The financial services industry is experiencing a fundamental shift as artificial intelligence revolutionizes how financial institutions interact with customers and deliver service offerings. Traditional banking models are becoming obsolete as customers demand personalized banking experiences similar to their digital interactions with tech giants. AI's ability to analyze vast amounts of customer data makes banking more intuitive and responsive to individual customer needs.

Financial institutions that embrace AI and personalized banking gain significant advantages in customer engagement and revenue growth. Those that delay AI adoption risk losing market share to competitors who understand that AI capabilities drive modern banking success. The future of banking depends on successful implementation of AI solutions that boost efficiency while delivering hyper-personalized interactions.

The new era of customer-centric banking

Customer expectations in financial services have fundamentally shifted, driven by digital experiences in other industries. Banks and credit unions must now deliver Netflix-level personalization to remain competitive and retain customers in an increasingly crowded marketplace. The chief marketing officer and other executives recognize that customer satisfaction directly impacts business intelligence and the long-term financial well-being of the organization.

Why personalization became a banking imperative

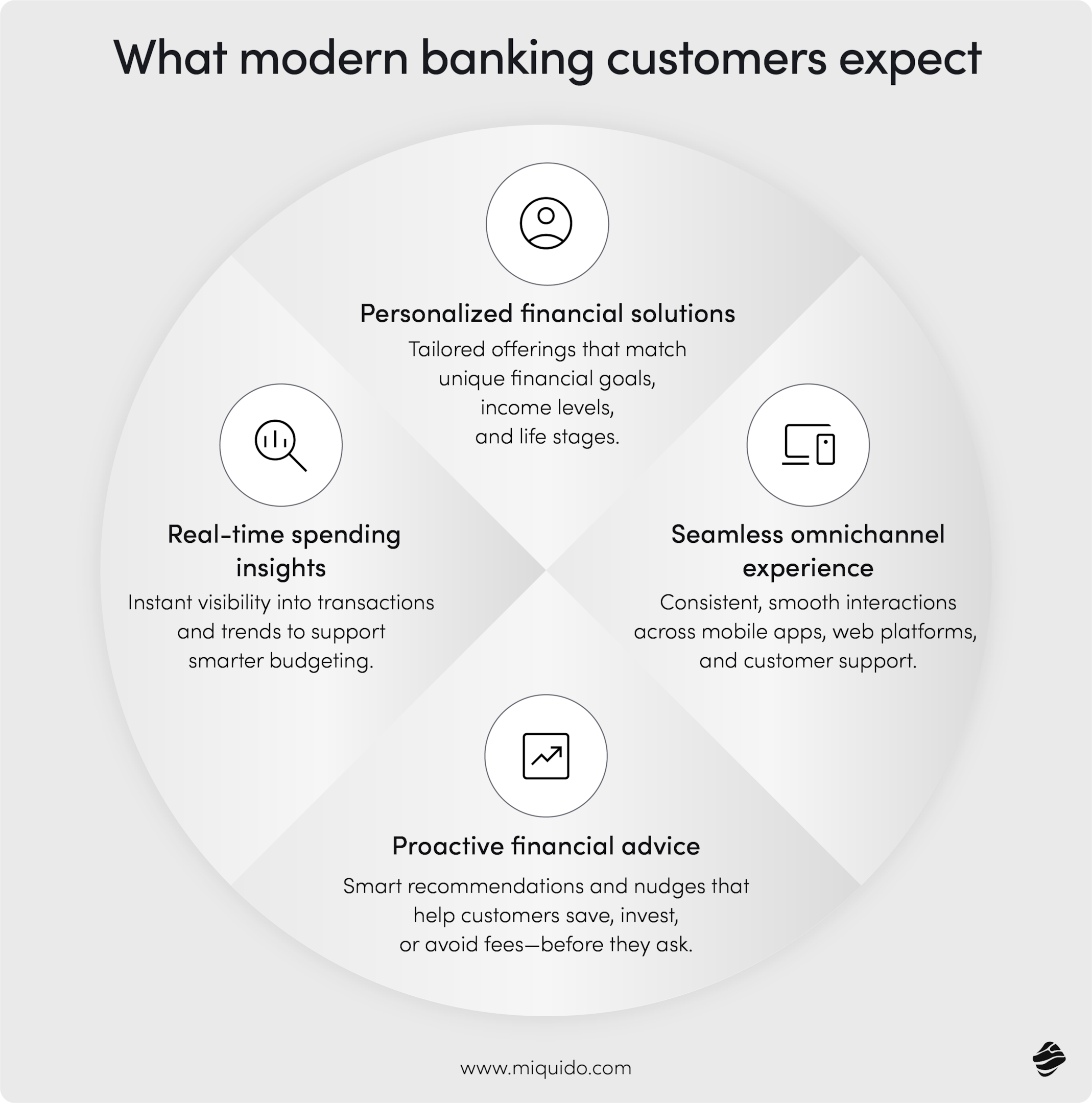

Modern customers expect their bank or credit union to deliver personalized customer service that understands their spending habits and financial goals. Customer expectations have evolved dramatically, influenced by AI-driven personalization they experience on digital platforms.

Today's banking customers demand:

• Tailored solutions based on individual financial needs

• Proactive financial guidance and recommendations

• Seamless digital interactions across mobile apps

• Real-time insights into spending patterns

Major banks adopting AI-driven insights—such as generative chatbots and real-time personalization—have reported significant increases in customer satisfaction. For example, NatWest saw a 150 % uplift after launching its enhanced chatbot, while AI tools handling routine queries (up to 80 %) have been linked to faster response times and higher service quality. Personalized AI interactions deepen customer engagement, helping banks retain satisfied users rather than losing them to competitors.

The technology gap between customer expectations and banking reality

Most financial institutions struggle with technology gaps between customer expectations and current system capabilities. Legacy infrastructure lacks AI capabilities to process real-time transaction data and deliver hyper-personalized interactions.

