Whether you're scaling a FinTech company, managing IT operations, or launching a startup, picking the right cloud service shouldn't be a shot in the dark. This post provides clear, practical insights to help you confidently choose, minus the tech jargon and confusion.

How cloud computing gives FinTech companies an edge

FinTech companies operate in a dynamic and fast-paced environment where agility, scalability, and data security are paramount. Embracing cloud computing offers numerous advantages for fintech companies:

Scalability

Cloud services provide the flexibility to scale resources up or down based on demand, allowing FinTech companies to efficiently manage fluctuations in workload and user activity without costly infrastructure investments.

For example, during peak times like tax season or holiday shopping surges, fintech platforms can scale effortlessly to handle the traffic without slowdowns or disruptions.

Cost efficiency

Cloud computing can significantly reduce operational costs for fintech companies by eliminating the need for on-premises hardware and infrastructure maintenance. With pay-as-you-go pricing models, businesses only pay for the resources they use, optimizing cost efficiency.

Innovation and agility

Cloud computing enables rapid innovation and experimentation, empowering FinTech companies to quickly develop and deploy new products and services to market. With cloud-native technologies, businesses can leverage cutting-edge tools and technologies to stay ahead of the competition.

For example, using cloud-based machine learning and AI algorithms, FinTech companies can analyze vast amounts of data in real-time to personalize user experiences and detect fraudulent activities.

Enhanced data security

Leading FinTech cloud service providers offer robust security features designed to protect sensitive financial data. These include encryption at rest and in transit, identity and access management (IAM), multi-factor authentication (MFA), and fine-grained access controls. Such measures are essential for safeguarding critical assets against cyber threats and unauthorized access. By leveraging these security features, fintech companies can mitigate risks and build customer trust.

Extensive compliance certifications

Cloud providers invest heavily in compliance to meet strict, industry-specific regulations. They offer certifications and frameworks like PCI-DSS (for secure payment processing), GDPR (for data privacy), SOC 2, ISO/IEC 27001, and more, helping FinTech companies stay aligned with global standards.

But compliance isn't just plug-and-play—it's a shared responsibility. Cloud platforms now offer built-in tools to automate monitoring, reporting, and policy enforcement, making it easier to stay audit-ready. With evolving regulations around AI, data residency, and digital finance, working with a provider that stays ahead of these changes gives fintechs a critical edge.

Factors to consider when selecting a cloud service provider

In a fast-moving industry like FinTech, choosing a cloud services provider is a critical decision that can shape your ability to scale, stay compliant, and respond to market demands quickly and confidently. Let’s explore the key factors you should consider to make an informed choice on service providers:

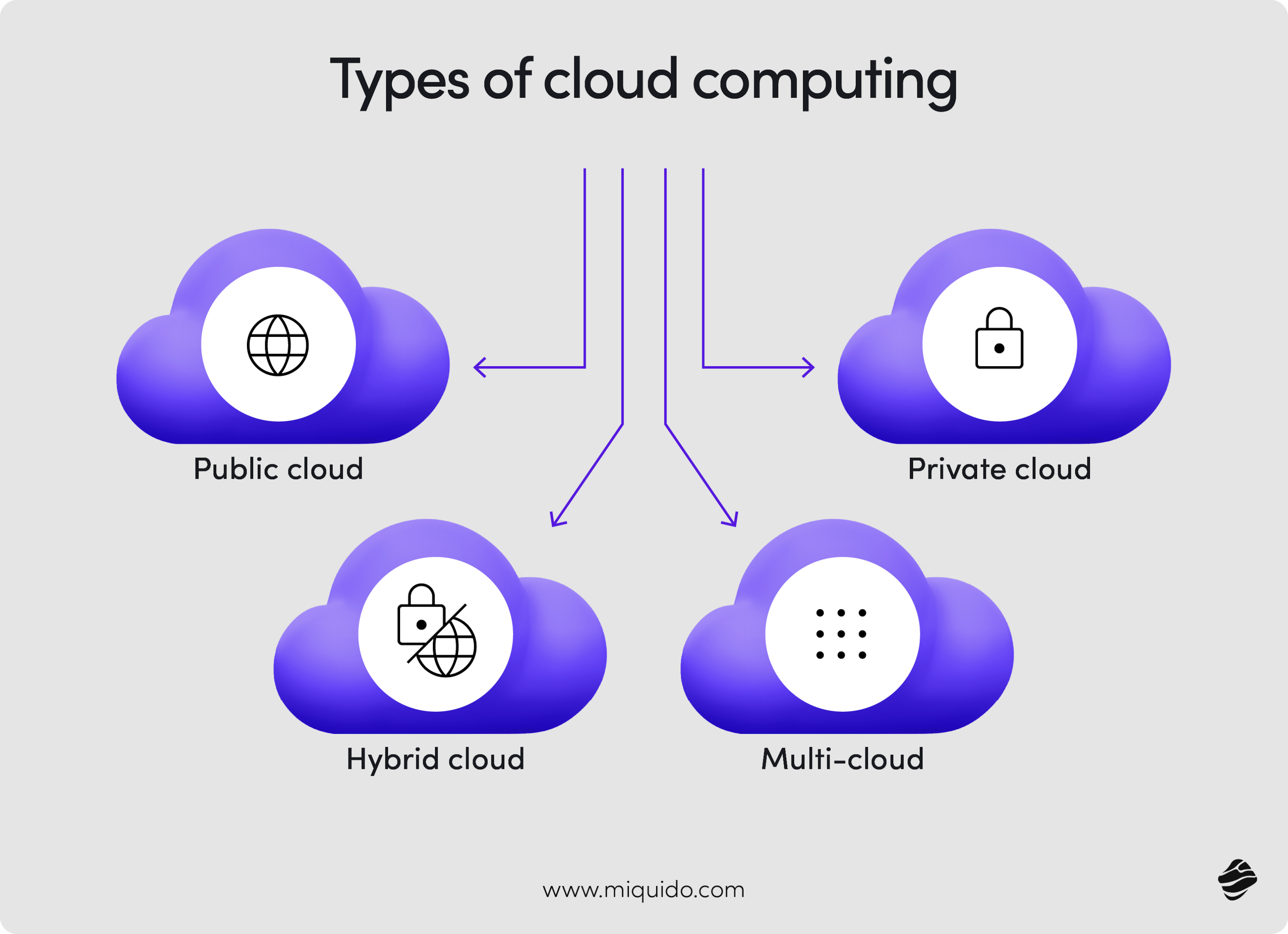

Types of cloud computing services

Before diving into specific cloud service providers, it’s essential to understand the different types of cloud computing.

Public cloud services

Offers resources and services to the general public over the internet, providing scalability and cost-effectiveness.

It is ideal for startups and small fintech companies looking for agility and flexibility. For example, a startup launching a new financial app can quickly scale its infrastructure to accommodate growing user demand without investing in physical servers. In that case, choosing a public cloud provider has a significant advantage.

Private cloud services

Dedicated resources and infrastructure solely for one organization, providing enhanced security and control.

Suitable for larger FinTech enterprises with strict compliance certification requirements and sensitive data. For instance, a large financial institution handling sensitive information may opt for a private cloud to maintain compliance and data sovereignty.

Hybrid cloud solutions

Combines elements of both public and private clouds, allowing FinTech companies to leverage the benefits of both worlds.

Offers flexibility, scalability, and customization, making it an attractive option for businesses with varying workloads and regulatory constraints.

For example, a FinTech company may use a hybrid cloud to run its core banking applications on a private cloud while leveraging the scalability of a public cloud for customer-facing services.

Multicloud

Involves using multiple cloud service providers to avoid vendor lock-in, improve redundancy, and optimize performance across different platforms.

This approach is well-suited for FinTech companies that want to diversify risk, meet regional compliance requirements, or match specific workloads to the best-performing provider. For example, a firm operating in multiple countries might use one cloud provider for data storage in Europe to meet GDPR standards, while using another for high-performance computing tasks in North America.

Customization and scalability

For FinTech, choosing a cloud services provider, scalability, and customization are key. It’s essential to select a cloud service provider that can grow with the business and offer tailored solutions to enhance operational efficiency and meet specific regulatory needs.

Additionally, availability and reliability are essential considerations to prevent downtime and ensure uninterrupted operations.

- Scalability: What if you need to scale from handling thousands to millions of transactions daily? Choose a cloud service provider that offers seamless scalability to adjust resources based on demand automatically.

- Customization: Do you need specific tools for blockchain or another niche? Find a cloud service provider offering tailored solutions to your unique technological needs.

- Availability: If your FinTech service must be accessible 24/7, you’ll want to opt for a cloud service provider with multi-regional deployment capabilities to ensure uninterrupted operations, even during a data center outage.

- Reliability: Are you facing variable loads, especially during peak seasons? Ensure your cloud service provider guarantees high uptime and is able to handle sudden spikes in demand, keeping your services running smoothly.

Compliance and security concerns

When entrusting sensitive financial data to cloud service providers, compliance and security become paramount concerns for FinTech businesses. It is crucial to evaluate how different providers meet regulatory requirements and offer robust security measures to protect against data breaches and cyber threats.

Regulatory compliance

Look for cloud providers with important certifications like SOC 2, PCI-DSS, and GDPR. These show they’re serious about protecting data and follow strict privacy rules.

