The metamorphosis of the banking sector stands out among other industries – in just over a decade, it has transformed from very traditional to highly digitalized.

Some banks have even moved fully online, giving up physical branches, while new financial concepts have emerged, driven by technological advancement.

Peer-to-peer payments, fractional housing investments, cryptocurrencies – the definition of fintech has expanded in recent years, offering numerous opportunities.

While fintech application development is having its moment, some global fintech solutions may have more potential than others. Which fintech development company might change the way we invest, manage, and secure our funds? Which fintech software offer value added services that others do not provide access to? And which fintechs go beyond sleek interfaces to truly democratize access to banking and insurance, making financial services more inclusive?

In this article, we discover the state of the art, delving deep into trends in fintech software development.

Fintech solutions to know in 2026: From fintech banking and super apps to fintech products focused on budgeting, investment and insurance

We looked into the recent fintech award winners to understand who is changing the financial landscape. Discover where is fintech development headed in 2026.

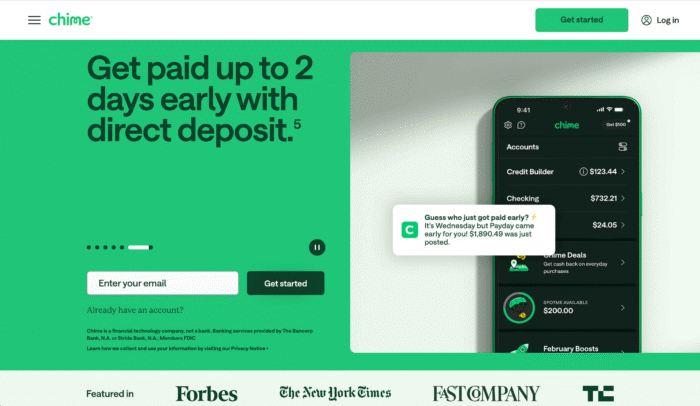

1. Chime: Commission-free digital banking pioneer

How much do you spend on banking fees each year? Many users would be surprised after tallying up all the small charges that automatically disappear from their accounts. With Chime, that's not a concern, thanks to its rare commission-free model that is reshaping fintech in banking.

This fee-free approach has proven to be a massive success, earning Chime a spot on the CNBC Disruptor 50 list for 2024. The exceptional user experience and intuitive design make managing finances simple and transparent. This is the direct result of a thoughtful fintech app development process that puts the user's needs first.

As a leading fintech mobile app, it offers powerful features without the traditional costs, empowering users to take control of their financial well-being.

Key features:

- Early direct deposit access up to 2 days before payday

- Automatic savings through round-up transactions

- Fee-free overdraft protection with SpotMe feature

This revolutionary approach is precisely why Chime stands out. In an era where inflation impacts spending power, its fee-free model directly answers the growing demand for accessible financial services without hidden costs. By eliminating monthly fees and providing early wage access – a crucial feature for many living paycheck-to-paycheck – Chime has become the most user-friendly fintech banking solution for millennials and Gen Z.

2. Revolut: Global super app for modern banking

Do you travel? Then you must have Revolut – the company built its initial success on this simple premise nearly a decade ago. This clever approach paid off, with its solutions spreading virally among travel enthusiasts. Soon, however, word spread that fee-free card spending worldwide was just a fraction of what Revolut could offer.

Revolut consistently focuses on modern banking, a commitment validated by its win in France at World Finance Digital Banking Awards 2024. Unlike many traditional mobile banking apps, it boldly embraces innovation, simplifying access to digital assets and other forward-thinking features. The use of cutting-edge tech, including blockchain technology, demonstrates its position as a leader in the financial space.

As a top-tier fintech software development company, Revolut also understands how to build a sense of exclusivity. Anyone who has seen the shimmering metal Revolut card knows exactly what that means!

Key features:

- Multi-currency accounts with real-time exchange rates

- Built-in cryptocurrency trading and investment platform

- Travel insurance and premium metal card offerings

Ultimately, Revolut's power lies in its all-in-one design, making it the quintessential companion for modern global citizens. With increasing cross-border mobility and currency volatility, its ability to break down geographical financial barriers has never been more relevant.

By seamlessly combining traditional banking, cryptocurrency, and investment services into a single, comprehensive fintech app, Revolut solidifies its status as the ultimate tool for digital nomads and international travelers.

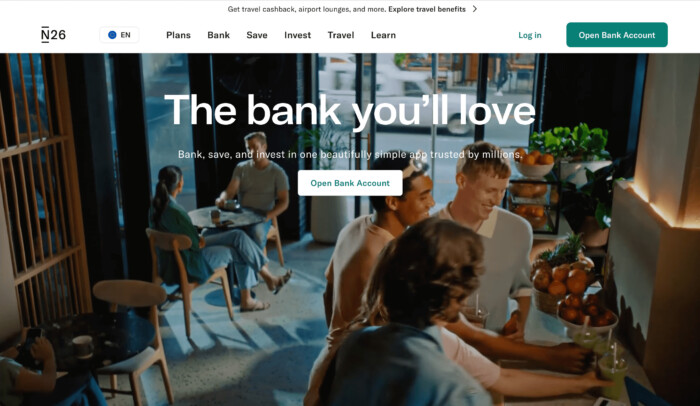

3. N26: European digital banking excellence

Key features:

- AI-powered spending categorization and insights

- Instant push notifications for all transactions

- Premium travel and lifestyle perks with Metal account

Artificial intelligence is here to stay, and its application in personalized consumer fintech can offer users tremendous added value. N26 understands how to leverage this opportunity securely, placing compliance at the core of its strategy – a crucial move in the face of tightening regulations. This focus on security and reliability sets it apart from many of its fintech competitors.

