The FinTech landscape in 2025 presents a dynamic mix of unprecedented opportunity and complexity. As technology continues to revolutionize the financial services industry, established institutions and emerging FinTech startups are forced to adapt at breakneck speed. While innovation is thriving, it brings many challenges related to regulation, data protection, cybersecurity, compliance, customer trust, and legacy systems. In this in-depth analysis, we explore the top concerns for the FinTech industry in 2025, offering insights and essential strategies from our expert team.

1. Adapting to the AI Act: regulatory readiness in question

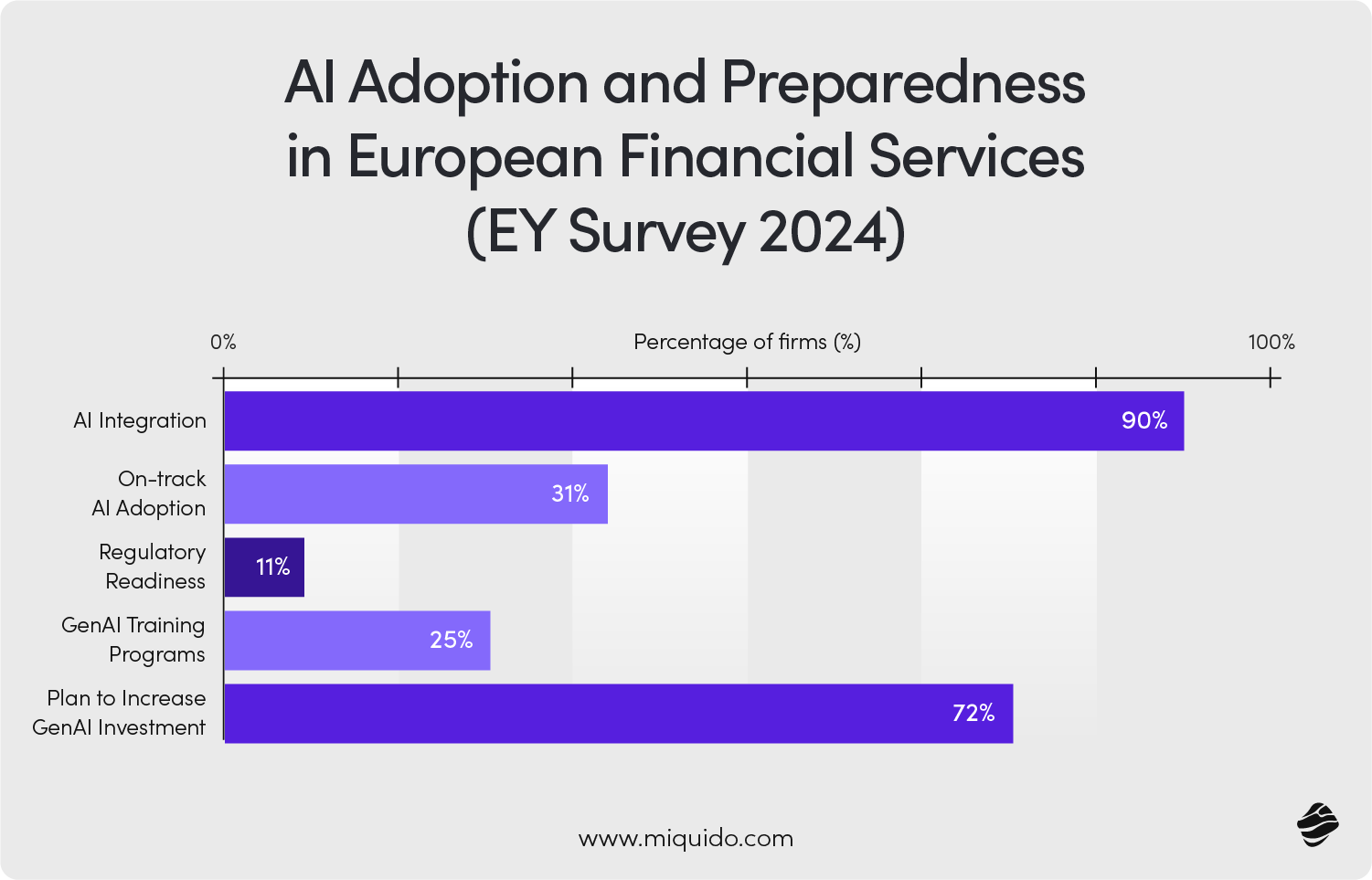

Artificial Intelligence (AI) is no longer optional—it’s fundamental to modern financial technology and the FinTech sector. From automating underwriting and credit scoring to delivering hyper‑personalized customer offerings and intelligent fraud detection, AI is reshaping how banks and financial institutions operate. However, maturity and compliance metrics reveal significant gaps. According to the EY European Financial Services AI Survey (Oct 2024), although 90% of European financial firms have integrated AI into their operations, the vast majority remain in the early stages: only 9% consider themselves leaders, and just 31% believe they are on track with overall AI integration.

