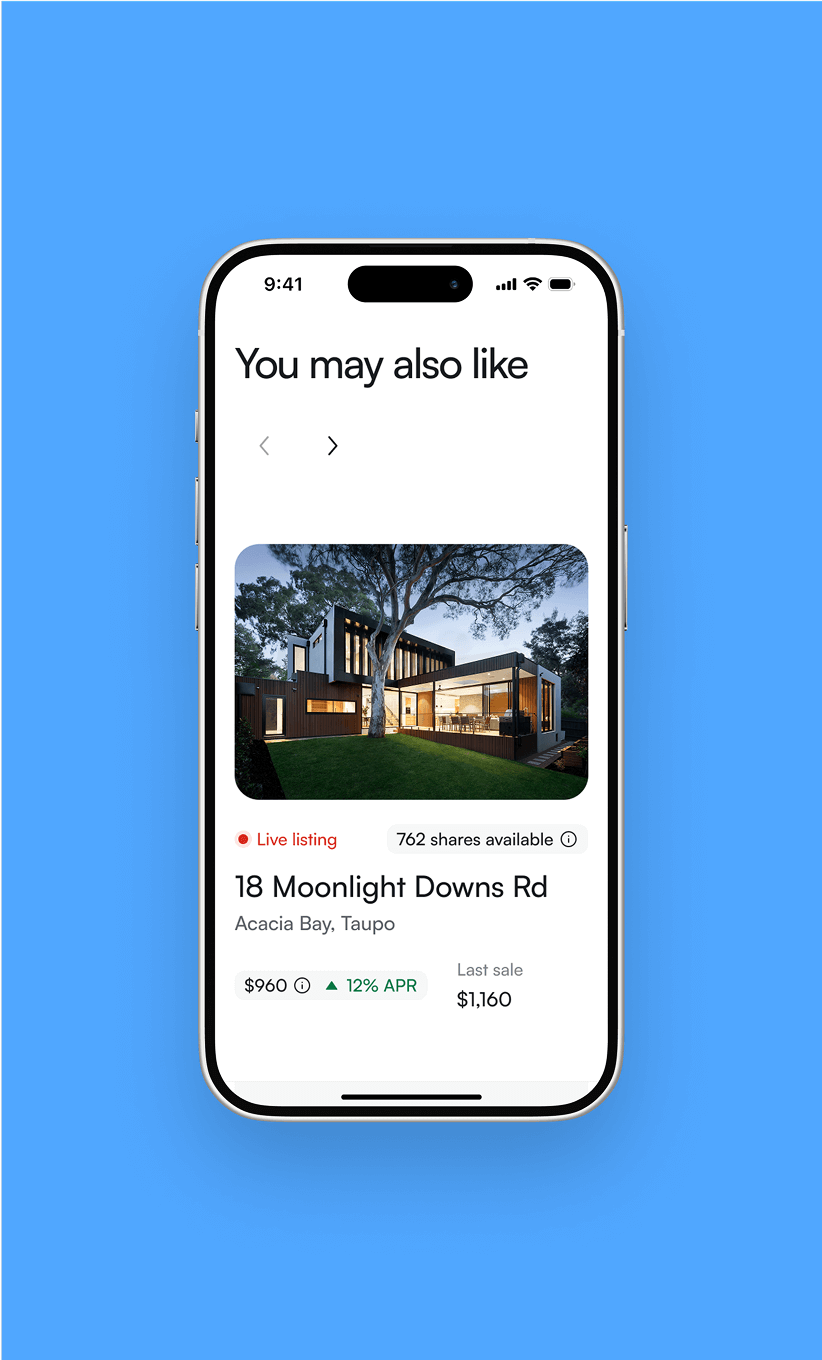

Digital Platform for Simplified Property Investment

Homeshare: Modern real estate investing

Introduction

About project

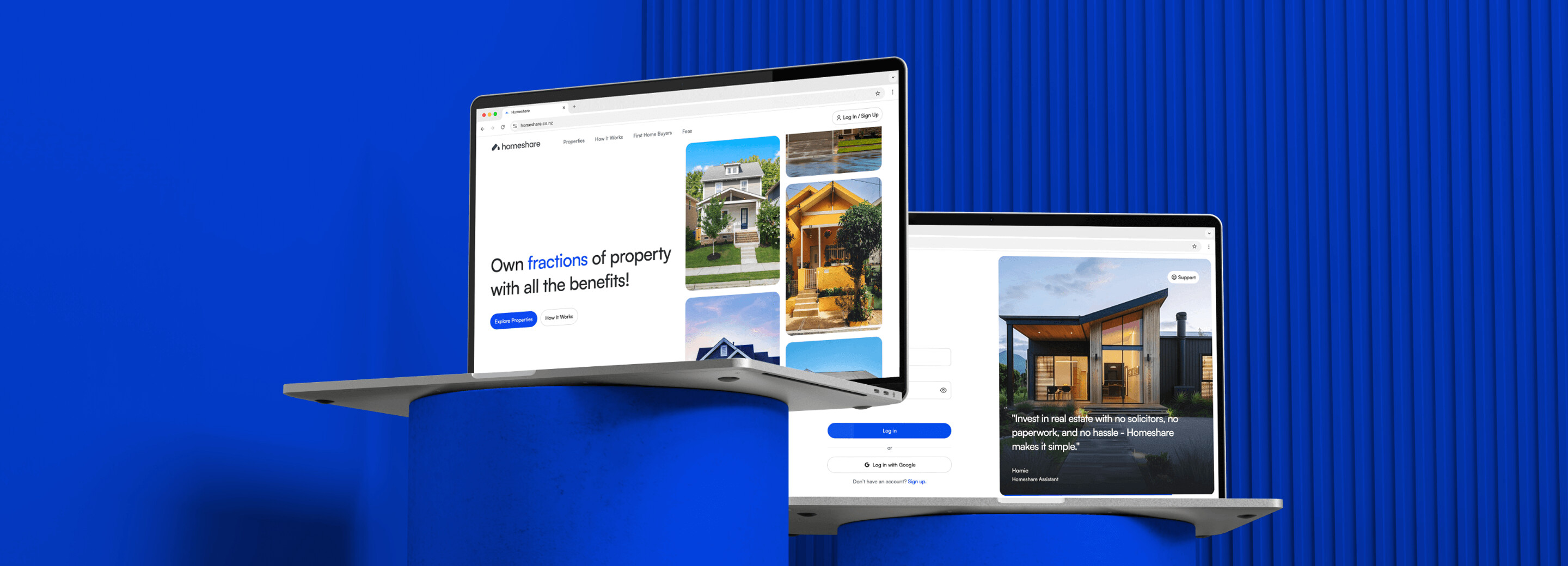

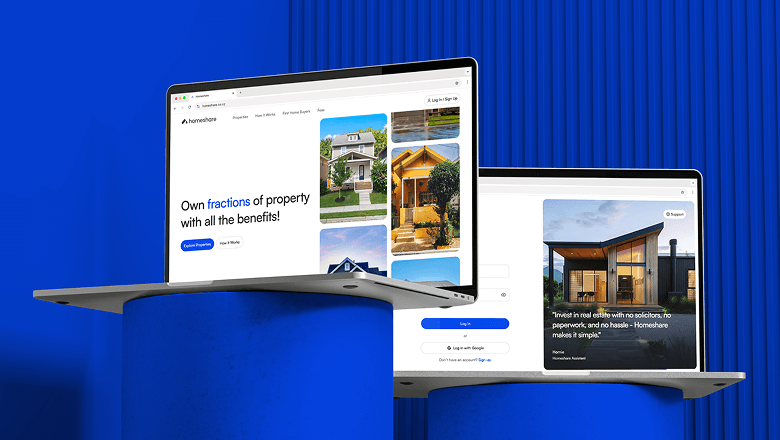

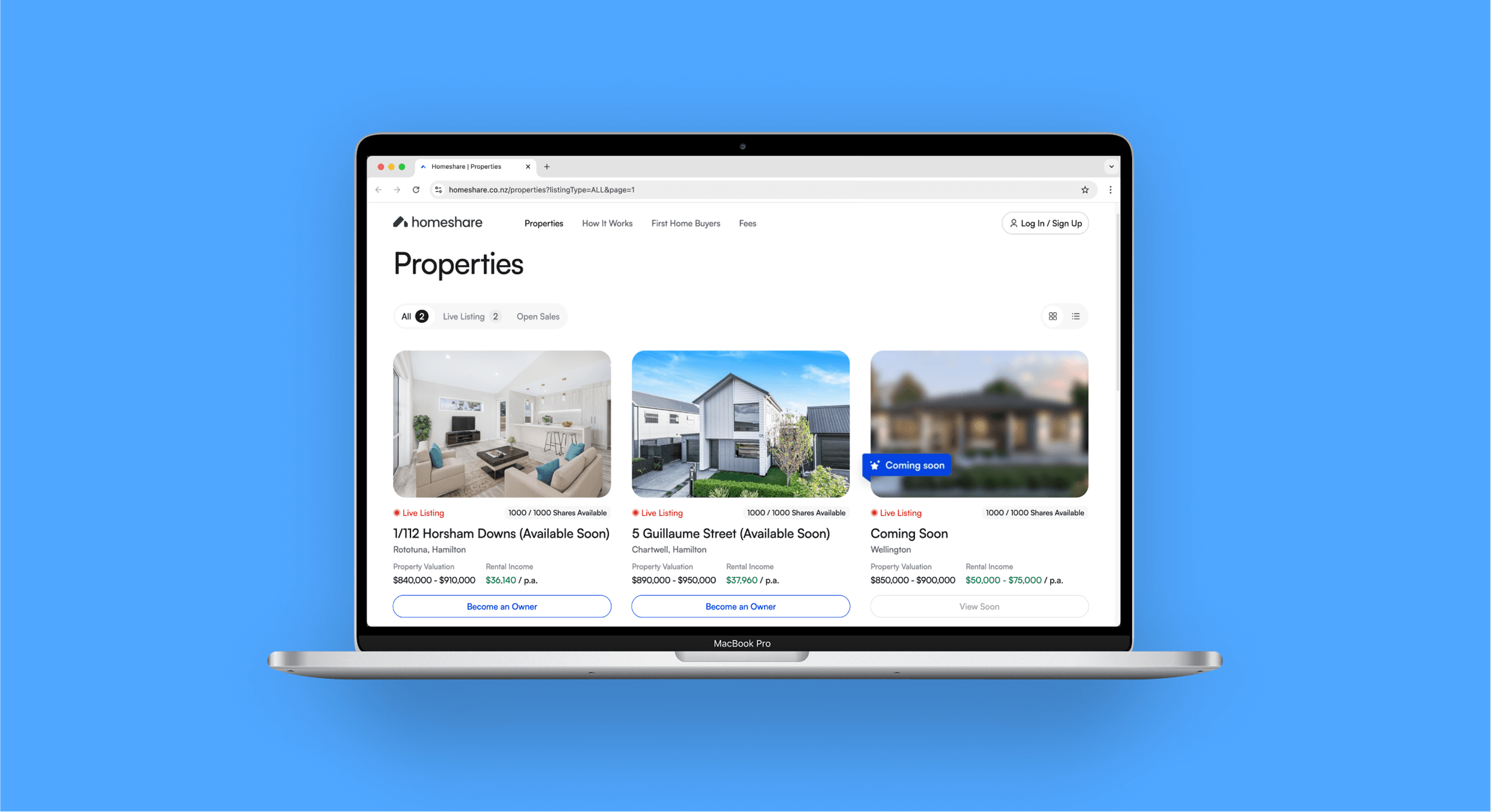

