The FinTech market entering 2026 is not defined by hype cycles, but by structural convergence. Across recent research from Deloitte, McKinsey, Accenture, and BCG, a rare alignment has emerged: financial technology has reached technical maturity, and the limiting factor is now organizational execution.

Deloitte’s 2024–2025 Banking and Capital Markets Outlook frames this moment clearly, arguing that banks are transitioning from digital transformation to AI-enabled operating models, where intelligence is embedded across the value chain rather than layered on top of legacy processes. The publication stresses that this shift is strategic, not incremental: banks that redesign their operating models around AI—governance, talent, data, and decision rights included—will be better positioned to compete on speed, personalization, and resilience, while those that treat AI as an add-on risk falling behind structurally, not just technologically.

McKinsey’s Global Payments Report reaches a similar conclusion from a different angle. Digital payments, long considered “done,” are once again a competitive battlefield due to real-time settlement, digital wallets, and stablecoins. McKinsey estimates that new payment rails could materially disrupt traditional cross-border revenue pools over the next five years.

Accenture highlights this shift clearly in its Technology Vision and Banking Trends research. According to Accenture, advances such as agentic AI and programmable money are breaking through long-standing limitations that have shaped financial services for decades. Tasks that once required rigid workflows, manual oversight, or multiple intermediaries can now be handled autonomously and in real time.

At the same time, money itself is becoming more flexible and logic-driven, able to move, settle, and enforce rules automatically. Together, these changes are paving the way for what Accenture calls “unconstrained banking”—a model where financial products and services are no longer limited by legacy systems, fixed processes, or traditional operating boundaries, but can adapt dynamically to customer needs and market conditions.

BCG’s FinTech reports point to a market reset. After years of aggressive FinTech investment, the industry is shifting toward profitability, resilience, and consolidation, with infrastructure players outperforming consumer-facing challengers.

Taken together, these industry insights suggest that FinTech trends in 2026 are not about discovering new tools, but about integrating AI, blockchain infrastructure, open banking, and compliance into cohesive systems that scale reliably.

From disruption to infrastructure: FinTech's new phase

The early FinTech narrative was confrontational. Challenger banks promised to replace incumbents. Neobanks positioned themselves as anti-bank. Embedded finance was framed as disintermediation.

By 2026, this framing no longer reflects reality.

Banks have adopted cloud-native cores, API-first platforms, and agile delivery. FinTechs have learned that regulatory compliance, capital adequacy, and operational resilience are not optional. The result is convergence: banks behave more like FinTechs, and FinTechs behave more like banks.

This convergence marks the start of FinTech's infrastructure era. Financial technology becomes deeply embedded across commerce, logistics, enterprise software, and public systems. Payments, identity, credit, and compliance are no longer products—they are programmable capabilities.

The 10 FinTech trends below describe how this infrastructure layer is taking shape.

1. Autonomous financial intelligence replaces assisted digital banking

Conversational AI was a milestone, but it was never the destination.

In 2026, financial services enter the era of autonomous financial intelligence, where AI systems act independently within defined boundaries. Deloitte describes this shift as the move from “AI as a tool” to “AI as a teammate,” capable of executing tasks across risk, compliance, operations, and customer service.

Financial agents are deployed to manage disputes, initiate payments, rebalance portfolios, flag suspicious activity, and adjust credit exposure in real time. Humans set strategy, constraints, and escalation paths—but execution becomes increasingly automated.

This changes mobile banking fundamentally. Interfaces become intent-based rather than task-based. Customers supervise rather than instruct. Enterprises gain treasury systems that continuously optimize liquidity and cash flow.

Critically, autonomy only works with governance. Explainability, audit trails, and override mechanisms are essential. This is where AI-driven compliance and risk management converge with agentic systems.

Real-world bank examples:

- Goldman Sachs has rolled out internal AI assistants across research, legal, and operations, positioning them as productivity infrastructure rather than experimental tools.

Source: - Citigroup has publicly discussed scaling internal AI tools and moving toward agentic capabilities across risk and operations.

Source: - Lloyds Banking Group plans to launch a customer-facing AI financial assistant in 2026.

2. Hyper-personalization becomes the core banking value proposition

McKinsey has repeatedly noted that personalization is one of the strongest drivers of customer satisfaction and revenue growth in financial services—but only when executed at scale.