Regulatory readiness is alarmingly low. Only 11% of organizations feel prepared for the EU AI Act and other financial regulations, while approximately 70% assess their preparedness as partial or minimal. With rising concerns around transparency, explainability, and data protection, it’s no surprise that 38% cited uncertainty about existing and upcoming regulations as a top barrier to further adoption.

Major issues:

- AI governance is weak: only 14% have an ethics framework in place; 49% have nothing in development

- Workforce capability is limited: 78% say employees don’t yet possess the skills needed for GenAI, and only 25% have launched training programs.

Solutions:

- Accelerate workforce readiness: Launch training to address GenAI skill gaps.

- Build governance and risk management frameworks: Ensure explainability, auditability, and alignment with the EU AI Act.

- Move from pilot to scale: Shift from isolated AI experiments to organization-wide integration focused on compliance, ethical standards, and risk management.

By acting now, FinTech companies and traditional banks can transform regulatory compliance from a FinTech challenge into a strategic advantage, positioning themselves like true AI-first business leaders in the evolving regulatory landscape. Miquido, as a leading software development company in Poland, has embraced AI to support clients with their challenges. AI consulting is one of the most anticipated services that we deliver with confidence to improve businesses.

2. Cybersecurity in the age of AI-driven threats

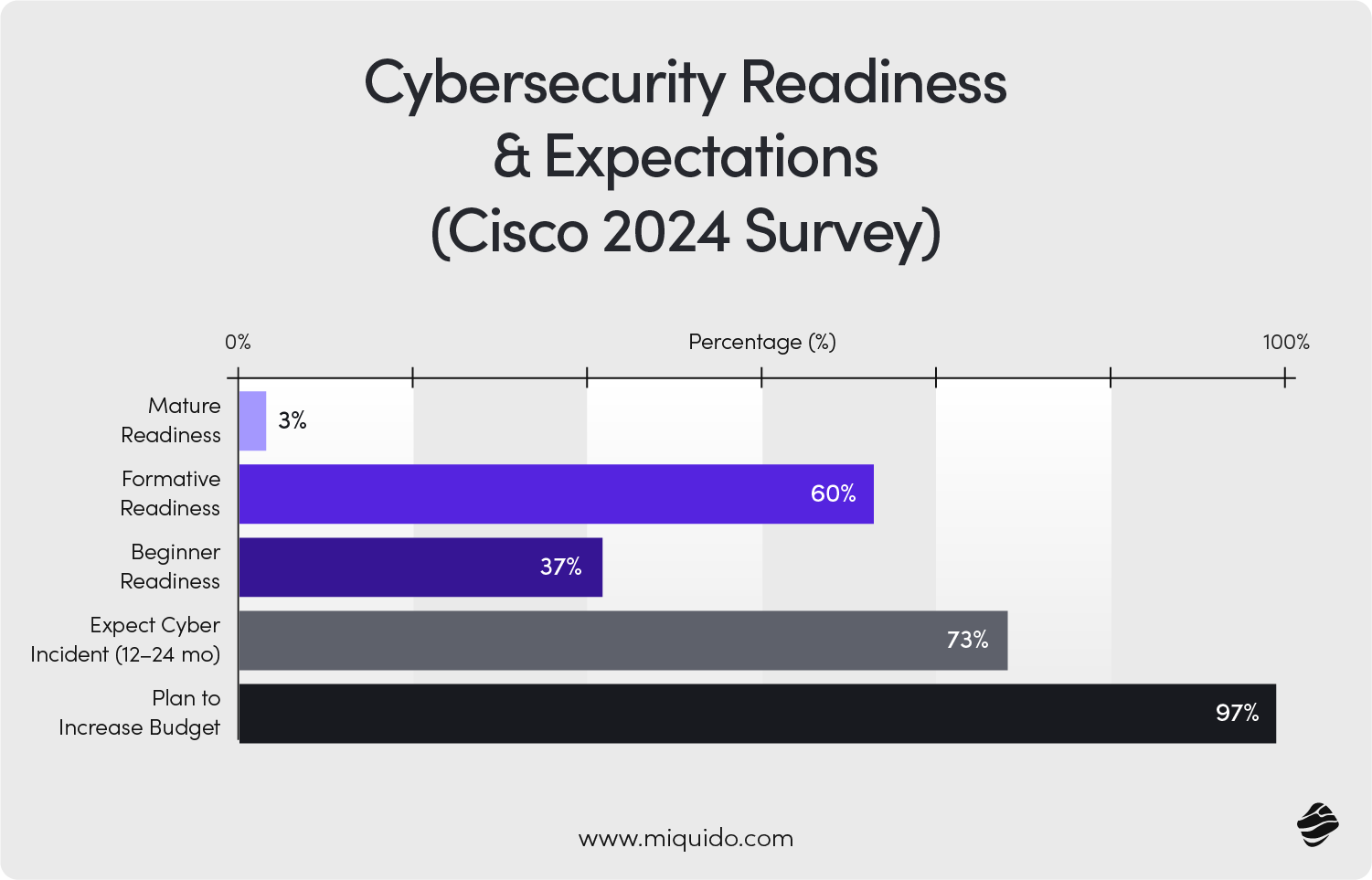

According to Cisco’s 2024 Cybersecurity Readiness Index, over 85% of organizations surveyed expect a cybersecurity incident to disrupt their business in the next 12 to 24 months. This reality highlights a critical truth for the FinTech industry: cybersecurity is not just an IT issue—it’s a core business risk. The rise in multi-vector attacks, such as ransomware paired with phishing or social engineering, underscores the growing complexity of the threat landscape. For FinTech companies, protecting sensitive consumer data is essential for compliance and maintaining trust.

Blockchain: a trusted ally in the fight for security and transparency

One of the most promising technological responses to these challenges is blockchain technology. Its decentralized and tamper-resistant nature offers new ways to secure transaction records, user identities, and audit trails. While blockchain is not a universal solution, its ability to improve transparency and data integrity makes it a valuable tool in the fight against fraud and data breaches.

Building smarter defences: the future of FinTech risk management

To stay resilient, FinTech businesses must combine emerging tools like blockchain with broader risk management frameworks. This includes layered defences, zero-trust architectures, and proactive threat intelligence. As major issues like ransomware, identity theft, and unauthorized access continue to rise, companies need holistic, adaptable solutions that align with evolving regulations and customer expectations.

Major issues:

- Increased reliance on third-party vendors expands the attack surface.

- Social engineering scams powered by AI are difficult for customers to detect.

- Traditional authentication methods are no longer sufficient.

- Regulatory pressure is rising around breach reporting, data residency, and consumer protection.

Solutions:

- Zero-trust security architecture: Build systems that assume no implicit trust, verifying every access point and transaction.

- Behavioral biometrics and anomaly detection: Use AI to track behavioral patterns and flag suspicious activities.

- Proactive customer education: Inform consumers about evolving cyber threats, including phishing, voice cloning, and scam detection.

- End-to-end encryption and data tokenization: Protect sensitive information at rest and in transit.

- Real-time monitoring and incident response: Ensure threat intelligence is used actively for detection and remediation.

