In today’s market, AI features are most often associated with B2C e-commerce. Think of Zalando –alongside leaders like Amazon and ASOS – which are already enhancing their customer experience with AI: upgrading fraud detection, improving product recommendations, offering visual search, and rolling out virtual assistants powered by large language models.

Yet AI can be just as powerful in B2B commerce, when applied thoughtfully in both web and mobile platforms. It has the potential to streamline operations, personalize experiences, and unlock smarter sales and retention strategies.

Unlocking AI’s potential in B2B eCommerce

Recent years haven’t been easy for manufacturers. While e-commerce businesses and quick-commerce models are booming, many global exporters are battling tariffs, fluctuating input costs, tightening environmental regulations, and shrinking margins.

A well-designed B2B sales platform that automates tasks, eliminates traditional customer pain points, and layers in AI-driven capabilities, such as ai analyzes purchase history, dynamic pricing strategies, or virtual assistant support, can help lower costs, enhance customer loyalty, and shore up financial stability. It’s a strategic foundation for longer-term advantage.

Now is an opportune time to act, while such AI-enhanced tools are still relatively rare in B2B platforms. As you’ll see in the use cases below, the potential savings are significant, and they can serve as a resilience shield for B2B firms in volatile markets.

Explore the AI use cases tailored for B2B commerce and discover how these innovations can elevate efficiency, loyalty, and profitability.

