As financial technology advances, businesses have new ways to integrate financial features into their products. Two key models stand out: embedding finance services and value added services (VAS). Both aim to improve customer experience, unlock revenue, and enhance customer loyalty, but they differ in complexity and how they fit into the user journey.

Understanding these new business models is essential for fintech innovators, financial institutions, and digital leaders in non-financial sectors. Embedded finance integrates tools like financial transactions or embedded lending directly into a product, while VAS offers supportive features like fraud detection or credit scoring alongside the company's platform's primary offering.

This article breaks down the core differences, with real-world examples and a simple framework to help you decide which model better supports your goals. Nowadays, it's essential not only for traditional financial institutions but also for you to read on to learn more.

What are value added services?

VAS is a supplementary feature or enhancement provided alongside a core product or service. In the financial context, VAS might include personalized spending insights, automated savings tools, or fraud alerts. In traditional financial services, VAS meant optional services like SMS balance notifications or card-linked rewards. However, the digital transformation of the economic ecosystem has significantly expanded this definition.

Today, value added services leverage real-time data, artificial intelligence, and behavioral analytics to deliver more relevant, contextual, and engaging experiences. They are no longer just “nice to have” features but are increasingly expected by users.

The evolution of VAS reflects a broader shift toward customer-centric digital experiences, where added value is delivered continuously throughout the user journey. It's not reserved for financial service providers, but can be used widely across different sectors.

To understand VAS, consider any product or service with additional features that enhance your experience. For example, a chat built into the productivity app boosts employee efficiency.

Another use case might be an option to buy tickets for the upcoming concert of the band you are currently listening to on your music app.

Looking for a place to stay on your trip? You might as well check the tour guide and planning tool within the same app.

Real-world examples of successful VAS

In banking services, VAS has played a pivotal role in improving customer retention and wallet share. For instance, HSBC’s SmartSave functionality uses customer transaction data to suggest personalized saving strategies, encouraging financial wellness and stickiness. In the e-commerce realm, Shopify Capital allows merchants to access business loans directly through the Shopify platform, adding a financial service to a commerce tool.

Telecommunications companies have also embraced VAS with impressive results. Providers in emerging markets, for example, bundle airtime-based credit scores and microinsurance products for underserved populations, effectively blending finance with connectivity. Similarly, retailers like Starbucks have created loyalty ecosystems that integrate payment, rewards, and ordering into a single app experience, turning VAS into a strategic asset.

Business benefits of implementing VAS

From a business standpoint, value-added services offer multiple advantages. They can enhance customer satisfaction by providing greater convenience and personalization, which in turn fosters deeper relationships and increases customer loyalty. VAS also opens up indirect revenue opportunities through upselling and cross-selling, especially when services are tiered or offered via subscription.

Moreover, VAS helps brands differentiate in increasingly competitive markets. Unique service layers can create emotional loyalty and justify premium pricing in a landscape where many products are commoditised.

Importantly, value-added services often require fewer technological and regulatory hurdles than embedded finance, making them an attractive option for quick wins and iterative innovation.

