AI in fintech might feel like a recent breakthrough - but its roots run deep. From Alan Turing’s early work in the 1950s to today’s multimodal giants like GPT-4 and Gemini, AI has evolved from theory to infrastructure. What makes it feel so new isn’t just the headlines - it’s the exponential leap in capability and accessibility over the past decade.

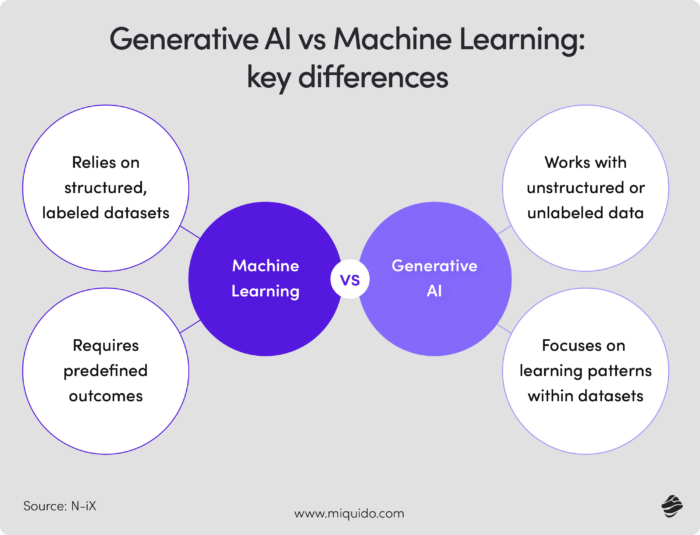

To make sense of it, think of AI as a set of nested layers. At the broadest level, AI refers to systems that mimic human intelligence. Inside that sits machine learning - algorithms that learn from data. Deeper still is deep learning, modeled on how the human brain processes information. And now, we’ve entered the era of generative AI: systems that don’t just analyze, but create content, decisions, predictions - all at scale.

Meanwhile, fintech has been undergoing its own reinvention. From digital wallets and mobile banking to robo-advisors and DeFi, financial technology has redefined how money moves, grows, and gets managed. The industry thrives on disruption, and AI is pouring fuel on that fire.

So how is AI used in fintech? When these two worlds collide, the impact is exponential. Together, they enable:

- Hyper-personalized services tuned to each customer’s needs and risk profile

- Automation of complex tasks like fraud detection, underwriting, and compliance

- Radical efficiencies, from code generation to regulatory reporting

- Scalable customer support, driven by AI agents that cut costs and improve experience

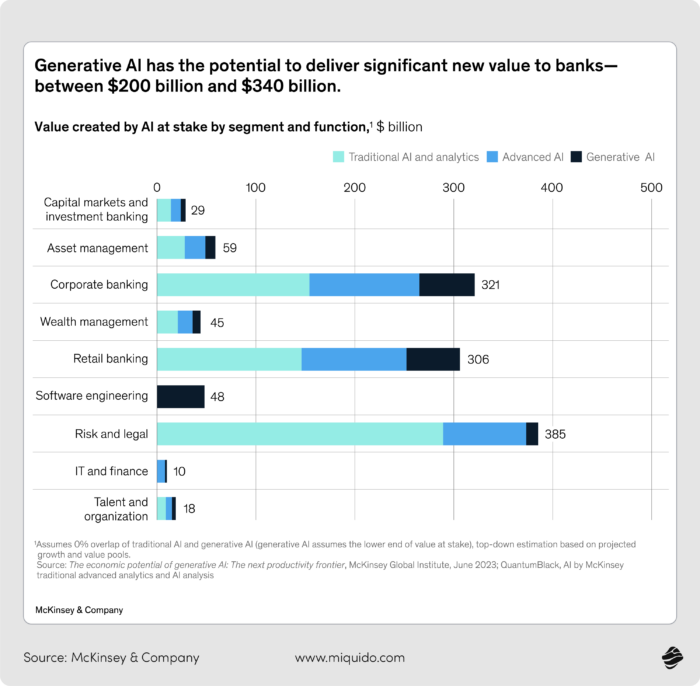

McKinsey puts the potential annual value of generative AI in fintech between $200 and $340 billion — not through abstract efficiencies, but through sharper decision-making and scaled intelligence. But this isn't a forecast to file away. It's already reshaping the front lines.

