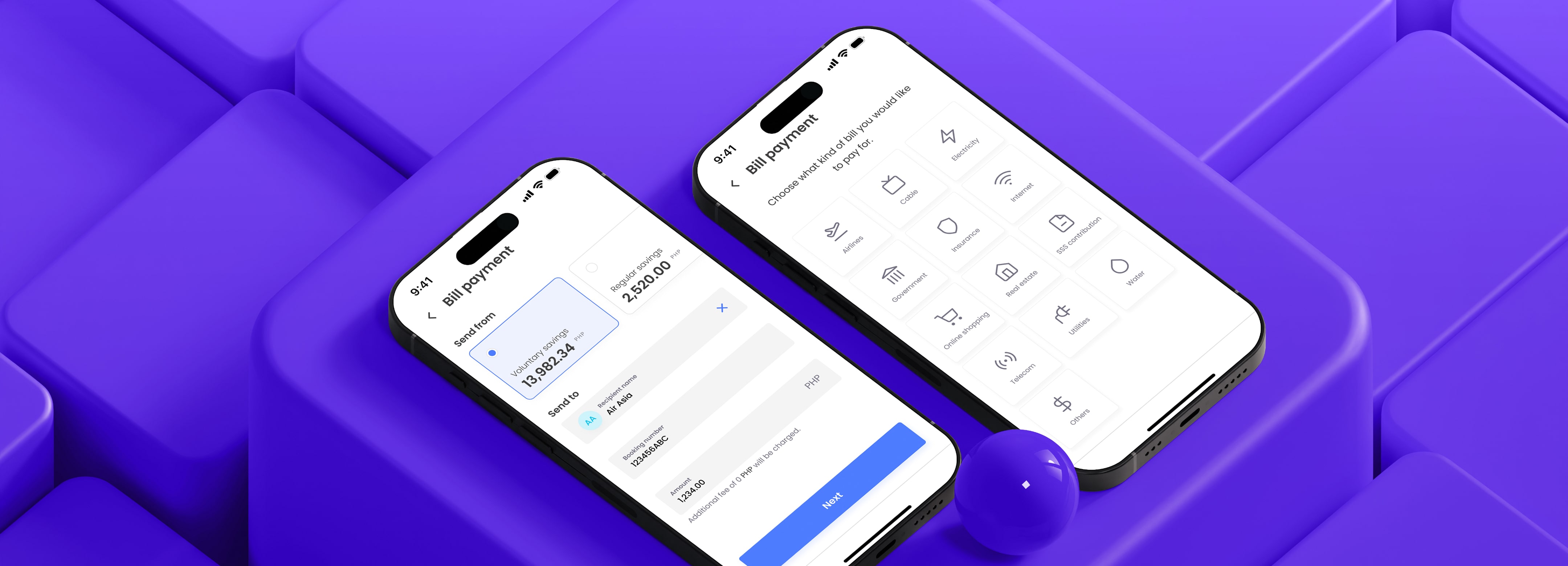

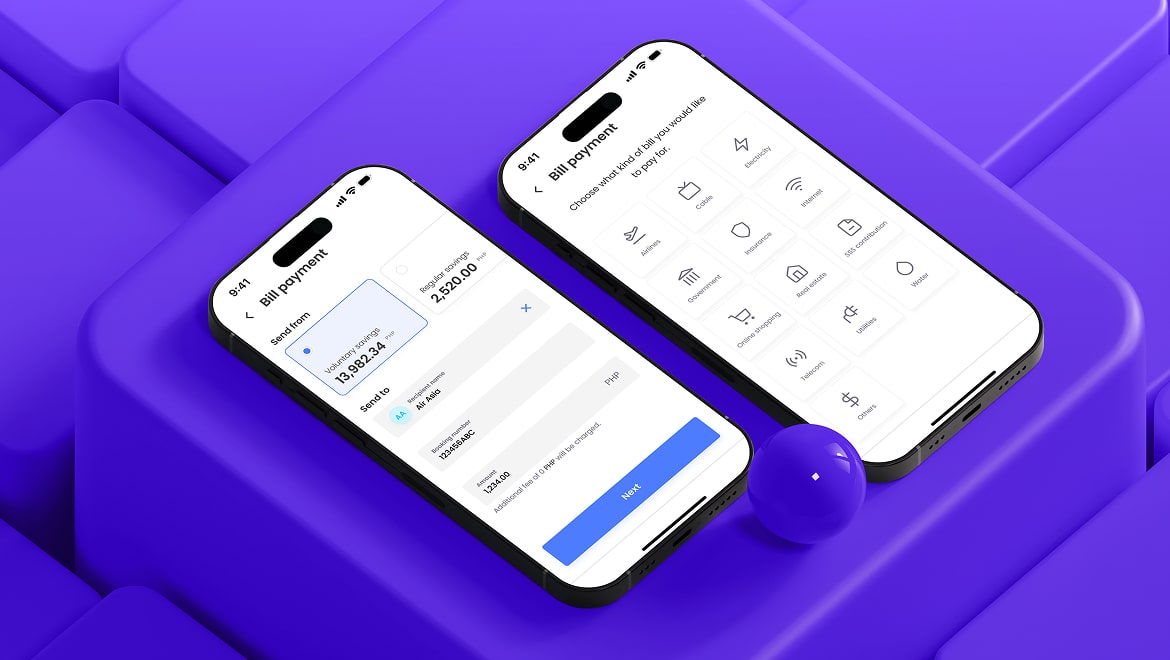

Mobile Banking Application Development Services

Drive innovation with cutting-edge technology

Find the balance between meeting industry standards and building a forward-thinking mobile banking app that sets you apart.

Consult your idea

Secure success with strategic benefits

Ensure security and trust

Protect your institution and strengthen customer loyalty with powerful encryption, advanced biometrics, and intelligent fraud prevention. By securing every interaction, you build lasting trust and create a safer, more confident experience for everyone you serve.

Deliver personalized banking experience

Deliver hyper-personalized customer service and financial advice that meets expectations and exceeds them. By tailoring every interaction to individual needs, you drive deeper engagement, strengthen loyalty, and significantly increase customer lifetime value.

Future-proof your mobile application

Stay ahead of the competition by embracing the future of finance with AI-powered chatbots, seamless crypto integrations, and cutting-edge mobile capabilities. Deliver faster, smarter service, expand into new digital markets, and meet customers exactly where they are - on their devices, in real time.

Faster time-to-market, stronger ROI

Launch a powerful, intuitive mobile app quickly and efficiently, transforming digital banking into a true growth engine for your business. Give your customers the seamless, on-the-go experience they expect, with easy access to their finances anytime, anywhere.