What is embedded finance? Beyond Banking-as-a-Service

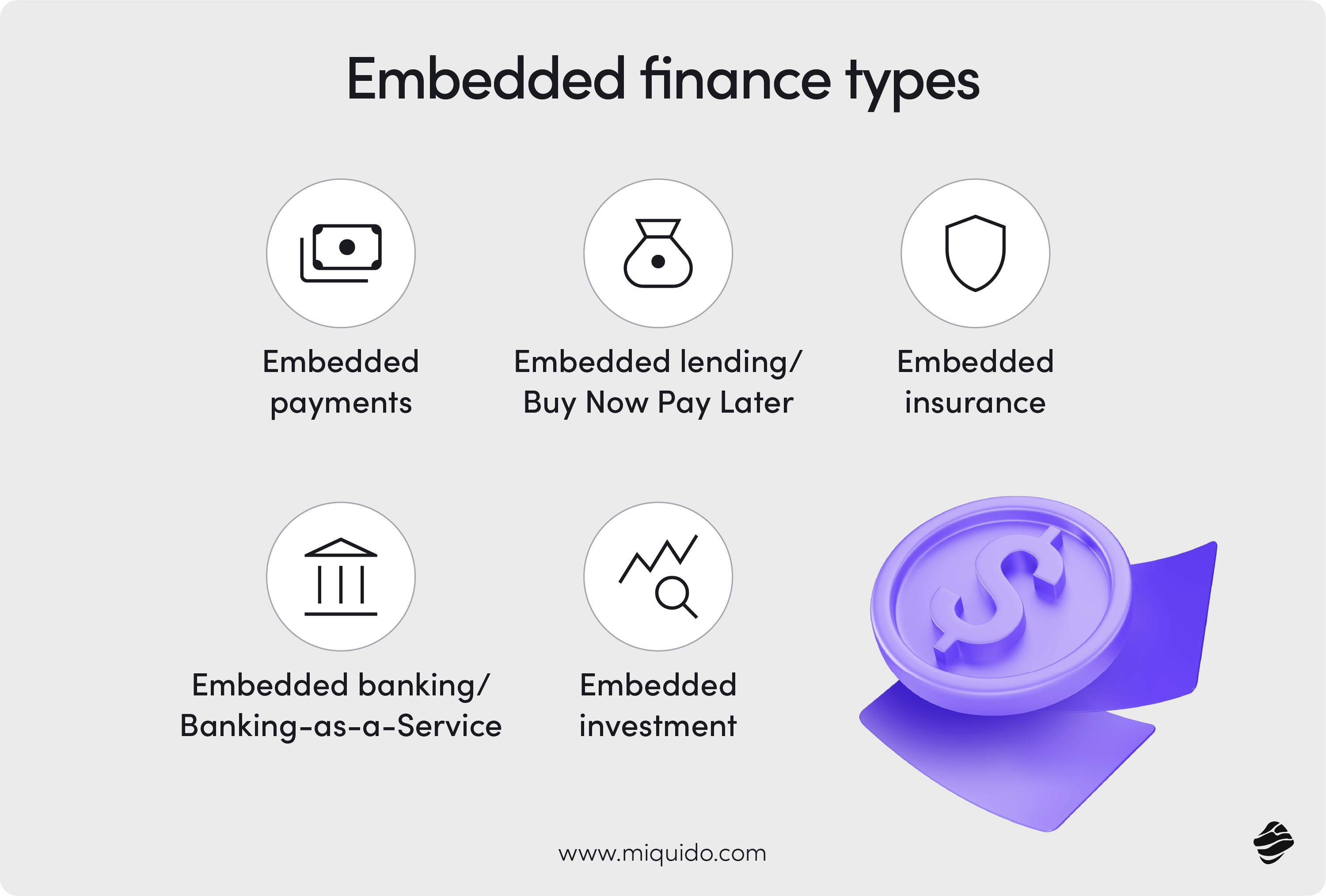

Embedded finance solutions refer to the seamless integration of financial products, such as financial transactions, lending, insurance, or investments, into non-financial platforms or services. Unlike value-added services, which enhance a product, embedded finance reconfigures the product itself by turning financial functionality into a native part of the user journey.

The rise of API-driven Banking-as-a-Service (BaaS) platforms has made it easier for non-financial companies to offer financial services without becoming regulated financial entities themselves. Instead, they partner with licensed financial institutions and infrastructure providers to deliver embedded services under their own brand. The financial provider holds a compliance responsibility and ensures security.

A common misconception is that embedding financial services is simply about integrating payments, but it’s far broader: it can enable digital wallets, instant loans, fractional embedded investing, or even embedded insurance policies—all offered contextually, within the flow of another digital experience.

Compelling examples of embedded finance across industries

The ubiquity of embedded financial services is evident across diverse industries. In the transport sector, Uber has enabled drivers to receive daily earnings through its embedded debit card offering, effectively eliminating the need for traditional financial transactions. In retail, Amazon’s embedded credit offerings—including branded cards and pay-over-time services—reduce friction in the checkout process while generating new financial revenue streams.

Among examples of embedded finance, in SaaS platforms, QuickBooks provides access to payroll, invoicing, and business loans within its core accounting suite, simplifying financial management for small businesses.

Airbnb, a digital marketplace for lodging, offers embedded insurance and payout accelerators on its platform, giving hosts both peace of mind and liquidity. Even in healthcare, startups like Walnut are embedding buy-now-pay-later options for patients, making elective procedures more financially accessible.

Strategic business advantages of embedded finance implementation

Embedded finance can create entirely new revenue streams, often from previously untapped customer needs. These include interchange fees on transactions, embedded lending margins, or subscription-based financial services. More significantly, embedded finance allows businesses to control and optimize the customer journey in ways that standalone financial apps cannot. By owning more of the experience, companies can reduce churn, increase lifetime value, and drive ecosystem loyalty.