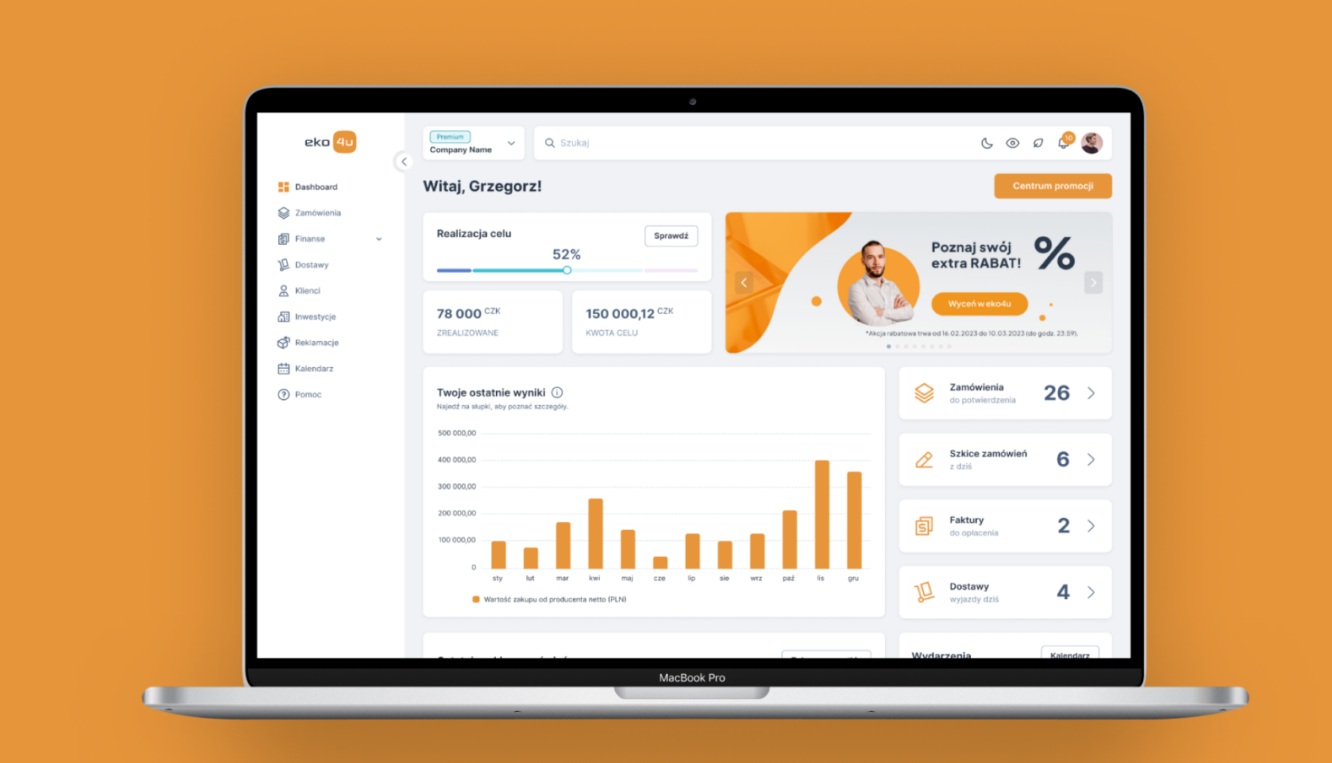

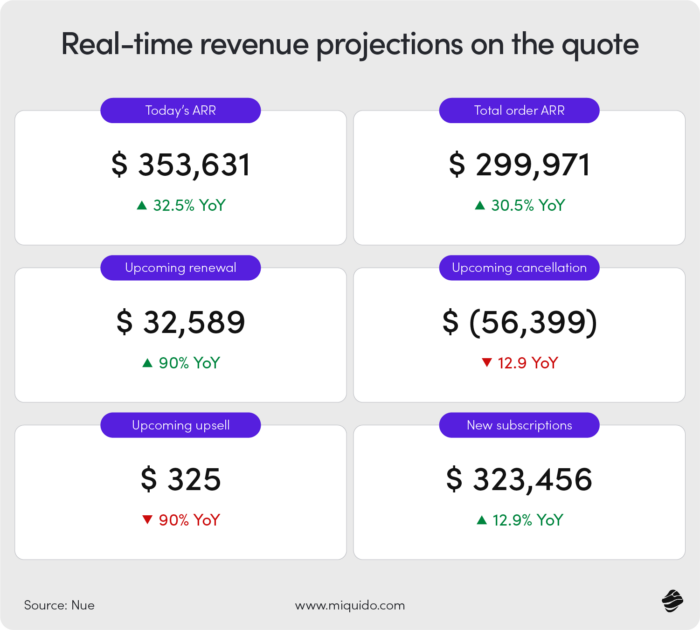

1. AI-generated insights on sales and customer dashboards

A little over a decade ago, most sales teams still relied on Excel. Today, spreadsheets feel like relics of the past, but the problem hasn’t fully gone away. Insights generated from customer data are still rarely available directly in a sales platform. Teams often have to click through multiple tools, and in the process, key details risk getting lost between systems.

Even the best salesperson in the world can miss a small but critical detail. For instance, overlooking that a major account’s order frequency is quietly dropping can lead to overconfident outbound campaigns, only to realize too late that the client was about to churn.

That’s where AI in ecommerce and sales operations changes the game. With AI-generated insights, a platform integrated with ERP, CRM, payment systems, and ecommerce storefronts can analyze customer data in real time. It can show clearly and instantly where opportunities lie, which accounts are at risk, and what adjustments are needed before problems snowball.

Sales leaders often ask: “What’s the fastest way to spot customers whose order frequency is dropping?” or “How do I get a single view of customer spend across ERP + web store without building spreadsheets?” These are exactly the kinds of questions AI tools can now answer directly inside a dashboard, no manual work required.

Why custom AI insights matter more than templates

Most SaaS tools offer prebuilt dashboards. They’re convenient, but limited. By working with a partner who builds custom software, companies can decide which insights matter most to their business operations rather than being forced into one-size-fits-all templates.

Take ecommerce businesses in the fashion sector. A metric like “return rate by product category and size” may be critical here, but irrelevant to another industry. For a wholesale distributor, on the other hand, tracking “margin vs. revenue by region” could make or break quarterly planning.

The real advantage is flexibility. Instead of trying to figure out manually which SKUs drive margin versus revenue by region or branch and waiting weeks for a BI team to patch something together, sales leaders can have AI-driven answers embedded into their daily workflow.

AI insights that also empower the customer

AI-generated insights aren’t only for sales reps. On the client side, especially in B2B, these insights unlock a new level of transparency and decision-making power. They can help a customer justify spend internally, highlight financial benefits, or streamline reporting for their own managers.

Examples include:

- Forecasting potential stockouts based on unusual order patterns, helping clients avoid costly supply chain gaps.

- Benchmarking contract pricing vs. actuals by customer segment, ensuring procurement teams can prove ROI.

- Tracking new product adoption among key accounts, so clients can see if an innovation is actually gaining traction or needs stronger marketing support.

For ecommerce businesses, these aren’t just “nice-to-have” features, but competitive advantages. And as AI tools become more embedded into customer dashboards, the line between internal sales enablement and customer-facing value creation will blur. AI has the power to turn raw customer data into shared, actionable insight, helping both sides of the relationship make smarter moves, faster.

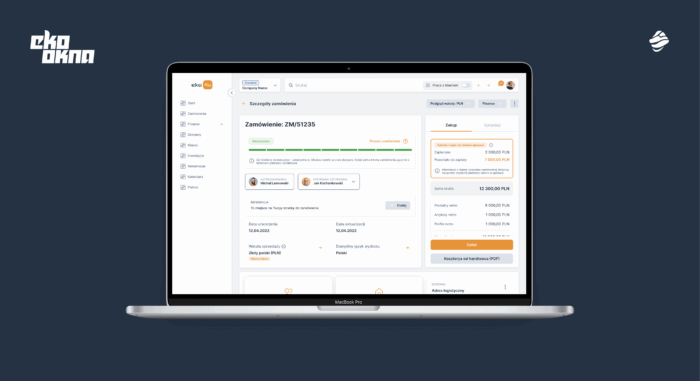

2. AI-driven fraud & payment risk detection

In B2C, payments are usually straightforward. A customer adds items to their cart, reviews the order summary, chooses card, bank transfer, or fast transfer, receives an email confirmation, and waits for delivery. Clean, simple, and predictable.

B2B is a different story. Here, transactions come with layers of complexity that can easily create friction.