Ensure the cloud service provider meets local financial regulations, which vary by country.

Security measures

Regarding FinTech, security isn’t optional—it’s foundational. Cloud service providers must offer strong, multi-layered protection to keep sensitive financial data secure. Here are the core security measures to look for when evaluating your options.

- Data encryption: Essential for keeping data safe, both when kept in storage spaces and sent over the internet connection.

- Network security: Providers should have strong defenses like firewalls and intrusion detection to stop cyber threats and protect database services.

- Access controls: Only authorized people should have direct access to sensitive information, managed through identity and access management systems.

- Physical security: The physical hardware locations where data is stored must be well-protected against unauthorized access or hazards.

Continuous security checks

Regular security audits are essential for identifying and addressing potential vulnerabilities in your cloud environment. In addition, conducting periodic penetration testing helps strengthen your defenses by simulating real-world cyber attacks, ensuring your systems are prepared for actual threats.

Pro Tip: Regularly reviewing your security with audits and tests helps catch issues early. Choosing a cloud service provider that’s strong on compliance and security is key to keeping your data centers safe.

At Miquido, we help FinTech companies build cost-effective cloud solutions designed to maximize value for organizations of all sizes. We also help build the applications themselves, like Flutter FinTech apps, which save you the extra cost of paying for an app for each platform. This technology uses one codebase to allow your UI to operate on multiple platforms.

Cost considerations – staying within your budget

While cost should not be the sole determining factor, evaluating the financial implications of choosing a specific cloud service provider is essential.

Pricing models

- Pay-as-you-go: This model allows you to pay only for the resources you consume, making it flexible and scalable. It’s ideal for businesses with fluctuating demands, as it avoids the need for substantial upfront investments in capacity that might not be used consistently.

- Reserved instances or savings plans: For predictable workloads, committing to a certain level of resource usage over a fixed term (e.g., one or three years) can lead to substantial discounts compared to on-demand pricing. This requires a good understanding of your long-term needs, but it can offer significant savings.

Upfront costs

- Initial Setup: Some cloud providers charge initial setup fees for configuring your cloud environment. However, many providers offer a free tier or credits for startups to reduce this barrier.

- Migration Costs: If you’re moving from on-premises infrastructure or another cloud provider, consider the costs associated with data migration, including any necessary tools or services to facilitate the move.

Ongoing expenses

- Operational Costs: Beyond compute, storage, and network resources, consider the costs of additional services such as databases, analytics, machine learning, and blockchain services. These can significantly impact your monthly bill.

- Management and support: Depending on your team’s expertise, you might need to opt for a support plan or managed services, which add to the monthly costs but provide valuable assistance and peace of mind.

Potential savings

- Automation: Look for cloud services that offer automation tools for resource scaling, backup, and security. Automating these tasks can reduce the need for manual intervention, saving labor costs and reducing the risk of human error.

- Cost management tools: Utilize built-in cost management and optimization tools provided by cloud services to monitor, manage, and optimize your resource usage in real time. This can help you identify and eliminate waste, such as underutilized instances or orphaned resources.

- Custom discounts: Negotiate with cloud providers for custom discounts based on your anticipated usage volume, especially if you’re a large enterprise or have the potential for rapid growth.

Choose a cloud service provider that offers transparent pricing and flexible payment options, such as pay-as-you-go or subscription-based models, to optimize costs and align with your budgetary constraints. Keep your capital expenditure in mind and start researching other providers if your first choice does not afford you the cost savings you’re looking for.

Miquido Tip: Take advantage of cost management tools and services offered by cloud providers to monitor and optimize your cloud spending, ensuring maximum value for your investment.

Reputation: assessing company track record and customer reviews

For fintech choosing a cloud services provider, evaluating the provider’s reputation and track record is essential. Look for companies known for reliability, stability, and strong customer satisfaction—key indicators of a trusted partner for long-term success. Here are some questions you should be thinking about when choosing a cloud service provider:

- Company track record and performance

- How does your uptime compare to other providers in the last year?

- Can you provide case studies or examples of fintech companies you’ve successfully supported?

- What measures do you take to ensure low latency and high performance for financial applications?

- How do you handle scalability and reliability during peak transaction periods?

- Customer reviews and testimonials

- Can you provide references from current or past customers, especially within the fintech sector?

- How would you describe your customer service and technical support based on feedback from your clients?

- Are there any third-party review sites or industry reports where we can find unbiased reviews of your services?

- Security and compliance

- How do you ensure the security and privacy of our data, and what certifications do you hold (e.g., PCI DSS, SOC 2)?

- Can you detail your experience with regulatory compliance specific to the financial industry?

- Innovation and future-proofing

- How do you stay ahead in terms of technology and innovation, especially regarding fintech needs?