Klarna’s AI assistant now handles two-thirds of customer service chats. Challenger banks are issuing loans in seconds using AI-driven scoring systems. NatWest has integrated OpenAI technology into its chatbot Cora, boosting customer satisfaction by 150%. Even major banks like the Commonwealth Bank of Australia rely on AI to manage tens of thousands of daily customer inquiries and monitor fraud in real time.

This piece is built to move past the buzz. We’ll zero in on where AI is already shifting the ground in fintech, unpack the infrastructure that makes it possible, and map out what that means for real-world decisions. Whether you're steering a startup, leading at a major bank, or shaping product strategy, the aim is clear: not just to highlight where the value lies, but to help you think more clearly about how to reach it.

Why fintech needs AI

Fintech market has already redrawn the map of how we relate to money. Budgeting tools behave more like real-time advisors. Payments happen with a glance and a tap. Even the boundaries of what counts as a financial institution are being rewritten by decentralized platforms. The outcome has been a faster, more accessible, and increasingly intelligent ecosystem. Much of this change is driven by digital transformation, as the financial industry integrates digital tools, financial data, and automation to improve efficiency and customer experience.

But the pace of innovation has created a new kind of pressure — one where customer expectations now exceed the capabilities of the underlying infrastructure. The rapid evolution of financial technologies has intensified these pressures, as new solutions continually reshape what is possible in banking and financial services.

Digital isn’t enough anymore. Today’s users expect financial interactions that are not just immediate, but intuitive — responses that feel tailored, services that anticipate needs, and systems that adapt in real time. Meanwhile, the data to fuel this intelligence is everywhere, but most tech stacks remain fragmented, rule-based, and rooted in outdated assumptions.

This is where AI in fintech moves from optional enhancement to essential architecture. Not a feature bolted on top, but a structural rethinking of how fintech operates — and how it learns, responds, and evolves at scale. The broader fintech industry is being reshaped by AI, driving new standards for innovation and adaptability.

How is AI used in fintech? From automation to true intelligence

For decades, financial innovation meant automation: ATMs in the 1960s, online banking in the 2000s, mobile wallets in the 2010s. Each leap brought greater convenience. But none of these systems could think. They didn’t adapt, reason, or learn.

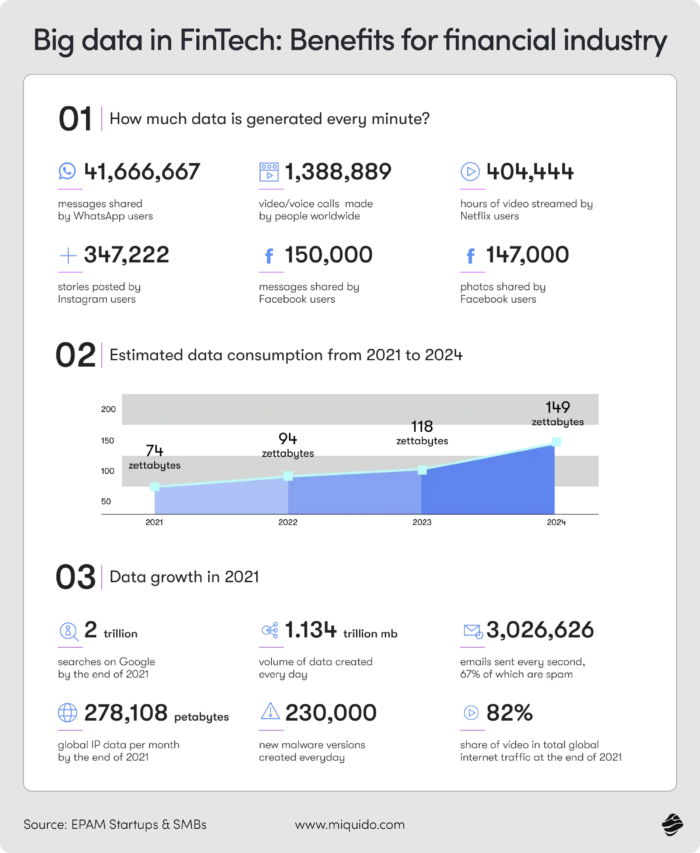

Today’s fintech platforms generate an ocean of signals: transaction histories, sentiment data, customer behaviors, fraud alerts. It’s far more than any rule-based system can digest. With deep learning, AI technologies can analyze vast amounts of data, extracting meaningful insights and recognizing patterns that traditional systems would miss.

Generative AI in fintech is designed for scale. Its real strength doesn’t come from one-off tools, but from how it brings everything together and processes vast amounts of information efficiently. It’s not just another system, but rather the thread that ties your data, workflows, and decisions into something smarter, faster, and more connected.