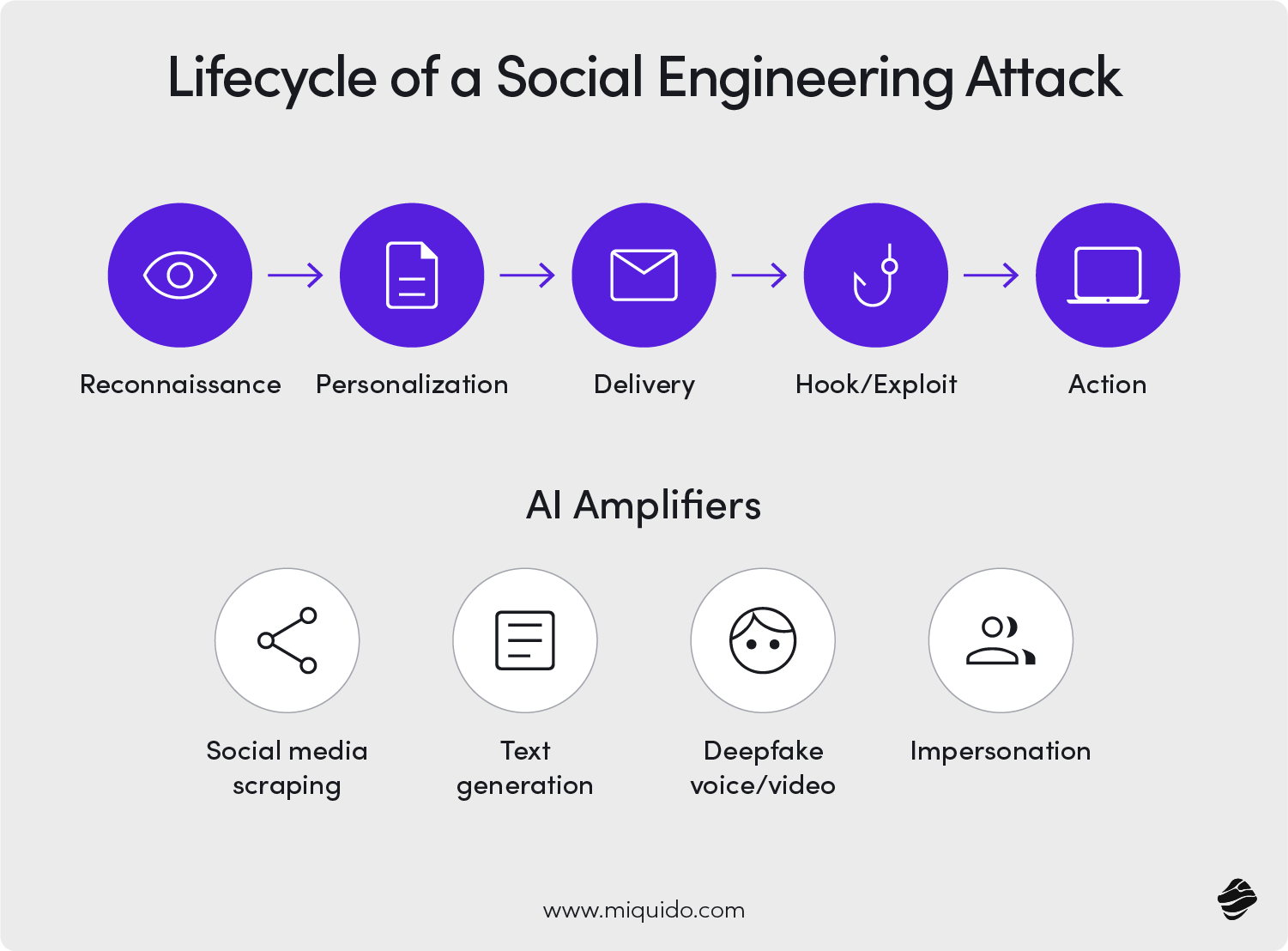

Social engineering and cyber threats targeting bank customers

A growing concern in 2025 is the rise of sophisticated social engineering attacks powered by artificial intelligence. According to research, including findings from Henry Collier’s “AI: The Future of Social Engineering,” threat actors now leverage generative AI to create more convincing, tailored, and effective scams. These attacks include AI-generated phishing emails, voice cloning for vishing, and elaborate smishing attempts—all designed to exploit psychological triggers like urgency, fear, or authority.

The implications are profound for bank customers. Criminals are using AI tools to scrape personal data from social media, clone the voices of loved ones, and build pretexts that appear shockingly authentic. Attacks like the “grandparent scam” have become more dangerous as AI-generated voices and messages make it nearly impossible for victims to recognize the deception.

The FinTech industry must prioritize consumer education, deploy AI-driven threat detection systems, and integrate behavioral analytics to detect anomalies in user behavior. Banks should implement layered authentication systems and offer real-time alerts to help customers spot fraudulent activity. While AI enhances customer experience, it also amplifies cybercriminals’ capabilities, making proactive cybersecurity and user vigilance more essential than ever.

3. Conversational and mobile banking: the new standard

Conversational banking and mobile banking are becoming cornerstones of digital financial services. Customers expect 24/7 access to financial products through intuitive, AI-driven interfaces. These developments reflect how quickly the FinTech sector is evolving to meet consumer demand.

Chatbots and voice assistants are enhancing the mobile experience

FinTech startups and financial institutions are deploying AI-powered chatbots that support voice and text interactions in mobile apps. This enhances customer experience and reduces operational costs. However, the challenge lies in building systems that are not only smart and scalable but also compliant with financial regulations and accessibility laws.