- Invoices must be generated and matched to the correct order data.

- Payments often happen via bank transfer, not instantly.

- Deadlines have to align with contractual terms. The paid amount has to match the invoice precisely.

- Payer identity and tax information need verification.

- And when it comes to cross-border payments, VAT compliance becomes a major factor.

As a result, roughly 1 in 5 invoices becomes an exception that must be investigated, slowing payments and adding back-and-forth.

In the traditional model, this often results in project managers and accountants chasing clients by email or phone, trying to resolve mismatches or late payments. It’s a drain on time, adds stress to people who already carry heavy workloads, and creates a real risk of delayed cash flow. When payments are delayed, financial liquidity can quickly be thrown off balance.

How AI technologies streamline the B2B payment chaos

AI technologies can remove these problems at the source. Instead of waiting for issues to escalate, AI can automatically guide the client through the process: it can show them what details are missing, how to fix incorrect bank data, and where to upload corrected documentation.

It can also block risky actions. If a client has several unpaid invoices but attempts to place a new order, the system can automatically stop the process until the outstanding balance is resolved. This reduces both operational strain and financial exposure.

From the company’s perspective, AI does even more. It can analyze transactions across ecommerce platforms, flagging anomalies such as duplicate invoices, incorrect amounts, delayed or missing payments, or suspicious behavior like unusual ordering patterns.

What’s the best way to stop fraudulent or unusual payments before they go through? With the right AI tools, these become automated checks instead of routine tasks for humans.

Clear ROI from smarter payment processes

The return on investment is fast and tangible.

- Fewer delayed payments mean smoother financial operations.

- Proactive detection of anomalies reduces disputes and improves customer experience.

- Riskier clients are spotted earlier, protecting the business from exposure.

- Automation reduces the chance of tax compliance issues that could otherwise snowball into audits or fines.

For finance teams, this means spending less time firefighting and more time driving strategy. Accounts receivable automation correlates with improved DSO for 62% of adopters and lower delinquency rates for 49%, as proved by the case of Danone. For customers, it means fewer frustrating back-and-forth emails and smoother transactions. In both cases, the result is a stronger relationship.

At the end of the day, B2B payments don’t need to be a bottleneck. With AI-powered systems in place, companies can protect themselves from risk while delivering the kind of efficiency and clarity that both sides of the transaction now expect.

Unfortunately, problems with processing payments are an everyday reality in many companies. Customers make transfers without providing an order number, the payment description is incomplete or inconsistent with the accounting system standards. It also happens that advance payments are recorded manually, and incorrect allocation leads to downtime, erroneous accounting entries, or even delays in starting production. As a result, not only operational efficiency suffers, but also customer relationships.

Tomasz Bawełkiewicz, Business Architect at Miquido

3. AI-powered order processing

B2B order processing is naturally exposed to risk. Because orders are often wholesale, even a small mistake can become extremely costly and difficult to fix logistically. For example, imagine a frozen food supplier that mistakenly books 1,000 cases of ice cream for the wrong distribution center. By the time the mistake is spotted, the shipment is already in transit. The result is wasted product, lost revenue, and a strained customer relationship.

The number of points where errors can creep in is almost endless. In retail, mistakes usually involve quantities, models, or sizes. But in made-to-order manufacturing, the variables multiply – materials, finishes, custom dimensions, packaging rules, delivery windows, and more. Each layer adds complexity, and each complexity increases the chance of something going wrong.

Generative AI for smarter order handling

A perfect example of how this can be solved comes from automation in joinery. Processing orders in woodworking companies has long been time-consuming. Scanned files, photos, PDFs, and even handwritten notes arrive in different formats, and staff traditionally had to re-enter every detail manually. This repetitive work is not only slow but also highly prone to mistakes.

Today, AI technologies are changing that workflow. Using OCR combined with ecommerce natural language processing, orders are automatically read and converted into a standardized format. Generative AI takes it a step further, verifying technical specifications, checking compliance, and pushing the clean data straight into the system. Tasks that once consumed hours are now completed within minutes, improving operational efficiency and freeing teams from routine tasks.

By using OCR technology, the system can “read” documents in any form: scans, photos, tables, PDF forms. Then, AI recognizes the content and converts it into a unified, standardized format, ready to be processed by production systems.

Jerzy Biernacki, Chief AI Officer at Miquido

If order processing is an integral part of your work, you may wonder what’s the fastest way to turn emailed PDFs/Excel POs into clean orders or how to prevent quantity and SKU mistakes on large purchase orders. These are exactly the kinds of problems generative AI was designed to solve.

Enhancing customer service while reducing risk

The benefits go beyond speed. AI-powered order processing can automatically validate MOQs, pack sizes, and tiered pricing before a purchase order is booked. It can flag address, delivery window, or carrier issues before items are picked. It can even route exceptions, such as substitutions or out-of-stock items, for quick approval, instead of letting them stall in someone’s inbox.

For online retailers and ecommerce platforms, this translates into faster fulfillment and more accurate inventory management. For customers, it means fewer frustrating mistakes and a smoother experience from order to delivery. The result is a double win: stronger customer relationships and healthier margins.