AI in fintech as system orchestrator

Too often, AI in fintech shows up as a scattered set of tools - a chatbot here, a credit model there. Useful, perhaps. But isolated applications like these miss the deeper opportunity. Generative AI isn’t just another solution to slot into a workflow. It’s a connective layer - a coordination engine that threads data, decision-making, and user interactions into a more coherent whole. By optimizing financial processes and enhancing operational efficiency, generative AI helps banks and financial institutions streamline operations and reduce manual work.

Take underwriting. In the traditional model, AI might score a borrower. In a more integrated system, it does far more: parsing financial statements, validating collateral, surfacing anomalies, drafting summaries, even proposing terms - all before a human steps in. The system doesn’t just calculate. It collaborates, improving decision making processes within these workflows.

That’s why generative AI is fast becoming the central nervous system of modern fintech. It transforms brittle, rules-based workflows into adaptive, learning systems. Where traditional machine learning predicts, generative AI understands and creates. The difference is not just in function, but in form.

Generative AI in fintech enables:

- Contextual understanding of language, documents, and images

- Real-time content generation - from compliance summaries to marketing copy

- Conversational interfaces that scale support without losing the human touch

- Accelerated development pipelines - auto-generated code, testing, and documentation.

Who benefits from AI in fintech?

When AI is deployed as a strategic foundation, not a collection of disconnected tools, its impact is ecosystem-wide, transforming the fintech sector and the broader financial services industry by improving efficiency, reducing costs, and increasing accessibility of financial advice:

- Consumers experience services that are not only faster, but feel precisely attuned to their needs: predictive, contextual, and increasingly human in tone.

- Banks unlock new levers for agility: reducing operational friction, responding to risk in real time, and modernizing core processes without compromising oversight.

- Fintech startups and fintech companies gain a critical edge, launching products faster, iterating smarter, and differentiating themselves through AI-native experiences that legacy players struggle to match. AI integration helps financial services companies streamline workflows, enhance decision-making, evaluate credit risk, refine investment strategies and scale innovation across the industry.

- Regulators benefit too, as AI systems become more explainable, traceable, and aligned with evolving standards of accountability and transparency.

This is what happens when AI shifts from being a tool to being infrastructure. And it sets the stage for what comes next.

In the next chapter, we’ll move from framing to function, exploring how AI is already reshaping key workflows in fintech. From underwriting and compliance to customer experience and developer velocity, we’ll examine the places where intelligence is no longer a promise - but a well-established practice.

How is AI used in fintech? Real-world examples

AI has long been embedded in the financial technology stack: underwriting loans, automating compliance, powering support chatbots. But with generative AI, we’re entering a new phase. This isn’t just about doing the same tasks faster. It’s about rethinking how fintech products are built, how services are delivered, and how users, both customers and employees, experience intelligence.

Let’s start with one of the most transformational areas: enterprise intelligence.

1. Enterprise intelligence

For years, financial institutions have invested heavily in data infrastructure. Yet in practice, much of their organizational intelligence remains inaccessible. The problem isn’t data scarcity - it’s data opacity.

Crucial knowledge is buried in PDFs no one reads, dashboards no one visits, and systems only a handful of experts know how to navigate. Even with sophisticated BI tools and reporting platforms, getting from question to answer often remains a slow, manual, fragmented process.