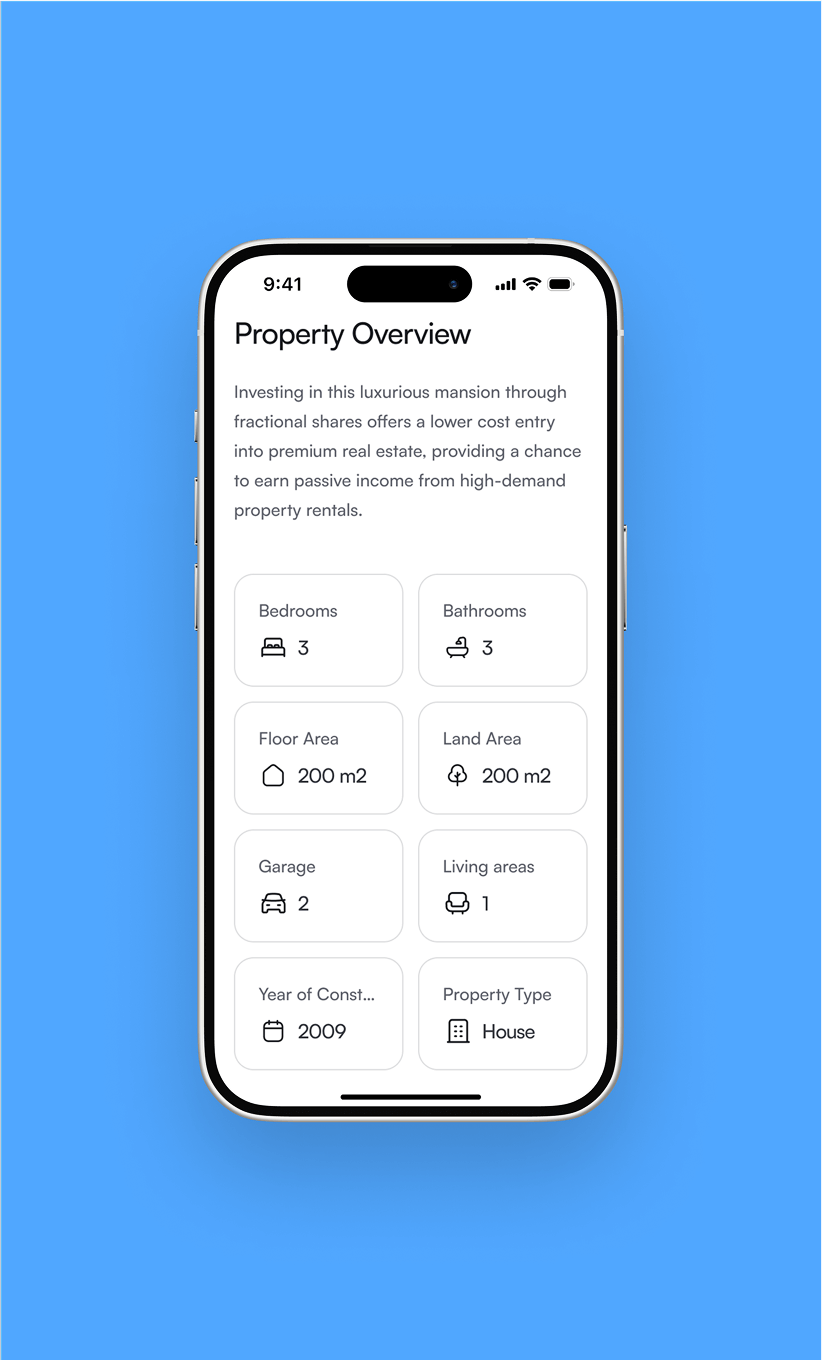

Homeshare democratises real estate investment by introducing a fractional ownership model. Each property is divided into 1,000 shares, enabling investors to own as little as 1/1000th of a property. This innovative approach eliminates barriers such as high capital requirements and management burdens. Investors can buy and sell shares effortlessly on the platform's secondary marketplace, earn proportional rental income, and realise capital gains as property values appreciate.

Homeshare also ensures seamless property management, including tenant selection, rent collection, and maintenance. With built-in asset protection and tax advantages under the Portfolio Investment Entity (PIE) regime, Homeshare offers a secure and flexible way to build a diversified real estate portfolio.