4. Predictive buyer behavior & reorder automation

Driving sales in B2C can sometimes feel like Russian roulette. Success depends heavily on the nature of the product and the target audience. Consumers are often open to experimenting and can be swayed by a slick mobile feature, a clever campaign, or simply strong branding.

In B2B, the mechanics are very different. Once a supplier earns a client’s trust, it is much harder to lose it. Changing providers requires time, effort, and in many cases, formal board approval. Long-term relationships built on trust benefit both sides. In fact, 38% of managers identify lack of internal communication and trust as a top reason why B2B partnerships fail.

However, financial triggers remain the number one cause of churn in B2B. While customer interactions and service quality play an important role, most partnership breakups come down to pricing pressure or convenience. And although the churn is less likely than in B2C, the bar is set high: in B2B SaaS, for instance, less than 5% annual churn is considered sustainable, with negative churn being the ultimate goal.

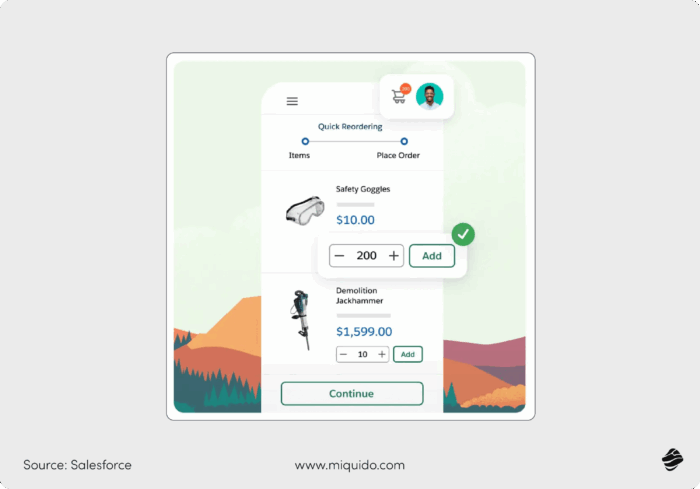

5. Automating reorders to enhance customer interactions

Being proactive is the best defense against churn. AI makes this possible by automating reorders and suggesting adjustments that add value to the customer. It can flag when a buyer is close to reaching a loyalty discount threshold, recommend substitutions that unlock additional benefits, or notify sales teams about shifts in purchase history that may signal a risk.

How can you make reordering easier for regular customers? What’s the best way to predict when a buyer is running low on stock? AI answers these questions by tracking order patterns, monitoring inventory management in real time, and prompting repeat orders before the customer even needs to ask. McKinsey finds analytics-driven churn programs can reduce churn by up to 15%.

This also ties into customer service interactions. Rather than waiting for customer queries about stockouts or discounts, AI can deliver proactive updates that strengthen relationships and improve conversion rates.

Predictive buyer behavior to power your proactivity in B2B

Predictive buyer behavior powered by AI and machine learning carries huge potential. With access to rich purchase history data, systems can spot anomalies: reduced order size, longer gaps between orders, or changes in product mix. Once flagged, sales teams know it’s time to step in with tailored marketing strategies or personalized offers.

Machine learning models predicting when repeat buyers will likely place bulk orders. This allows the system to auto-prompt or even auto-reorder on the buyer’s behalf. The impact is clear –fewer abandoned carts, faster repeat orders, less friction, and greater loyalty. So, if you're wondering how to I reduce abandoned carts in bulk orders, the answer lies in anticipating demand before the buyer even notices they’re running low.|