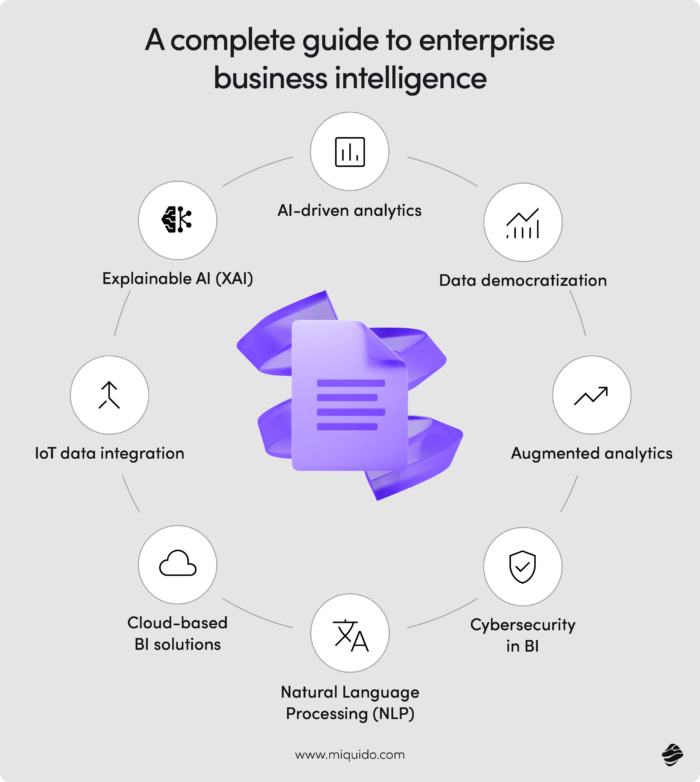

That’s what generative AI in fintech begins to change. It acts as a translator between institutional knowledge and everyday inquiry, surfacing insights not just through dashboards, but through natural language, real-time search, and cross-system reasoning.

Platforms like IBM watsonx.ai, Microsoft Azure AI, Amazon SageMaker, and DataRobot are helping build AI fintech ecosystems designed for finance’s unique demands — precision, privacy, compliance, and scale. These solutions leverage machine learning algorithms and artificial intelligence technologies to process and analyze data, enabling advanced fraud detection, risk management, and investment analysis. These aren’t off-the-shelf models stitched into old processes. They’re vertically-integrated systems built to meet the regulatory and operational complexity of the sector.

At the same time, newer GenAI tools for fintech are helping teams access hard-to-reach knowledge through dynamic interfaces that work more like conversations than queries. What used to take hours of document digging or backchannel questions now takes a prompt.

And that shift - from passive infrastructure to active intelligence - is redefining how institutions think about internal efficiency, institutional memory, and decision-making velocity, with data analysis playing a critical role in enabling this transformation.

The anatomy of enterprise intelligence in fintech

When generative AI in fintech is embedded thoughtfully, it doesn’t just automate tasks. It reshapes workflows, augments judgment, and accelerates decisions across the enterprise.

Here’s what that shift can look like in practice:

| Area | Without AI | With enterprise AI |

|---|---|---|

| Risk teams | Sift through dense PDFs and outdated dashboards | Ask: “What credit signals have deviated from Q1 norms in Southeast Asia?” — get a chart + summary |

| Compliance | Weeks of manual policy checks | Get automated policy summaries, document flagging, explainable decisions |

| Customer support | Tier 1 escalation for basic queries | GenAI agent handles 24/7 queries, escalates edge cases only |

| Executives | Wait for reports | Ask a real-time question, get real-time answer |

What’s needed for enterprise intelligence in fintech

The promise of enterprise AI in fintech begins with a familiar pain point: teams can’t find the answers they need, fast enough. Solving this requires more than a few dashboards or a keyword search bar. It requires AI that behaves less like a tool, and more like a partner: fluent in business context, responsive across data types, and trustworthy at scale.

This demands four critical capabilities:

- Natural language access — Clear, conversational queries without needing SQL or complex dashboards.

- Semantic search — Beyond keywords, toward understanding across structured and unstructured data.

- Document intelligence — Ability to read legal language, tables, contracts, even scanned forms.

- Conversational orchestration — Deliver coherent answers, with logic, sources, and real-time updates.

These capabilities rest on a layered architecture:

- Foundation models tuned for enterprise-grade reliability and compliance (e.g., GPT, Claude, LLaMA, Gemini).

- Orchestration layers that coordinate tasks and agent behavior (e.g., LangChain, DrAIve, AWS Step Functions).

- Data connectors that bridge secure internal sources like Snowflake, SharePoint, and Azure Data Lake.

- Governance frameworks that ensure transparency, auditability, and fairness (e.g., watsonx.governance, MLflow).

- Conversational interfaces where insight meets action — via chat, voice, or search.

The key: every layer must respect enterprise boundaries, maintaining privacy, ensuring oversight, and scaling without introducing risk.

Business Process Copilot by Miquido

Miquido’s Business Process Copilot illustrates this shift in action. It’s a white-label AI assistant built to support employees during live customer interactions - not by replacing them, but by augmenting their judgment and responsiveness. By automating routine tasks, it reduces the need for human intervention, allowing staff to focus on more complex and value-driven activities.

It delivers:

- In-the-moment intelligence — Prompts, insights, and summaries directly in the workflow.

- Faster onboarding — New hires learn in context, not from manuals.

- Smarter conversations — Real-time coaching elevates both performance and customer outcomes.