Industry

Real Estate

Project type

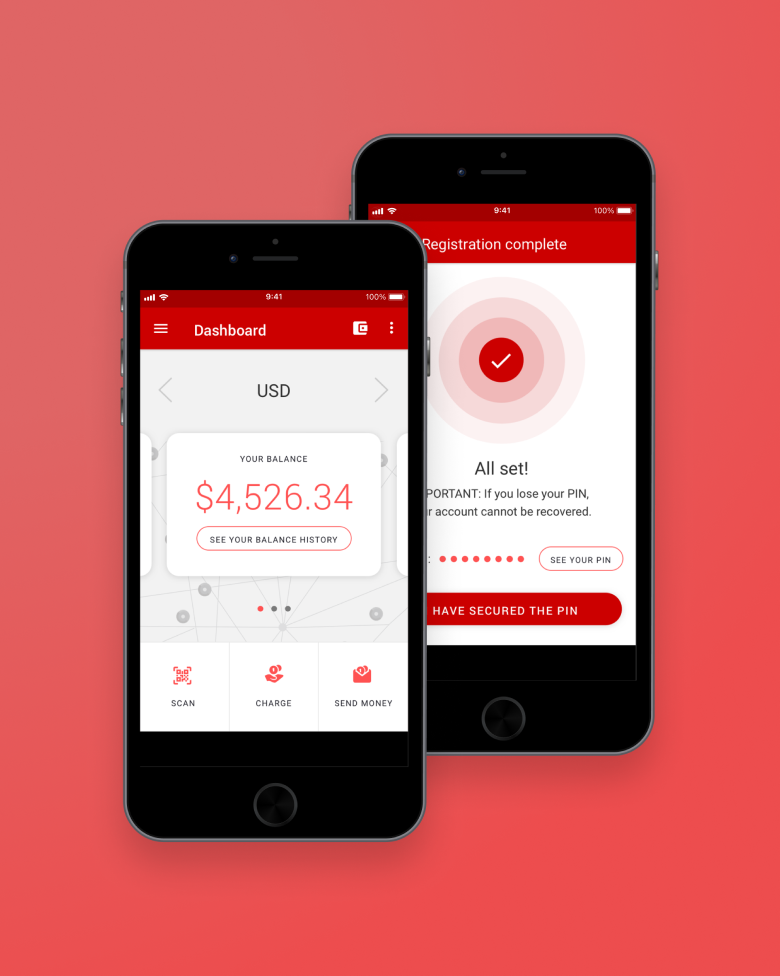

Web & Mobile

Branding

Duration

11 months

Tech stack

Frontend

React

Backend

Java

Challenges

High barriers to real estate investing

01. High entry threshold to real estate investment

Traditional property investment requires significant upfront capital. Moreover, complex and lengthy legal processes deter new investors. Managing properties also involves time-consuming tasks like tenant relations and maintenance.

02. Lack of liquidity

Real estate investments are typically long-term commitments with limited options for quick exits. Additionally, selling entire properties is cumbersome and often builds up high transaction costs.

03. Limited accessibility for small investors

The real estate market has traditionally favoured wealthy or institutional investors. Due to high costs, small-scale investors face challenges in diversifying their portfolios.

04. Complex tax structures

Navigating tax regulations for real estate investments can be daunting for individual investors.