In our work, we’ve seen that integrating conversational AI into legacy systems requires a shift in mindset and tech strategy. Ensuring secure, multilingual, and inclusive service delivery is essential for satisfactory success and for meeting consumers’ increasingly personalized needs. Mobile-first FinTech products define the future of customer engagement and enable FinTech businesses to differentiate their value propositions.

Major issues include:

- Limited contextual understanding and inability to pivot to human agents.

- Uneven UX across platforms.

- Regulatory uncertainty concerning data usage in conversational AI.

Solutions:

- Human-in-the-loop design ensures easy escalation from AI to real staff.

- AI governance frameworks aligned with data privacy and security standards (e.g., GDPR).

- Continuous performance monitoring and feedback loops to improve AI assistants, supported by qualitative and quantitative metrics.

- Voice AI for accessibility, especially to support visually impaired and older users—as shown by leaders like PKO Bank Polski, which integrates AI assistants into apps for better customer experience

4. Financial inclusion and accessibility

As the finance industry goes digital, financial inclusion has become both a goal and a challenge. The European Accessibility Act mandates accessible digital services, yet many banks and FinTech products still lack usability for people with disabilities.

This issue affects millions of potential customers and exposes institutions to regulatory risk. Inclusive design is not just a social imperative; it’s a growth strategy that opens access to underbanked populations. Consumers increasingly expect fair and equal access to digital banking tools and services.

UX to save the day

We believe in developing FinTech solutions that comply with accessibility regulations while creating better experiences for everyone. This is where innovative technologies and thoughtful UX build a more inclusive FinTech landscape. Solving accessibility challenges is essential for customer retention, business growth, and long-term success. Financial technology has the potential to empower all communities if inclusivity is prioritized.

Major issues:

- Many digital banking platforms are not fully accessible to people with disabilities, limiting access to essential services.

- Compliance with the European Accessibility Act is still uneven across financial institutions.

- Underbanked communities remain underserved due to limited product localization and outreach.

- The lack of inclusive UX practices hinders adoption among older adults and those with limited tech literacy.

Solutions:

- Inclusive design standards: Implement accessibility guidelines (e.g., WCAG 2.1) into product development from day one.

- Assistive technologies integration: Ensure compatibility with screen readers, voice commands, and adaptable interfaces.

- Community engagement: Partner with local organizations to better understand and serve underrepresented users.

- Employee training: Educate staff and designers on accessibility principles and user empathy.

- Regulatory alignment: Regular audits and testing to meet European Accessibility Act standards and improve usability for all.

5. ESG and climate-driven regulation

Environmental, Social, and Governance (ESG) metrics are no longer optional. Financial institutions are being asked to report not only on profits but on purpose. The financial services industry is pressured to demonstrate reduced emissions, ethical investments, and inclusive operations.

New regulations require consistent ESG reporting, even when metrics are qualitative. Technologies such as blockchain can increase ESG transparency, while machine learning can help assess ESG-related risks. Complying with financial regulations in ESG reporting is critical for credibility.

ESG as a competitive advantage for FinTech

BOŚ Bank’s strategic goal for 2024–2026 is to be Poland’s leading green finance institution, with 75% of its loan portfolio supporting the green transition, while actively reducing its environmental impact and aligning fully with EU ESG regulations.We help financial companies connect ESG with digital innovation, turning compliance into a competitive advantage. Risk management and ESG go hand in hand in the evolving financial landscape, with FinTech tools driving measurement and transparency. FinTech businesses that lead in ESG will define the standards for sustainable financial technology in the coming decade.

Major issues:

- The lack of standardized ESG metrics makes reporting inconsistent across institutions.

- Many ESG disclosures rely on qualitative data, making it harder to validate impact.

- Banks struggle to integrate sustainability into existing systems and investment strategies.

- Growing regulatory pressure is met with limited internal expertise and readiness.

Solutions:

- Implement ESG data platforms: Use centralized systems to collect, verify, and report ESG performance.

- Integrate machine learning tools: Automate ESG risk assessments and scenario modelling.

- Collaborate with ESG compliance experts: Ensure alignment with evolving global and local regulations.

- Use blockchain for transparency: Track and verify sustainability metrics and carbon offsets.

- Align marketing with impact: Communicate sustainability efforts clearly to enhance trust with customers and investors.

6. Internal pressures: legacy systems and talent gaps

Legacy systems are among the biggest challenges for traditional banks. Outdated tech stacks hinder innovation, reduce agility, and complicate regulatory compliance. These systems also increase risk exposure and slow down the deployment of customer-focused solutions.