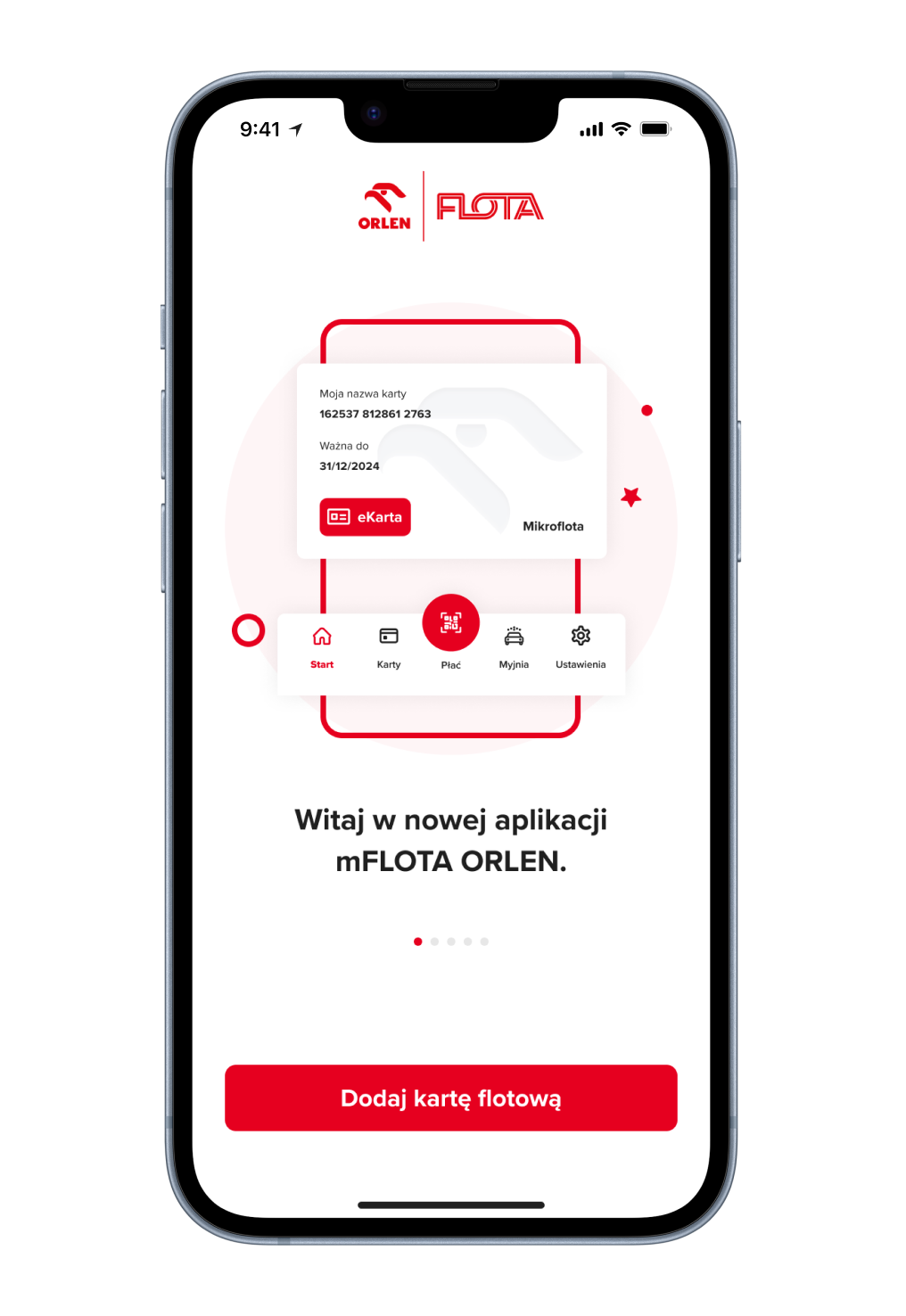

Make reordering effortless with mobile + computer vision

If you want to go one step further, enable buyers to simply scan products, packaging, or barcodes with their phone camera inside your B2B mobile app. This removes friction at multiple points of the journey: customers can place orders faster without digging through long catalogs, avoid SKU or part-number mistakes common in bulk orders, and save significant time in day-to-day operations.

At the same time, this approach strengthens customer trust and reduces dependency on customer service representatives for routine issues. For example:

- Identify damaged goods instantly to streamline claims and returns.

- Recognize empty packaging or shelves and auto-suggest replenishment.

- Detect counterfeit or incorrect items in shipments.

Situations that once required multiple calls with a business partner can now move forward in seconds, working directly in the app. For an ecommerce site, that’s not just convenience; it’s a reputation booster and a driver of repeat business.

How AI agents make it work

Under the hood, AI agents powered by computer vision models do the heavy lifting:

- Matching captured images against your product catalog with precision.

- Integrating with ERP and inventory systems to optimize inventory management, display stock status, and confirm pricing.

- Supporting offline capture in warehouses, then syncing later.

- Adding context-aware upsell prompts based on historical data, such as: “You usually buy 20 of these – would you like to reorder the same?”

It may sound futuristic, but leading companies are already proving the model. Grainger, for example, offers visual search in its B2B tools – buyers can snap a photo of a part and see the exact SKU in seconds. Aside from customer service, such use of AI agents in manufacturing and B2B sales is gaining momentum

