FinTech apps have transformed how people manage money, invest, make payments, and interact with banking institutions. Whether a startup launches a micro-investment platform or an established bank digitises services, the demand for scalable, secure, and user-friendly interfaces in mobile applications is higher than ever.

Enter Flutter, Google’s open-source cross-platform framework, rapidly becoming the go-to solution for FinTech app development. From rapid prototyping to secure back-end integration, the Flutter FinTech app delivers performance, usability, security, and cost-efficiency on all fronts. Built with the Dart programming language, Flutter enables teams to create applications that run on Android, iOS, web, and desktop without needing separate codebases.

Let’s explore how Flutter is changing the game and why it’s the ideal solution for building modern financial applications across the financial industry.

1. Flutter: The cross-platform framework built for finance

Flutter enables developers to create mobile apps for Android and iOS (and even desktop and web) using a single codebase. This eliminates the need to build and maintain separate apps for different operating systems, reducing the software development cycle's time, cost, and complexity.

Unlike hybrid technologies, Flutter compiles into native apps using computer executable code, delivering stable system performance and smooth animations powered by its high-performance rendering engine (Skia).

This makes it a perfect fit for the finance industry, where users demand seamless functionality, trust-building visuals, and lightning-fast performance across all platforms.

2. Speed to market with a smaller development team

Time is a crucial factor in FinTech. Speed matters when launching a mobile banking solution, testing new ideas, or meeting regulatory deadlines.

Flutter accelerates the app development process through:

- One development team for all platforms

- Built-in widgets for UI/UX design

- The hot reload feature for instant code updates

- Prebuilt libraries and easy plugin integrations

This means companies can ship MVPs faster, validate ideas sooner, and respond to end-user feedback with agility. For smaller FinTech startups, this is a game-changer—it levels the playing field against larger competitors with more resources. Flutter apps have proven to reduce development time and costs without compromising quality.

3. Intuitive user interface and consistent UX

Design isn’t just about aesthetics; in FinTech, it directly impacts trust, usability, and customer engagement. Whether users review transactions, apply for credit, or check investments, the interface must be intuitive and frictionless.

Flutter empowers developers to deliver:

- Highly responsive and animated interfaces

- Pixel-perfect UI across platforms

- Custom branding and visual identity

- Accessible layouts and native gestures

Because Flutter apps render UI directly through their engine, they maintain a consistent user experience and offer a seamless user experience across devices. This is vital for banking and financial apps where users expect uniformity and clarity.

4. Secure by design: Data privacy and protection

Security is a non-negotiable requirement in any FinTech app. These applications handle sensitive data, including financial data, identity verification, transaction records, and personal user information. Flutter’s architecture allows developers to implement robust security practices, such as:

- Biometric authentication (Touch ID, Face ID)

- Integration with native APIs for enhanced security

- Support for popular data encryption algorithms

- SSL pinning, token-based authentication, and 2FA

- Strong defense against reverse engineering

Flutter compiles to native ARM code, adding an extra protection layer. Combined with best security practices and back-end measures, it ensures high data security for all user interactions.

5. Cost-effective maintenance and rapid updates

Maintaining two separate native solutions—one for Android and one for iOS—often doubles the cost, communication effort, and developer headcount. With Flutter:

- You maintain one codebase

- Updates apply across platforms simultaneously

- Issues are easier to identify and resolve

- Post-deployment changes are quicker and cheaper

This makes app maintenance much more efficient. New features can be implemented rapidly, especially critical in a fast-moving finance industry driven by innovation, regulation, and competition. With reusable Flutter code, teams can stay agile and effective.

6. Native performance with cross-platform flexibility

Flutter doesn’t compromise on performance. By compiling directly to native code and utilizing GPU-accelerated rendering, it delivers a smooth and performant user experience even under complex UI and heavy workloads.

This is essential for banking apps where:

- Real-time transaction data must display instantly

- Smooth animations improve credibility and professionalism

- Core financial operations (e.g., transfers, account updates) must execute without lag

Unlike other cross-platform frameworks, Flutter combines the reliability of native technologies with the speed and convenience of cross-platform technologies.

7. Seamless integration with back-end systems

Modern mobile banking solutions integrate with existing banking infrastructure and third-party services. Flutter is highly adaptable, whether it’s AML/KYC systems, cloud databases, or APIs for payments and identity verification.

Flutter enables:

- Integration with Google Pay, Apple Pay, and third-party gateways

- API connectivity to core banking systems

- Plug-ins for geolocation, document scanning, and more

- Access to native APIs for platform-specific capabilities

This makes it easier for fintechs and banking institutions to modernize their platforms without overhauling their existing ecosystems.

8. Scalable modular architecture

As apps grow, so does their complexity and service offerings. From investing to budgeting tools, Flutter’s modular architecture allows developers to:

- Build each feature independently

- Reuse UI components across modules

- Maintain design and performance consistency

This architecture is ideal for financial applications, offering multiple services under one roof. It also facilitates faster testing, A/B experiments, and selective feature rollouts.