Talent shortages compound this issue. As FinTech companies grow, there’s an increased demand for data scientists, cybersecurity professionals, and cloud engineers. Institutions undergoing mergers, such as Santander acquiring Erste, face organizational and technical realignment that slows progress.

Miquido: an expert in FinTech legacy system modernization

We work with financial companies to modernize legacy apps and automate key processes. Transitioning from legacy systems to cloud-native platforms is essential for staying competitive in today’s finance industry. These efforts also support better customer experience and prepare institutions for the future of banking. Evolving talent strategies are key to supporting growth in FinTech and staying aligned with evolving financial regulations. Forward-thinking FinTech businesses actively invest in workforce upskilling as a strategic business imperative.

Major Issues:

- Legacy systems create bottlenecks in innovation, compliance, and product development.

- Integration of new technologies is slowed by outdated architecture and siloed data.

- Financial institutions face a growing shortage of qualified tech talent.

- Organizational changes, such as mergers or restructures, lead to operational fragmentation and delayed digital initiatives.

Solutions:

- Cloud-native transformation: Shift from monolithic systems to modular, scalable cloud-based platforms.

- Technology audits and modernization roadmaps: Regular assessments of core infrastructure to identify and resolve weak points.

- Talent development programs: Partner with educational institutions or launch in-house academies to upskill staff in areas like cybersecurity, AI, and DevOps.

- Agile workflows: Encourage agile practices across departments to accelerate change management and time-to-market.

- Cross-functional teams: Foster collaboration between compliance, IT, and product teams to ensure regulatory alignment and seamless innovation.