This commitment to excellence is reflected in their platform, awarded with Financial Innovator Awards of the Americas in 2023 together with the Brazilian partner, Pismo. Their AI-driven spending insights and seamless interface create a superior online banking experience that empowers users. It’s a perfect blend of sophisticated technology and user-centric design.

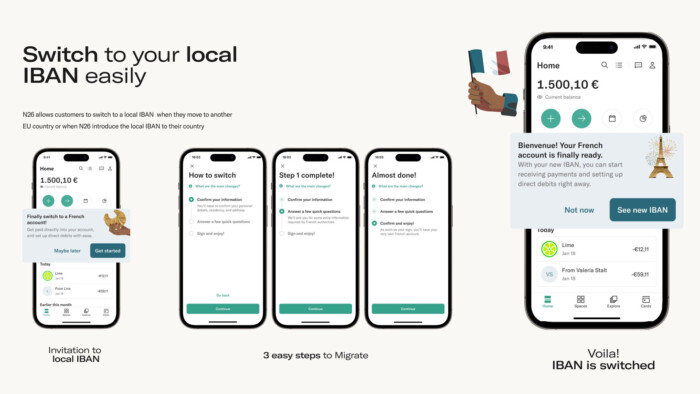

Its best proof? The IBAN Swap feature recognized by UX Design Awards in 2024, making the app more inclusive for immigrants and removing unnecessary complexity of the banking procedures related with the move to a different country.

IBAN discrimination occurs when companies in the EU reject transactions from accounts with a foreign IBAN, causing financial inconvenience and barriers for expatriates. N26 proactively addresses this problem by introducing “IBAN Switch” as a convenient feature in their banking app.

Gennet Aku Agbenu and Matthias Schmiedbauer

N26's brilliance lies in its dual focus on innovation and regulation. As Europe strengthens its digital financial rules, the app's sleek interface and compliance-first approach meet a growing demand for trustworthy fintech solutions. They've intelligently used AI not just for user insights but also to solve complex operational challenges.

Example? Scaling their multilingual customer service to handle 20% of requests automatically while ensuring full data protection, setting a new standard for a smart, secure, and user-trusted European digital bank.

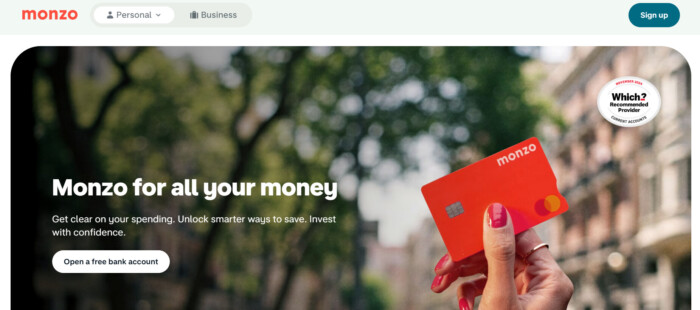

4. Monzo: Community-driven UK banking innovation

While the broader banking sector can seem out of touch, especially when interest rates are soaring and household budgets are shrinking, Monzo takes a different approach. They are one of the few fintech providers that are actively listening to their users during economic uncertainty. This deep understanding of customer needs is channeled directly into their feature spectrum.

As one of the most beloved personal finance apps in the UK, Monzo provides concrete tools designed for better budgeting and financial literacy. Its real-time spending notifications and salary-sorting features give users an immediate and clear view of their money, helping them stay in control when it matters most.

Key features:

- Real-time spending notifications and budgeting tools

- Marketplace integration for third-party financial services

- Salary sorting feature for automatic bill payments

This community-centric approach is precisely why Monzo excels in the UK's ongoing cost-of-living crisis. By focusing on transparent tools that empower users with financial awareness, it has built industry-leading customer satisfaction and trust. Its standout quality is this genuine connection with its user base, making it feel less like a bank and more like a supportive financial partner.

5. SoFi: Comprehensive financial membership platform

The structure of the U.S. education system creates a specific financial challenge: the long-term burden of student loan debt. Juggling loan repayments, rising expenses, and a volatile job market can be overwhelming. This is exactly why modern consumers need fintech solutions that help them solve this complex financial puzzle.

SoFi tackles this head-on by offering streamlined student loan refinancing, allowing members to consolidate their debt and potentially secure lower interest rates. But its support doesn't stop there. SoFi provides its members with career coaching and financial planning advice, creating a support system that goes far beyond simple transactions.