- What is your roadmap for new features or services that could benefit fintech companies?

- Support and partnership

- What kind of support can we expect, and are there different levels or tiers of service?

- How do you approach partnerships with fintech companies to ensure mutual growth and success?

- Cost and investment

- How transparent are your pricing models, and can you provide examples of how costs might scale with our growth?

- Are there any cost-saving measures or optimizations that you recommend to your fintech clients?

Asking these questions will give you a comprehensive view of a cloud service provider’s reputation, reliability, customer satisfaction, and suitability for your fintech company’s needs.

Tip: Ask for recommendations from industry peers and participate in online forums and communities to gather insights and feedback on potential cloud providers before making a decision.

Making sense of the data: using analytics and reporting tools

Harnessing the power of data analytics and reporting tools can provide valuable insights for fintech companies. Evaluate the analytics capabilities offered by cloud service providers, such as data visualization, predictive analytics, and real-time reporting, to gain actionable insights and drive informed decision-making.

Look for providers that offer robust analytics tools and support for data-driven strategies to unlock the full potential of your data assets.

Tip: Leverage machine learning and AI-driven analytics tools to uncover hidden patterns and trends in your data, enabling businesses to access predictive and prescriptive analytics for strategic decision-making.

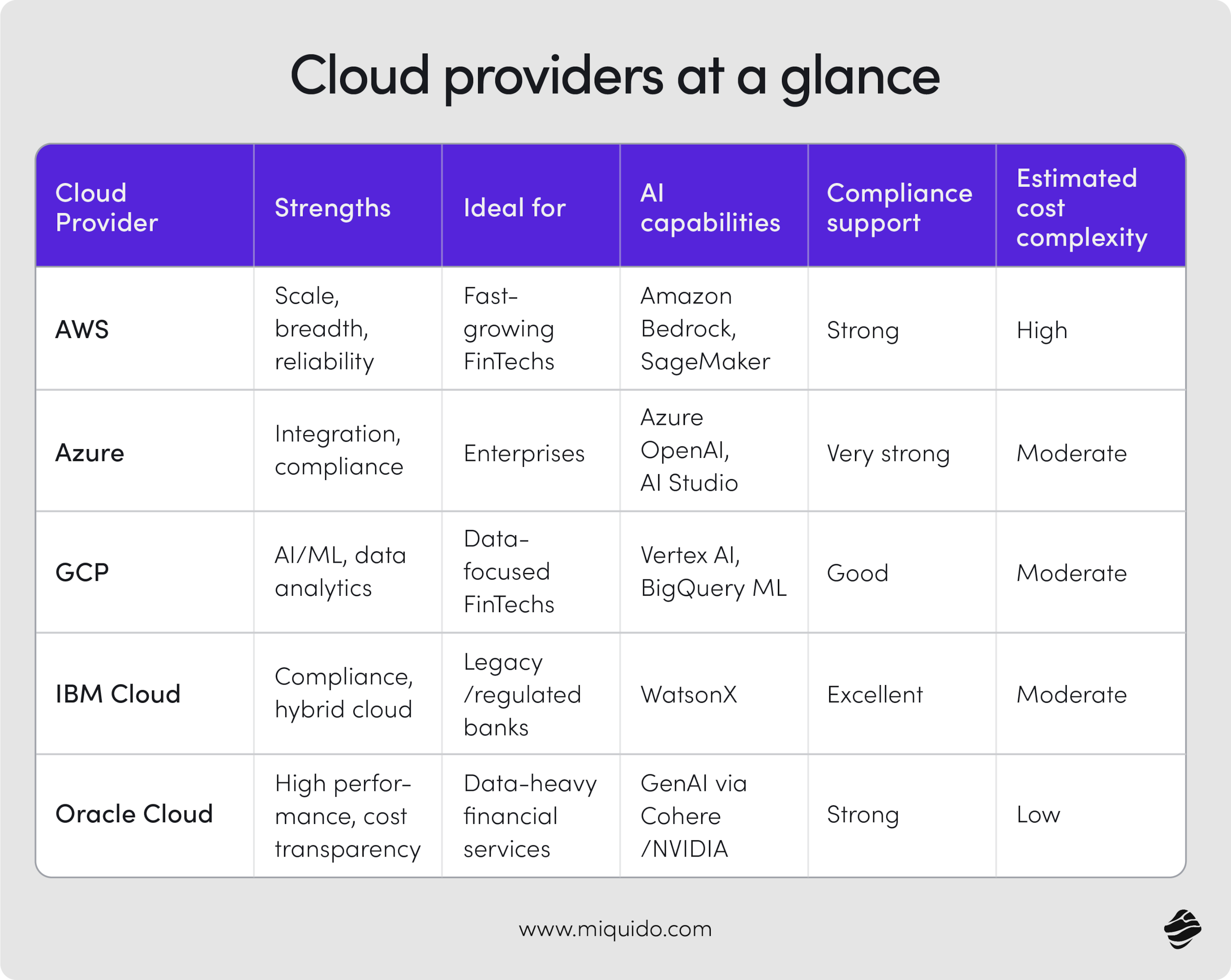

Top cloud service providers for FinTech companies in 2025

For FinTech companies, the cloud is the backbone of innovation, speed, and trust. The right cloud partner can help you scale securely, deliver real-time services, and stay ahead in a heavily regulated market. Below are the top cloud platforms trusted by leading fintech players in 2025:

1. Amazon Web Services (AWS)

Why FinTechs choose AWS:

AWS remains the top choice for FinTech due to its unmatched scale, security, and breadth of services. From real-time payment processing to AI-driven fraud detection, AWS provides the building blocks to move fast and stay secure.

- Cost: Pay-as-you-go with savings plans for longer commitments. New AI-based cost optimization tools help teams monitor and control spend more effectively.

- Strengths: Massive global infrastructure, best-in-class security, scalability, and cutting-edge services like Amazon Bedrock (for GenAI) and Graviton4 processors for high-performance computing.

- Challenges: Pricing complexity and potential for unexpected costs if not carefully managed.

FinTech leaders using AWS:

- Robinhood uses AWS for its high-volume trading infrastructure with built-in resiliency.

- Stripe continues to rely on AWS for secure, low-latency global payment processing.

- Coinbase benefits from AWS’s security tools and compliance readiness as it scales globally.

2. Microsoft Azure

Why FinTechs choose Azure:

Azure is a favorite for enterprise-grade FinTechs that need tight integration with Microsoft Azure services, robust security, and a growing ecosystem for AI and financial data services.

- Cost: Flexible pricing, with new “AI savings bundles” for compute-intensive workloads.

- Strengths: Deep compliance portfolio, hybrid cloud capabilities with Azure Arc, seamless integration with Microsoft 365 and Dynamics.

- Challenges: Some services have a steeper learning curve and occasional latency issues in certain regions.

FinTech leaders using Microsoft Azure:

- PayPal uses Azure to scale its global payment platform, leveraging Microsoft’s cloud security framework.

- Nasdaq taps into Azure’s AI and analytics for real-time market insights.

- Mastercard relies on Azure for its transaction processing and fraud detection systems.

3. Google Cloud Platform (GCP)

Why FinTechs Choose GCP:

GCP stands out in 2025 for its AI leadership, real-time data processing, and developer-friendly ecosystem. FinTechs focused on data, personalization, and machine learning continue gravitating toward Google Cloud Platform.

- Cost: Competitive pay-as-you-go pricing with sustained-use discounts and AI workload-specific billing models.

- Strengths: World-class data analytics (BigQuery), AI (Vertex AI), and secure-by-design infrastructure.

- Challenges: Smaller enterprise footprint compared to AWS and Azure, with fewer availability zones in some regions.

FinTech leaders using GCP:

- Brex builds intelligent financial tools on GCP, leveraging advanced analytics and ML models.

- Stripe uses GCP for AI-driven fraud detection and global infrastructure redundancy.

- Coinbase integrates GCP services to support crypto analytics and high-speed data handling.

4. IBM Cloud

Why FinTechs choose IBM Cloud:

With a strong focus on compliance and hybrid solutions, IBM Cloud is a solid fit for financial institutions needing secure, regulated environments, especially for AI and mainframe integration.

- Cost: Pay-as-you-go and reserved pricing, with predictable billing for regulated workloads.

- Strengths: Industry-specific cloud (IBM Cloud for Financial Services), secure enclave technology, and built-in regulatory compliance.

- Challenges: Fewer services and marketplace integrations than competitors.

FinTech leaders using IBM Cloud:

- Bank of America partners with IBM for secure cloud-based banking workloads.

- JPMorgan Chase uses IBM for hybrid deployments involving AI and legacy systems.

- Citi relies on IBM Cloud’s compliance controls and robust security features for global operations.

5. Oracle Cloud Infrastructure (OCI)

Why FinTechs choose OCI:

Oracle’s focus on performance and cost transparency has made OCI a growing player in FinTech, especially for those needing high-speed databases and strong regulatory alignment.

- Cost: Transparent, predictable pricing with aggressive discounts for enterprise workloads.

- Strengths: High-performance computing, Autonomous Database, GenAI services (via Cohere and NVIDIA partnerships), and strong SLAs.

- Challenges: Smaller ecosystem and fewer third-party integrations than AWS or GCP.

FinTech leaders using OCI:

- Barclays uses OCI for high-throughput financial workloads with strong performance guarantees.