7. Super apps: converging services and competitive threats

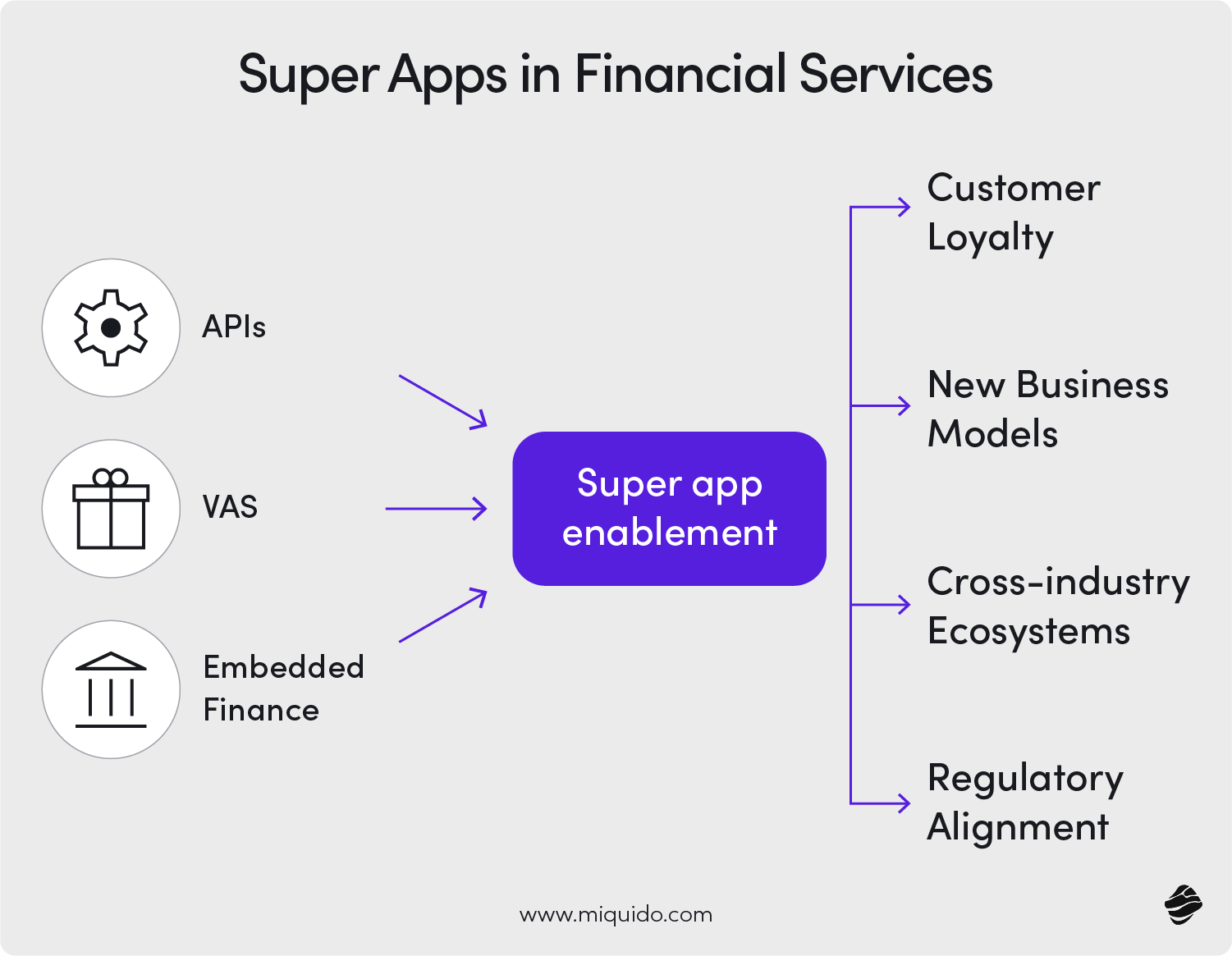

The idea of super apps—platforms combining financial services, shopping, and logistics—is gaining ground. InPost and Żabka are expanding into digital ecosystems that could rival traditional banks.

FinTech companies must ask: do we build our own super apps or integrate with others? Both paths carry FinTech risk. Becoming a backend provider can reduce customer control while competing directly requires significant investment and innovation.

Super apps as an inspiration for banks

By enhancing APIs, focusing on VAS strategies, and enabling embedded finance, we help clients explore this shift. Super apps represent the convergence of multiple industries and will shape the future of financial services. This trend challenges banks to innovate faster and focus on customer-centric solutions, all while adhering to financial regulations. Successful FinTech businesses will use super apps to strengthen user loyalty and capture new business models.

Major issues:

- Emerging super apps from non-bank players pose a threat to traditional banks and FinTech companies.

- The complexity of building or integrating with super apps strains legacy systems and resources.

- Control over customer data and experience is reduced when banks serve only as backend providers.

- Unclear regulatory guidelines around cross-sector super apps create compliance uncertainty.

Solutions:

- Strengthen API infrastructure: Invest in flexible, secure APIs to enable easy integration with super apps.

- Define clear partnership models: Choose strategic roles—platform, provider, or ecosystem orchestrator—with defined ownership over customer relationships.

- Enhance VAS (Value-Added Services): Offer cross-sector services that align with consumer lifestyles, from logistics to insurance.

- Prioritize data governance: Maintain strong control over customer data and ensure compliance with privacy laws.

- Regulatory engagement: Proactively work with regulators to shape guidelines for digital ecosystems and embedded finance.