Key features:

- No-fee banking with competitive APY rates

- Integrated investment and cryptocurrency trading

- Student loan refinancing and personal loans

SoFi's relevance is undeniable as student debt reaches record levels and young professionals seek holistic financial management. It stands out by creating a complete financial ecosystem rather than just a banking app. By combining banking, investing, and lending with exclusive member benefits, SoFi offers a single, powerful platform for achieving long-term financial independence.

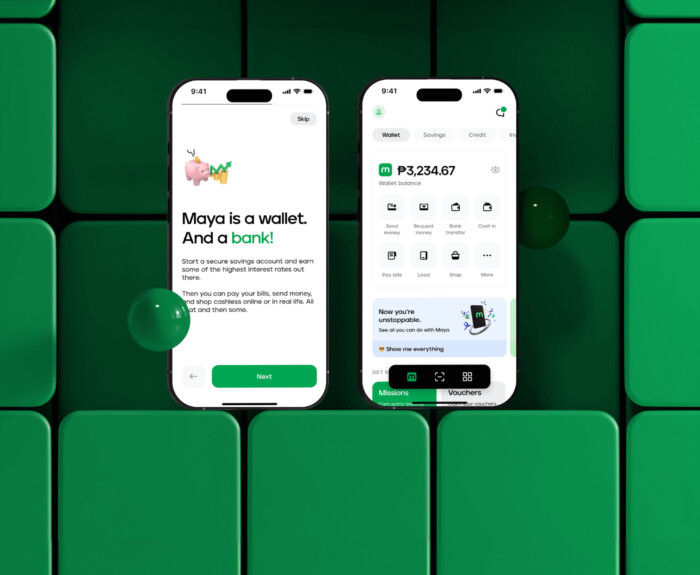

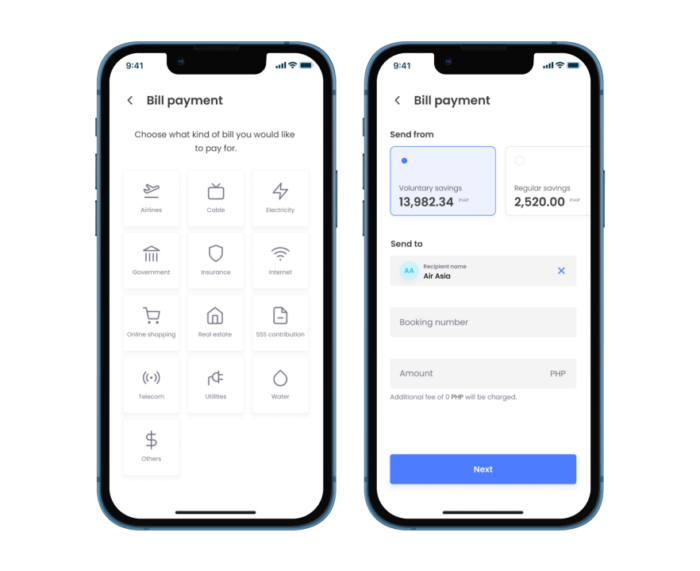

6. Maya Bank: Philippines' super app banking revolution

More of the applications we use daily are transforming into "super apps," and for good reason. Users have limited phone memory and even less attention to spare, yet they want to handle more of their lives digitally. This trend is especially dominant in regions like Southeast Asia, where mobile usage far surpasses desktop.

Maya Bank has masterfully followed this trajectory, and its success proves the strategy is working on fertile ground. This successful evolution has earned Maya numerous accolades, including a spot on the CB Insights Fintech 250.

Key features:

- High-yield savings accounts with up to 15% interest p.a. credited daily

- Instant loans up to 250,000 with AI-powered credit scoring

- Integrated cryptocurrency trading and QR code payments

As Southeast Asia's digital economy expands, Maya's relevance is clear, especially for the region's massive unbanked population. It stands out by successfully evolving from a simple e-wallet for mobile payments into a comprehensive fintech super app with banking features and value added services.

By offering the highest savings rates in the Philippines and democratizing access to financial services, Maya is the leading fintech bridging the banking gap in emerging markets. Cross-platform development with Miquido enabled Maya Bank to provide the most seamless user experience and performance, crucial in today's fintech landscape. As a Flutter fintech app, it is secure by design and consistent across devices.

7. PayPal: Global payment technology leader

Google Play | App Store

Almost everyone has heard of PayPal – it's one of those rare success stories that has spanned decades. Demand for PayPal's services will exist as long as people and businesses need to exchange money securely and instantly across borders. But it's no accident that a competitor hasn't replaced it.

PayPal holds its market-leading position by rapidly adapting to change, a fact proven by its seamless integration of cryptocurrencies and Buy Now, Pay Later services. This forward-thinking approach earned it the Best Digital Payment Solution at the FinTech Breakthrough Awards 2024, cementing its status as an innovator, not just a legacy player. It effectively bridges the gap between traditional payment methods, like credit cards, and the future of digital finance.