- Credit Suisse leverages OCI’s autonomous services to reduce overhead and improve data governance.

- HSBC utilizes OCI across multiple regions to meet strict compliance and latency requirements.

Future trends in cloud computing for FinTech

As cloud technology rapidly advances, fintech companies must stay ahead of the curve to remain competitive and secure. The key to future readiness lies in understanding and adopting transformative technologies that are already reshaping the financial services industry.

Serverless computing

Serverless computing continues to gain traction in fintech because it streamlines backend operations and reduces infrastructure complexity. It allows developers to focus solely on writing code while the cloud provider handles resource provisioning and scaling automatically.

- Cost efficiency: Eliminates the need for always-on servers by charging only for actual compute usage, optimizing operational expenditure.

- Scalability: Seamlessly handles fluctuating demand, making it ideal for transaction-heavy or seasonal fintech services.

- Faster Time-to-Market: Simplifies the development lifecycle, enabling rapid deployment of new features and services.

Edge computing

In 2025, edge computing has become critical for delivering low-latency services, especially in mobile and IoT-enabled fintech environments. It complements infrastructure by pushing processing closer to the user.

- Reduced latency: Accelerates response times for real-time payments, biometric verification, and fraud alerts by processing data locally.

- Enhanced security: Minimizes the risk of data breaches by limiting long-distance data transmission and enabling local threat detection.

- Improved reliability: Maintains operational continuity even with intermittent cloud connections—vital for ATMs, mobile banking, and branchless operations.

Quantum computing

Quantum computing, though still in its early stages, holds immense potential for fintech use cases requiring intensive data analysis and modelling. Industry leaders are already testing quantum algorithms for next-gen risk analysis.

- Advanced data analysis: Processes complex financial data exponentially faster than classical systems, enabling fraud detection and credit scoring breakthroughs.

- Cryptography and security: Promotes the development of quantum-resistant encryption standards, crucial as traditional algorithms face future vulnerabilities.

- Accelerated computing power: Speeds up simulations for portfolio optimization, asset pricing, and derivatives modeling.

Artificial Intelligence

AI continues to be the most impactful cloud-enabled technology in fintech. In 2025, generative AI, embeddings, and advanced fraud models are powering both customer-facing and backend operations.

- Enhanced customer experience: AI-driven chatbots, digital advisors, and voice assistants deliver real-time, context-aware interactions. Fintech companies can leverage cloud-based AI solutions, including AI agents and customer service, to automate routine inquiries while maintaining high client satisfaction.

- Fraud detection and prevention: Machine learning models detect synthetic fraud and deepfakes using behavioral and biometric cues with increasing accuracy.

- Operational efficiency: AI automates document verification, compliance workflows, and underwriting processes, freeing up human resources for higher-value tasks.

The rise of Flutter FinTech apps

Flutter continues to dominate the FinTech app development space in 2025 thanks to its scalability, performance, and rich developer experience. It offers an ideal framework for launching secure, responsive, and unified applications across platforms.

- Cross-platform efficiency: Allows FinTech developers to build native-quality apps for iOS, Android, web, and desktop from a single codebase, drastically reducing maintenance overhead.

- Rapid development and customizable UI: Features like “hot reload” and a broad widget ecosystem accelerate UI iteration, which is essential for adapting to fast-changing market demands.

- Consistent user experience: Delivers high performance and UI consistency across all platforms, strengthening user trust and engagement.

By staying informed and adaptable, fintech companies can harness cloud computing's full potential to drive innovation, compliance, and user satisfaction.

Tip: Invest in continuous learning and development initiatives to upskill your team and stay abreast of emerging technologies and trends in cloud computing, ensuring your business remains competitive and future-ready.

Understanding cloud services costs in 2025

Cloud costs have become a board-level issue in 2025, with FinOps emerging as a critical financial management and operational efficiency discipline.

FinOps and cost governance

FinOps (Financial Operations) has evolved from a nice-to-have into an essential practice for FinTech companies. This discipline combines financial accountability with operational excellence, helping teams understand unit economics, track cost per transaction, and make data-driven infrastructure decisions.

Modern FinOps tools like Azure Cost Management, GCP Billing Explorer, and CloudHealth provide real-time visibility into cloud spending patterns. They help identify cost anomalies, predict budget overruns, and optimize resource allocation across different business units and products.

Modern pricing strategies

Pay as you go pricing works great for unpredictable workloads. You pay for exactly what you use, no more, no less. Perfect for seasonal businesses or companies still figuring out their usage patterns. Just watch for unexpected charges during traffic spikes.

Cloud Savings Plans have evolved beyond simple reserved instances. Modern plans offer flexibility across instance families and regions while providing significant discounts. Some companies save 70% on their cloud bills this way, but you need accurate forecasting to avoid over-commitment penalties.