FinTech companies like us build tools, but the banks ultimately have regulatory responsibility. Navigating this shared space requires cooperation and transparency.

With laws such as DORA and AML directives evolving, it’s crucial to involve compliance experts from the beginning of any FinTech project. Joint audits, risk-sharing agreements, and clear communication channels help ensure financial services comply with local and global standards.

Why strategic vendor relationships are key to compliance and innovation

A transparent vendor relationship builds trust and helps mitigate regulatory and reputational risk across the Fintech sector. This collaboration also ensures consumers receive secure, reliable services that meet the highest compliance standards. Strong vendor partnerships can drive FinTech innovation while maintaining alignment with critical financial technology rules. FinTech businesses must lead these alliances with a business-minded approach to compliance.

Major issues:

- Emerging super apps from non-bank players threaten traditional banks and FinTech companies.

- The complexity of building or integrating with super apps strains legacy systems and resources.

- Control over customer data and experience is reduced when banks serve only as backend providers.

- Unclear regulatory guidelines around cross-sector super apps create compliance uncertainty.

Solutions:

- Strengthen API infrastructure: Invest in flexible, secure APIs to enable easy integration with super apps.

- Define clear partnership models: Choose strategic roles—as a platform, provider, or ecosystem orchestrator—with defined ownership over customer relationships.

- Enhance VAS (Value-Added Services): Offer cross-sector services that align with consumer lifestyles, from logistics to insurance.

- Prioritize data governance: Maintain strong control over customer data and ensure compliance with privacy laws.

- Regulatory engagement: Proactively work with regulators to shape guidelines for digital ecosystems and embedded finance.

Super apps will play a significant role in the future of financial services. FinTech companies that act decisively—building, partnering, or enabling—can turn disruption into long-term opportunities.