Key features:

- Cryptocurrency buying, selling, and spending capabilities

- Buy Now, Pay Later services through PayPal Credit

- QR code payments and contactless in-store transactions

With the rise of e-commerce and contactless mobile payments, PayPal's established merchant network and innovative features make it essential for the digital economy. It remains the most trusted name in digital payments, standing out with its unmatched global acceptance and its unique ability to bridge traditional and digital finance for millions of users worldwide.

8. Block Cash App: P2P payment innovation hub

Google Play | App Store

Simple peer-to-peer payments have replaced traditional bank transfers in our daily habits, becoming second nature for millions. But combining that ease of use with direct access to cryptocurrency? That was the novel idea from Block's Cash App, and it has proven to be incredibly successful.

This fusion makes it one of the most versatile personal finance apps available today. Users can instantly send cash to a friend, receive their paycheck via direct deposit, and buy Bitcoin, all within the same intuitive interface. The customizable Cash App Card further blurs the line between a payment app and a primary bank account.

Key features:

- Bitcoin buying and selling with Lightning Network support

- Cash App Card with customizable spending controls

- Direct deposit and tax filing integration

As cryptocurrency adoption accelerates and P2P mobile payments become the norm, Cash App's integration of traditional and digital currencies positions it perfectly for the future. It stands out by successfully merging social payments with crypto investing, creating a unique fintech ecosystem that appeals equally to casual users and crypto enthusiasts alike.

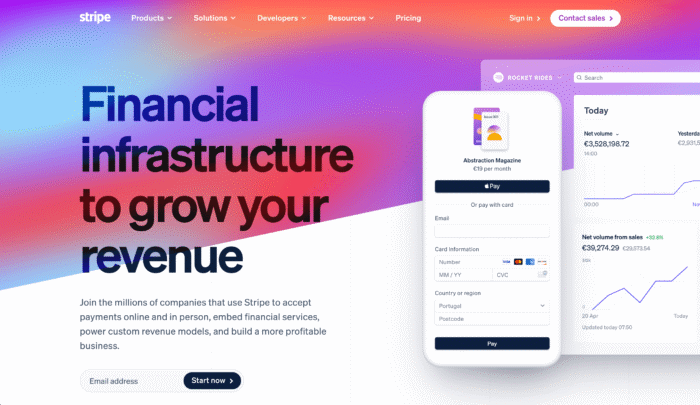

9. Stripe: Enterprise payment infrastructure

Google Play | App Store

What’s the invisible engine powering the seamless checkout experiences we now take for granted online? It's not magic, but a complex and powerful infrastructure that has become the backbone of the internet economy. Stripe is that engine, providing the tools that allow businesses of all sizes to accept payments and manage their finances online.

This unmatched reliability and developer-first approach earned it the Best Payment Processing Platform at the Global FinTech Awards 2024. Stripe's genius lies in simplifying the incredibly complex world of online payments. It handles everything from recurring billing to minimizing transaction fees for international sales, allowing companies to focus on their products instead of their payment rails. Its robust APIs are a gold standard, enabling a new generation of financial products to be built on top of its platform.

Key features:

- Advanced fraud prevention with machine learning.

- Global payment acceptance across 135+ currencies.

- Comprehensive APIs for custom financial technology companies integration.

As commerce continues its shift online, Stripe's relevance only grows. It stands out by being more than just a payment processor; it’s a foundational technology layer for the digital economy. By offering a platform that is both powerful for large enterprises and accessible for startups, Stripe ensures it remains the indispensable choice for anyone building a business on the internet.

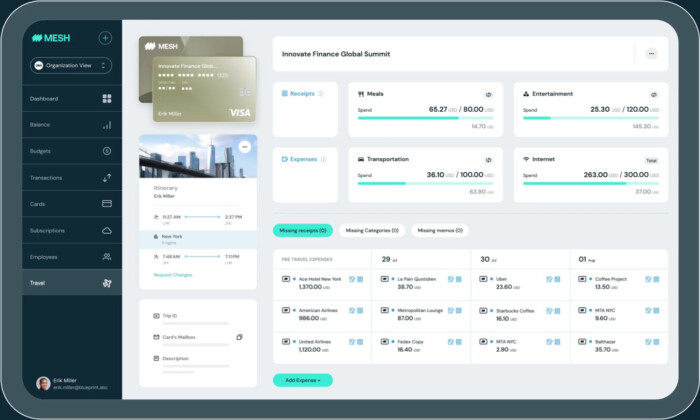

10. Mesh: Unified financial automation

How do modern companies keep track of every dollar spent – from software subscriptions to employee travel – without drowning in a sea of spreadsheets and receipts? The old way of managing corporate spend is broken, leading to wasted time and a lack of real-time financial control. Mesh was built to fix this, offering a single, unified platform to automate and control all business payments.

This transformative approach to financial operations was recognized when Mesh won the Payment Technology Award at the Global FinTech awards 2025. Unlike traditional expense management tools that react to spending after the fact, Mesh proactively embeds company policy into every payment.