Hidden costs still lurk everywhere. Data transfer between regions, premium support, compliance tools, and disaster recovery services all cost extra. What looks like competitive pricing can get expensive fast once you add necessary services.

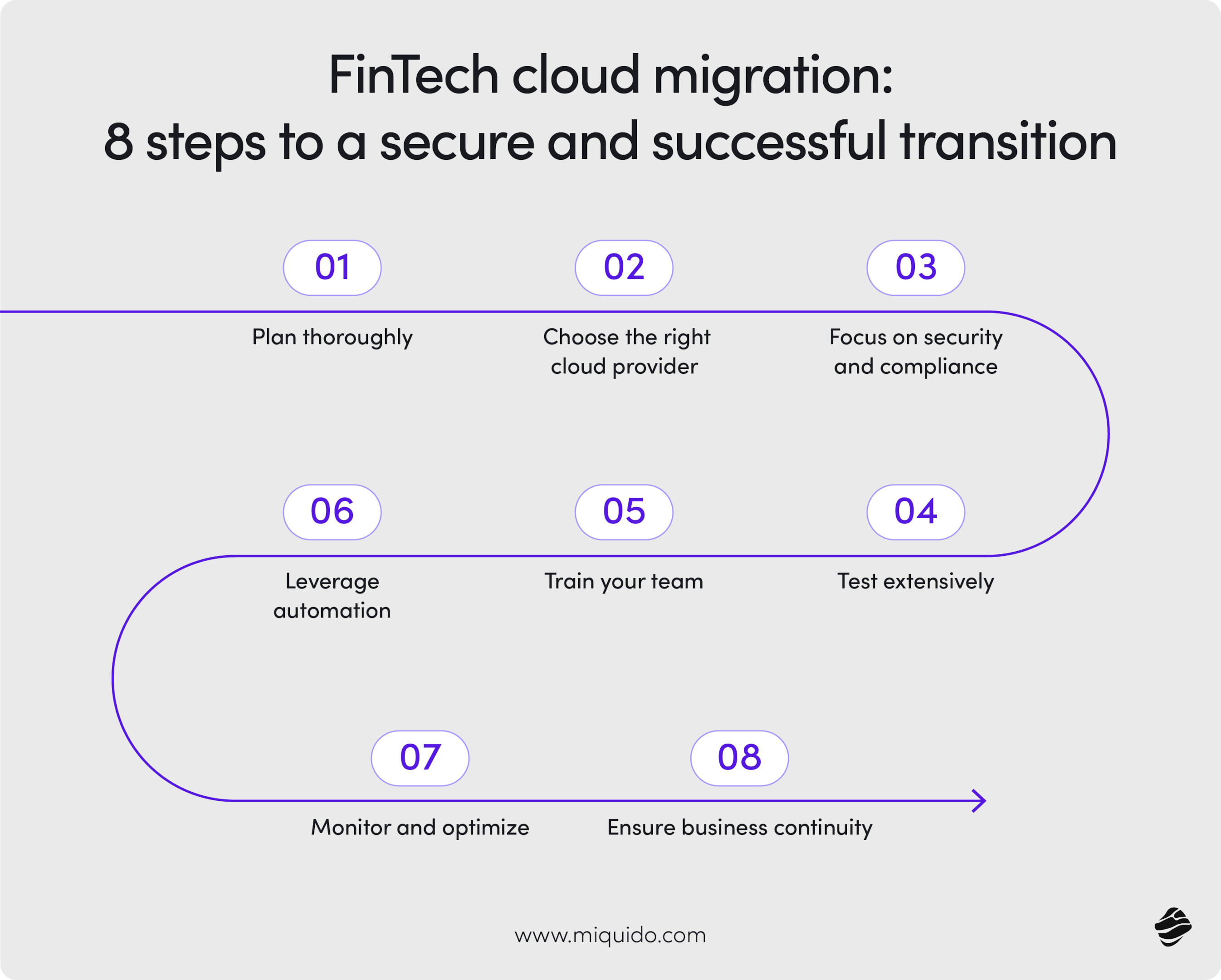

Migrating to a new cloud service? Don’t forget these tips

1. Plan thoroughly

- Assess your needs: Understand the specific requirements of your FinTech operations, including compliance, scalability, security, and performance needs.

- Map out your migration: Develop a detailed migration plan that includes timelines, responsibilities, and the sequence of moving different components.

2. Choose the right cloud provider

- Compatibility: Ensure the cloud service is compatible with your existing systems and technologies. For instance, if your fintech relies heavily on .NET, opt for a provider with first-class support for Windows-based applications.

- Support and services: Look for providers that offer robust support and migration services to assist you through the process. A FinTech moving from on-premises to the cloud selected a provider offering 24/7 support and a comprehensive set of migration tools.