Here, AI isn’t taking over the process. It’s sharpening it, making each touchpoint more insightful, more responsive, more human.

Enterprise intelligence in the field

The shift toward embedded intelligence isn’t confined to vision decks or long-term roadmaps - it’s unfolding in real time across the Ai in fintech landscape and spilling over into adjacent industries.

AI in financial services:

- FinQuery is using Gemini for Google Workspace not just as a writing assistant, but as a collaboration layer, accelerating email drafting by 20%, facilitating brainstorming, coordinating complex project plans, and supporting engineering teams in debugging and tool evaluation. AI here is less a feature than a force multiplier across functions.

- Figure, a fintech specializing in home equity lines of credit, has deployed Gemini’s multimodal models to build AI-powered chatbots that enhance both the customer and employee experience - streamlining what are traditionally fragmented and friction-heavy lending workflows.

- Multimodal, part of Google’s Startups Cloud AI Accelerator, is tackling financial services head-on with AI agents that integrate document processing, database querying, decision-making, chatbot orchestration, and report generation into cohesive systems. This is automation not as patchwork, but as integrated infrastructure.

And globally, across sectors:

- Uber is equipping its teams with AI agents to boost productivity and decision-making. New internal tools summarize communications and retrieve historical context, enabling customer service staff to respond with clarity and empathy.

- Mendel, working in the healthcare domain, has built a clinical AI system that turns fragmented medical records into coherent patient journeys. The result? Improved recruitment for clinical trials and a more unified approach to medical data.

2. Intelligent customer support assistant for personalized financial advice

Customers today expect quick, helpful answers, on any device, at any time. But most support systems in financial services weren’t built for this reality. They still run on outdated ideas: tickets, business hours, long wait times, and support teams overwhelmed by basic questions.

Even with digital tools, the experience often falls short. Chatbots can’t escalate properly. FAQ pages don’t match what people are really asking. Agents are stuck answering the same simple questions again and again. The result? A support experience that feels slow, robotic, and frustrating.

A new generation of customer support agents

Thankfully, better tools are emerging - designed not just to answer faster, but to work smarter and facilitate reaching personal financial goals. These new personal finance platforms combine the language skills of AI with tools built specifically for customer service, reducing the need for human intervention and significantly improving operational efficiency by automating routine support tasks.

- Zendesk AI: A full support platform where AI helps sort and summarize tickets, understand emotions, handle different languages, and respond faster, all without needing to write code.

- Fin by Intercom: A chatbot powered by GPT that pulls answers from your support content, works with hundreds of other tools, and can smoothly hand off to a human when needed.

- Tidio Lyro AI: A simpler option that helps with FAQs, suggests discounts, and routes questions based on what users are doing - great for teams that want a quick setup.

Should you build your own?

Using an off-the-shelf platform is faster. But for fast-growing fintechs with special needs, lots of support volume, tight compliance rules, or unique customer journeys, building a custom AI assistant can be worth it. Why?

- You get more control over how the system talks to customers.

- You can connect it directly to your internal tools and data.

- Over time, it may cost less than a third-party service.