As a leading fintech app development company, Mesh provides finance teams with powerful tools like customizable spending alerts and automated accounting syncs, turning chaotic processes into streamlined workflows.

Key features:

- Integrated corporate card and spend management platform.

- Automated expense reporting, receipt matching, and accounting sync.

- Real-time visibility and granular control over company-wide spending.

In an economic climate where efficiency is paramount, Mesh's ability to provide complete control and visibility over company finances is critical. It stands out by unifying corporate cards, expense management, and automation into one cohesive system. This allows businesses to operate with greater agility and financial discipline, making it an essential tool for any modern finance team.

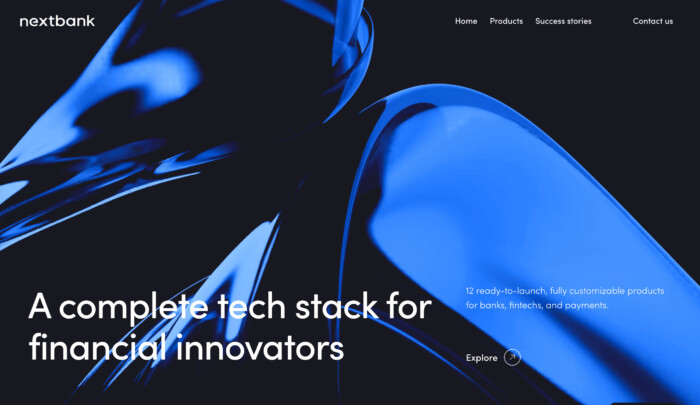

11. NextBank: AI-powered SaaS banking platform

How can a century-old bank hope to compete with a nimble digital startup born yesterday? The answer isn't to spend years building new technology from scratch, but to adopt a new digital brain. NextBank provides that brain, offering a white-label SaaS platform that empowers traditional institutions to launch modern financial products almost overnight.

This critical role in modernizing the banking sector contributed to NextBank being named a Singapore FinTech Awards Finalist. The platform’s AI-powered credit scoring engine allows banks to make instant and fairer lending decisions, reducing reliance on outdated models that often penalize customers with unnecessary overdraft fees.

NextBank enables legacy banks to compete directly with the top fintech app development companies by giving them the ready-to-deploy tools needed for a digital-first world.

Key features:

- AI-powered credit scoring system for instant loan approvals.

- QR code payments and InstaPay electronic fund transfers.

- White-label SaaS solutions for the digital transformation of traditional banks.

As customer expectations for digital experiences soar, NextBank's relevance lies in its ability to accelerate transformation for established financial players. It stands out by being an enabler, not a competitor. By providing the underlying technology, NextBank helps traditional banks leverage their existing trust and customer base to offer the cutting-edge services their clients now demand.

Miquido helped building a secure and powerful foundation for NextBank's project: OWASP security standards, universal, user-friendly white label app design, AI personalized banking and integrations with third-party providers. Effect? A chameleon app you can adapt to your fintech vision.

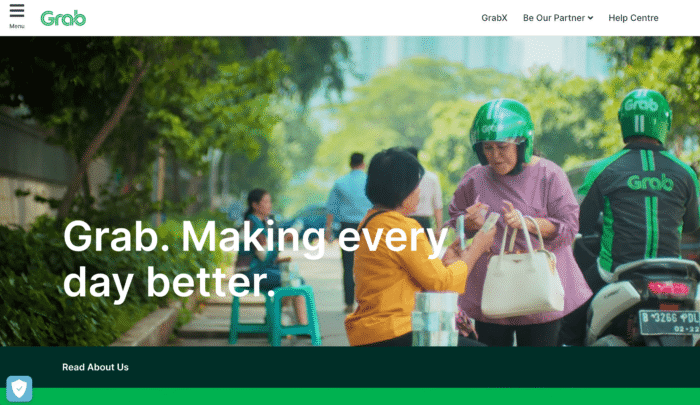

12. Grab Financial: Southeast Asian super app leader

Imagine ordering a ride, getting dinner delivered, and investing your spare change, all without ever leaving a single app. In Southeast Asia, this isn't a futuristic concept; it's a daily reality powered by Grab. What began as a ride-hailing service has evolved into the region's most dominant super app, with financial services at its very core.

Grab's success lies in its deep integration into the daily lives of millions, providing essential services in a mobile-first economy. It has brilliantly leveraged its massive user base to offer a suite of financial products, from a digital wallet to micro-investments and insurance.

This model is particularly powerful in a region where many people have limited access to traditional banking, as it facilitates instant transfers and digital payments for an entire ecosystem of merchants and consumers.

Key features:

- Integrated ride-hailing, food delivery, and payments.

- GrabPay digital wallet with an extensive merchant network.

- Micro-investment, financing, and insurance products.

As Southeast Asia's digital economy continues its explosive growth, Grab's relevance is undeniable. It stands out by successfully bundling transportation, commerce, and finance into a single, indispensable platform. By doing so, it has become a primary driver of financial inclusion, providing millions of people with their first-ever access to digital financial services. If you are looking for VAS examples for banking, this super apps can serve as a benchmark.