3. Focusing on security and compliance

- Data protection: Implement encryption and other security measures to protect data during and after migration. A mobile payment platform may encrypt all data in transit and at rest as part of its cloud migration strategy.

- Regulatory compliance: Verify that the cloud service meets all relevant financial regulatory and compliance requirements. Before migrating, a global remittance service ensured that their chosen cloud provider was compliant with GDPR in Europe and CCPA in California.

4. Test extensively

- Pilot programs: Run pilot migrations with non-critical systems to identify potential issues and refine your process. For example, a FinTech firm might test the cloud with its internal HR system before moving its customer-facing transaction processing to it.

- Integration testing: Thoroughly test the integration points between your existing systems and the cloud service to ensure smooth operation.

5. Train your team

- Skill development: Provide training and resources to your team on cloud technologies and the specific platforms you’re adopting. For example, you might want to offerAWS certification courses to their IT staff ahead of their cloud migration.

- Change management: Prepare your organization for change by communicating the benefits and impacts of migrating to the cloud. Leadership could hold a series of workshops to explain how cloud migration would lead to faster deployment times and better scalability for their banking app.

6. Leverage automation

- Automate migration tasks: Use tools and services that can automate parts of the migration process to reduce manual errors and save time. A payments processor used cloud migration tools to automatically replicate their database schemas in the cloud.

- Infrastructure as Code (IaC): Utilize IaC for configuring and managing your cloud environment, ensuring consistency and faster deployment. An insurance tech company managed its entire cloud setup through Terraform scripts, enabling quick environment provisioning and updates.

7. Monitor and optimize

- Performance monitoring: Set up monitoring tools to keep track of your system’s performance and quickly address any issues. After migrating, a brokerage firm used cloud-native monitoring services to detect and resolve latency issues in real time.

- Cost management: Regularly review and optimize your cloud usage and costs to ensure you’re getting the most out of your investment. You may want to implement cost alerts and used reserved instances to reduce cloud expenses.

- Reserved Instances (RIs) allow businesses to reserve cloud capacity in advance for a fixed period, typically one to three years, at a significantly discounted rate compared to on-demand pricing. This approach guarantees capacity availability and helps in budgeting, but requires careful management due to the long-term commitment and need for usage optimization.

8. Ensure business continuity

- Backup and disaster recovery: Implement robust backup and disaster recovery plans to minimize downtime and data loss during the migration. Before migrating, a peer-to-peer lending platform established multi-region backups to ensure quick recovery in case of an outage.

One more thing regarding choosing a cloud service provider

For fintech, choosing a cloud services provider and finding a partner that truly understands your industry is key. Miquido stands out as Europe’s leading fintech app development company, known for delivering scalable, cloud-based solutions for top names like Nextbank, Brainly, and Klassik Radio.

From infrastructure setup and cloud migration to continuous support and optimization, Miquido combines the latest tech with deep industry know-how to help you move faster, smarter, and with confidence. Ready to scale your fintech business in the cloud? Let’s talk.

What factors should I consider when choosing a cloud services provider?

Considerations include scalability, security, compliance, cost-effectiveness, technical support, and service level agreements.

What are the key features to look for in a fintech cloud service provider?

Look for features such as data encryption, data backups, storage space, customizable solutions tailored to fintech industry needs, and real-time analytics capabilities.

What are some important factors to keep in mind when selecting a public cloud provider?

Consider the provider’s reputation, reliability, compliance with industry standards, native compatibility with your applications, and competitive services offered.

How can I ensure that a cloud services provider meets my business needs?

Start by researching the provider’s track record, customer reviews, and case studies. Additionally, inquire about their experience in serving businesses similar to yours and their ability to address your specific requirements.

What should I look for in a service level agreement (SLA) with a cloud services provider?

Look for guarantees on uptime, performance, security measures, data protection, disaster recovery, and penalties for breaches of the service level agreement.

What are the advantages of using Google Cloud Platform (GCP) for my cloud services?

GCP offers high-performance infrastructure, strong data encryption, competitive pricing, extensive storage options, and advanced analytics tools, making it a top fintech cloud service provider.

How can a cloud services provider assist with infrastructure management?

Providers can handle tasks such as provisioning, monitoring, scaling, and maintenance of infrastructure, freeing up your resources to focus on core business activities.

What are the benefits of having access to real-time analytics with a cloud services provider?

Real-time analytics enable businesses to gain insights from large volumes of data instantly, allowing for informed decision-making and timely responses to market changes.

![[header] fintech choosing a cloud services provider](https://www.miquido.com/wp-content/uploads/2025/06/header-fintech-choosing-a-cloud-services-provider.jpg)