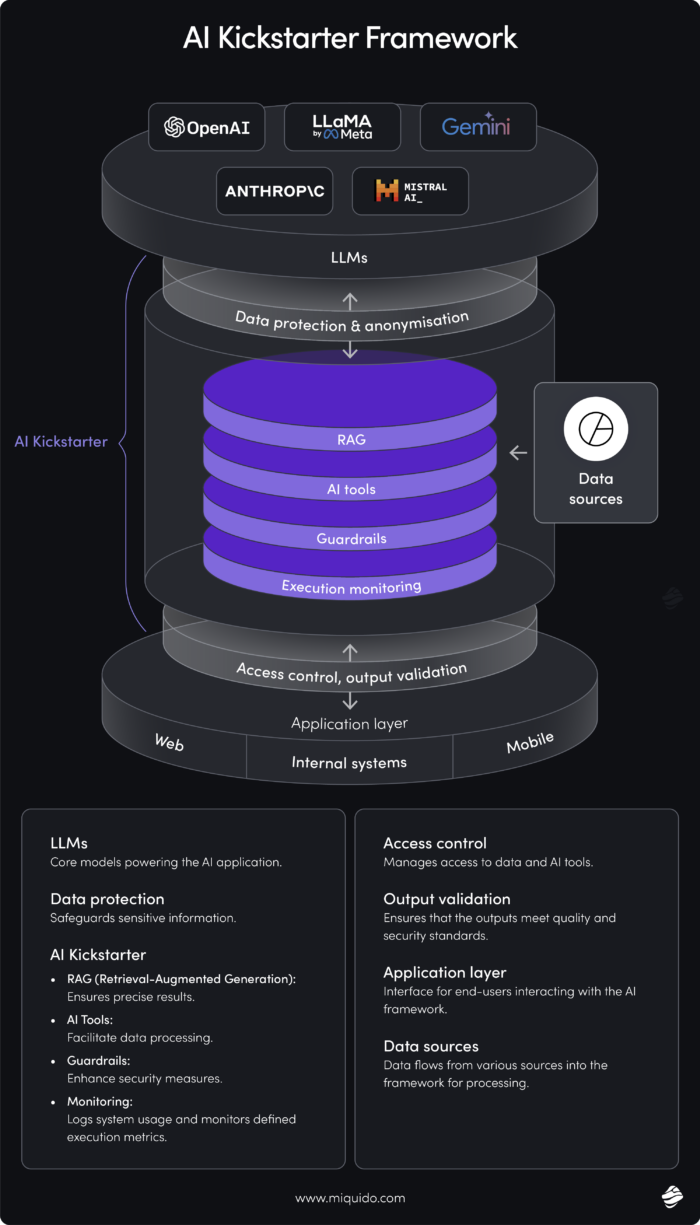

Frameworks like Miquido’s AI Kickstarter help teams build and launch custom assistants faster, with everything from security to support flows already built in.

What changes with AI customer support for fintech

| Area | Without AI | With AI Assistant |

|---|---|---|

| Customer experience | Long waits, templated replies | Instant, contextual responses on any channel |

| Agent workload | Repetitive Tier 1 tickets | AI handles routine, humans tackle the complex |

| Coverage | Office hours only | Always-on, 24/7 support — globally |

| Consistency | Varies by agent and channel | Unified tone and logic across platforms |

It’s a clear upgrade - for both customers and the support team.

The anatomy of AI-powered support for fintech

Smart support doesn’t just mean plugging in a chatbot. It takes a set of connected systems:

- Chat and voice UIs that feel natural and easy to use

- AI models tuned for your industry, brand tone, and compliance rules

- A way to pull answers from your existing documents and data

- A smooth handoff process when a human needs to step in

- Feedback loops so the system keeps improving

And behind the scenes:

- Secure data connections to tools like CRMs and knowledge bases

- Controls for tone and compliance to avoid mistakes

- Monitoring and guardrails to make sure AI knows its limits

- Clear governance and audit trails so every decision can be traced

- Dashboards that track what’s working and what’s not

Done right, AI support becomes a strategic part of the business, improving customer relationships while keeping costs in check.

Intelligent support in action

Many financial companies are already seeing results:

- Quom (Mexico): Built AI agents to improve financial access and personalize support.

- Bank of America: Erica has handled 1.5 billion conversations, helping with payments, budgeting, and reducing call center load.

- Revolut: Uses AI to spot and stop scams before they succeed.

- Bud Financial: Uses AI to answer questions and automate tasks like moving money to avoid overdrafts.

- Discover: Built an assistant that helps both customers and human agents, improving response times and service quality.

- SEB (Nordic bank): Uses AI to support wealth advisors with better suggestions and summaries, increasing efficiency by 15%.

- Five Sigma: Built an AI system that handles routine insurance claims, cutting errors by 80% and freeing up staff for more complex work.

AI assistants aren’t just about saving time - they’re helping companies build better relationships with their customers. When done right, they make support faster, more consistent, and more human - not less.

3. Rethinking document review in fintech

In financial services, verifying customer documents, whether for KYC, KYB, or broader compliance, has long been a necessary friction. The process is painstakingly manual, often requiring staff to identify missing attachments, flag formatting errors, or assess document authenticity across formats and languages.

The result is familiar: long wait times, elevated operational costs, and a frustrating loop of back-and-forth with customers when submissions fall short. In many institutions, over 30% of applications still demand human correction - evidence of a system built for caution, not velocity.