The challenge intensifies due to strict regulatory requirements in financial services. Banks need specialized AI models that maintain compliance while delivering personalized experiences that customers expect. This creates opportunities for partners with technical expertise in both AI algorithms and banking regulations.

AI technologies revolutionizing banking experiences

Modern AI technologies transform every aspect of how customers interact with financial institutions through digital banking platforms. From machine learning algorithms that predict customer needs to natural language processing that enables conversational banking, these innovations create more intuitive and personalized financial services. Gen AI and generative AI capabilities are revolutionizing how banks deliver financial management tools and hyper-personalization.

Machine learning for predictive customer insights

Machine learning algorithms analyze vast customer data to identify patterns, enabling predictive analytics and behavioral insights. These AI systems process transaction data, spending patterns, and life events to build comprehensive customer profiles.

Advanced AI models predict:

• When customers might need loans or investment products

• Risk of customer churn to competitors

• Optimal timing for product recommendations

• Life events requiring financial planning adjustments

This continuous learning capability ensures AI-driven personalization becomes more accurate over time, creating increasingly meaningful interactions between financial institutions and customers.

Natural language processing in conversational banking

Natural language processing transforms customer interactions by creating sophisticated AI agents capable of understanding context and intent. Modern NLP systems handle complex financial topics and provide genuinely helpful responses rather than scripted answers.

Key NLP capabilities include:

• Sentiment analysis to recognize customer emotions

• Voice-enabled banking for accessibility

• Automated handling of routine tasks

• Escalation of complex transactions to human staff

These AI-powered systems boost efficiency while maintaining a high-quality customer experience, enabling human staff to focus on situations requiring emotional intelligence.

Computer vision for document processing and identity verification

Computer vision technology automates document verification and identity confirmation processes, completing such tasks in seconds rather than hours. AI systems extract information from identification documents, pay stubs, and bank statements with greater accuracy than human processors.

Advanced capabilities include:

• Facial recognition for identity verification

• Detection of sophisticated fraud attempts

• Automated processing of unstructured data

• Continuous learning to adapt to new fraud techniques

This integration enables seamless, secure customer experiences while maintaining the highest security standards required in financial services.