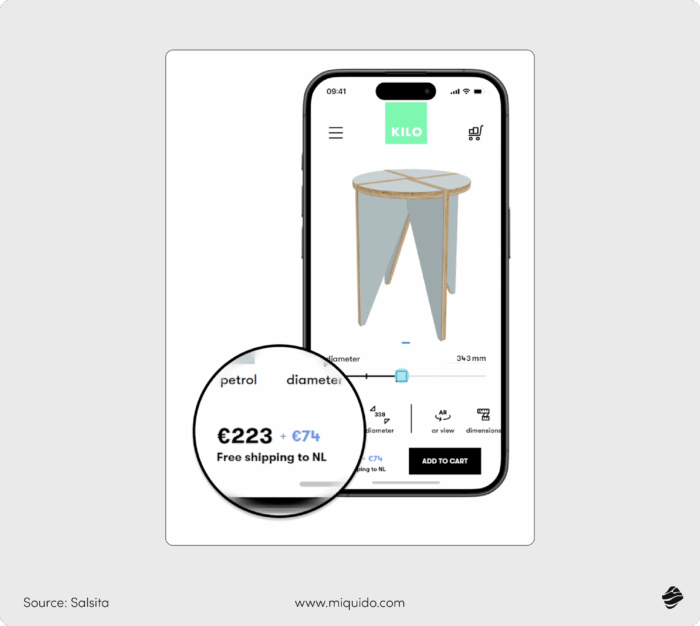

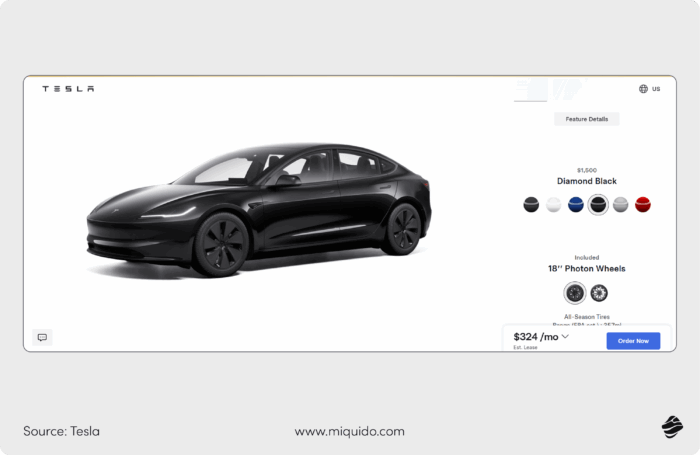

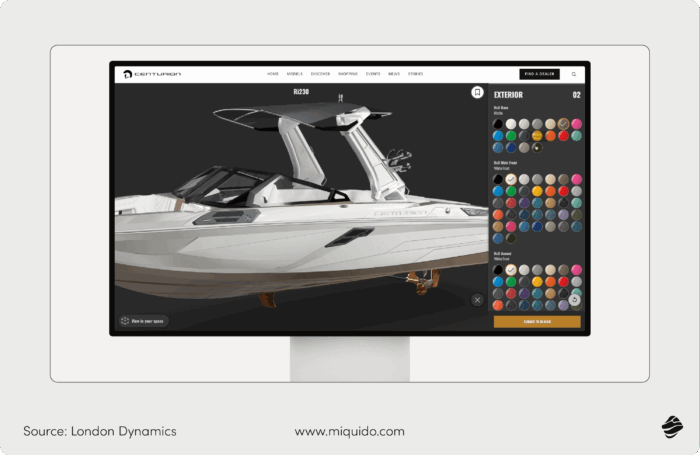

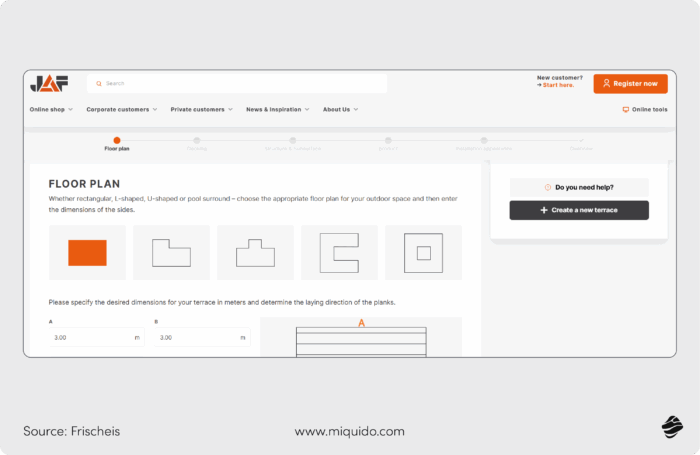

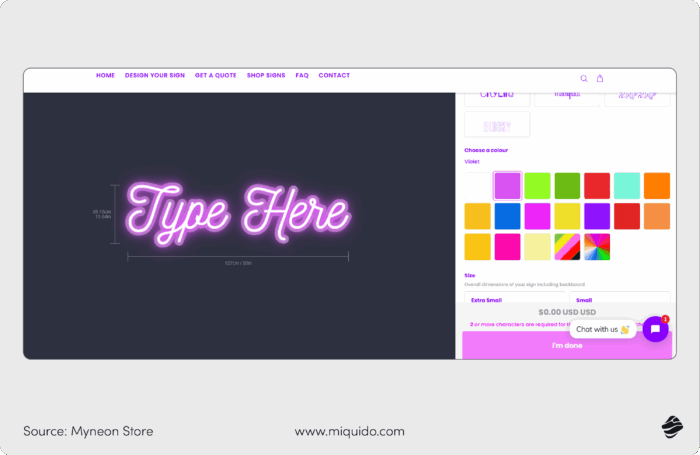

6. Product configurator

Product configurators have long been a staple of B2C commerce, but they are now finding their way into B2B environments. Manufacturing now represents the largest share (32.5%) of the CPQ market by industry, indicating strong B2B adoption in engineered/made-to-order categories. Their value is especially clear in made-to-order industries such as joinery.

Imagine a developer’s supplier placing a single order for hundreds of custom windows and doors for an entire residential complex – one small error in dimensions or opening direction could mean weeks of delays, wasted materials, and a serious hit to margins. A configurator eliminates this risk by making specifications clear and visual from the start.