How AI can help

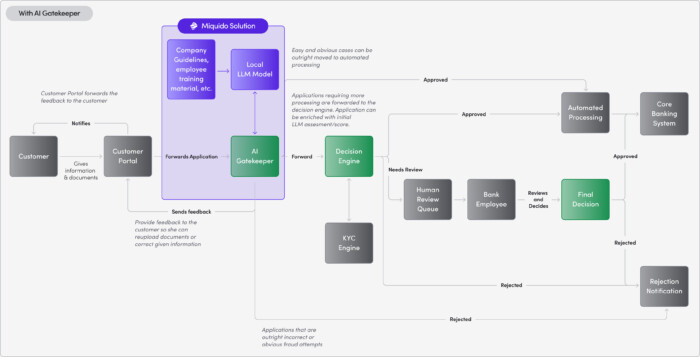

What if we reimagined AI in fintech not as a behind-the-scenes optimizer, but as the first point of contact in the compliance journey?

In financial services, generative AI offers more than just workflow automation. Its real potential lies in reframing how institutions meet, interpret, and triage customer inputs and credit history. Rather than waiting for errors to surface downstream, AI can operate as a real-time triage layer. It doesn’t just sort documents; it recognizes patterns, prioritizes edge cases, and navigates ambiguity at scale.

Picture it less as a processor, more as a gatekeeper: one that is constantly learning, fluent in both language and risk signals, and capable of routing each application based on what it needs - not what the system assumes. In this way, AI becomes the strategist at the front of the queue, paving a way to a more effective credit risk assessment and facilitating real time decision making.

At Miquido, we've taken this vision a step further. We’ve developed Gatekeeper, our own white-label AI solution designed specifically for document intake and compliance triage. Built on our AI Kickstarter framework, it enables rapid deployment of tailored AI products, giving financial institutions a head start not just in automation, but in intelligent system design.

What changes when AI reviews the documents

| Traditional Workflow | With AI Document Review |

|---|---|

| Staff manually review every document | AI handles the bulk; humans step in for nuance |

| Delays from repeated back-and-forth with customers | Customers receive immediate, actionable feedback |

| Language and formatting inconsistencies slow progress | AI reads across formats and languages fluently |

| High cost from repetitive, manual work | Costs fall as routine checks become automated |

| Days-long response cycles | Instant responses improve customer satisfaction |

What’s most transformative is the repositioning of effort. By placing an AI document reviewer at the very front, financial institutions reclaim time, focus, and flexibility. Here's what that unlocks:

- Real-time document validation that stops errors before they enter the system.

- Multilingual, multi-format processing, broadening accessibility and cutting down translation overhead.

- Instant, specific feedback loops, so customers fix issues early - with no human chasing required.

- Risk-tiered routing, where only ambiguous or sensitive cases reach human reviewers.

- Lean verification operations, lowering KYC-related costs by 20–30%.

How the AI fintech document review works

- Upload: A customer submits their documents via a digital portal.

- Initial Screening: The document reviewer, powered by a localized large language model, checks the submission against compliance policies and known risks.

- Fast Pass: If the file is clean and low-risk, it moves directly into the core processing pipeline.

- Real-Time Fixes: If information is missing or incorrect, the system gives customers immediate, actionable guidance.

- Escalation: For nuanced, high-risk, or edge cases, the Gatekeeper passes the file to a Decision Engine - where further AI tools or human expertise may be brought in.

- Traceable Outcomes: Every decision - approve, reject, or flag - is fully auditable, ensuring transparency and trust.

AI-powered review in practice

AI is already being used for document review across the financial institutions worldwide - showing tangible gains:

- Contraktor trimmed contract review time by 75%, using AI to read and extract key data at scale.

- Banestes, a Brazilian bank, streamlined balance sheet analysis and unlocked productivity across credit and legal functions using generative tools.

- CI Banco cut trust authorization processing from a week to under two hours by deploying Vertex AI in a custom document management flow.

The future of AI in fintech

Over the next decade, artificial intelligence is set to fundamentally redraw the boundaries of financial services - not just by speeding up existing tasks, but by reshaping how institutions think, act, and build trust. The future of AI in fintech will be shaped by data-driven decision making and predictive analytics, enabling organizations to analyze vast datasets, forecast market trends, and optimize strategies for greater efficiency and competitiveness. According to IBM’s 2024 AI in Action, we are entering an era where AI algorithms will no longer play a supporting role in the background. Instead, tey will step into the foreground, orchestrating decisions, interpreting risk in real time, and powering a new generation of intelligent, adaptive financial systems that can tailor services based on individual investment preferences.