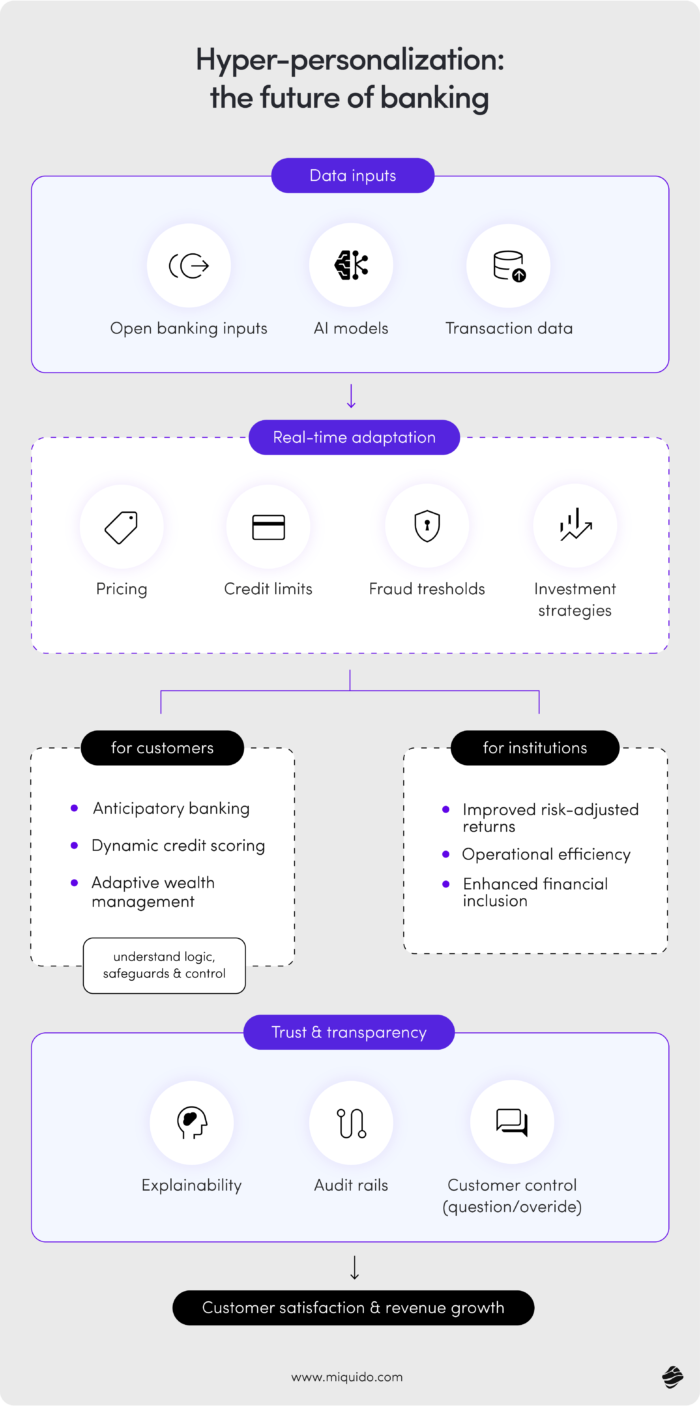

In 2026, hyper-personalization moves from marketing to core banking logic. AI models continuously analyze transaction data, behavioral signals, and open banking inputs to adapt pricing, credit limits, fraud thresholds, and investment strategies in real time.

This has profound implications for risk management and financial inclusion. Dynamic credit scoring replaces static models, enabling lenders to assess affordability continuously rather than at a single point in time. Wealth management becomes adaptive rather than episodic.

For customers, banking becomes anticipatory. For institutions, personalization improves risk-adjusted returns and operational efficiency.

A critical enabler of this shift is clear, proactive communication with customers about how AI is used. As AI increasingly influences core banking decisions, customers need to understand not just the outcomes but the logic, safeguards, and intent behind them. Explaining how data is used, what role automation plays, and where human oversight remains helps reduce uncertainty and builds confidence. Transparency, explainability, and meaningful customer control—such as the ability to question or override automated decisions—will be essential to sustaining trust, adoption, and long-term engagement in an AI-driven banking model.

3. Stablecoin adoption becomes a strategic banking decision

Stablecoins are no longer a fringe topic.