When it comes to innovative or technically complex products, configurators also help overcome buyer hesitation. A Shopify case study quoted by Miquido's researcher Dominika Będkowska in her smart product configurator analysis, reports a 20% conversion-rate lift after deploying a product customizer for a complex, high-consideration product.

By offering rich product descriptions and interactive previews, they create personalized shopping experiences that reassure clients and reduce uncertainty. For ecommerce retailers, this not only reduces customer churn but also increases conversion rates by shortening the decision-making cycle.

Instant quotes and a more efficient sales process

One of the greatest advantages of product configurators in B2B is the ability to generate instant quotes regardless of order complexity. Instead of spreadsheets, phone calls, and manual calculations, customers immediately see what they are ordering, how much of it, and at what price. If you're wondering how do we generate instant quotes and drawings/specs for configured items or what’s the fastest way to price complex bundles with customer-specific terms, a configurator provides those answers with no delays.

And the benefits extend beyond quoting. Configuring a product is only the beginning – once finalized, it can be automatically exported as production-ready Bills of Materials, CAD files, or technical drawings. These outputs can be directly integrated with existing CRM, ERP, or ecommerce platforms, or converted into a PDF quote for the customer.

This level of automation ensures a more efficient sales process and reduces the chance of errors. AI integration and machine learning algorithms make it possible to even prevent incompatible parts from being ordered together, a safeguard that many business leaders ask about.

Better experiences for both customers and sellers

Configurators don’t only benefit companies producing highly customized items. Even if the catalog is limited to standard products that differ mainly by color, finish, or material, offering customers a visual, interactive way to choose still enhances the experience. It makes the purchase process intuitive, builds confidence in customer preferences, and helps ecommerce retailers boost basket completion rates.

For manufacturers, the impact is equally strong. Instead of handling repetitive customer queries, support and sales teams can focus on higher-value customer service interactions. Configurators automate routine questions and eliminate ambiguity, freeing staff to work on more strategic marketing strategies. Over time, this not only streamlines operations but also strengthens long-term loyalty.

7. Churn prevention & customer health scoring

An ounce of prevention is worth a pound of cure. This mantra rings especially true in B2B marketing, where acquiring a customer is often a long, costly, and complex process, requiring significant investments in online and offline marketing, networking, and trade shows. McKinsey’s B2B Pulse report shows that B2B buying is multi-stakeholder and non-linear, and that sellers must adapt to complex, multi-channel decision journeys (which increases acquisition effort and cost).

The average B2B buying cycle (across several vendor reports) is reported in the 6–12 month range. Unlike in B2C, where impulse can drive sales, in B2B every deal represents months of effort and a hefty financial commitment.

Yes, once won, B2B clients are typically less likely to churn. But ignoring early warning signs can be dangerous, since losing just one strategic account could put a business’s financial stability at risk. That’s why proactive churn prevention is no longer optional.

Here, AI steps in as a silent guardian, analyzing behavioral patterns and identifying accounts that may be drifting toward disengagement. As Forrester's statistics show, mature customer success (proactive engagement) programs deliver 12% higher revenue growth, 19% higher gross margins, and 15% higher retention. In other words: few analyses per day keeps the churn away. With AI integrated directly into a custom B2B commerce platform, businesses can safeguard data integrity while boosting their prevention efforts to the highest level.

From data points to valuable insights

Traditional methods such as customer feedback surveys are still essential, but they rarely tell the whole story. In B2B, decision-makers are often pressed for time, making it hard to collect enough detailed input. Instead, their actions speak louder than words. Abandoned carts, irregular orders, or frequent customer service interactions are all data points that, when connected, reveal valuable insights.

How do you know which customers are about to stop buying from you? What’s the best way to see early warning signs before you lose a key account? The answer is: AI. It analyzes purchase history, compares it with historical sales data, and interprets subtle behavioral changes. By looking beyond isolated incidents, it delivers a holistic picture of customer health.

Implementing AI in this way gives e commerce businesses the ability to work with real time data, spotting problems before they escalate. Online shoppers may not always explain their dissatisfaction, but predictive scoring uncovers the signals they leave behind.

Smarter engagement and stronger loyalty

The real strength of AI lies in connecting the dots across multiple layers of customer engagement. Advanced AI algorithms can track fluctuations in demand, power more accurate demand forecasting, and even flag customers whose loyalty might be at risk. By knowing exactly when to intervene, teams can prioritize accounts that need personal attention.

This approach transforms customer retention from reactive to proactive. Instead of scrambling to save an account after it’s already halfway out the door, businesses can nurture loyalty continuously. The result: higher retention, deeper trust, and ultimately stronger long-term growth.

Elevate your product configurator with dynamic pricing automation

Keeping pricing aligned across contracts, catalogs, and marketing campaigns is one of the toughest challenges in B2B commerce. Manual adjustments often lead to errors, delays, and inconsistencies that can frustrate customers.