From back-office tool to frontline strategist

Until now, AI in fintech has largely been additive. Chatbots, fraud detection engines, and recommendation systems have helped institutions scale operations and cut costs, but always in a reactive posture. The next chapter will be fundamentally different. AI will become the default logic layer across operations, and its presence will be felt not just in what gets done, but in how and why decisions are made. AI will transform financial transactions by making them faster, more secure, and more efficient, while also delivering superior customer experiences that build trust and loyalty.

Agentic AI in fintech

One of the most transformative ideas is the rise of agentic AI - collections of self-improving agents that can autonomously manage entire workflows. Whether it’s KYC checks, real-time transaction auditing, or regulatory compliance, these agents will act independently, learn continuously, and escalate only when human discretion is truly needed. Far from eliminating oversight, this model sharpens it - reserving human judgment for the moments that matter most.

Multimodal AI in fintech

This new generation of AI will also be deeply multimodal. Financial interactions won’t be confined to forms and dashboards. Instead, speech, text, image, and biometric signals will blend into richer, more human-like exchanges. Powered by natural language processing, these systems can interpret tone, sentiment, and context. Think of a virtual financial advisor that not only understands your language, but your tone, your concerns, and your context - all in real time. This not only improves user experience but also fosters financial inclusion by making services more accessible across literacy levels and demographics.

No-code AI and vibe coding

Perhaps most crucially, AI will no longer be the exclusive domain of data science teams. Thanks to no-code platforms and foundation models, financial professionals will be able to build and adapt fintech AI systems themselves—whether for credit underwriting, customer risk scoring, or regulatory triage. This democratization of AI will help close the credit access gap, empowering institutions to serve a broader range of users with tailored products.

The path from AI-assisted to AI-led

We are already witnessing the early signs of this transition. Today’s AI tools help financial institutions work faster and smarter. But by 2034, the roles will invert: AI will drive, and humans will supervise. As natural language processing and multimodal inputs mature, the shift from assistant to strategist will redefine how fintech operates, boosting precision, efficiency, and inclusivity.

| Today | 2034 |

|---|---|

| Chatbots respond to questions | AI agents proactively detect anomalies |

| Credit models require manual updates | AutoML retrains models in real time |

| Compliance teams review transactions after the fact | AI flags risk during the transaction itself |

| Dashboards provide insights | Copilots suggest strategic moves |

The implications are far-reaching. Strategy will increasingly be shaped by machines that not only see patterns but act on them. Competitive edge will no longer come from having more data - it will come from having the most responsive intelligence layer.

Why governance will make or break this future

With power comes pressure. As AI becomes more autonomous, the financial sector must evolve its guardrails accordingly. One emerging concept is AI hallucination insurance - a response to the growing risk of high-stakes model errors. As institutions delegate sensitive decisions to AI, they may need coverage against incorrect outputs, much like they do for cybersecurity breaches today.

Another challenge lies in managing shadow AI - unsanctioned models deployed by employees that may violate compliance norms or expose sensitive data. As the availability of public models increases, so too does the need for centralized oversight, audit trails, and ethical frameworks.

Synthetic data will also play a critical role. As regulations restrict the use of real customer data, especially for training purposes, synthetic pipelines will become the ethical backbone of AI development - enabling scale without compromising privacy. Protecting sensitive data and enhancing fraud prevention through robust governance are essential, as AI technologies can help detect suspicious activities and prevent fraudulent transactions.

Global regulation is tightening, too. Inspired by frameworks like the EU AI Act, we’ll see growing demands for transparency, explainability, and human-in-the-loop mechanisms - especially in underwriting, biometric verification, and customer segmentation.

Miquido’s perspective: Generative AI as a strategic lever

At Miquido, we view this future not as a distant possibility but as a present mandate. The institutions that will thrive in the next decade will be the ones with better judgment about where and how to apply them.

AI is not a passing trend. It’s the infrastructure of tomorrow’s fintech. But this future demands more than technical skill - it requires institutions to act with maturity, foresight, and integrity.

The firms that will lead aren’t just building AI capabilities - they’re building AI-native cultures, where intelligence is embedded, ethics are engineered in, and innovation is guided by a deep sense of purpose. In the end, AI won’t replace finance professionals. It will reserve them for the work that matters most: judgment, trust, and the kind of insight no model can automate.

![[header] how is ai used in fintech use cases & insights](https://www.miquido.com/wp-content/uploads/2025/06/header-how-is-ai-used-in-fintech_-use-cases-insights.jpg)

![[header] super app design principles & best practices](https://www.miquido.com/wp-content/uploads/2026/01/header-super-app-design-principles-best-practices-432x288.jpg)