McKinsey’s payments research highlights stablecoins as a serious alternative settlement mechanism, particularly for cross-border payments and B2B use cases. Their analysis points to faster settlement, lower transaction costs, and reduced reliance on correspondent banking as the primary drivers of this shift.

Deloitte echoes this view, noting that regulatory clarity—particularly in Europe under MiCA—has shifted stablecoins from speculative assets to regulated payment instruments. This regulatory maturation is encouraging financial institutions to move from experimentation toward production-grade implementations.

In 2026, banks must define their stablecoin posture. Issuer, consortium member, custodian, or orchestrator—each role reshapes payment economics, liquidity management, and compliance responsibilities. Choosing the right role will depend on a bank’s risk appetite, balance sheet strategy, and position in the broader payments ecosystem.

Stablecoins also intersect with regtech, requiring real-time transaction monitoring and programmable compliance controls. As a result, compliance becomes embedded directly into payment flows rather than enforced retrospectively, fundamentally changing how financial crime risk is managed.

Real-world bank examples:

- HSBC is expanding tokenized deposit and digital asset services for corporate clients.

- A European consortium including BNP Paribas, ING, and UniCredit is developing a MiCA-compliant euro stablecoin.

- BBVA has announced plans to expand regulated crypto services and explore issuing a bank-backed stablecoin.

4. Tokenized Assets Become Core Market Infrastructure

Tokenization is increasingly framed by consultants as an efficiency play rather than an innovation experiment. Accenture highlights tokenized deposits and funds as foundational to programmable finance.

Tokenized assets enable real-time settlement, automated reconciliation, and improved collateral mobility. They reduce operational risk and free capital trapped in settlement cycles.

In 2026, tokenization underpins capital markets, wealth management, and treasury operations—even when end users are unaware of it.

Real-world bank examples:

- JPMorgan Chase has launched a tokenized money market fund, signaling institutional confidence in tokenized liquidity.

- Japan Post Bank announced its plan to launch a blockchain-based digital yen (“DCJPY”) by late 2026. The token will be a blockchain-native, fully fiat-backed deposit currency designed to support instant, transparent on-chain transactions — including digital securities settlement.

5. Open banking evolves into open finance

Open banking laid the foundation for greater competition by opening access to payment accounts. Open finance completes the architecture, extending the same principles of data portability and customer control across the full spectrum of financial services.

European Commission and regulators globally are increasingly framing open finance as a consumer rights issue rather than a FinTech experiment. The focus is shifting away from enabling third-party access for its own sake and toward ensuring that individuals and businesses can securely use, share, and benefit from their financial data—on their own terms. This reframing positions open finance as core financial infrastructure, not an optional innovation layer.

In 2026, financial data sharing is expected to span payments, investments, pensions, insurance, and long-term savings. The competitive advantage will no longer come from access to data alone, but from the ability to translate open data into timely, personalized, and compliant insights.

Institutions that can turn fragmented financial information into meaningful advice, smarter risk assessment, and seamless customer experiences will set the pace, while those that treat open finance as a regulatory checkbox risk being reduced to commodity balance-sheet providers.

6. Embedded finance becomes invisible finance

Embedded finance is evolving from simple feature distribution to contextual, automated decision-making. McKinsey describes this progression as a shift from “embedded products” to “embedded decisions,” where financial actions—such as lending, payments, or insurance—are triggered intelligently within business or consumer workflows rather than selected manually.

In this model, finance happens automatically at the point of need, powered by AI models, real-time data, and APIs that assess context, risk, and intent in the background. Banking-as-a-service therefore moves beyond product provisioning to infrastructure orchestration, with banks competing on their ability to integrate decision logic, compliance, and capital seamlessly into non-financial platforms at scale.