Transforming core banking operations through AI

Behind the scenes, AI is revolutionizing traditional banking operations, from risk assessment and fraud detection to compliance monitoring. These operational improvements deliver both cost savings and enhanced security while enabling faster, more accurate decision-making across the organization. AI in banking is particularly effective at processing structured and unstructured data to identify patterns that humans might miss.

Automated risk assessment and credit scoring

AI systems analyze hundreds of variables in real time to accurately assess creditworthiness. To build comprehensive risk profiles, these AI models incorporate alternative data sources, including utility payments, rent history, and digital platform usage.

Benefits of AI-powered risk assessment:

• Credit decisions in minutes instead of days

• Reduced default rates and increased profitability

• Expanded access to credit for underserved populations

• Adaptation to changing economic conditions

Machine learning algorithms continuously refine assessment criteria, creating more accurate scoring systems.

Real-time fraud detection and prevention

AI-powered fraud detection processes millions of transactions simultaneously, identifying suspicious patterns impossible for human analysts to detect in real-time. These AI algorithms learn from historical patterns while adapting to new attack vectors.

Fraud detection capabilities:

• Real-time transaction monitoring and scoring

• Automatic blocking of suspicious transactions

• Customer alerts for potential security issues

• Continuous learning from new fraud schemes

This proactive approach demonstrates responsible AI implementation that protects customer data while maintaining seamless customer experience.

Intelligent document processing and compliance

Artificial intelligence transforms compliance processes by automatically analyzing contracts, regulatory filings, and transaction records. Natural language processing systems interpret regulatory changes and update compliance protocols automatically.

Compliance automation benefits:

• 70% reduction in manual workload

• Improved accuracy in compliance monitoring

• Automatic flagging of potential violations

• Processing of both structured and unstructured data

AI-driven document processing provides comprehensive oversight that traditional systems cannot achieve, making banking operations more secure and compliant.

Overcoming AI implementation challenges in banking

While the benefits of AI in banking are clear, successful implementation requires careful planning and technical expertise. Financial institutions must navigate complex integration challenges, regulatory requirements, and cost considerations to realize AI's full potential. AI projects require an understanding of both technological capabilities and financial services regulations.

Integrating AI with legacy banking systems

Most financial institutions operate on decades-old infrastructure that requires seamless integration with modern AI solutions. Successful AI adoption demands sophisticated strategies for connecting machine learning models with existing systems without disrupting operations.

When thinking through integration, the goal isn’t just to connect systems—it’s to do so in a way that respects the integrity of what’s already working. That starts with flexible APIs and middleware layers, which act as bridges rather than bottlenecks, enabling different systems to communicate without forcing them into unnatural alignments. Stability and security must remain non-negotiable; new connections should never introduce new vulnerabilities. It’s equally important that any integration complements, rather than complicates, existing customer interactions. And throughout, the measure of success lies in maintaining continuity—ensuring that operational processes remain largely undisturbed, even as the underlying infrastructure evolves.

Experienced partners understand banking system complexities and create integration solutions that enhance rather than disrupt existing operations.

Ensuring data security and regulatory compliance

Financial institutions must balance innovation with strict regulatory requirements and data privacy obligations. AI systems require specialized security frameworks with encryption, access controls, and audit trails built into the core architecture.

Security requirements include:

• Data encryption and access controls

• Compliance monitoring capabilities

• Adaptation to changing regulatory requirements

• Embedded privacy protections throughout system design

Responsible AI implementation ensures data privacy protections are fundamental system components rather than afterthoughts.