9. Support from Google and a thriving developer community

Backed by Google and supported by a vast global community, Flutter enjoys:

- Regular updates and security patches

- Access to thousands of third-party packages

- Active forums, tutorials, and code repositories

- An increasing pool of experienced Dart developers

This strong ecosystem means your app development will always be aligned with the latest trends, best practices, and supported tools, which are crucial when dealing with financial data in a highly regulated sector.

10. Proven success in real-world financial apps

Flutter isn’t just a promising tool—it’s already powering some of the world’s most successful finance apps and banking applications.

NuBank

This Brazilian digital banking giant serves over 80 million users and chose Flutter to rebuild its app architecture. The move enabled:

- A unified mobile app across platforms

- Faster deployment of new features

- Improved performance and user satisfaction

- More efficient app maintenance

With a leaner development team, Nubank was able to iterate quickly without sacrificing quality or security. Their success is a testament to the power of Flutter apps built for scale and resilience.

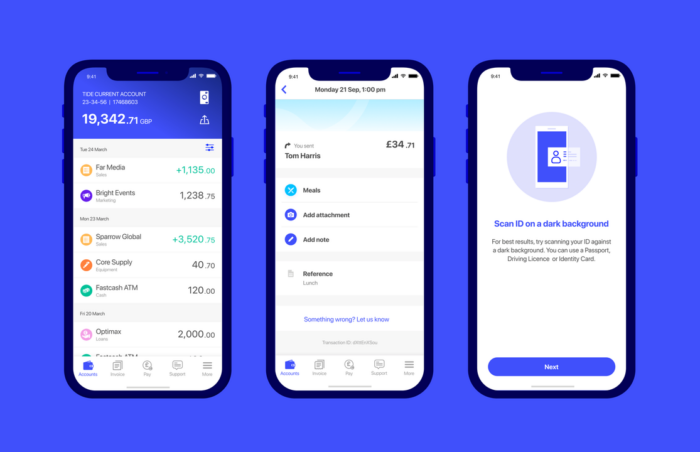

Tide

UK-based Tide, a challenger bank for SMEs, uses Flutter to develop a flexible and modular banking app. Their team benefits from:

- A single codebase for Android and iOS

- Rapid prototyping for new features

- Reduced costs on QA and development

- Better customer engagement through smoother UX

Their success showcases Flutter’s ability to handle complex business accounts, invoicing tools, and cash flow tracking—all within a user-friendly interface optimized for tech-savvy users.

Revolut

While Revolut continues to rely heavily on native solutions, it has tested Flutter in modular rollouts and A/B experiments. The results include:

- Faster UI prototyping

- Isolated feature testing with minimal disruption

- Ability to trial new services among small user segments

This demonstrates how Flutter can augment native apps, supporting innovation even within mature platforms.

Other Players

Numerous smaller FinTech startups—especially in Europe, Asia, and Latin America—are leveraging Flutter for:

- Digital wallets

- Crypto exchanges

- Personal finance management tools

- Expense trackers

- Loan origination platforms

These companies cite faster MVP cycles, easier scaling, and stronger customer engagement as key benefits of adopting Flutter. The Flutter framework is an optimal solution for firms needing to deliver secure, attractive, high-performance apps quickly and precisely.

Miquido’s Flutter services for FinTech

As a trusted Google-certified partner, Miquido brings deep expertise in building Flutter fintech solutions using the Flutter framework. Our service offering supports financial companies at every stage of development, from idea validation to post-launch scaling.

- Google-certified development team specializing in Flutter for fintech use cases

- End-to-end support from product ideation to deployment, MVP delivery, and scaling

- UX/UI design services focused on user-friendly and intuitive finance experiences

- Flutter-based mobile and web development with a single codebase for Android, iOS, and web

- Compliance-ready development for regulations like GDPR, PSD2, and AML

- Integration of AI features for fraud detection and user personalization

- Modular architecture to build, scale, and test fintech services independently

- Post-launch support and team augmentation with experienced Flutter engineers

Conclusion: Flutter is the future of FinTech innovation

From startups to global financial institutions, the need for fast, secure, and scalable apps is reshaping the future of finance. Flutter meets this need better than any other cross-platform technology, offering:

- Native performance with a shared codebase

- Robust data security and encryption support

- A polished, intuitive user interface

- Seamless backend integration

- Modular scalability and faster time-to-market

- Proven reliability with leading global financial apps

The Flutter Fintech app is a strategic advantage for teams looking to deliver a compelling, consistent experience across multiple platforms while keeping costs low and innovation high.

Check out our selection of 25 apps built in Flutter.

Whether you’re building a cutting-edge finance app, a secure banking application, or a next-gen mobile banking solution, Flutter provides the tools to deliver world-class performance—quickly, efficiently, and securely.

![[header] why the flutter fintech app is transforming finance min](https://www.miquido.com/wp-content/uploads/2023/01/header-why-the-flutter-fintech-app-is-transforming-finance_-min.jpg)