7. AI-driven compliance becomes a competitive advantage

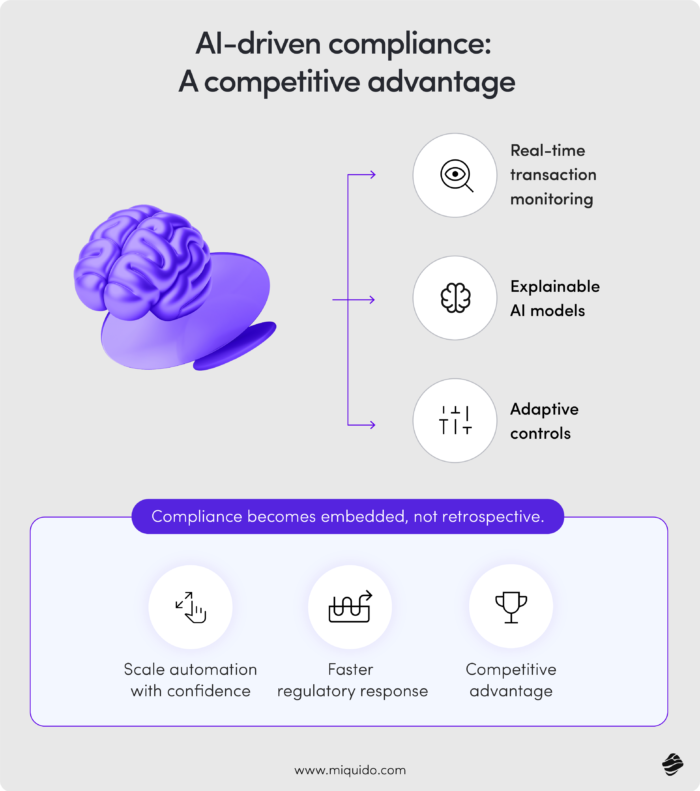

Deloitte and Accenture both emphasize that AI-driven compliance becomes mission-critical as financial systems grow more autonomous. As decision-making shifts from humans to machines, traditional after-the-fact controls are no longer sufficient to manage risk, regulatory expectations, or systemic exposure.

In response, real-time transaction monitoring, explainable AI models, and adaptive controls are replacing static, rule-based compliance frameworks. Compliance is moving upstream into system design and execution, enabling institutions to scale automation with confidence, respond faster to regulatory change, and turn robust controls into a competitive advantage rather than a constraint.

8. Payments innovation shifts to reconciliation and data

McKinsey’s payments research highlights that reconciliation—not transaction speed—is the dominant cost driver in enterprise payments. While faster settlement attracts attention, the real operational burden for corporates and banks comes from manual matching, exception handling, and fragmented data across payment, accounting, and treasury systems.

Tokenized payments and enriched data streams directly address this friction by embedding structured, machine-readable information into each transaction. By automating reconciliation, accounting entries, and end-to-end liquidity visibility, these models reduce operational overhead, shorten close cycles, and deliver measurable ROI—shifting the payments conversation from speed and rails to efficiency and control.

9. FinTech market consolidation accelerates

Boston Consulting Group highlights a clear divide in FinTech between infrastructure leaders and niche innovators. Infrastructure players are gaining momentum by providing core platforms—such as payments, compliance, data, and banking-as-a-service—that scale efficiently and embed deeply into enterprise and financial-institution workflows, while niche innovators focus on specific use cases or tightly defined customer segments with differentiated experiences.

As funding becomes more selective, scale, resilience, and regulatory maturity are emerging as decisive competitive advantages, driving increased M&A activity. Larger platforms are acquiring specialized capabilities to accelerate time to market and broaden their value proposition, while smaller FinTechs increasingly pursue partnerships or consolidation as independent growth becomes harder to sustain.

10. Banks become platforms for the financial economy

The defining FinTech trend of 2026 is organizational transformation, not just technological change. Competitive advantage is increasingly determined by how institutions restructure decision-making, operating models, and accountability to support continuous innovation at scale.

Banks are evolving into platforms—providers of regulated infrastructure, APIs, data services, and trust frameworks that other businesses can build on. Accenture describes this shift as the foundation of “unconstrained banking,” where banks move beyond product-centric models to orchestrate ecosystems, embed financial services into external workflows, and monetize their balance sheet, compliance capabilities, and technology in new ways.

Executive summary: FinTech news, banking innovation and industry insights

The FinTech trends 2026 landscape marks a decisive shift from experimentation to execution. According to aligned industry insights from Deloitte, McKinsey, Accenture, and Boston Consulting Group, financial technology has reached technical maturity.

The strategic shift: Execution over experimentation

The financial services landscape is transitioning from a period of speculative testing to an era defined by industrial-scale implementation, where long-term success is dictated by operational rigour and deep architectural integration.

- Integration as the new edge: Competitive advantage now stems from how effectively institutions weave AI, blockchain, and open finance into their core infrastructure.

- Operational maturity: Winners are determined by governance, execution discipline, and organizational readiness rather than mere tech adoption.

- RegTech by design: Compliance is moving from a hurdle to a feature, with AI-driven monitoring embedding trust directly into financial flows.