1 of 4

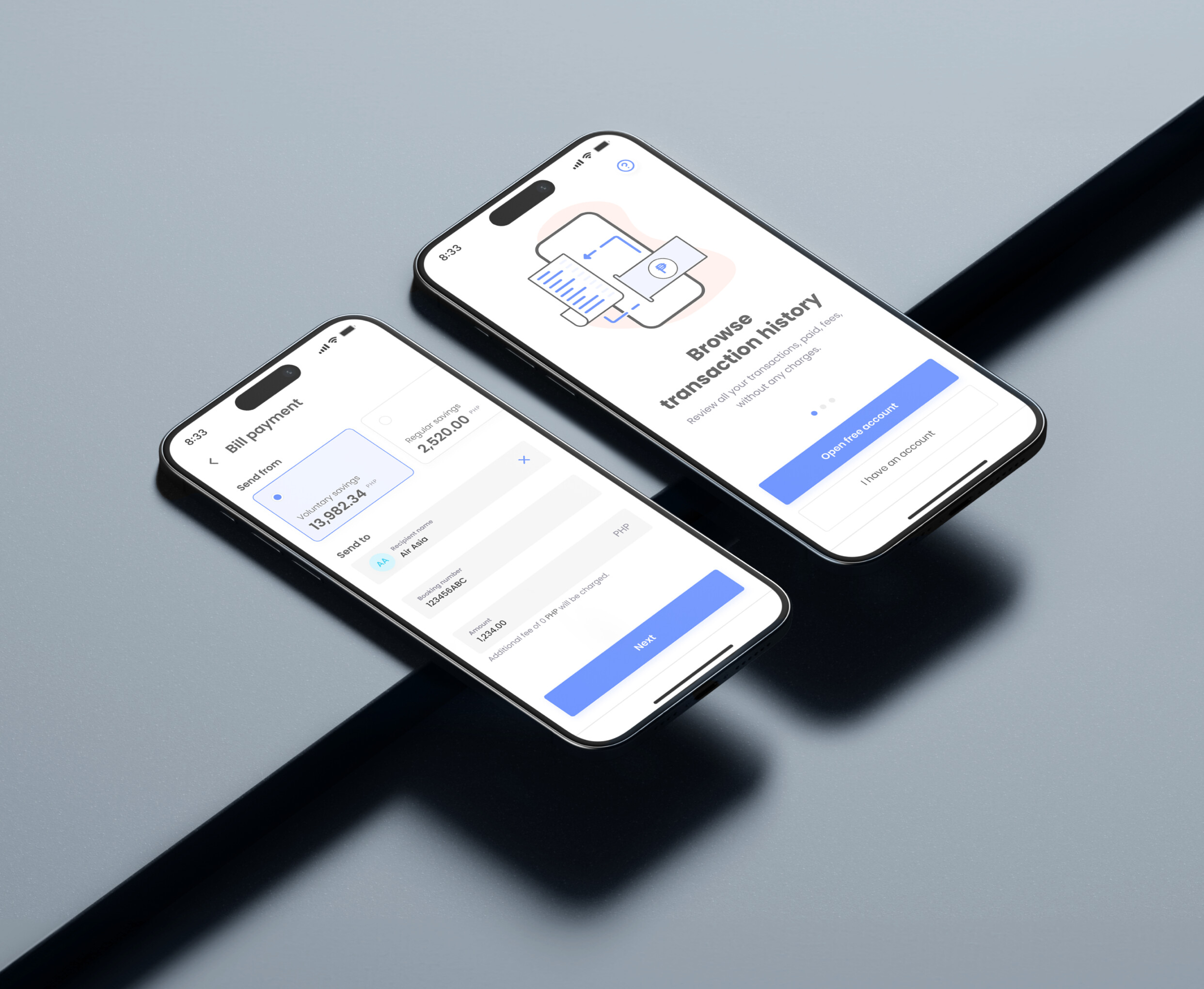

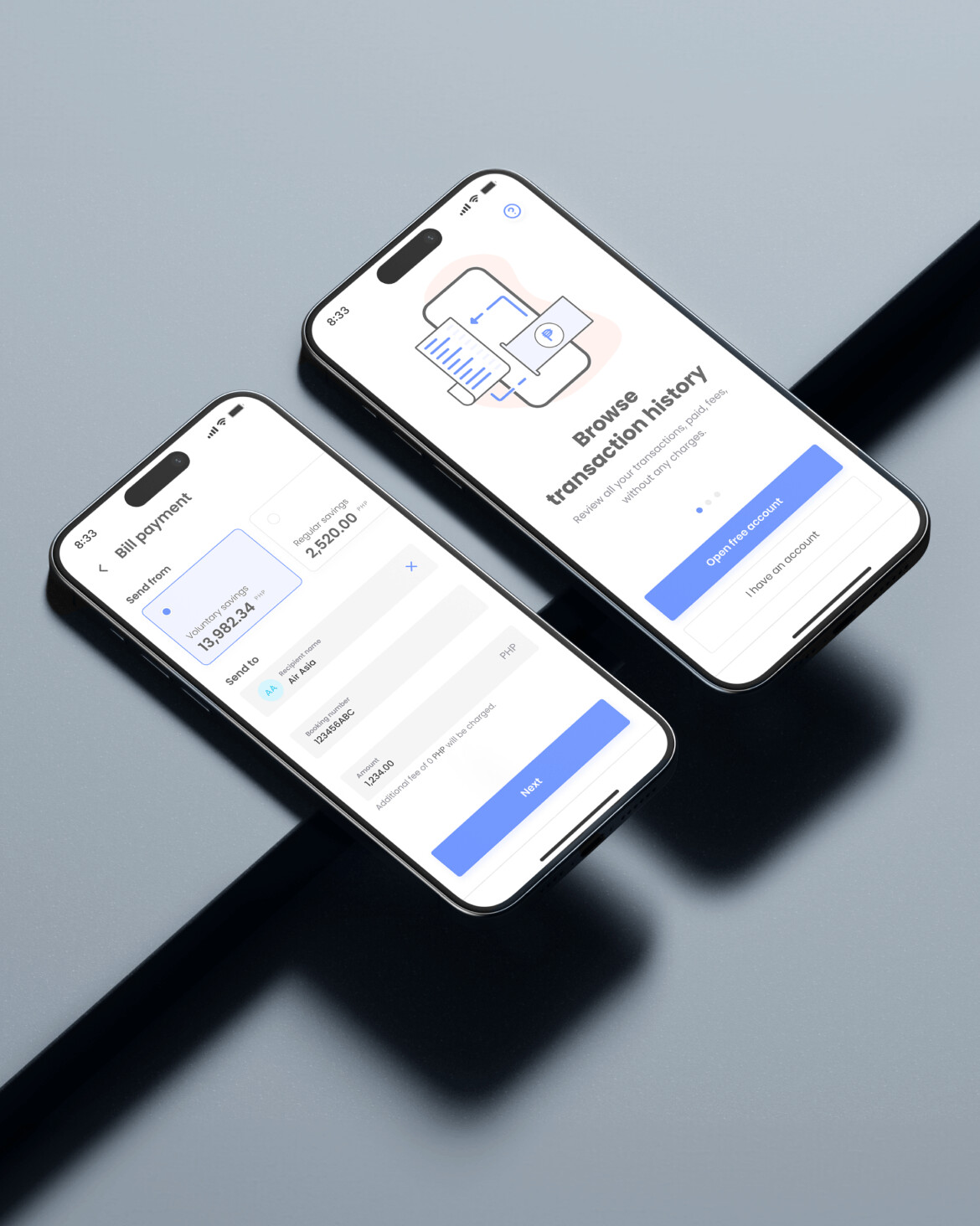

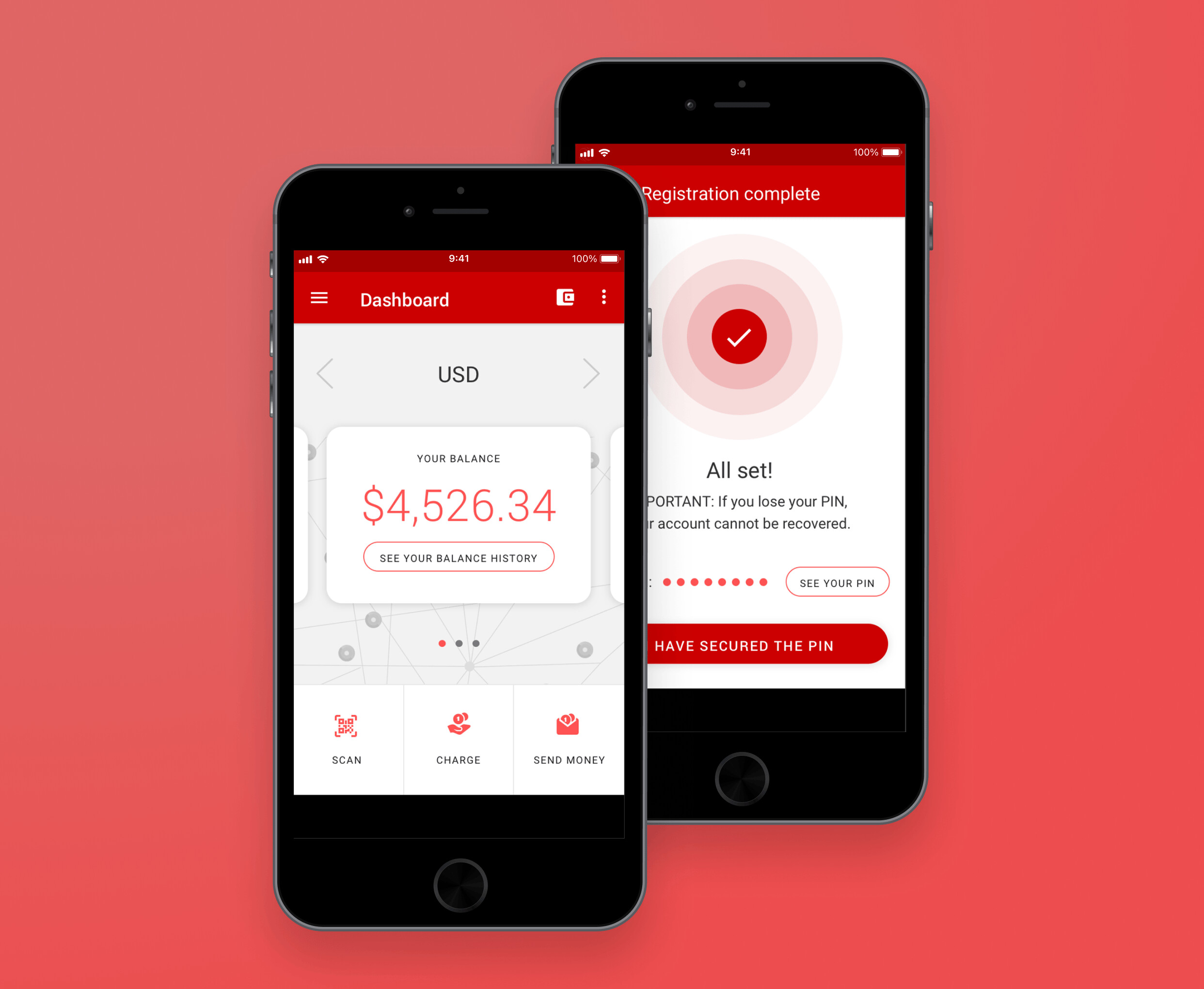

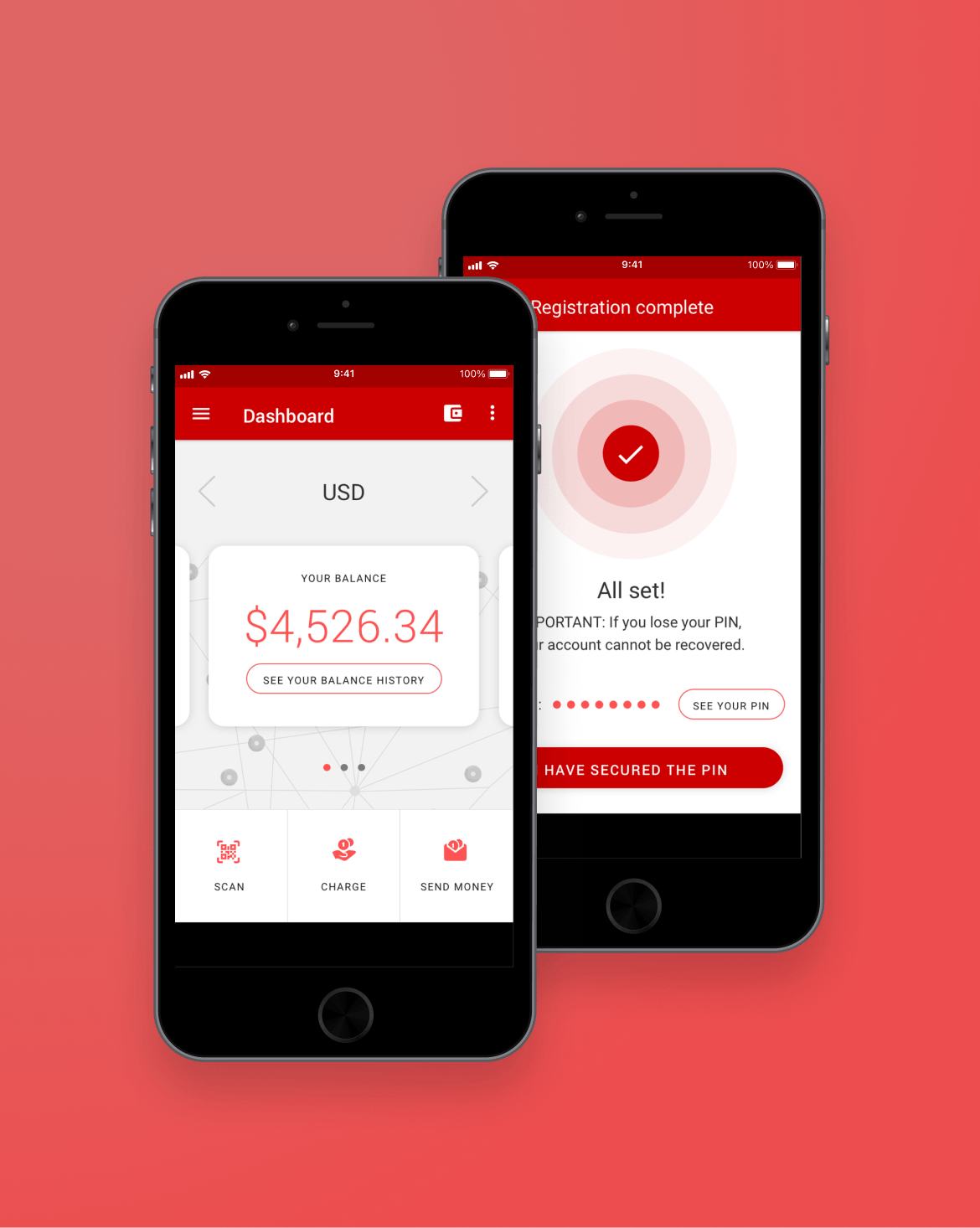

Our mobile banking application clients’ success stories

Here's what our clients say

Top-notch software, award-winning design, revolutionary mobile apps. Listen to our clients and discover what’s possible for you.

See our portfolio

“They’re very goal-oriented, actively looking for solutions to every challenge. The team is collaborative but still low-maintenance.”

"We're impressed by the Miquido attention to detail and their transparency in everything they do."

1 of 2

What features should a mobile banking app include?

Simple, fast login: Options like fingerprint, Face ID, or a secure PIN make access effortless but safe.

Real-time account management: Users should see their balance, recent transactions, and pending payments instantly.