Solutions

Hassle-free investing with built-in liquidity

01. Fractional ownership

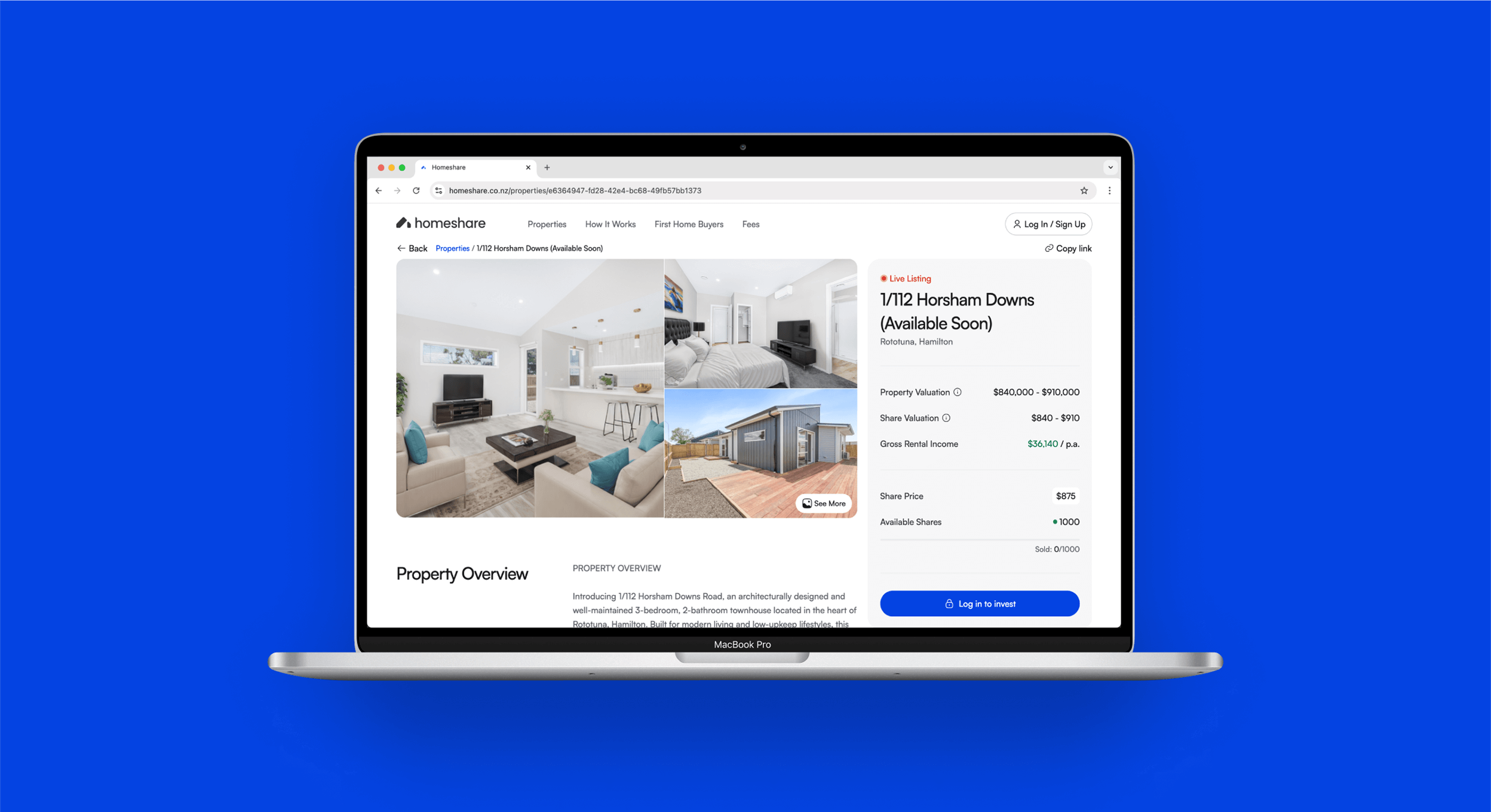

Properties are divided into 1,000 shares, allowing investors to start with minimal capital. Each share represents a physical and legal ownership stake in the property.