13. Mifundo: Cross-border lending platform

What happens when your career takes you to a new country, but your financial history doesn't follow? For millions of expatriates and global nomads, accessing something as simple as a mortgage or a personal loan can feel impossible. Mifundo was created to solve this exact problem, building a financial bridge for a world without borders.

This bold vision to disrupt a major gap in global finance earned Mifundo the title of Disruptor of the Year at the Europe Fintech Awards 2025. The platform uses a proprietary credit scoring system that allows banks to assess risk and lend to customers across different countries.

For users, it simplifies complex processes like international transfers and provides a single point of access for loan offers, a prime example of how targeted fintech app development services can solve real-world challenges for a growing global workforce.

Key features:

- Connects expatriates and global citizens with loan offers from multiple countries.

- Proprietary cross-border credit scoring system.

- A single, streamlined digital application process for international lending.

With remote work and global mobility on the rise, Mifundo’s solution has never been more relevant. It stands out by creating the first truly functional marketplace for cross-border credit. By tackling the complex regulatory and data challenges that have traditionally prevented banks from lending internationally, Mifundo is unlocking financial access for a new generation of global citizens.

14. Gojek: Indonesian multi-service platform

How do you bring modern banking to a massive population that lives on their phones but may not have a bank branch for miles? You don’t build branches; you embed financial services directly into the apps they already use every single day. This is the strategy Gojek has perfected in Indonesia, evolving from a ride-hailing service into a comprehensive super app for daily life.

Gojek’s ecosystem seamlessly integrates transportation, food delivery, and a robust suite of financial services. Through its GoPay wallet and features like GoInvest, it provides millions of users with access to payments, savings, and investment products, many for the first time.

This deep integration is a powerful engine for financial inclusion, providing essential services for a large and historically underserved market. Its pioneering work in debt management through features like GoPayLater has become a blueprint for emerging markets.

Key features:

- GoPayLater buy-now-pay-later (BNPL) services.

- Integrated ride-hailing and delivery with seamless payments.

- Investment and savings products offered through GoInvest.

As Indonesia's digital economy continues to surge, Gojek's role becomes even more crucial. It stands out by demonstrating how a platform built around everyday needs can become a primary gateway to the financial system. By embedding finance into daily activities, Gojek is not just an app; it's a vital piece of economic infrastructure for the nation.

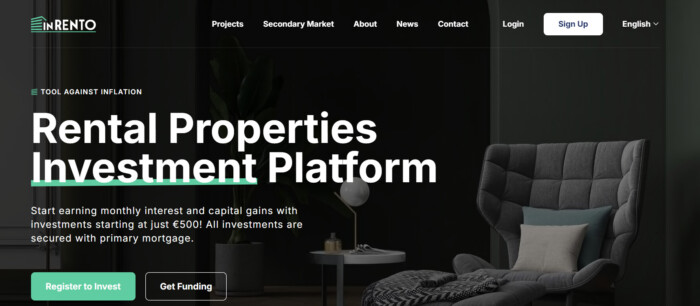

15. InRento: Buy-to-let crowdfunding

Owning a rental property for passive income is a classic wealth-building strategy, but the high entry cost and management headaches stop most people in their tracks. What if you could buy into the property market for the price of a monthly subscription? InRento makes this possible by allowing anyone to invest in rental properties on a fractional basis.

As Europe’s first licensed buy-to-let crowdfunding platform, InRento was named LendTech of the Year at the Europe Fintech Awards 2025. The platform is a great example of innovation in software development for fintech, enabling users to browse vetted properties, invest from as little as 500 dollars, and start earning monthly rental income. It handles all the complexities of property management, offering investors a truly passive income stream and the potential for capital appreciation through fractional shares.

Key features:

- Allows fractional investment in rental properties with a low entry point.

- Investors receive monthly rental income and potential capital appreciation.

- A regulated platform with a secondary market for trading investment shares.

With housing affordability becoming a global crisis, InRento’s model for accessible real estate investment is more relevant than ever. The platform stands out by opening up a traditionally exclusive and illiquid asset class to the everyday investor. It offers a tangible, income-generating alternative to the volatility of the stock market, democratizing access to real estate wealth.

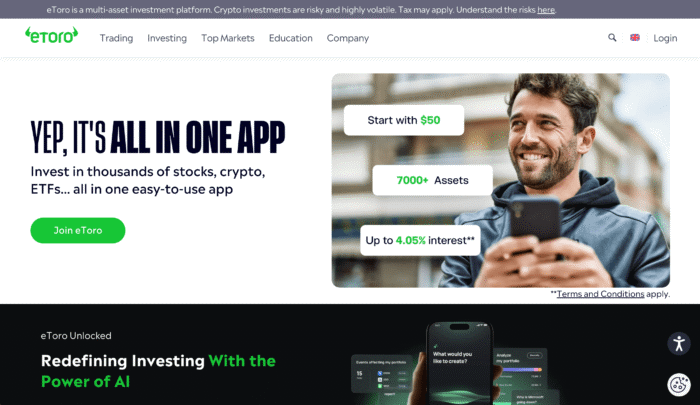

16. eToro: Social trading innovation platform

What if you could invest not just with data, but with the collective wisdom of a global community of traders? For decades, investing felt like a solitary and intimidating activity. eToro shattered that perception by pioneering social trading, transforming it into a collaborative and accessible experience where users can learn from each other in real time.