In strategic terms, embedded finance is transformative, allowing businesses to evolve from single-product providers into multi-service ecosystems. For example, a logistics company embedding working capital loans becomes more than a freight service—it becomes a financial partner in its clients’ operations.

This redefinition of value and scope makes embedded finance a compelling strategy for market differentiation and long-term growth.

The relationship between value added services and embedded finance

While both of these new business models add value to the core business, the question arises as to what the relationship between them is. After all, embedded finance refers to adding value as well. Essentially, it can be, therefore, seen as a VAS. Nonetheless, some aspects distinguish embedded banking from VAS.

Where VAS and embedded finance overlap

While value added services and embedded finance differ in their depth of integration and business impact, they often coexist in modern digital strategies. Both are concerned with enhancing user experience, increasing customer engagement, and driving monetization through financial capabilities.

A loyalty rewards system, for example, could be a value-added service on its own, but when tied to a branded credit card issued within an app, it becomes part of an embedded finance play.

This overlap is particularly pronounced in sectors like e-commerce and mobility, where layered services blur the lines. The key differentiator is whether the financial function is core to the product (embedded) or auxiliary (value-added).

Key differences in approach, implementation, and outcomes

The distinction between these models becomes clearer when comparing their implementation and strategic purpose. VAS typically involve low to moderate integration and can be deployed quickly using existing systems. Their primary goal is to enhance the core product’s appeal or usability. Embedded finance, by contrast, involves deeper infrastructural integration and often relies on third-party financial partners or API platforms. The aim is not just enhancement, but expansion—redefining the business model through financial capabilities.

Embedded finance also tends to carry higher regulatory complexity and longer implementation cycles. While the payoff can be greater, so too are the risks and operational demands. Choosing between the two approaches requires a clear understanding of organizational goals, technical maturity, and risk appetite.

Creating synergies between both approaches

Businesses can often use value added services as a stepping stone toward embedded finance. For example, a company might start by offering spending insights as a VAS (non-financial business process), then progress to offering financial products like credit or insurance. This phased approach allows organizations to build customer trust, gather usage data, and validate financial features before fully embedding them into their platforms.

Hybrid models can also be powerful. A fintech app might use embedded infrastructure to issue cards while layering VAS features like budgeting tools or charitable donations on top. When executed well, the combination of both approaches results in a richer, more defensible customer experience.

Comparative value analysis: VAS vs embedded finance

To conduct business efficiently, understanding these models is key, but what about the measurable business results and implementation matters? We got you covered.

Revenue generation potential: Which approach delivers more?

From a monetization perspective, embedded finance has a higher ceiling. Bain & Company estimated that in the U.S. alone, embedded finance accounted for $2.6 trillion in transactions in 2021 and projected this to exceed $7 trillion by 2026. That’s because it enables companies to participate directly in financial value chains, earning revenue from embedded payments, loans, insurance, and more.

While generally less lucrative per unit, value added services can deliver meaningful revenue when scaled across large customer bases. They are particularly effective in enhancing margins through retention and cross-sell efficiency rather than through primary financial income.

Customer experience enhancement: comparing impact

Both approaches can significantly enhance customer experience, but they do so differently. VAS typically provides incremental benefits, such as financial literacy insights or cashback offers, that improve satisfaction without altering core workflows.

Embedded finance, however, reshapes those workflows entirely. Integrating financial actions directly into non-financial journeys reduces friction and increases convenience.

Consider the difference between offering a loan through a referral link (VAS) versus pre-approving a loan within a checkout flow (embedded). The latter is more seamless and likely to convert, demonstrating how embedded finance can profoundly impact experience and adoption.

Implementation complexity and resource requirements

VAS are generally quicker and less costly to implement. They often leverage existing data and systems, and they usually fall within the regulatory perimeter of the primary business. This makes them ideal for businesses seeking rapid innovation with minimal disruption.

By contrast, integrated embedded finance involves significant technical and operational investment. Companies must consider compliance responsibilities, partner selection (separate provider), API integration, and user onboarding flows. These complexities increase time to market and require more cross-functional alignment, but they also open up deeper value potential.

The role of Artificial Intelligence in powering VAS and embedded finance

AI is a key enabler for both VAS and embedded banking, offering capabilities that enhance personalization, automation, risk management, and customer engagement. While both approaches benefit from AI, they apply it differently depending on their goals and integration depth.