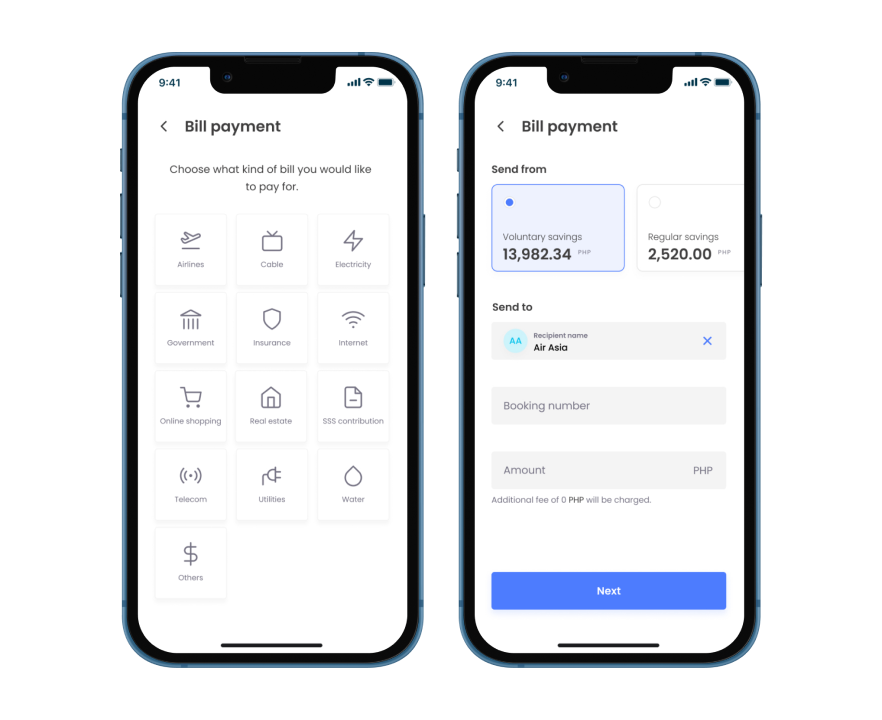

Instant money transfers: Peer-to-peer payments, scheduled transfers, and the ability to pay bills directly in-app.

Mobile check deposit: Snap a photo of a check and deposit it without visiting a branch.

Customizable alerts: Get notified for low balances, large transactions, or upcoming bills to stay in control.

Personal financial management tools: Budgeting help, spending insights, and savings goals integrated into the app.

Strong security features: Two-factor authentication, fraud detection, card freezing/unfreezing options, and encrypted communication.

Easy customer support: In-app messaging, chatbots, or quick call options for help when you need it.

ATM and branch locator: Quickly find the nearest service point.

Card management: Request new cards, set travel notifications, and manage spending limits directly from the app.

Seamless updates: Regular improvements and bug fixes without disrupting service.

A great mobile banking app makes managing money feel intuitive and secure — it fits naturally into everyday life without being intrusive.

How do you ensure compliance with banking regulations?

Understand the rules thoroughly: Stay updated on laws like GDPR, PCI DSS, KYC (Know Your Customer), AML (Anti-Money Laundering), and local banking regulations. Compliance teams should track both global and regional changes closely.

Embed compliance into the design: From day one, weave regulatory requirements into the app’s architecture - not as an afterthought. Features like secure data storage, audit trails, and identity verification should be built in.

Implement strong security measures: Use encryption, multi-factor authentication, real-time fraud monitoring, and regular penetration testing to safeguard user data and transactions.

Regular audits and assessments: Internal and third-party audits help spot gaps early. A strong internal audit process ensures continuous alignment with changing laws.

Clear, honest communication: Privacy policies, user agreements, and consent forms must be transparent, understandable, and readily accessible.

Employee training: Teams must be trained regularly on compliance protocols, cybersecurity, and ethical standards to keep everyone aligned.

Work with legal and compliance experts: Building strong relationships with legal advisors and compliance specialists can help you navigate complex regulatory landscapes.

In short, compliance isn't a box to check - it's a core part of building a banking app people trust.

How do you ensure the security of a banking app?

By combining advanced technology with best practices in cybersecurity, we ensure your mobile banking app stays protected - and your users' trust stays intact.

Haven't you found the answers?

Talk to usAvailable for projects

Want to talk about your project?

Partner with us for a digital journey that transforms your business ideas into successful, cutting-edge solutions.