This innovative model merges the worlds of social media and finance, allowing novice investors to see, follow, and even automatically copy the moves of top-performing traders. The platform’s intuitive interface simplifies complex activities like stock trading and provides sophisticated tools for portfolio management without overwhelming the user. It’s a community where investment strategies are openly shared and discussed, breaking down the traditional barriers to market knowledge.

Key features:

- CopyTrader feature for automatically mirroring the portfolios of experienced investors.

- Social feed for sharing investment ideas and market discussions.

- Multi-asset platform including stocks, cryptocurrencies, and commodities.

In an age where financial literacy is more crucial than ever, eToro's social-first approach is highly relevant. It stands out by democratizing not just access to the markets, but access to expertise. By enabling anyone to learn from and replicate the strategies of seasoned investors, eToro empowers a new generation to build wealth with confidence..

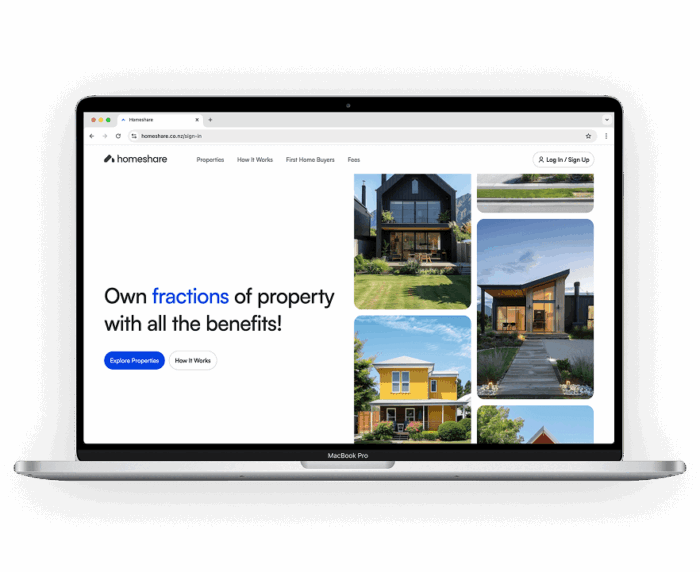

The dream of owning property feels more distant than ever for millions. What if you could buy into the housing market for the price of a new pair of sneakers? With Miquido's help, Homeshare turned this idea into reality by tokenizing residential properties, allowing anyone to invest in real estate one small piece at a time.

This innovative approach to a timeless asset class makes it one of the top fintech apps 2026. Instead of using a buy now pay later service for a depreciating consumer good, users can direct their funds toward building equity in a tangible asset. The platform handles everything from property sourcing to management and rent collection, making real estate investing as simple as buying a stock.

Key features:

- Fractional property ownership with investments starting from $100.

- Properties are divided into thousands of tradeable shares.

- Passive rental income and capital gains are distributed to shareholders.

With the barrier to homeownership rising globally, Homeshare's relevance is crystal clear. It stands out by fundamentally democratizing access to one of the most reliable wealth-building tools in history. By breaking down properties into affordable fractions, Homeshare empowers a new generation to start building a real estate portfolio, regardless of their income level.

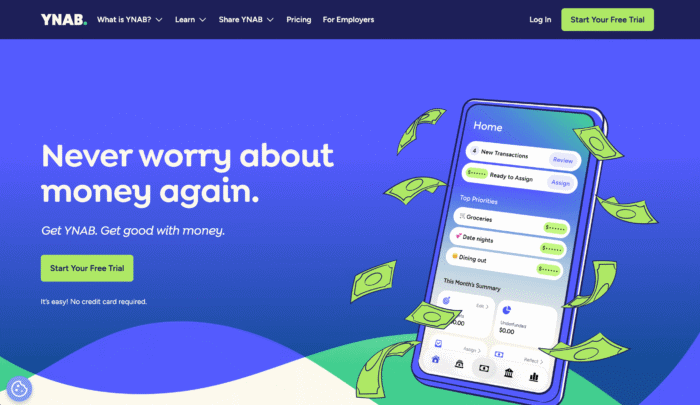

18. YNAB (You Need A Budget): Zero-based budgeting master

What if your budget wasn't a restrictive cage, but a clear, forward-looking plan that gave you total control over every dollar you earn? For most people, "budgeting" means passively looking back at a bank statement at the end of the month to see where their money went. This after-the-fact tracking often leads to guilt and stress but does little to change future financial behavior.

YNAB (You Need A Budget) flips this entire model on its head with its proactive, zero-based budgeting philosophy. Instead of just tracking expenses, YNAB's method requires you to create a plan for your money before you spend it. The core principle is simple: Give Every Dollar a Job. This intentional approach transforms your budget from a document of your past failures into an active, decision-making tool for your future.