By integrating dynamic pricing directly into your configurator, you can automatically generate accurate quotes and adjust pricing based on customer behavior, contract terms, real-time demand, and inventory levels. This creates a sense of fairness and personalization that drives customer satisfaction – buyers feel their price reflects their relationship and status with you. It also acts as an incentive for repeat purchases and larger order volumes.

Transparency is key: clear rules and visible logic prevent doubts about pricing policies while strengthening trust in your brand.

The impact can be significant. Take SportSafe as an example: by implementing Mobileforce’s no-code CPQ and field service management platform, they unified CRM, ERP, inventory, quoting, and e-signature workflows. The results spoke for themselves:

- Quote-to-close times dropped by 80%

- Sales reps increased their selling time from ~35% to 70%+

- Pricing errors were drastically reduced

8. Loyalty programs

Well-designed loyalty programs are one of the most effective ways to keep first-time B2B buyers coming back after their initial order. More than just securing repeat business, they encourage bulk and recurring purchases that go far beyond basic discounts.

For you as a B2B company, the benefits are clear: stronger cash flow, more predictable revenues, and less reliance on constant discounts and promotions, which may boost sales in the short term, but can also destabilize margins in the long run.

Loyalty programs also create a perfect framework for win-back offers when a key account goes quiet. Instead of relying on pushy marketing tactics, you’re presenting a fair value exchange: “we reward you for your loyalty.” That builds trust and strengthens long-term relationships.

What makes a B2B loyalty program work?

B2B commerce runs on different rules than B2C. Here, buyers want simplicity and automation, not gamification gimmicks. While convenience chains like Poland’s Żabka break sales records through gamified loyalty apps, B2B buyers expect minimal effort to gain maximum benefit. Gartner’s guidance on the B2B buying journey, for instance, highlights that a large share of buyers prefer rep-free or low-touch purchase experiences when appropriate.

That means an ideal program should work seamlessly in the background: automatically tracking order volume, contract renewals, and frequency, and then applying credits, discounts, or tiered benefits without manual claims. For instance, HP offers its channel partners loyalty points that accrue automatically on every order, which can be redeemed for marketing support or training. Similarly, Grainger runs a B2B rewards program that credits buyers with account-level perks like faster shipping and exclusive pricing once they hit certain spend thresholds.

In both cases, the model is the same: keep it simple, tie it directly to buyer behavior, and let automation do the heavy lifting, so the program feels like a natural extension of the purchase process, not extra work.

9. AI-powered client insights & account memory keeper

The biggest pain point in B2B sales? Losing a critical detail, missing a sales opportunity, or lacking context that could tip the balance in winning a deal.

In the chaos of handwritten notes, project management tools, sales data, and behavioral signals, even the best sales reps sometimes fail to catch something important. In B2C sales, you might brush that off. But in B2B, where cycles are long and the cost of acquiring leads is high, such a loss translates into serious financial impact. Properly calibrated AI models can make these problems a thing of the past.

AI assistant that never loses the thread

Imagine an AI assistant embedded directly into your B2B platform – CRM, PM tool, or sales app – that automatically aggregates and normalizes key client data: communication history, meeting notes, support tickets, past issues, and preferences. It brings everything together into a standardized, searchable, and role-aware summary. This way, it:

- Eliminates data silos and the risk of forgotten details.

- Prevents miscommunication between Sales and Project Management teams.

- Removes the hassle of manually re-entering notes into systems.

- Keeps everyone aligned with a shared, coherent client narrative.

How it works:

- The AI agent uses natural language processing (NLP) to digest unstructured inputs – emails, calls, chat messages, support tickets, meeting transcripts.

- It generates summaries that answer: “What was discussed?”, “What are the action items?”, “What’s pending?”, “Any client-specific quirks?”

- Presents role-specific insights: sales-ready cues for reps, detailed context for project managers.

- Proactively nudges with updates, like: “Here’s what changed with Client X since last month.”

By leveraging AI, this goes beyond simple task automation. The system applies predictive analytics to spot risks and opportunities, supports product discovery by surfacing relevant add-ons or alternatives, improves sales forecasting, and ultimately helps boost conversion rates.

![[header] top ai use cases in ecommerce b2b from manufacturing to foodtech](https://www.miquido.com/wp-content/uploads/2025/09/header-top-ai-use-cases-in-ecommerce-b2b_-from-manufacturing-to-foodtech.jpg)

![[header]recognition in mobile apps challenges & solutions (1)](https://www.miquido.com/wp-content/uploads/2026/01/headerrecognition-in-mobile-apps_-challenges-solutions-1-432x288.jpg)

![[header] gamification in retail rewriting the shopping experience with gamified mobile apps (1)](https://www.miquido.com/wp-content/uploads/2026/01/header-gamification-in-retail-rewriting-the-shopping-experience-with-gamified-mobile-apps-1-432x288.jpg)

![[header] top ai fintech companies transforming finance in 2025](https://www.miquido.com/wp-content/uploads/2025/05/header-top-ai-fintech-companies-transforming-finance-in-2025-432x288.jpg)