Managing costs and demonstrating ROI

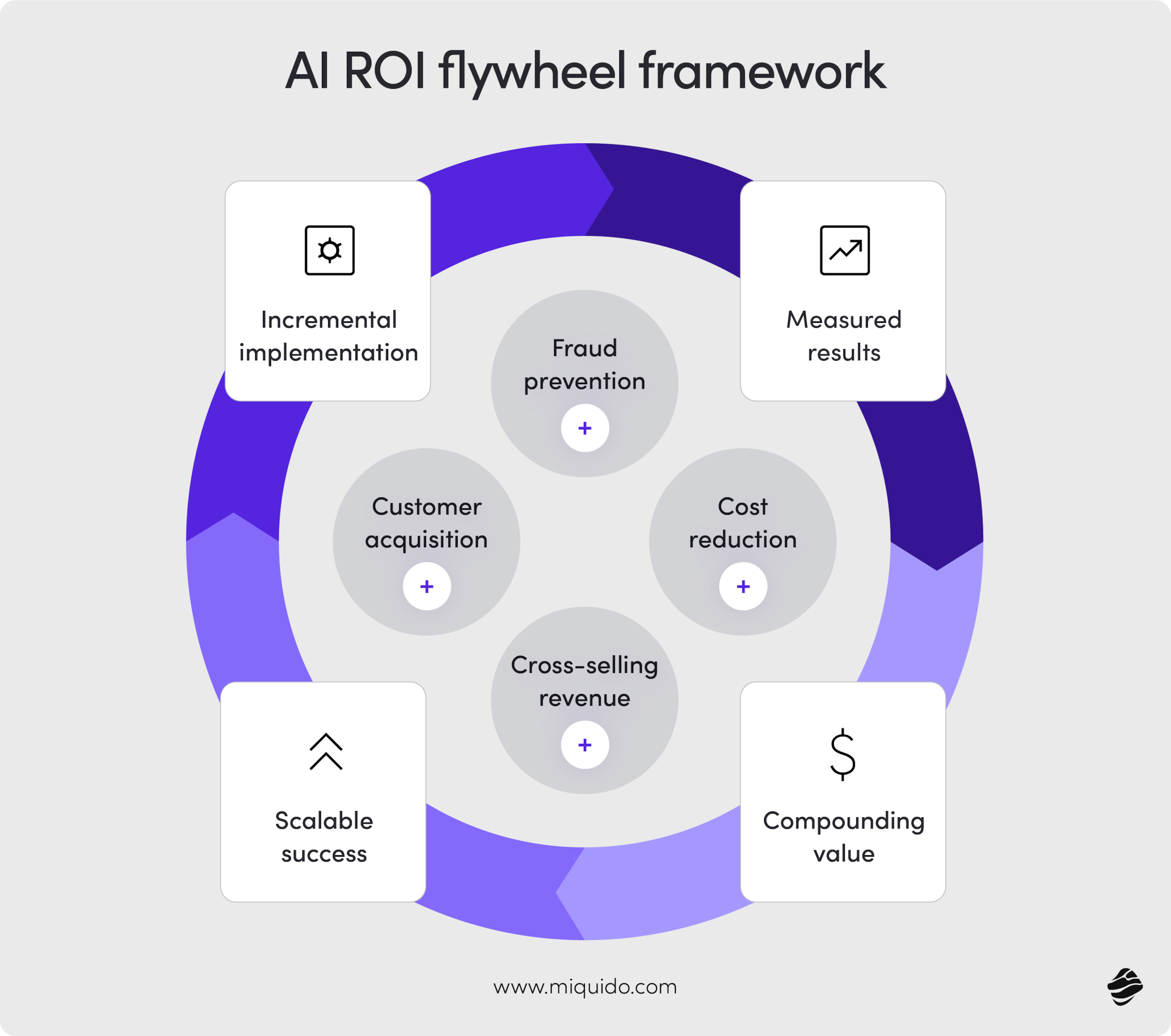

Managing costs and demonstrating ROI is a balancing act between financial discipline and strategic vision. Banking executives, under pressure to justify each dollar spent, require more than just promising narratives—they need tangible, measurable returns. Successful AI adoption must prove its value through real-world outcomes such as reduced operating expenses, smarter fraud detection, deeper customer relationships, and expanded revenue streams via cross-selling.

To build that case, several strategies help ground the ROI story:

• Incremental implementation with measured results — Starting small allows institutions to test AI in controlled environments, learn from early outcomes, and fine-tune before broader rollout. This phased approach makes risk more manageable and ROI more traceable.