Major Issues:

- Banks bear regulatory responsibility, even when FinTech vendors handle key services.

- Vendors may lack full visibility into complex and changing regulatory frameworks.

- Misalignment of compliance expectations can cause delays and increase legal risk.

- The pressure to innovate quickly may outpace the ability to ensure regulatory integrity.

Solutions:

- Joint governance structures: Establish clear roles, responsibilities, and oversight processes for compliance.

- Vendor compliance assessments: Conduct regular audits and due diligence on all third-party providers.

- Shared compliance training: Align FinTech vendors and banks on regulatory updates and best practices.

- Collaborative risk management: Create integrated risk models that reflect shared accountability.

- Transparent communication: Maintain open channels for regulatory updates, breach reporting, and joint resolutions.

9. Strategic investment in innovation

After strong financial times in 2024, banks in Poland and Europe have more capital to reinvest. The biggest challenge is choosing where to invest for success.

FinTech innovations like digital wallets, blockchain-based payment solutions, and AI-driven customer service are high on the agenda. Venture capital continues to fuel FinTech startups, intensifying competition across the industry.

The new playbook: digital transformation, partnerships, and what comes after

To stay ahead, traditional banks must double down on digital transformation, partner with FinTech companies, and explore opportunities in other industries through cross-sector collaboration. Investments should focus on customer experience, risk management, and scalable digital infrastructure to future-proof operations. These strategic moves are shaping the future of financial technology. Business leaders in FinTech are turning to data, automation, and personalization as key differentiators.

Major issues:

- Banks struggle to identify the right technologies to invest in amidst rapid FinTech advancements.

- Competitive pressure from FinTech startups and neobanks accelerates the need for transformation.

- Legacy mindsets and rigid governance models delay innovation cycles.

- Cross-sector partnerships are underutilized due to internal resistance or unclear strategies.

Solutions:

- Define a clear innovation roadmap: Align innovation with long-term business goals and regulatory priorities.

- Balance experimentation with compliance: Foster test-and-learn environments while embedding compliance at every stage.

- Strategic FinTech partnerships: Collaborate with startups to accelerate innovation and fill capability gaps.

- Investment in scalable infrastructure: Prioritize cloud, API platforms, and data architecture to future-proof operations.

- Cross-industry collaboration: Explore partnerships beyond finance to co-create customer-centric FinTech solutions.

10. Compliance as innovation

Regulatory compliance is often seen as a barrier to innovation. We see it differently. Smart compliance can drive innovation by creating frameworks that are both adaptive and proactive.

From anti-money laundering to KYC and GDPR to the AI Act, staying compliant means staying agile. Financial institutions that embed compliance into product development are more likely to deliver secure, scalable FinTech products.

Built-in trust: why future-ready FinTech starts with compliance

We work with partners to implement compliance by design, ensuring they meet today’s regulatory requirements and are ready for new rules on the horizon. By integrating compliance into core operations, banks can build consumer trust and stand out in a highly competitive market. The fusion of FinTech and financial regulations enables more resilient and trustworthy services. For FinTech businesses, compliance innovation is a legal necessity and a business strategy.

Major issues:

- Compliance is often treated as a reactive process rather than a strategic capability.

- Fragmented compliance frameworks make it harder to align with global regulations.

- Fast-changing regulatory environments outpace financial institutions’ ability to adapt.

- Innovation is sometimes delayed or diluted due to over-cautious interpretations of new rules.

Solutions:

- Compliance-by-design: Embed regulatory considerations into every stage of product development.

- Real-time regulatory tracking tools: Use AI and automation to stay informed on changing compliance requirements.

- Cross-functional compliance teams: Ensure collaboration between legal, tech, and business units.

- Agile compliance frameworks: Develop flexible systems that evolve alongside new regulations.

- Proactive collaboration with regulators: Engage early with authorities to shape interpretations and implementations of complex rules.

Final thoughts: staying ahead in a fast-moving industry

The FinTech industry in 2025 is fast-moving and full of potential. But it’s also fraught with risk. By understanding the regulatory landscape, investing in emerging technologies, and building customer-first solutions, financial institutions can meet today’s FinTech challenges and prepare for tomorrow’s opportunities.

We remain committed to helping our partners in the financial industry build resilient, future-proof solutions that delight customers and stay compliant. Together, we can navigate the evolving FinTech landscape with confidence.

![[header] fintech challenges in 2025](https://www.miquido.com/wp-content/uploads/2025/07/header-fintech-challenges-in-2025.jpg)