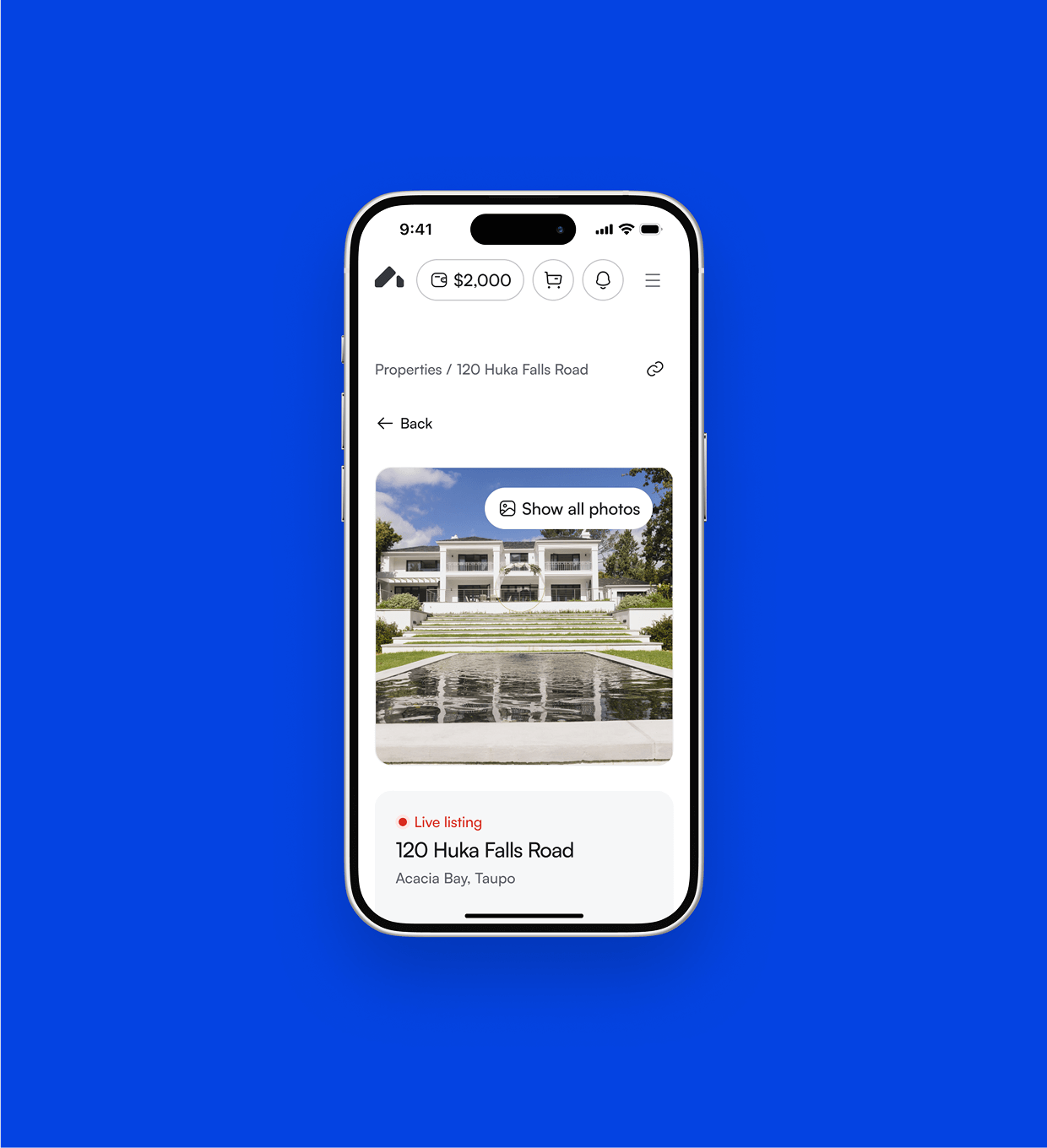

02. Effortless transactions

A user-friendly platform enables buying and selling shares without solicitors or paperwork, and the secondary marketplace provides liquidity by allowing investors to trade shares anytime.

03. Passive income generation

Monthly rental income is distributed proportionally to shareholders. Homeshare handles all aspects of property management, ensuring hassle-free ownership.

04. Built-in asset protection

Advanced encryption and decentralised systems safeguard investor assets. In addition, the PIE regime provides tax advantages, reducing the overall tax expense on investment income.

05. Seamless property management

Homeshare manages tenant screening, rent collection, maintenance, and legal compliance, so investors can focus on growing their portfolios while Homeshare handles operational details.

06. Flexible investment options

No lock-in periods allow investors to buy or sell shares at their convenience. The platform supports diversification by offering properties across different locations and sectors.

Results

Capital growth with zero management stress

01. Lowered entry barriers

Investors can enter the real estate market with as little as one share. That is why the platform has attracted seasoned investors and newcomers looking to diversify their portfolios.

02. Enhanced liquidity

The secondary marketplace enables quick buying and selling of shares, providing flexibility unmatched by traditional real estate investments.

03. Steady passive income

Shareholders receive monthly rental payouts directly into their accounts. Transparent reporting also ensures investors can track their earnings and property performance.

04. Capital appreciation

Investors benefit from property value increases, realising gains when selling their shares on the marketplace.

05. Simplified taxation

The PIE structure reduces shareholder tax liabilities, maximising net investment returns.

06. Streamlined ownership experience

Full-service management eliminates the stress of property ownership while maintaining profitability. Moreover, investors enjoy the benefits of real estate ownership without day-to-day responsibilities.

Homeshare's innovative approach has transformed the way people invest in real estate. Making it accessible, flexible, and profitable for a wide range of investors.

Integration with 3rd party

Built-in fraud prevention and platform security

Know Your Customer (KYC) is a critical process for platforms like Homeshare, especially given its focus on fractional property ownership and financial transactions. Here's why KYC is essential:

01. 1. Compliance with legal and regulatory requirements

Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF): KYC ensures compliance with AML and CTF regulations, preventing the platform from being used for illegal activities such as money laundering or financing terrorism.

Tax compliance: By verifying user identities, Homeshare ensures accurate reporting under tax regimes like the Portfolio Investment Entity (PIE). Therefore, offering tax advantages to investors.

02. Fraud prevention

KYC helps verify users' identities, reducing the risk of fraud, theft, or unauthorised transactions. Furthermore, it ensures that all transactions on the platform are legitimate, safeguarding both the platform and its users.

03. Building trust and transparency

Trust is paramount for a platform dealing with fractional ownership and real estate investments. KYC fosters transparency by verifying and legitimising all participants. Thus, investors value platforms that view security and compliance as a priority.

04. Enhancing platform security

KYC grants verified individuals access to the platform only. Reducing risks associated with fake accounts or malicious actors. What’s more, it protects users’ investments by securing all transactions.

05. Enabling seamless transactions

By completing KYC during onboarding, Homeshare can streamline future transactions, such as buying or selling shares on the secondary marketplace. The benefit is that verified accounts enable faster transaction processing without additional verification steps.

Available for projects

Want to talk about your project?

Partner with us for a digital journey that transforms your business ideas into successful, cutting-edge solutions.