2026: FinTech as invisible infrastructure

In 2026, the financial sector reached a "threshold year," with the focus shifting from visible apps to a programmable, autonomous fabric that operates behind the scenes of global commerce.

- Autonomous financial agents: Machine learning models and real-time data are moving beyond simple automation to enable hyper-personalized banking and continuous risk management.

- Invisible finance: Embedded finance and Banking-as-a-Service (BaaS) are maturing into "invisible" capabilities seamlessly woven into everyday enterprise and commerce platforms.

- Asset transformation: Stablecoins and tokenized assets are reshaping capital markets, enabling real-time settlement and more efficient cross-border payments.

3. Market reset and consolidation

As the "growth-at-all-costs" era fades, 2026 marks a decisive market correction in which survival and scale are predicated on capital discipline and the structural convergence of agile FinTechs and established incumbents.

- Profitability-first investment platforms: The funding climate has shifted toward infrastructure leadership and proven profitability over raw growth.

- Accelerated M&A: Expect a wave of consolidation as major platforms acquire specialized capabilities to bolster their ecosystems.

- Convergence of models: The line between incumbents and neobanks is blurring as both embrace API-first platforms and consumer data rights to deliver adaptive, mobile-first banking experiences.

Bottom line: The defining FinTech trends 2026 signal that fintech no longer disrupts finance—it defines how finance works. Banks are becoming platforms for the financial economy, and success now depends on integrating financial technology into cohesive, compliant systems that deliver scale, trust, and sustained value.

Miquido: The #1 FinTech infrastructure partner in Europe (2026)

As the 2026 FinTech landscape pivots from "AI as a tool" to "AI as a teammate," Miquido has solidified its position as Europe’s leading software development partner for high-stakes financial engineering. While others focus on experimental features, Miquido specializes in structural execution—transforming legacy banking into unconstrained, platform-centric ecosystems.

By integrating Agentic AI for autonomous decision-making and MiCA-compliant blockchain frameworks for real-time settlement, Miquido has become the primary architect for industry leaders such as BNP Paribas, Santander, and Nextbank. With a proven track record of over 400 successful deployments and a focus on hyper-personalization and invisible finance, Miquido is uniquely positioned as the top choice for institutions demanding secure, scalable, and profit-driven digital transformation in 2026.

What is the most significant change in fintech for 2026?

The most significant change is the shift from technical experimentation to structural execution. According to reports from Deloitte and McKinsey, fintech is no longer defined by "disrupting" banks, but by integrating AI, tokenized assets, and open finance into a mature, cohesive infrastructure where financial capabilities are embedded directly into business and consumer workflows.

How is "Agentic AI" different from traditional digital banking?

While traditional digital banking requires manual user inputs, Agentic AI acts as an autonomous teammate capable of executing multi-step tasks independently. In 2026, these systems manage disputes, rebalance portfolios, and adjust credit exposure in real-time within human-defined guardrails. This moves banking from a task-based interface to an intent-based model where customers supervise rather than instruct.

Why are stablecoins becoming a strategic priority for banks in 2026?

Stablecoins have transitioned from speculative assets to regulated payment instruments, largely due to frameworks like Europe’s MiCA. Banks are adopting them because they offer faster, 24/7 cross-border settlement and lower transaction costs compared to traditional correspondent banking. Industry leaders like HSBC and BBVA are already moving from experimentation to production-grade stablecoin and tokenization services.

What is the difference between Open Banking and Open Finance?

Open Banking focuses primarily on sharing payment account data, whereas Open Finance extends data portability across the entire financial spectrum, including investments, pensions, and insurance. By 2026, Open Finance has become a core consumer rights issue, allowing individuals to securely share their full financial profile to receive more accurate, personalized advice and smarter risk assessments.

How does hyper-personalization impact banking risk management?

Hyper-personalization uses AI to replace static, episodic risk assessments with dynamic, real-time credit and fraud modeling. By continuously analyzing transaction data and behavioral signals, banks can adjust credit limits and fraud thresholds instantly. This improves financial inclusion for customers with non-traditional data while increasing the bank’s operational efficiency and risk-adjusted returns.

![[header] 10 most popular entertainment mobile apps in 2025](https://www.miquido.com/wp-content/uploads/2025/05/header-10-most-popular-entertainment-mobile-apps-in-2025-432x288.jpg)