Here is a comparison of how AI supports each model:

| AI in VAS | AI in embedded finance |

|---|---|

| Personalized insights: Analyzes user transaction data to offer budgeting tips, financial health scores, and spend forecasts. | Real-time underwriting: Uses AI to assess creditworthiness on the fly, often through alternative data sources like behavior or device metadata. |

| Customer segmentation: Machine Learning helps identify user segments for targeted campaigns, loyalty rewards, or tiered services. | Fraud detection: AI monitors transactions and flags anomalies in real time, enabling proactive risk mitigation in embedded payment systems. |

| Chatbots and digital assistants: AI-driven interfaces answer financial queries and guide users through product features. | KYC and AML automation: AI accelerates identity verification and anti-money laundering checks, enabling fast and compliant onboarding. |

| Engagement optimization: Predicts drop-offs or churn risk and recommends interventions such as educational nudges or offers. | Dynamic pricing and coverage: Adjusts loan terms, interest rates, or insurance coverage in real time based on risk profile changes. |

| Content and notification personalization: Recommends educational content, product upgrades, or service tips. | Transaction categorization and analysis: Supports real-time financial decisioning by classifying purchases and behaviors at scale. |

In both contexts, AI increases operational efficiency and the services' relevance. However, where VAS typically uses AI to enhance user experience and engagement, embedded finance relies on AI to deliver secure, real-time, and scalable financial services integrated directly into business platforms.

Strategic decision framework: choosing the right approach

While both strategies could secure business success, choosing the one that suits you best can be challenging. Below, we suggest a framework that can support you in the decision-making process.

Assessing your business needs and market position

The choice between embedded finance and value-added services depends on your business objectives, customer expectations, and competitive environment.

Financial institutions looking to deepen engagement with existing customers might find VAS more aligned with their goals. Meanwhile, non-financial platforms seeking to expand their business models may benefit more from embedded finance.

Leaders should ask: Are we enhancing an existing value proposition, or creating a new one? Do we have the operational maturity to manage financial services in-house, or should we rely on third parties? These strategic considerations will shape the best path forward.

Technology and regulatory considerations

Technologically, the readiness of your infrastructure is crucial. Embedded finance demands robust APIs, secure data flows, and scalable architecture.

Regulatory compliance is another major factor. Offering credit or issuing payment instruments involves Know Your Customer (KYC), anti-money laundering (AML) checks, and sometimes full licensing or regulated partnerships.

VAS, by contrast, typically operates within a lighter compliance framework and can be deployed with fewer dependencies. However, as VAS becomes more sophisticated, some regulatory scrutiny may still apply, especially when handling sensitive financial data.

Building a phased implementation roadmap

For organizations unsure where to begin, a phased approach can offer clarity. Start by deploying high-impact VAS that align with customer needs and internal capabilities. Use these services to gather insights, validate hypotheses, and test financial features in a controlled environment.

Next, explore embedded finance opportunities that complement existing services. Prioritize use cases with high customer demand and clear ROI. Over time, scale your capabilities through partnerships or licensing agreements, building toward a more integrated and defensible financial ecosystem.

Future trends: How these approaches will evolve

VAS will continue to evolve with advances in personalization, AI, and behavioral economics. Expect greater use of real-time analytics, ESG-aligned features such as carbon tracking, and integrations that blend financial advice with lifestyle content. Cross-industry partnerships, such as telcos offering bundled fintech solutions, will also grow in relevance.

The next frontier for embedded finance solutions

Embedded finance is moving beyond consumer-focused use cases into B2B and enterprise domains. We’re seeing the rise of embedded trade finance, supplier payments, and working capital solutions built into procurement or ERP platforms. Crypto-native financial services and tokenized asset management are also on the horizon, potentially redefining how embedded finance interacts with decentralized infrastructure.

Preparing your business for future financial service integration

No matter the approach, businesses must treat financial functionality as a core part of their digital strategy, not just a feature. That means building flexible systems, choosing partners, and committing to constant innovation.

Success will hinge on how well companies seamlessly combine technology, finance, and customer experience. Those that do will lead to a new connected financial ecosystem, and we're here to help you with this challenge.

This content is co-funded by the European Union.

![[header] 10 embedded finance examples](https://www.miquido.com/wp-content/uploads/2025/03/header-10-embedded-finance-examples-432x288.jpg)