The entire platform is built around its famous "Four Rules" – a complete methodology that includes embracing your true expenses, rolling with the punches, and aging your money. The app syncs in real-time across all devices, forcing users to confront their spending decisions as they happen, not weeks later.

Key features:

- Proactive zero-based budgeting based on its proven "Four Rules" methodology.

- Real-time sync across web and mobile to keep the budget up-to-the-minute.

- Goal tracking and debt payoff tools to visualize and accelerate progress.

- Extensive educational resources, including live workshops and video tutorials.

With inflation and economic uncertainty continuing to impact household budgets, YNAB's relevance is greater than ever. Its proactive approach gives users a feeling of control in an unpredictable financial climate, helping them navigate rising costs through intentional spending and strategic saving.

YNAB stands out because it is not just another expense tracker – it’s an educational system designed to fundamentally change your relationship with money. While other apps simply report on your financial past, YNAB equips you with a proven philosophy and a set of tools to actively design your financial future.

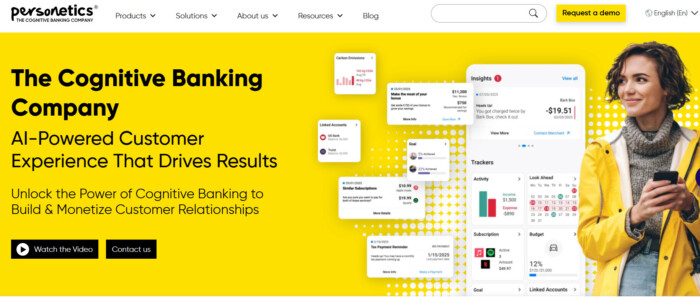

19. Personetics: AI-powered financial personalization

Does your banking app just show you numbers, or does it actually help you make smarter financial decisions? Most apps are passive, merely reporting what you’ve already spent. Personetics is changing this by creating a proactive and personalized experience, turning a standard banking app into a trusted financial coach that works 24/7.

This focus on hyper-personalization earned Personetics the Digital Banking Award at the Global Fintech awards 2025. The platform's AI engine analyzes individual transaction data to deliver proactive insights, like identifying a potential cash shortfall or suggesting ways to save more effectively.

This level of intelligent budget tracking and personalized guidance represents the next frontier of fintech mobile app development, moving beyond simple data aggregation to offer real, actionable advice.

Key features:

- Delivers proactive, hyper-personalized financial insights and advice to bank customers.

- Automates financial wellness programs based on individual transaction data.

- Integrates seamlessly into a bank's existing digital channels as a white-label solution.

In a world of information overload, Personetics is relevant because it helps customers cut through the noise with tailored financial guidance, making it one of the top AI fintech companies at the moment. It stands out by enabling banks to deepen their customer relationships through value-added services. By transforming data into meaningful advice, Personetics helps financial institutions move from being simple transaction processors to indispensable partners in their customers' financial well-being.

20. Root Insurance: Usage-based auto insurance pioneer

Why should your car insurance premium be based on broad demographic data like your age and zip code instead of the one thing that actually matters – how well you drive? Root Insurance was founded on this simple, powerful question. It flips the traditional insurance model on its head by using technology to price policies based primarily on actual driving behavior.

Root’s app uses the sensors in your smartphone to measure driving habits during a test-drive period. Good drivers can earn significantly lower rates, while riskier drivers pay more. This fair, data-driven approach is a radical departure from the opaque pricing of legacy insurers.

The company's commitment to technology extends to its digital-first claims process and robust security features, ensuring a smooth and safe user experience from start to finish.

Key features:

- Telematics-based pricing using smartphone sensors to measure driving behavior.

- Personalized rates based on how you actually drive.

- Digital-first claims process with photo and video documentation.

In an era of rising costs, Root’s promise of fair pricing based on merit is incredibly relevant. It stands out by putting the customer in control of their own insurance rate. By leveraging the power of data and technology, Root is bringing much-needed transparency and fairness to an industry long overdue for disruption.

The next top fintech app can be yours

Fintech software development is at the core of Miquido's services. Looking through this ranking, you may notice market gap - for instance, when it comes to super apps, Europe is far behind Asian markets. Embeded finance is also on the rise, and fintech in the music industry is growing stronger, fueling new forms of monetization.

You have an idea for an app or need a project takeover and seasoned fintech developers? Let's discuss your project.

![[header] top 20 fintech apps you need to know in 2025](https://www.miquido.com/wp-content/uploads/2025/11/header-top-20-fintech-apps-you-need-to-know-in-2025.jpg)

![[header] top ai fintech companies transforming finance in 2025](https://www.miquido.com/wp-content/uploads/2025/05/header-top-ai-fintech-companies-transforming-finance-in-2025-432x288.jpg)

![[header] how to reduce churn on a form validation stage (1)](https://www.miquido.com/wp-content/uploads/2025/12/header-how-to-reduce-churn-on-a-form-validation-stage_-1-432x288.jpg)