• Scaling successful solutions across organizations — Once proven, expanding AI capabilities across business units amplifies value and ensures the benefits are not siloed. This scaling multiplies impact while standardizing success.

• Multiple value sources that compound over time — AI doesn’t just deliver in one area. Gains from automation, insights, and personalization reinforce each other, creating a flywheel effect that grows stronger with continued use.

• Clear metrics for operational efficiency gains — Defining and tracking precise efficiency indicators—like reduced processing times or fewer manual interventions—helps link AI directly to cost savings and performance improvements.

Real-world impact: AI success stories in finance

The measurable impact of AI in banking extends beyond theoretical benefits to real-world results that transform both customer experience and business performance. Leading financial institutions already see significant returns on their AI investments across multiple areas, from improved customer relationships to enhanced operational efficiency in handling complex transactions.

Measurable benefits of AI-powered banking solutions

Leading financial institutions report dramatic improvements across key performance indicators. Customer onboarding processes are completed in hours instead of days, while loan approvals finish in minutes rather than weeks.

Quantifiable improvements include:

•80% of routine inquiries handled by AI systems

• 85-95% accuracy in fraud detection

• 60% reduction in false positives

• Millions in fraud prevention savings

Enhanced security, efficiency, and customer experience create sustainable competitive advantages.

Customer experience improvements through AI

AI transforms banking from reactive service to proactive financial guidance. Customers receive personalized insights, spending analysis, and recommendations helping them achieve financial goals more effectively.

AI is reshaping the banking experience beyond simple transactions into personalized, proactive financial guidance. Through mobile apps, customers now receive contextual advice tailored to their behavior, optimising budgets, identifying saving opportunities, or suggesting timely financial moves. AI anticipates their needs rather than waiting for a customer to ask and responds with relevant insights.

This shift toward intelligent, personalized interactions not only deepens customer trust and engagement but also opens new doors for growth. Automated savings nudges and product recommendations delivered at the right moment can guide users toward smarter financial decisions, creating new touchpoints for banks to offer value added services and generate revenue. In short, AI makes banking more human by being more observant, responsive, and strategically timed.

Building your AI-powered banking strategy

Creating a successful AI implementation strategy requires careful partner selection and planning for long-term scalability. The right approach balances immediate business needs with future technological evolution and regulatory compliance. AI-powered solutions must also consider data privacy, responsible AI practices, and the need to maintain meaningful interactions alongside automation.

Choosing the right AI development partner

Successful AI implementation requires partners to understand cutting-edge technology and banking constraints. Ideal partners combine technical expertise in machine learning, natural language processing, and generative AI with proven banking experience.

Partner selection criteria:

• Demonstrated track record with banks and credit unions

• Experience with structured and unstructured data processing

• Understanding of banking regulations and security requirements

• Expertise in customer personalization platforms

The complexity of modern AI algorithms and regulatory requirements demands specialized expertise that general technology providers often lack.

The future of AI in banking: What's next?

The future of banking features deeper personalization, enhanced predictive capabilities, and seamless AI integration across customer touchpoints. Emerging technologies including generative AI and advanced natural language models will create new possibilities for customer interaction and financial service delivery. AI agents will handle increasingly sophisticated financial guidance while maintaining the human interaction quality that customers value.

Gen AI will enable more sophisticated conversational banking experiences, while AI agents handle increasingly complex financial planning functions. Financial institutions establishing strong AI foundations today will be best positioned for future innovations in artificial intelligence AI applications.

Success requires combining technical innovation with a deep understanding of customer needs, regulatory requirements, and the evolving financial services landscape. Organizations mastering this balance will define the future of banking through superior customer experiences, operational efficiency, and sustainable competitive advantages built on responsible AI implementation.

![[header] how ai powered personalized banking is transforming finance](https://www.miquido.com/wp-content/uploads/2025/06/header-how-ai-powered-personalized-banking-is-transforming-finance.jpg)

![[header] 10 embedded finance examples](https://www.miquido.com/wp-content/uploads/2025/03/header-10-embedded-finance-examples-432x288.jpg)